- Lawyer Invoice Morgan reveals how the 2023 banking disaster disrupted Ripple’s on-demand liquidity (ODL) system.

- Ripple associate Tranglo confronted critical liquidity points and compelled a short lived swap from XRP to Fiat Pre-Funding.

- XRP adoption has declined, with solely seven of the 93 lively Tranglo prospects utilizing ODL in 2024.

XRP Lawyer Invoice Morgan has revealed new particulars about Ripple’s On-Demand Liquidity (ODL) system. Info comes from Currenc Group’s March sixth SEC submission. This doc outlines the monetary dangers and divulges how the 2023 banking disaster affected Tranglo’s XRP buying and selling.

Tranglo, a significant ripple associate in Southeast Asia, confronted critical liquidity challenges following the collapse of Silicon Valley Financial institution, Signature Financial institution and Silver Gate Financial institution.

Many crypto exchanges, together with the 2 that Tranglo makes use of, struggled to course of XRP transactions. Because of this, some ODL companions have stopped utilizing XRP a bit and switched to utilizing the standard cash that they had available.

How the Banking Disaster Disrupts XRP Transactions

The submitting explains how the failures of main US banks have created a liquidity scarcity within the crypto market. Many exchanges relied on these banks for money move. Once they fell, the fluidity was exhausted. The 2 exchanges utilized by Tranglo (unbiased reserves and Cash.ph) didn’t enable XRP to be transformed to native forex rapidly sufficient.

Associated: Crypto Lawyer shares his views on Ripple ‘ODL XRP gross sales

The confusion compelled Tranglo to ask ODL companions to droop XRP transactions. In response, 9 of the 11 ODL companions switched to Fiat’s advance funding and continued to run operations. This reveals the danger of counting on fast money, particularly when conventional financial institution help is misplaced.

Decline in ODL adoption in 2024

The submitting additionally supplies perception into ODL adoption in 2024. This reveals that seven of Tranglo’s 93 lively prospects solely used ODL within the first 9 months of the 12 months. These transactions account for 4.8% of Tranglo’s remittance income and three.6% of whole cost transactions.

ODL continues to be a part of Tranglo’s enterprise, however its restricted recruitment means that some companions are hesitant to undertake it after previous turmoil. Most selected to stay to Fiat’s advance funding as a substitute of returning to XRP-based settlements.

