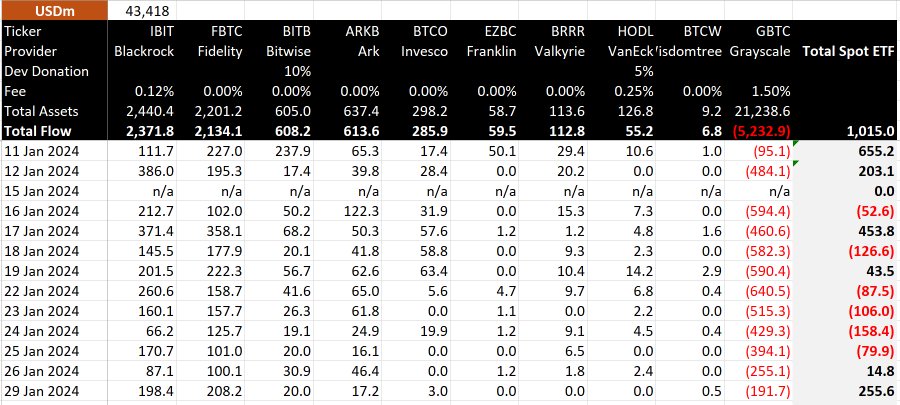

Grayscale Bitcoin Belief (GBTC) has seen a slowdown in outflows, with just below $200 million withdrawn from the fund on January twenty ninth.

information BitMEX Analysis reveals that whole outflows throughout this reporting interval have been roughly $192 million. Notably, that is the bottom outflow for the reason that fund's inception, surpassed solely by the primary day of buying and selling, when withdrawals reached $95 million.

In the meantime, the 9 new shares present that inflows into the fund proceed to offset inflows into Grayscale.

Constancy Sensible Origin Bitcoin Fund (FBTC) was a standout, ending the twelfth buying and selling day with the best inflows of $208 million. By comparability, different funds, together with BlackRock's IBIT, noticed inflows of $198 million. ETFs resembling BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, whereas different ETFs reported zero inflows.

Excessive buying and selling exercise contributed web inflows of $255.6 million within the twelfth buying and selling day.

GBTC maintains “liquidity crown”

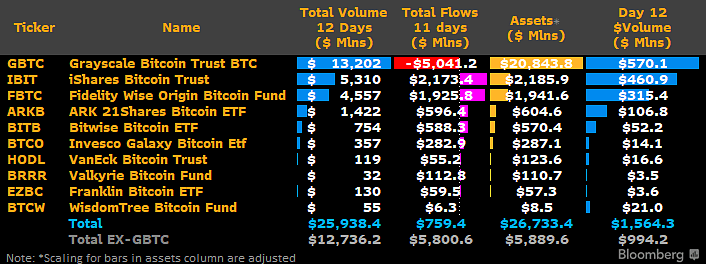

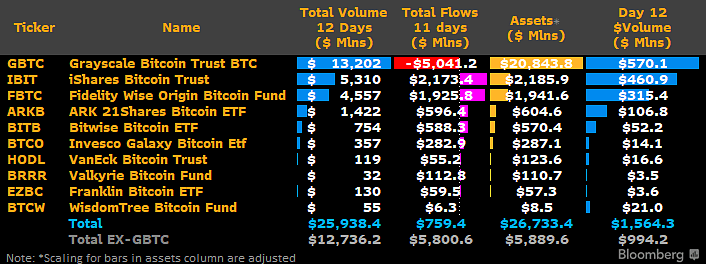

Nonetheless, as Bloomberg Intelligence analyst James Seifert noticed, Grayscale’s GBTC stays the highest crypto ETF by way of liquidity.

Regardless of current capital outflows, GBTC's buying and selling quantity reached $570 million on January 29, surpassing BlackRock's IBIT by $110 million, reaffirming its market dominance.

After the current conversion, Grayscale's ETF skilled vital outflows totaling greater than $5 billion. Analysts attribute the outflow to profit-taking by traders who have been uncovered to a reduction to earlier web asset values.

Moreover, the fund's comparatively excessive administration payment of 1.5% has been cited as an element driving some traders to competing ETF suppliers resembling BlackRock and Constancy, which cost decrease charges of 0.25%.

In keeping with experiences, as of January 29, Grayscale ETF's property underneath administration (AUM) have decreased from the year-to-date excessive of roughly $29 billion (623,390 BTC) to roughly $21,431 million (equal to 496,573 BTC) as a consequence of outflows. ). Official web site of the fund. The information reveals that fund customers have bought over 100,000 models of main cryptocurrencies for the reason that approval of the ETF conversion.

(Tag translation) Bitcoin