- The cryptocurrency market confronted a report $19 billion in liquidations following President Trump’s risk of 100% tariffs on China.

- Coinglass referred to as this the most important liquidation in crypto historical past. 1.6 million merchants have been worn out.

- Analysts Seberg and Van de Poppe anticipate a last rally earlier than macro cooling.

The cryptocurrency market suffered its greatest one-day drop in months, with its market capitalization down 9.93% to $3.73 trillion, as President Trump’s risk of 100% tariffs on Chinese language imports despatched shockwaves via danger property.

Buyers rushed to scale back their publicity as a sequence of liquidations worn out billions of {dollars} inside hours, bringing again flashbacks to the coronavirus-era panic of March 2020.

In line with CoinGlass, 1,618,240 merchants have been liquidated in 24 hours, totaling $19.13 billion, the most important liquidation in crypto historical past. Cryptocurrency analyst Ash Crypto stated the incident was 20 occasions the scale of the coronavirus crash And greater than 10 occasions the FTX collapse.

Bitcoin help falls under $112,000

Bitcoin is at present buying and selling at $111,802, down almost 8% up to now 24 hours. Ethereum fell greater than 12% to $3,778. Each property broke via key help zones that had been secure for a number of weeks.

Altcoins have been hit even more durable. Binance Coin (BNB) fell 13%, whereas Solana and Cardano plummeted 16% and over 20%, respectively. XRP has fallen almost 14% and is at present buying and selling round $2.42. Dogecoin, Tron, and different mid-cap tokens additionally suffered important declines, confirming a broad correction that largely spared property.

Associated: U.S. authorities shutdown stalls 90 crypto ETF approvals in October, freezing $10 billion in inflows

Economist Henrik Seberg sees this as “the final rally earlier than collapse”.

Economist Henrik Seberg believes this crash may set off the following massive transfer in Bitcoin. In his view, the crypto market is coming into a crucial part earlier than a possible breakout. Whereas many are predicting a weaker greenback, Seberg believes the greenback is definitely nearing a near-term backside, which may present a brief enhance to danger property like Bitcoin.

Zeberg stated weak U.S. non-farm employment figures point out the financial system is shedding momentum. That usually creates the best situations for an eventual “explosive” rally, the final robust rally earlier than the market cools down massively, he says.

“Final assembly earlier than autumn”

Zeberg defined that a lot of the greatest positive aspects in cryptocurrencies come throughout this final vertical part, when costs rise quickly and concern of lacking out (FOMO) reigns.

Nevertheless, he warned that this era wouldn’t final lengthy. If the greenback begins to rise once more, there could possibly be one other correction throughout shares and cryptocurrencies.

Bitcoin focuses on ranges that outline its cycle

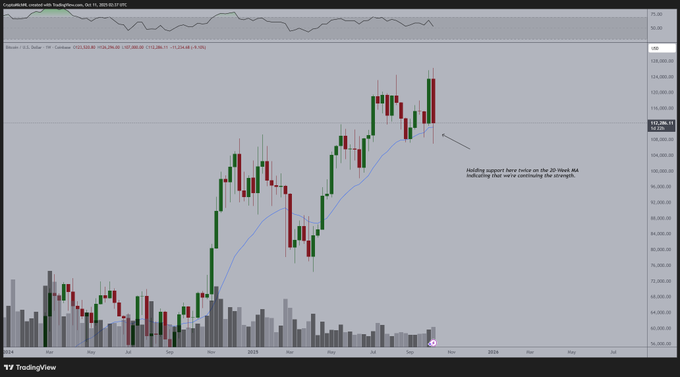

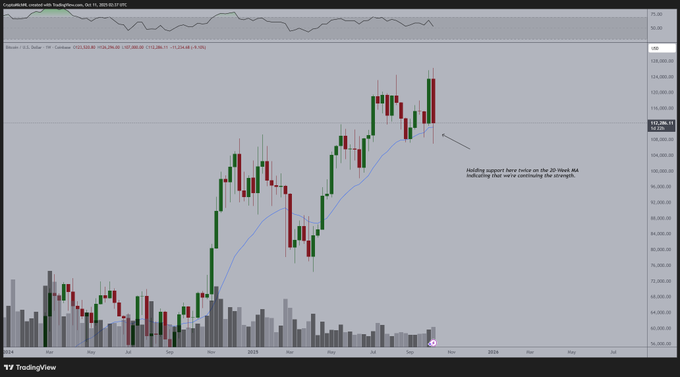

Market analyst Michael van de Poppe stated Bitcoin’s subsequent transfer will rely on whether or not it could actually break above its 20-week transferring common, which is at present close to $112,000. If it continues to rise above this stage and begins to rebound, the decline may sign a last stage of capitulation, just like what occurred through the COVID-19 crash and the FTX collapse, he stated.

A powerful restoration from this zone may affirm Seberg’s view that the market nonetheless has one final massive rally left earlier than the cycle peaks.

Associated: Bitcoin value now tracks world liquidity curve fairly than blocking rewards

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.