- Algorand holders are dealing with vital losses, with a staggering 89% of them underwater.

- At the moment, solely 8% of buyers are benefiting from ALGO's worth of $0.1818.

- Gary Gensler beforehand praised Algorand for serving to the asset attain an ATH of $3.56.

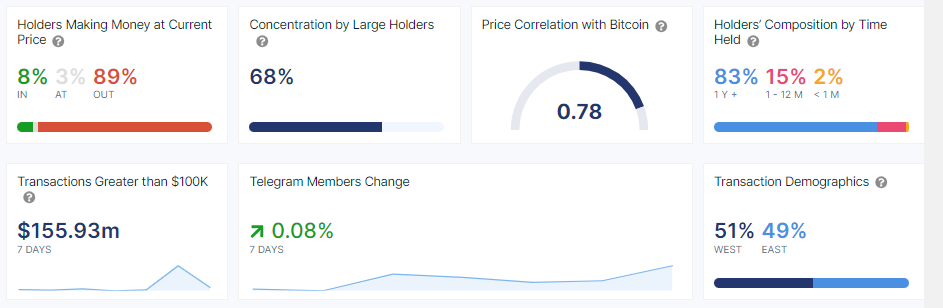

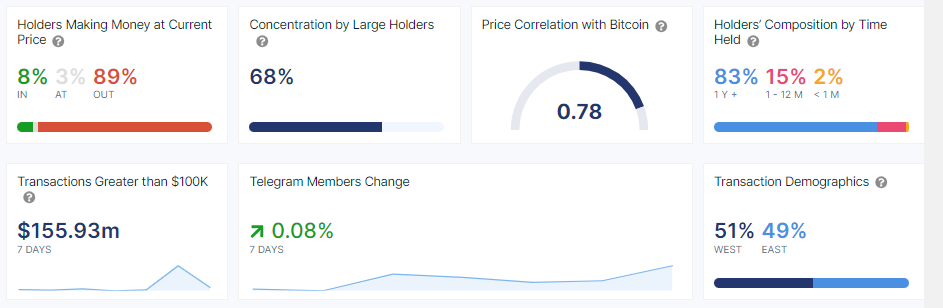

Amid the crypto market downturn, crypto buyers are feeling the warmth, particularly these holding Algorand (ALGO), a mission praised by Gary Gensler. In accordance with information from the analytical platform IntoTheBlock, 89% of ALGO holders are in losses. These buyers are “out of cash”. Because of this the overwhelming majority of his ALGO buyers are holding belongings for lower than their preliminary buy worth.

ALGO is buying and selling at $0.1818 on the time of writing, up 5% up to now 24 hours. At this market worth, solely 8% of Algorand holders are making a revenue. On the similar time, 3% is on the breakeven level, making no bearish good points or earnings.

Notably, among the many cryptocurrencies monitored by IntoTheBlock, ALGO stands out for having the best share of holders in loss-making positions.

Moreover, in response to IntoTheBlock statistics, not less than 83% of those Algorand buyers are long-term buyers who maintain their belongings for greater than a 12 months. Up to now 12 months he participated within the ALGO market by solely 15%. In the meantime, his 2% of the holder spectrum accounts for many who bought his ALGO inside the previous 30 days.

Massachusetts Institute of Know-how (MIT) professor Silvio Micali based Algorand in 2017. His blockchain mission drew reward from the now notorious US Securities and Trade Fee (SEC) Chairman Gary Gensler.

This was throughout Gensler's tenure as a tenured professor on the MIT Sloan College of Administration in 2018 and 2019. Particularly, throughout a 2019 presentation, Gensler stated that Algorand: “It’s nice expertise and has the efficiency to construct Uber on prime of it.”

This assist has grow to be much more necessary since Gensler turned SEC chairman in 2021. Nevertheless, when the SEC filed a lawsuit towards crypto buying and selling platform Bittrex final April, it labeled ALGO as a safety.

Regardless of preliminary optimism and assist, Algorand has struggled to maintain tempo with its friends in recent times. Three months after Gensler's 2019 presentation, ALGO soared to an all-time excessive of $3.56. Nevertheless, the asset bought for round $0.1818, reflecting a staggering 94% drop in worth since then.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.