Regardless of the volatility skilled by Bitcoin in 2023, the extended sideways motion from February to July proved to be fertile soil for accumulation. Our on-chain evaluation reveals that short-term holders (STH) and long-term holders (LTH) have been steadily accumulating over the previous quarter, indicating a robust perception within the asset’s long-term worth.

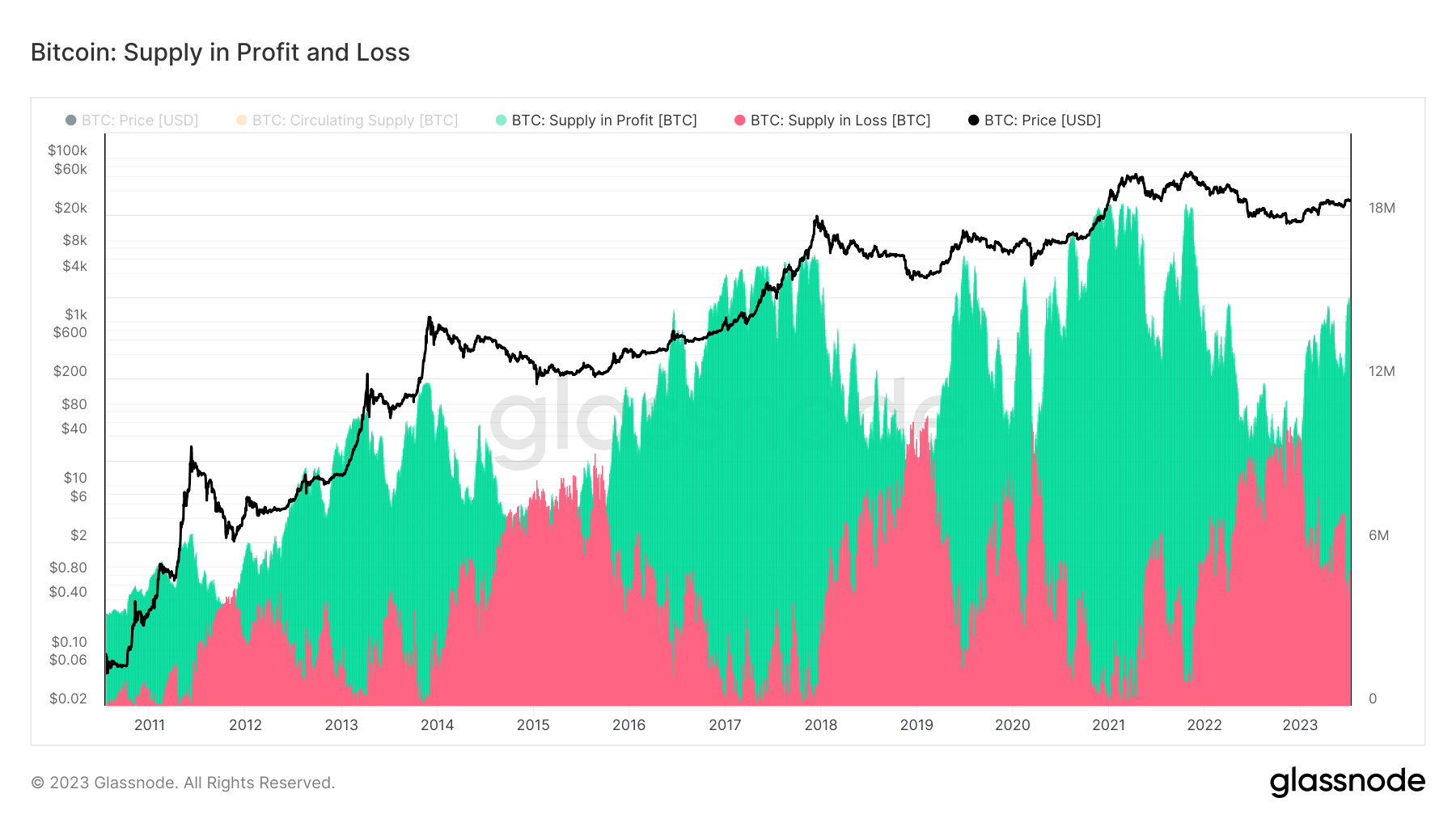

Measuring Bitcoin provide in revenue or loss is an important a part of analyzing the market. These indicators present worthwhile perception into market sentiment and investor habits. A excessive provide of income signifies that buyers are holding onto belongings in hopes of additional worth appreciation. Conversely, a rise in loss provide can sign a possible sell-off.

