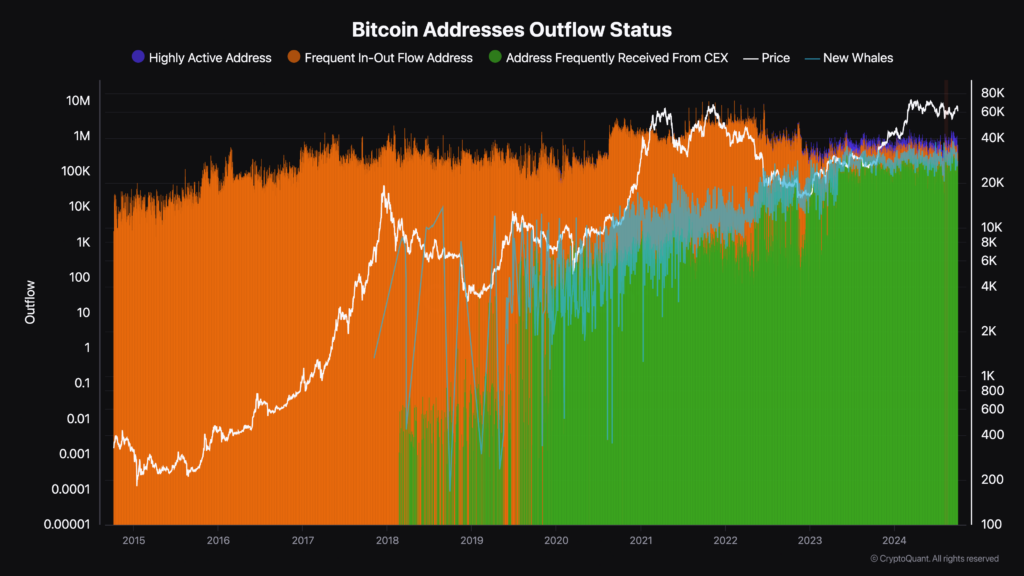

Evaluation of Bitcoin handle outflow patterns reveals a correlation between handle exercise varieties and Bitcoin worth actions from 2014 to 2024. In keeping with CryptoQuant knowledge, adjustments in outflow tendencies amongst completely different handle classes mirror underlying market tendencies and participant habits.

From 2014 to 2017, high-traffic addresses dominated Bitcoin outflows. This era coincides with a interval when Bitcoin costs had been decrease in comparison with as we speak, suggesting that prime buying and selling exercise between these addresses didn’t have a big influence on market valuations. The predominance of frequent deposits and withdrawals displays a market pushed primarily by particular person customers who make small transactions and ship cash repeatedly.

Round 2018, a noticeable change occurred because the variety of addresses continuously obtained from centralized exchanges started to extend quickly. This development occurred as extra Bitcoins had been held at or moved via trade addresses attributable to elevated buying and selling exercise and elevated adoption of exchanges by customers. .

This timing coincides with the upward pattern in Bitcoin costs, demonstrating the hyperlink between trade exercise and market valuation. The prominence of exchange-related addresses could mirror traders shifting belongings to exchanges in anticipation of market actions or elevated speculative buying and selling.

The variety of new whale addresses recognized by new or current large-scale Bitcoin holders skyrocketed in early 2020. This surge coincides with a rise in Bitcoin worth and volatility, that means it accumulates no matter worth.

The inflow of recent whales throughout this era means that institutional traders and rich people could have entered the market and pushed up costs with giant purchases.

