- Centralized everlasting alternate reached $58.5 trillion in 2024 buying and selling quantity, doubled the 2023 determine.

- Excessive lipids dominated, decentralized, with market share of over 55% within the fourth quarter.

- Bitcoin led open curiosity at 45%, and Solana noticed a good quantity of spikes in 2024.

The Crypto Perpetual Futures Market grew to become Overdrive in 2024, transferring previous earlier buying and selling figures.

Market Tracker Coingecko’s newest report reveals that the highest 10 exchanges have recorded buying and selling volumes of $58.5 trillion. That is greater than double the 2023 report of over $28 trillion.

CEXS: Binance remains to be main however loses the bottom

Regardless of its spectacular quantity, Vinanence has lengthy seen its benefit waning to market leaders. Trade market share fell from 43% in January to 34% by December. Nonetheless, Binance continues to steer the sector with a big margin.

Associated: Binance crackdown: ban market makers and compensate customers with $GPS, $shell instances

In the meantime, a notable improvement within the centralized alternate market was Coinbase Worldwide’s first rise to the highest 10. The platform’s quantity quadrupled in December, securing a spot amongst key gamers within the everlasting sector.

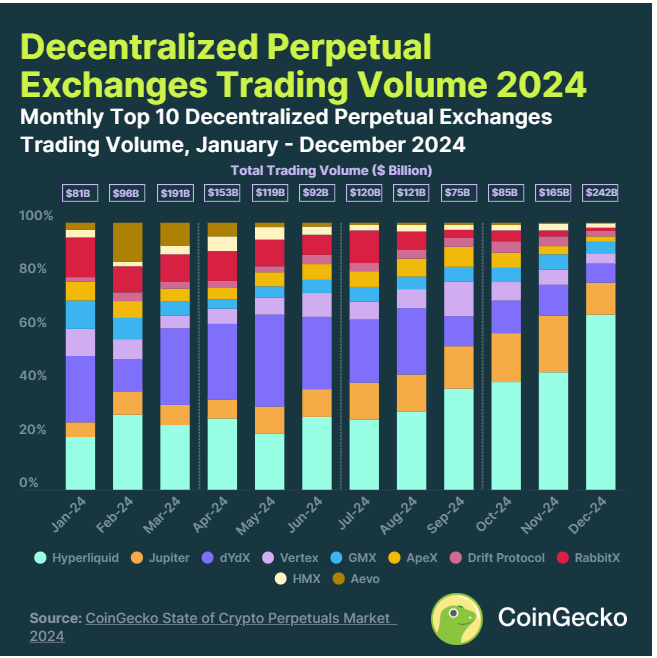

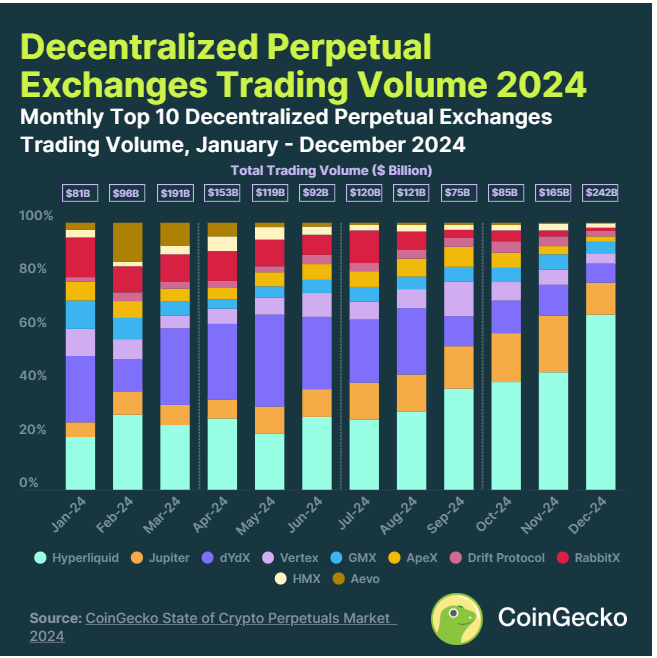

Dexs: Hyperliquid rise and Dydx fall

On the decentralized aspect, buying and selling volumes skyrocketed to $1.5 trillion in 2024 as a result of prime 10 decentralized everlasting exchanges. That is an astounding +138.1% improve from $64.76 billion in 2023. It accounted for $492.8 billion within the fourth quarter alone, reflecting a 55.9% improve from the earlier quarter.

The excellent performers of the distributed alternate house have been excessive lipids (hype). It achieved greater than 55% of its whole market share within the fourth quarter. This surge was pushed by a profitable airdrop that noticed a excessive lipid peak at a dominant 66% of market share in December.

Whereas excessive lipids flourished, former market chief Dydx noticed a pointy decline in market share in 2024. Initially of the 12 months, Dydx was main 73% of its market share. Nonetheless, by December, this had fallen to only 7%.

Solana’s position: rising, however nonetheless behind

Solana-based decentralized exchanges additionally noticed important progress. Jupiter has emerged because the second largest participant on this house. Nonetheless, Solana general accounted for less than 15% of the full everlasting buying and selling quantity in 2024.

This means that whereas its ecosystem is increasing, it’s nonetheless behind different main blockchains within the PARP buying and selling sector.

Associated: Solana Neighborhood Refuses to Overhaul Inflation Whereas Supporting Reforms Staking Rewards

Bitcoin domination of open curiosity

In terms of helpful earnings (OI), Bitcoin continued to dominate the centralized everlasting market, constantly accounting for round 45% of OI in 2024.

Associated: Bitcoin Open’s curiosity reaches $18.2 billion after BTC exceeds $72,000

Ethereum continued at 21%, whereas Solana misplaced 4% share. OI hit a significant milestone in November 2024, surpassing the $100 billion mark, pushed by bull market sentiment after the US presidential election for the primary time.

In the meantime, Solana additionally noticed a pointy surge in everlasting buying and selling quantity at a number of factors within the 12 months. Particularly, these spikes occurred in the course of the launch of Pump.Enjoyable in early 2024. The corporate has launched tokens based mostly on celebrities like Caitlyn Jenner (Jenner) and Mom Iggy (Mom) to additional amplify Solana’s presence out there.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version just isn’t chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.