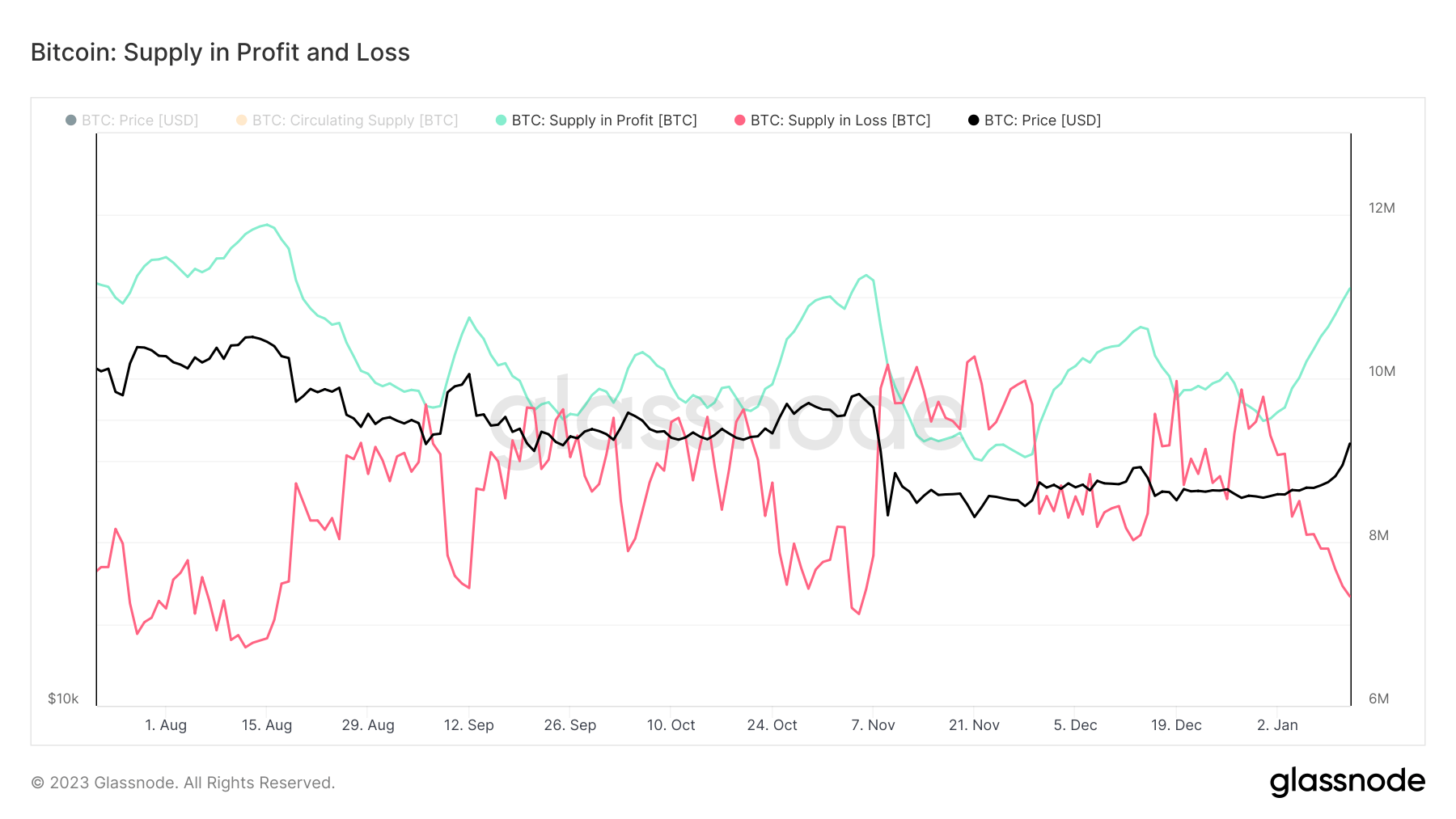

Throughout a interval of excessive worth volatility from September to December 2022, provide in P&L converged a number of instances, reflecting market uncertainty.

