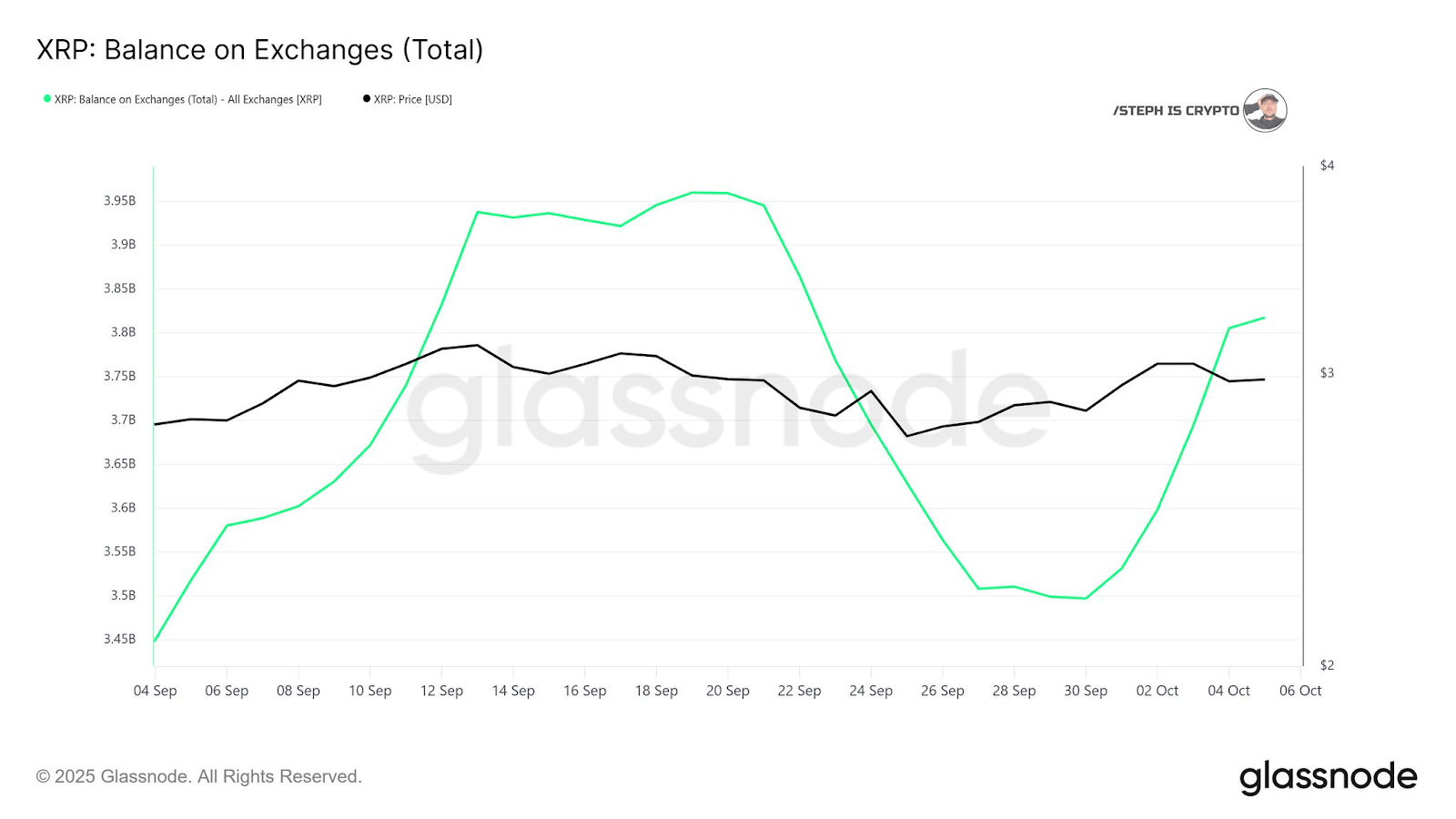

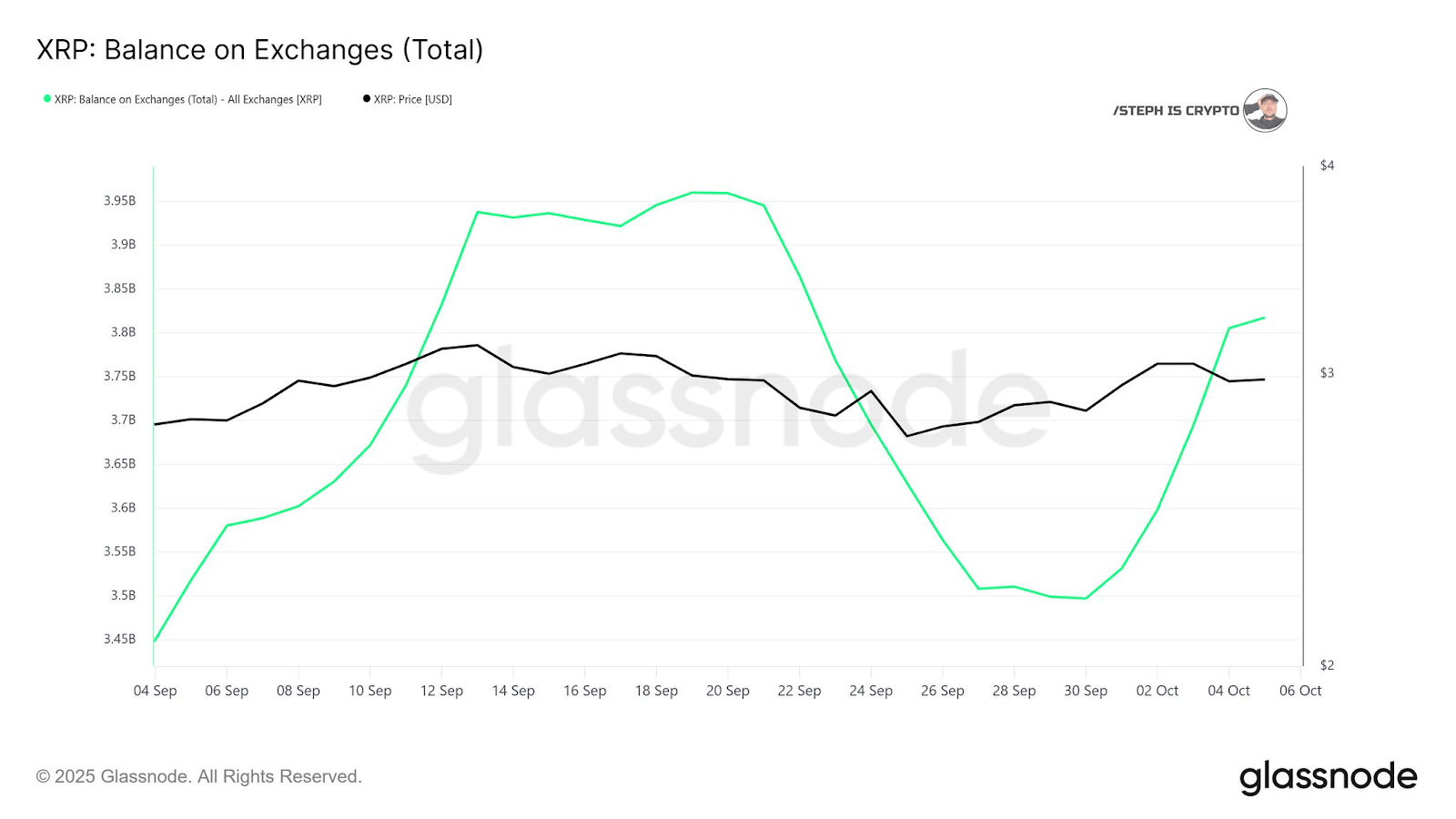

- On-chain knowledge evaluation exhibits that the online provide of XRP in Crypto Exchanges has skilled a pointy enhance up to now few days.

- Demand for XRP by whale buyers has been rising in latest weeks amid explosive ETF approval hype.

- The XRP/USD pair exhibits a bullish breakout after a couple of weeks of uneven.

Greater than 320 million XRP, almost $950 million, have moved to main crypto exchanges over the previous week, in keeping with GlassNode knowledge. The inflow lifted a complete alternate expenditure of over 3.8 billion XRP, reviving debate over whether or not the whales are getting ready to promote or staging the following leg for the 2025 alto season.

XRP Alternate balances spikes throughout main platforms

GlassNode’s on-chain knowledge exhibits the sharpest seven-day leap in XRP provide since early 2024.

Between September twenty ninth and October fifth, the stability rose from 34.5 billion to three.8 billion XRP, however the worth reached almost $3.10.

Which exchanges led to a rise in XRP provide?

Encrypted knowledge identified Binance and Bitfinex as the largest contributors of the buildup. Their pockets clusters confirmed a sustained inflow from late September to early October as market depths improved.

In Vinanence, tracked balances rose from round XRP 2.9 billion in August to round XRP 3.5 billion by October 5, 2025.

Associated: XRP Worth Prediction: Analyst Eye $3.60 BreautETF Evaluation Begins

Bitfinex strengthened its view that the stability elevated from round 58.5 million XRP in June 2025 to round 164 million XRP by October, requiring skilled venues so as to add inventory when volatility returned.

Do you purchase whales?

Internet demand for XRP from whale buyers stays comparatively excessive. Final week, on-chain knowledge evaluation from Santiment revealed that whale buyers had bought 100 million to 1 billion account balances of 250 million XRPS, growing their holdings to 9.2 billion cash.

