- Ether dropped by 9%, XRP dropped by 2%, and Dogcoin misplaced over 8% in 24 hours

- Buyers reply to Trump’s feedback about doable recession

- The US inventory market has misplaced greater than $1.7 trillion

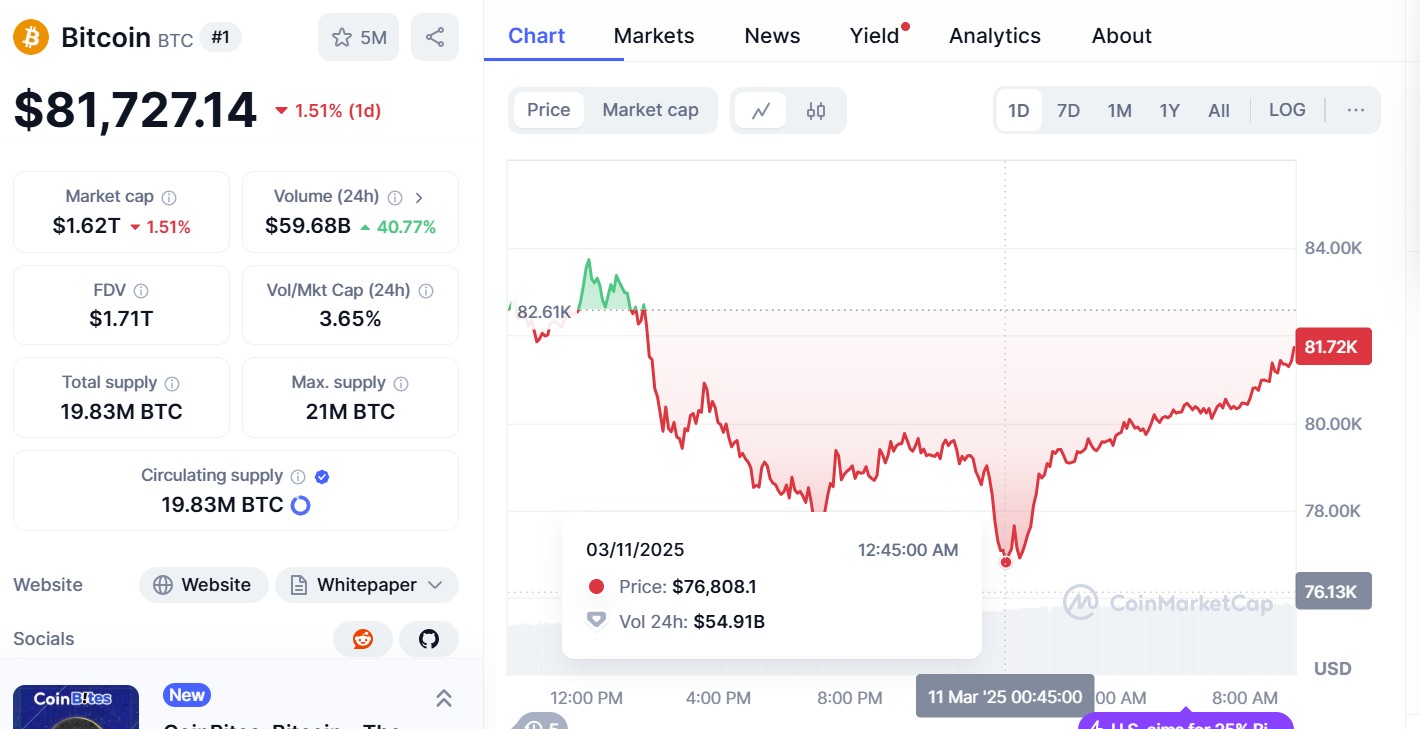

Crypto costs have fallen fully, with Bitcoin falling beneath $77,000 as traders continued to answer President Donald Trump’s tariff insurance policies and Bitcoin reservations plan.

Earlier on Tuesday, March 11, Bitcoin fell to $76,000, a determine that hadn’t been seen since final September. In a submit on X, Crypto Dealer Ali mentioned:

“If #bitcoin $btc holds $80,000, the bull case stays robust. Nonetheless, in the event you lose this degree you possibly can play $69,000 as your subsequent necessary help!”

https://twitter.com/ali_charts/standing/1899267277654229041

Bitcoin has risen barely, backing up about $81,600 on the time of publication, in response to CoinmarketCap. In the meantime, ether was over 9% to $1,920 in 24 hours, with XRP down over 2% to $2.13, and DogeCoin exceeding 8.81% to $0.1607.

The market reacts

Information of ongoing market gross sales are as traders reply to Trump’s commerce tariffs, the announcement of a US strategic Bitcoin reserve, and the potential for a recession.

Following Trump’s remarks, the US inventory market misplaced greater than $1.7 trillion yesterday. Elon Musk’s Tesla noticed its inventory decline at the least 15% to $222, falling in worth from its December peak at $479.86. In a submit on X, Musk acknowledged:

Trump’s commerce tariffs in Canada, China and Mexico haven’t helped the market state of affairs. Final month it was confirmed that Trump is imposeting 25% commerce tariffs on Canada and Mexico. Nonetheless, that is delayed till April 2nd. China has collected 20% tariffs.

Bitmex co-founder Arthur Hayes requested X to turn out to be a “affected person.”

“$btc may backside round $70k. A 36% repair from $110K ATH, v-in-the-blue market,” he provides.

“Merchants will attempt to purchase dip if it is extra risk-averse for the central financial institution to deploy extra capital. They could not be capable to grasp the underside, however they do not must undergo mentally by means of long-term lateral orientation or potential unrealized losses.”

(tagstotranslate) Markets