Rune was launched on April twentieth, the fourth Bitcoin halving. Fueled by the hype surrounding the long-awaited halving, they had been launched to the market in an enormous approach and attracted unbelievable consideration and exercise.

Their launch induced an enormous stir within the cryptocurrency trade, particularly the Bitcoin market, sparking heated debates concerning the future and usefulness of Bitcoin, just like what we noticed with the launch of Bitcoin Ordinal. .

It's been a month since Runes was launched. That is lengthy sufficient to get a stable understanding of how Runes has impacted the market and to make some predictions concerning the future.

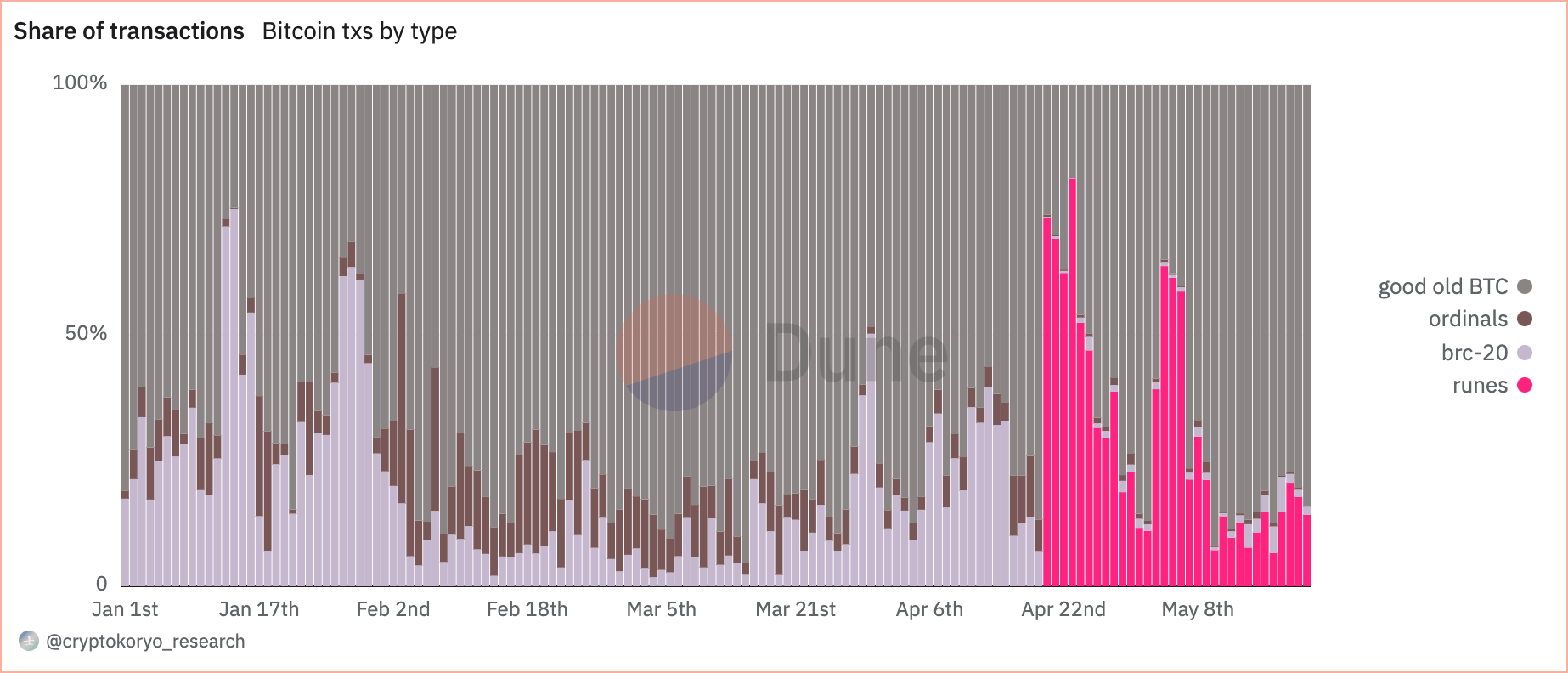

currencyjournals's preliminary evaluation reveals that Runes' preliminary influence in the marketplace was substantial. On the day of the halving, Runes trades accounted for 57.7% of all Bitcoin trades on the day, in comparison with Ordinals simply 0.5% and BRC-20 tokens 0.2%.

Though this sudden dominance mirrored nice curiosity in runes, it was clear that such a sudden surge in commerce share was unsustainable in the long run.