Moreover, whale buyers have bought cash with account balances starting from 10 million to 100 million, growing their holdings to 7.9 billion XRP cash.

What is the large image?

Necessary fundamentals

XRP continues to be one of many largest crypto property attributable to its market worth, supported by cross-border fee use instances and elevated developer exercise in XRPL. Latest courtroom developments relating to Ripple’s case have improved readability in some establishments.

A number of asset managers, together with Grayscale and WisdomTree, explored Spot XRP ETF merchandise and different fund buildings. The formal development within the SEC is a short-term catalyst that may redirect the movement from alternate to long-term autos.

Ripple Labs has engraved strategic partnerships with a number of corporations in varied jurisdictions to facilitate the mainstream adoption of the XRP and XRPL ecosystem. For instance, Ripple Labs introduced a number of partnerships final week to strengthen mainstream adoption of Ripple USD (RLUSD) throughout Africa.

Interim forecast

Provide and demand for intensive venues will information costs within the coming weeks. The chart has proven uneven consolidation since mid-July, adopted by breakouts and retests in early October.

Nonetheless, XRP costs present a bullish breakout in direction of the all-time excessive (ATH). Particularly, XRP costs recorded bullish outlook amid the latest rise in Bitcoin (BTC) costs to $125.5,000.

From technical evaluation outlook, XRP costs have already retested latest breakouts from the declining logarithmic developments which have served as resistance over the previous two months.

Associated: XRP outweighs vital resistance. It is an vital goal to think about

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version will not be responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.