- Iran’s cryptocurrency ecosystem reached $7.78 billion in 2025, as inflation and the collapse of the rial accelerated adoption.

- Bitcoin exercise spikes throughout protests, conflicts, and cyber assaults, which function a sign of financial stress.

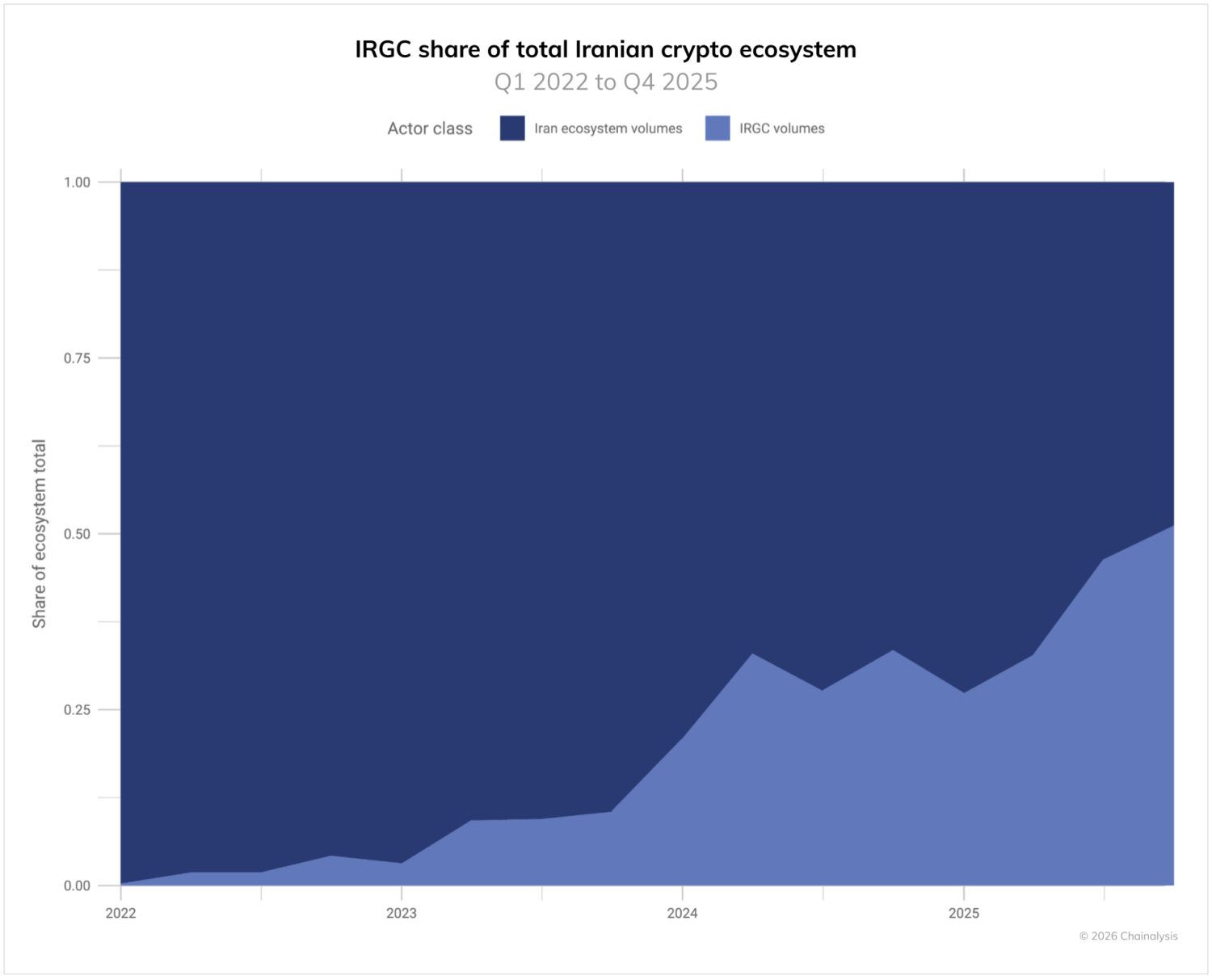

- At present, IRGC-linked wallets account for about half of Iran’s cryptocurrency flows, which is able to exceed $3 billion by 2025.

The enlargement of Iranian cryptocurrency exercise shouldn’t be about chasing the subsequent uptick. It is about survival. In 2025, Iran’s cryptocurrency ecosystem reached an estimated worth of $7.78 billion, rising at a sooner tempo than in 2024 for many of the yr. On the middle of this variation is Bitcoin, which is more and more used as a monetary lifeline relatively than a speculative asset.