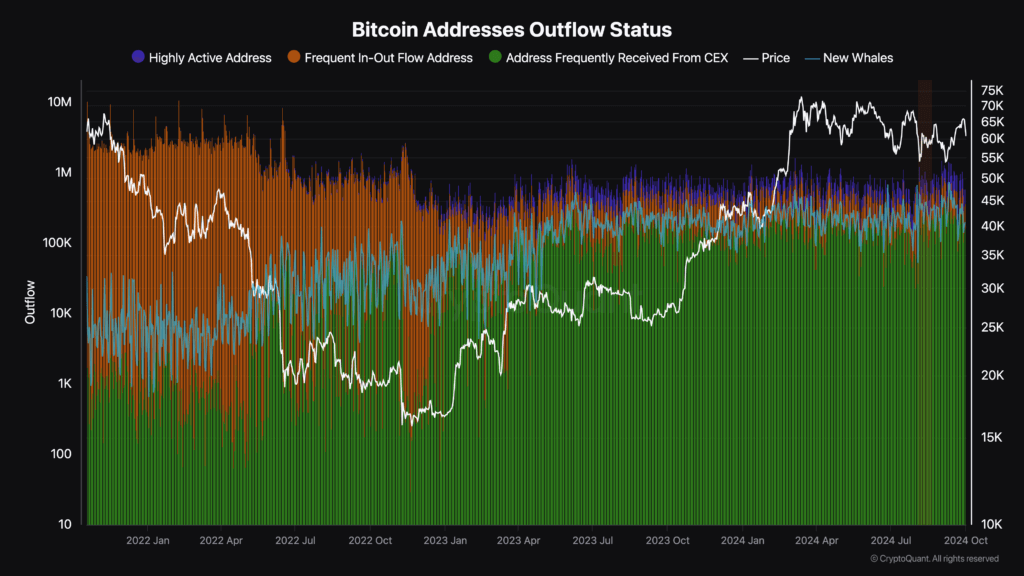

Bitcoin handle actions after 2021

Bitcoin costs declined all through 2022, however addresses that continuously moved out and in continued to dominate. Nevertheless, its affect has weakened since mid-2022, according to a big improve in addresses continuously obtained from centralized exchanges. This alteration means that extra Bitcoin was being handed via or held by trade addresses through the restoration interval, indicating elevated buying and selling exercise and traders altering positions in response to market circumstances.

New whale exercise continued to extend in late 2022 and into 2023, indicating continued purchases by giant holders throughout worth lows. This development displays strategic market repositioning at a time of heightened market uncertainty. This transfer correlates with Bitcoin's worth bottoming out in 2022 after which recovering via 2023 and into 2024.

A rise in new whales at a time of low costs suggests bullish sentiment to make the most of a future worth restoration.

Since 2023, for the primary time in Bitcoin's historical past, extremely lively addresses have been attracting consideration. Partly concerned within the improvement of buying and selling bots, high-frequency buying and selling, and the Bitcoin metalayer. The expansion of these kinds of addresses alerts an evolution in how Bitcoin is used, and undermines the idea that Bitcoin is changing into only a retailer of worth. Bitcoin has core utility around the globe and continues to develop.

Persistent tendencies in Bitcoin addresses

The salience of exchange-related addresses over a given time frame displays adjustments in investor habits, corresponding to a shift towards holding belongings on exchanges for liquidity or a rise in buying and selling exercise in response to market volatility. is mirrored. Equally, the timing of whale exercise suggests that enormous holders are influencing market tendencies or responding strategically to cost fluctuations.

The noticed patterns recommend that enormous holders play an vital function in stabilizing markets and reversing tendencies. Their elevated exercise throughout worth lows could help the market and forestall additional declines. Conversely, durations of diminished whale exercise could coincide with phases of market uncertainty or consolidation.

By monitoring the stream of Bitcoin throughout completely different handle classes, you’ll be able to determine rising tendencies and adjustments in market sentiment. For instance, a spike in exchange-related addresses could point out elevated buying and selling exercise or anticipation of market actions, whereas elevated whale exercise could point out giant traders' confidence in future worth will increase. could point out.

The correlation between handle exercise and worth fluctuations highlights the inherent transparency of Bitcoin. Publicly obtainable on-chain knowledge permits complete evaluation of market tendencies, offering insights not usually obtainable in conventional monetary markets. This transparency permits individuals to make extra knowledgeable choices primarily based on observable patterns within the community's transaction exercise.

Finally, analyzing Bitcoin handle outflow patterns over the previous decade reveals important correlations with market cycles and worth fluctuations. Evolving tendencies throughout completely different handle classes mirror adjustments in market construction, participant habits, and broader adoption tendencies.

The article 10 Years of Bitcoin Handle Information Reveals Investor Conduct and Market Modifications appeared first on currencyjournals.