- QCP Capital warns Bull Entice if China retaliates.

- Market makers are stated to be offered to gatherings earlier than Could and June.

- USD/CNY hits at 7.35, inflicting capital outflows from China.

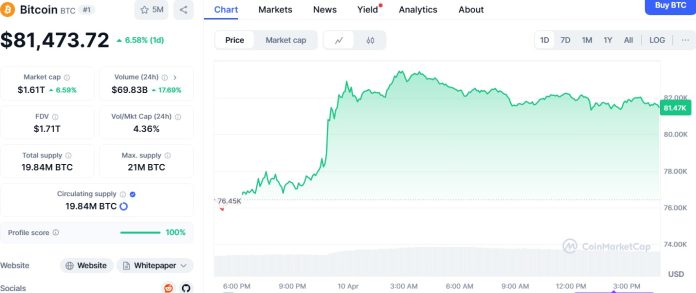

Bitcoin (BTC) surged above $82,000 earlier this week, however rally stability stays a difficulty.

On the time of writing, BTC is buying and selling at $81,473.

Supply: CoinMarketCap

Regardless of the broader rise throughout world shares and crypto markets, analysts now warn that Bitcoin may step into the basic Bull Entice because the US-China commerce struggle is altering much more.

Market contributors, backed by information of tariff suspensions for a number of nations, are serving to President Trump combat a possible counterattack from Beijing after President Donald Trump maintains China’s restrictions.

If retaliation happens, Bitcoin’s upward pattern could possibly be pushed by macro uncertainty and reversed sharply.

QCP flag revised from Could to June

Bitcoin and altcoin gathered alongside shares following President Trump’s resolution to roll again tariffs, however as China was faraway from reduction, the market expects aggressive measures from Beijing.

QCP stated the short-term conferences have decreased civic volatility, notably on the brief finish.

Nonetheless, the corporate’s inner buying and selling desk continues to look at “topside gross sales in Could and June.” This means that many market makers use present gatherings as an exit technique somewhat than as a long-term belief vote.

This view is supported by historic market responses.

Earlier within the week, rumors of a wider tariff suspension had already produced sharp whipping strikes of shares and codes as the shortage of official affirmation shortly modified traders’ sentiment.

QCP signifies that “frenzy gatherings” below these unsure situations will lock traders in and lose positions solely as a result of costs rise quickly and fall sharply.

Former slide gas BTC demand

There’s a warning from the bull entice loom, however others see one other facet of the coin.

The Chinese language Yuan (CNY) fell to its 18-year low in opposition to the US greenback, with the USD/CNY pair reaching 7.35.

In accordance with some market watchers, the devaluation could possibly be a catalyst for additional capital flights from China.

Sina, co-founder of twenty first Capital, identified on X (previously Twitter) that “the capital won’t be positioned when the ex is weakened.” Traditionally, such a transfer has led to the circulation of funds to gold, overseas belongings and more and more Bitcoin.

For Chinese language traders searching for to guard capital from each foreign money devaluation and the unpredictability of commerce insurance policies, BTC gives a decentralized different.

This dynamic sits not solely as a hedge of Bitcoin, however as an escape valve for an period that can enhance monetary stress.

The concept that BTC is changing into a “necessity” in an unstable surroundings has gained traction, notably within the face of shut capital administration and weakening Fiat foreign money.

The steadiness of BTC continues to be unsure

Capital outflow from China may increase BTC’s short-term demand, however analysts are nonetheless not satisfied that Bitcoin has reached its long-term backside.

The significant, sustained rebound worth goal continues to concentrate on the $70,000 vary. That is flagged by many technical indicators as essential assist and resistance ranges.

The $81,552 worth vary represents a noticeable excessive, however there may be rising skepticism about whether or not it will likely be in a position to keep its present momentum and not using a extra favorable macroeconomic sign.

Commerce dynamics, foreign money actions and rate of interest insurance policies will all proceed to play a task within the Bitcoin trajectory within the coming weeks.

Bitcoin is navigating a extremely unstable part with the uncertainty of the worldwide macroeconomic that clashes with rising curiosity in beneficial alternate options.

Digital belongings may gain advantage from the worry of formerly-led outflows and tariffs, however escalation of commerce tensions can flip present income into short-lived spikes, particularly when China responds aggressively.

Bitcoin at $81,552 was first launched in Coinjournal, and due to this fact faces the chance of a $81,552 bull entice.