Forex collapse with few choices left

Financial stress on Iran has been constructing for years. Since 2018, the Iranian rial has misplaced almost 90% of its worth, and annual inflation has repeatedly reached the 40-50% vary. Meals, housing, and imported items have grow to be steadily costlier, whereas wages have lagged far behind.

For a lot of households, saving in actual cash not is sensible. The query has modified from “How do I earn more money?” “How will we cease it from shrinking?” Bitcoin stepped into that hole as a retailer of worth exterior of a quickly collapsing financial system.

Bitcoin exercise spikes when politics turmoil

On-chain information reveals that cryptocurrency exercise in Iran will increase sharply at moments of political and army stress. The massive spike adopted the Kerman bombing in January 2024, the Iranian-Israeli missile escalation in October 2024, and the 12-day battle in June 2025, which additionally included cyberattacks on banks, crypto platforms, and state media.

Every disaster provoked the identical response. Meaning extra cryptocurrency transactions, sooner cash transfers, and elevated demand for digital belongings. Bitcoin has successfully grow to be a real-time stress indicator for the Iranian economic system.

Associated: Will Bitcoin hit new all-time highs quickly? This is what our customers say

IRGC expands its management over cryptocurrencies

Whereas residents flip to cryptocurrencies for cover, the Islamic Revolutionary Guard Corps is utilizing cryptocurrencies on an industrial scale. By the fourth quarter of 2025, IRGC-linked wallets accounted for about 50% of all Iranian cryptocurrency exercise.

Supply: Chainalysis

Funds acquired at these addresses elevated from greater than $2 billion in 2024 to greater than $3 billion in 2025. Analysts warning that these numbers could also be an underestimate as they solely mirror recognized sanctioned wallets and exclude hidden shell entities and international intermediaries used to evade sanctions or switch cash throughout borders.

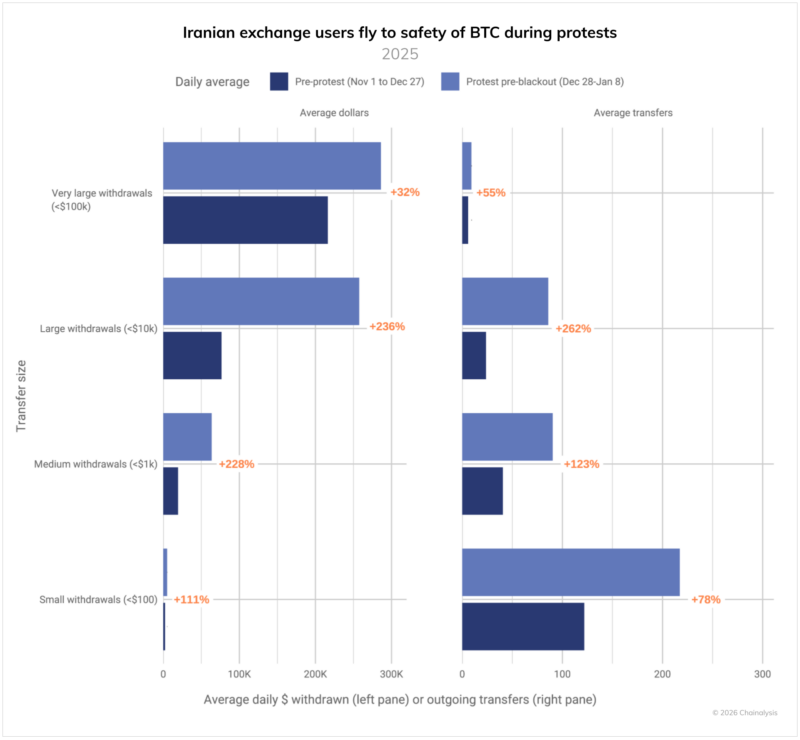

Protests trigger surge in voluntary custody instances

The distinction turns into much more stark throughout protests. Evaluating the pre-uprising interval (November 1, 2025 to December 27, 2025) and the interval of protests and web blackouts (December 28, 2025 to January 8, 2026), the information reveals a pointy enhance in Bitcoin withdrawals from Iranian exchanges.

Supply: Chainalysis

Extra customers are shifting their funds into private wallets, selecting self-storage relatively than platforms with potential restrictions and oversight. This motion indicators a flight to security from fears of financial institution failures, capital controls, and additional foreign money losses.

Why Bitcoin and never simply one other digital foreign money?

In accordance with our evaluation, there are three the explanation why Bitcoin stands out. Self-custody permits customers to handle their funds and not using a financial institution. Censorship resistance permits buying and selling to proceed regardless of a shutdown. Its portability makes it helpful in case of evacuation or sudden motion of the capital.

Comparable spikes in Bitcoin withdrawals have occurred in different battle and disaster areas, pointing to a broader international sample.

Associated article: Shares fall, Bitcoin rises as Peter Schiff calls crypto rally a ‘duck wager’

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.