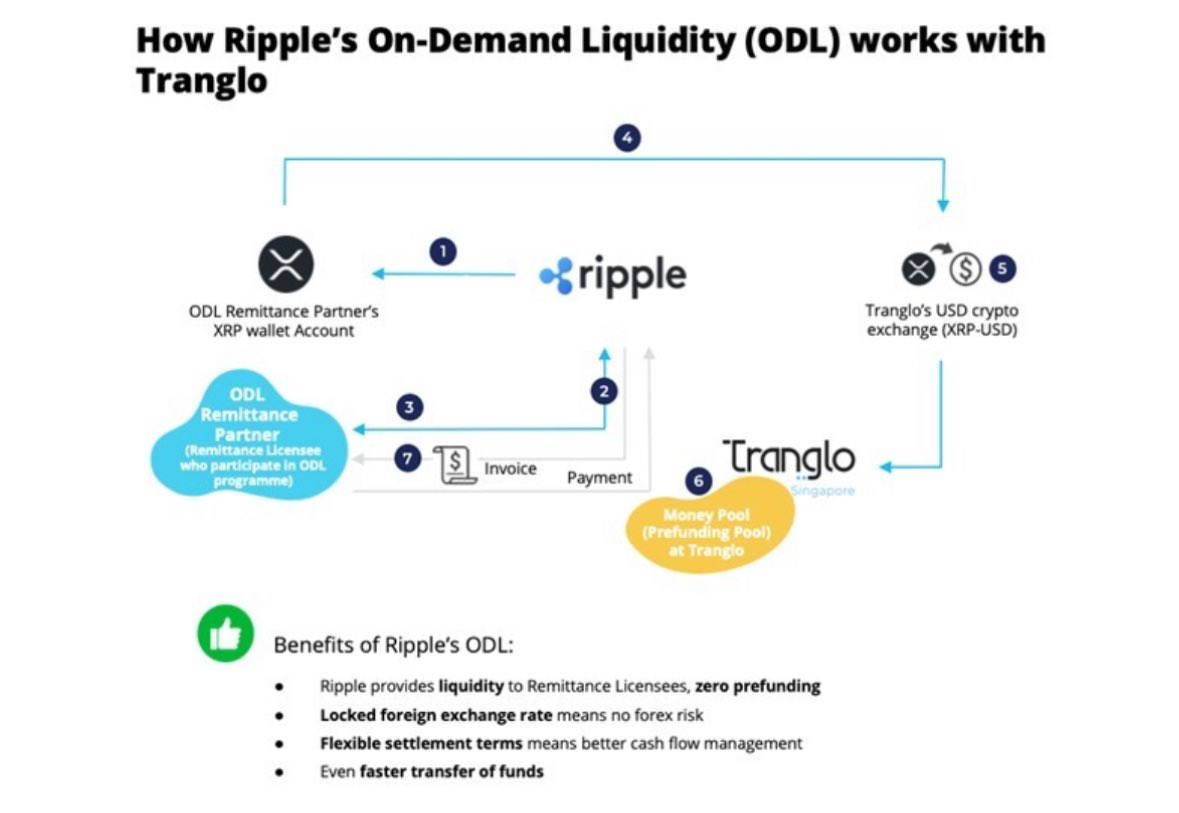

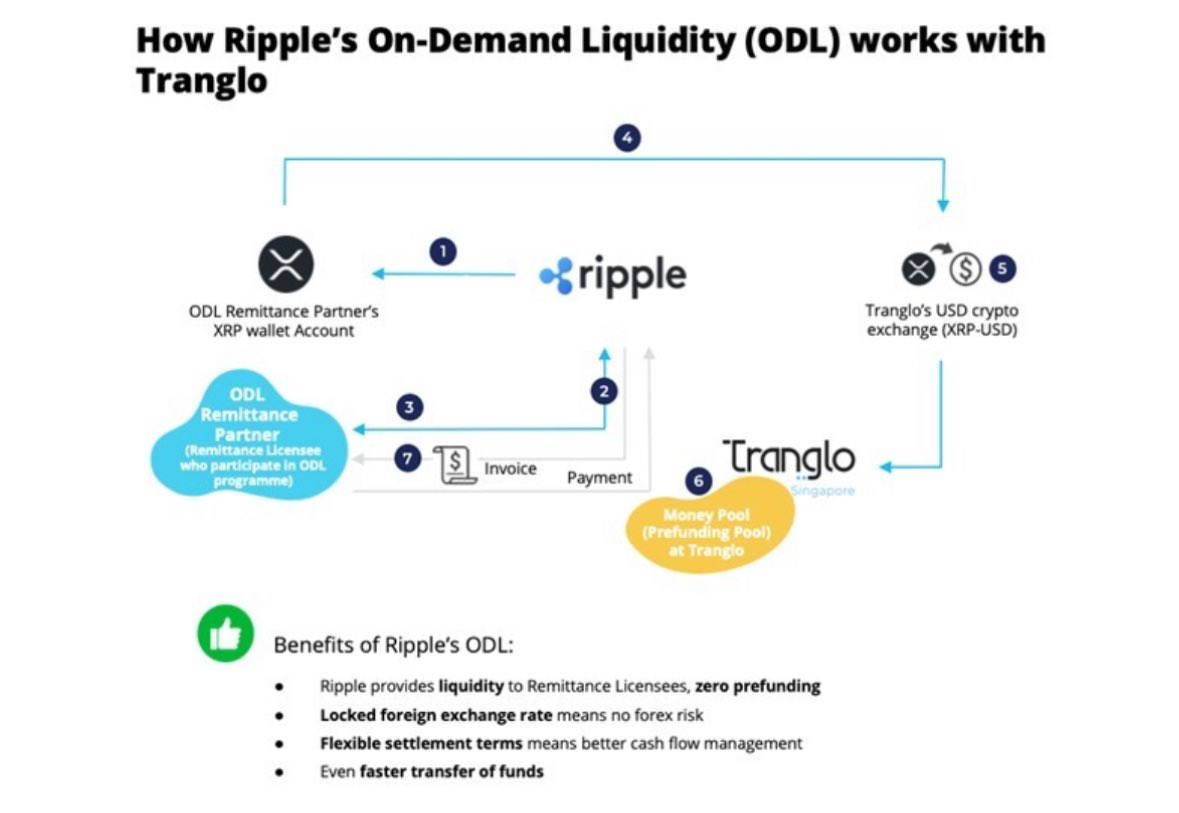

Tranglo’s ODL Course of and the Function of XRP

Morgan famous that the submitting contains one of the crucial detailed breakdowns of Tranglo’s ODL system. Pages 82-85 clarify how XRP promotes cross-border transactions. The prospectus diagram illustrates the method and confirms that XRP stays integral to Tranglo’s operation.

Associated: XRP Value Alerts: Assist Checks, Bear Alerts, Bullish Hope

Ripple’s ODL eliminates the necessity for pre-funded accounts through the use of XRP as bridge forex. This technique permits for quicker settlements and reduces prices. Nonetheless, the 2023 banking disaster revealed potential weaknesses throughout the liquidity scarcity.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version just isn’t accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.