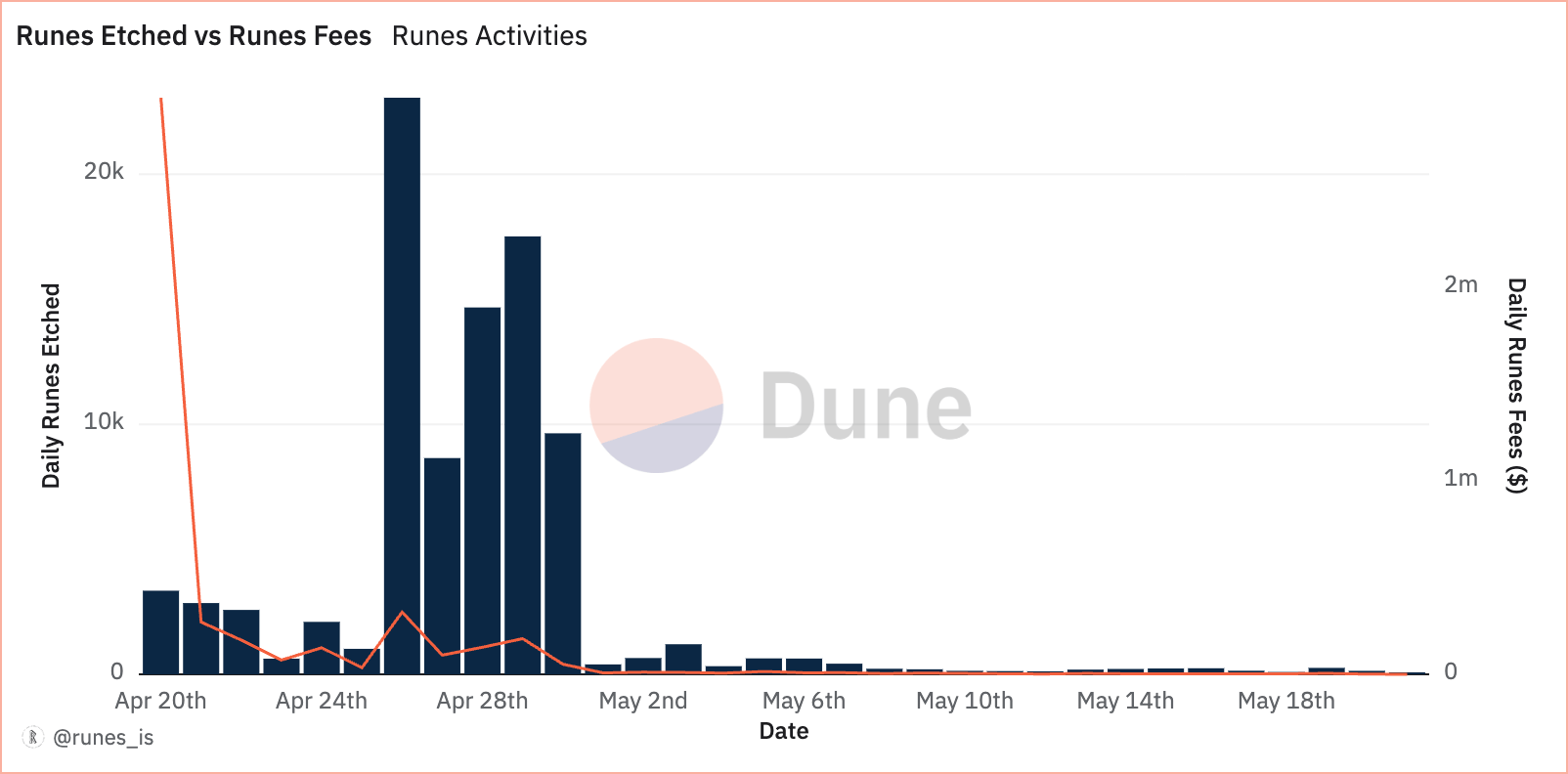

Each day knowledge from Dune Analytics reveals that rune exercise has fluctuated within the days following launch. On April twentieth, he had 3,344 runes carved and earned $2.997 million in charges. This excessive exercise stage didn’t final lengthy and a pointy decline was noticed over the subsequent few days.

By April 23, solely 625 runes had been etched, bringing the worth all the way down to $73,793. The height occurred on April twenty sixth, with 23,061 runes etched, however this momentum didn’t final, and by Could twentieth the determine had fallen to 139 runes.