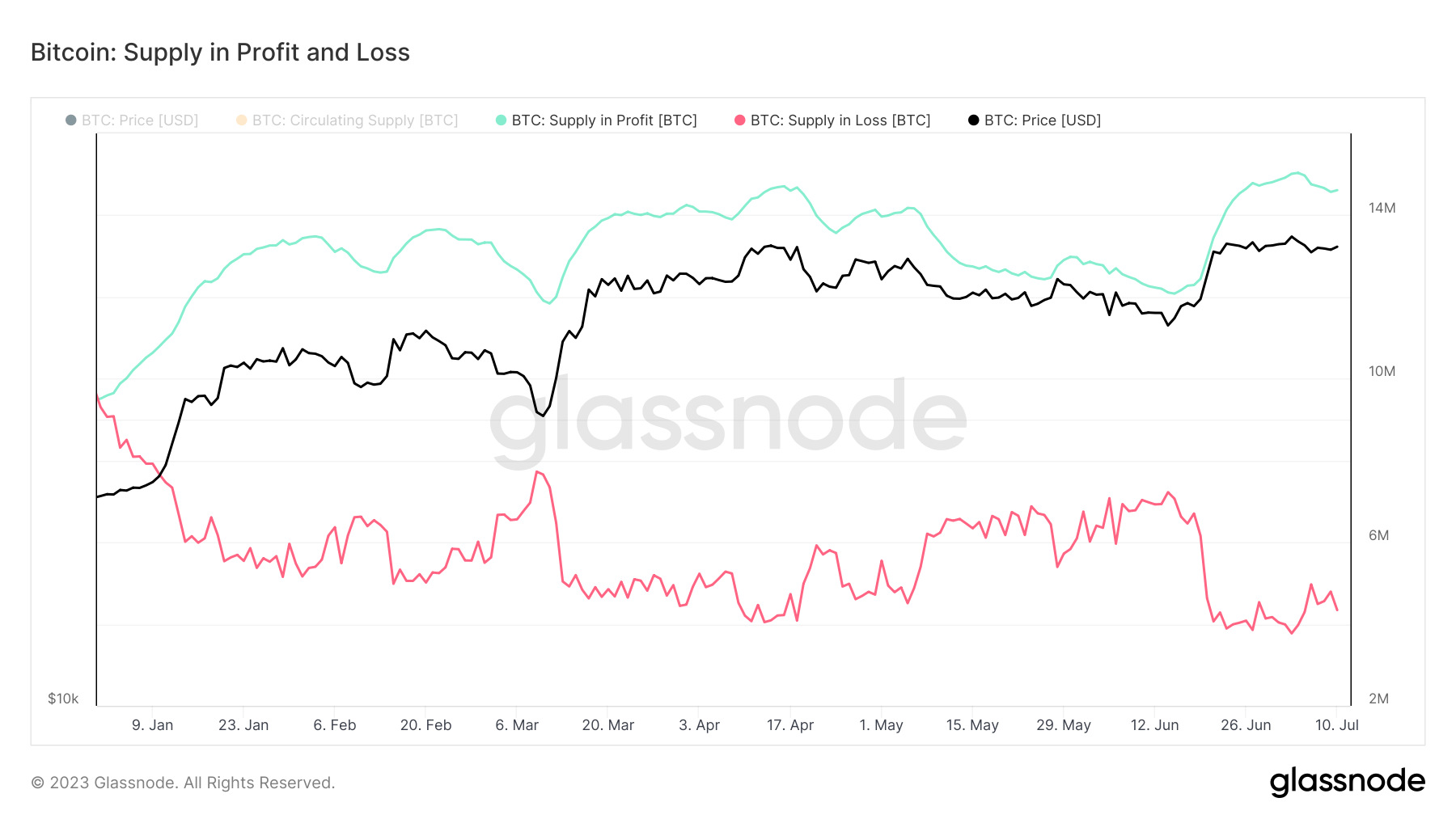

Nevertheless, from early 2023, the scenario has modified. Revenue and loss provide diverged, and he elevated the ratio of provide to revenue by greater than 53%. In response to Glassnode knowledge, 14.61 million BTC is at the moment worthwhile, whereas 4.34 million BTC is in loss.

As of July 11, 75% of provide is worthwhile and solely 25% is loss. This key equilibrium is harking back to the state of affairs witnessed on the midpoint of the 2016 and 2019 market cycles. Glassnode’s knowledge additional revealed that fifty% of Bitcoin buying and selling days had a better P&L steadiness and 50% had a decrease P&L steadiness.

The present accumulation part and the ensuing 75% revenue of Bitcoin’s circulating provide bodes properly for the cryptocurrency. If previous patterns proceed, this could possibly be the midpoint of Bitcoin’s present market cycle, having reached a backside, suggesting the market is now gearing up for an upside.

Nevertheless, you will need to think about that whereas previous patterns present helpful context, they don’t seem to be all the time predictive of future habits. In the present day’s Bitcoin market is extra affected than ever by numerous macro elements, together with regulatory developments and the broader financial local weather.

Put up-Heavy Accumulation, with a revenue of 75% of Bitcoin’s circulating provide, first appeared on currencyjournals.

(tag translation) bitcoin

Comments are closed.