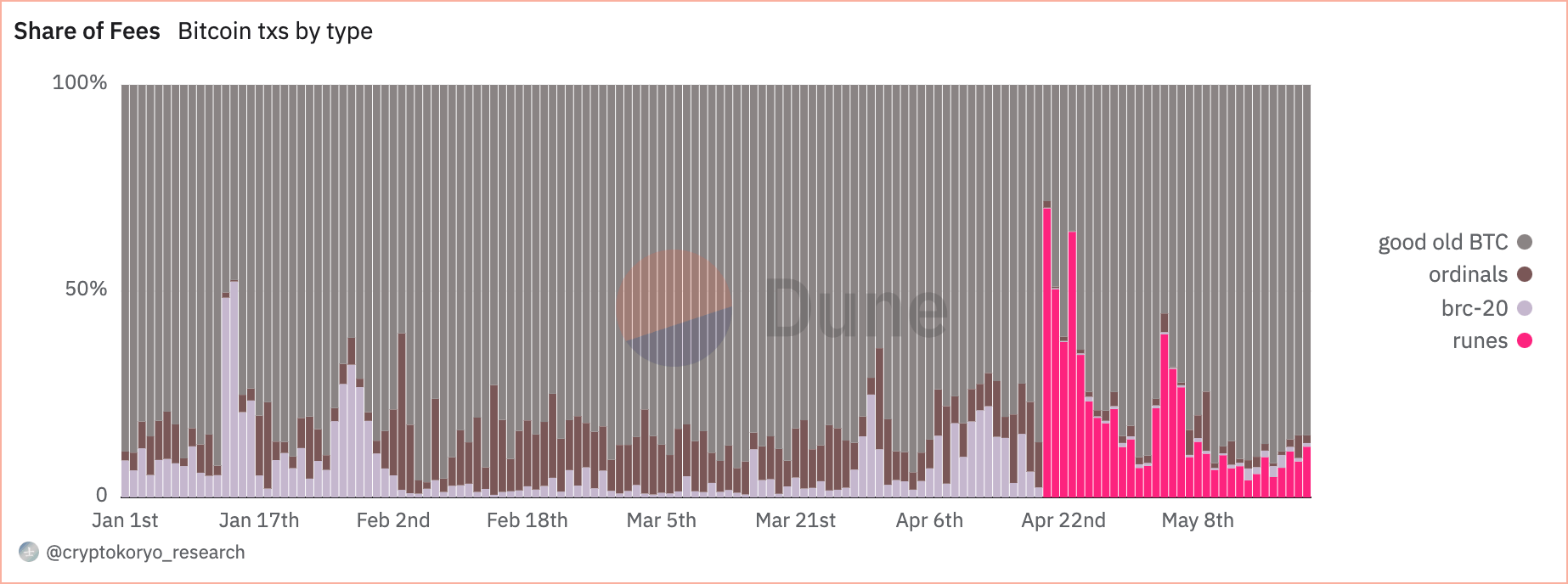

Rune’s share of complete Bitcoin charges was additionally unsustainable. As of April 20, it accounted for 70.1% of commissions. These numbers fluctuate broadly from month to month, with transaction share reaching 81.3% and commissions reaching 64.4% on April twenty third. By Could 20, rune transactions accounted for 17.8% of the entire, and charges had fallen to eight.7%.

Regardless of a major decline in reputation and utilization, Rune nonetheless managed to depart a substantial imprint on the Bitcoin market. In his first 30 days, a complete of 92,713 runes had been created by means of 7.15 million transactions, of which 3.861 million mint transactions accounted for.

All this exercise resulted in vital transaction charges totaling 2,299 BTC, of which 1,282 BTC was generated from mint transactions alone.

The information means that Rune is settling right into a extra secure, albeit much less dominant, position inside the Bitcoin ecosystem, a sample that mirrors that of Ordinals, which confronted an identical frenzy initially, adopted by stabilization.

As Loon turns into extra completely established within the Bitcoin market, we count on Loon's influence on charges and transactions to lower considerably. Even after only a month of launch, the preliminary spike in exercise and charges has regularly subsided, resulting in a extra secure and predictable integration into the Bitcoin buying and selling atmosphere. Whereas we count on short-term spikes in exercise in periods of mint reputation, this stability is more likely to proceed over the approaching months.

The publish 30 Days of Runes: Lack of Curiosity After a Fierce Launch appeared first on currencyjournals.