- The weekly RSI is under 30, indicating that it’s oversold.

- Traditionally, comparable circumstances preceded greater than 200% rebounds.

- ETH might rise from $6,500 to $7,000 if a reversal is confirmed.

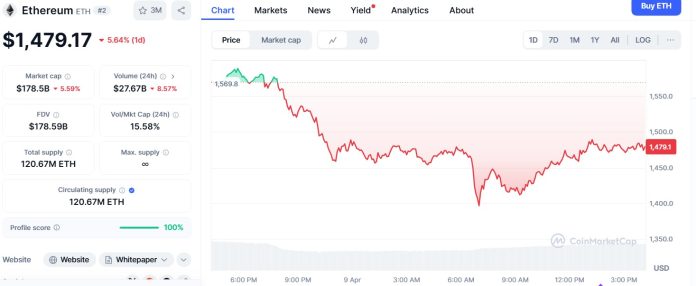

Ethereum, the world’s second largest mayoral cryptocurrency, fell by greater than 5%.

With digital belongings struggling to carry greater than $2,000, analysts are specializing in the mix of technical indicators and on-chain knowledge to find out whether or not present worth motion reveals a broader development reversal.

Supply: CoinMarketCap

Ethereum is at present testing the identical stage that it has bounced again for lately. This additionally corresponds to the very best ever since 2018, suggesting {that a} potential market backside could also be forming.

Ethereum reaches realised worth ranges

Another essential improvement is that Ethereum has achieved a realisation worth of lower than $2,000. This can be a metric that calculates the typical worth that each one ETHs within the circulation moved final.

Traditionally, this stage has served as a uncommon and highly effective sign for long-term buyers. The final time Ethereum fell under its realised worth was in March 2020.

The return of ETH under this line depicts some historic similarities.

Again in 2020, Ethereum lastly achieved a large restoration of over $4,800 in November 2021, at an all-time excessive.

In line with long-term development indicators, the return of this situation will enhance the chance of the same upward motion within the coming months.

RSI is under key threshold

Technical evaluation reveals that weekly relative energy index (RSI) is under 30 momentum oscillators used to evaluate circumstances which were purchased or oversold circumstances, at a stage not seen for the reason that 2018 and 2022 Naked Market Backside.

Such low RSI measurements have traditionally been distinguished with the acquisition zone of Ethereum technology.

This decline in RSI coincides with ETH’s present worth check and 2018 highs. This can be a stage of help that has not been touched since March 2023.

These circumstances recommend that gross sales stress could also be approaching fatigue, which might set a reversal stage.

Particularly, earlier intervals of such low RSI ranges coincided with the launch of prolonged bull markets.

Community exercise can be slower after merge

Regardless of these bullish long-term indicators, the short-term foundations of Ethereum draw extra cautious footage.

A lower in day by day energetic addresses, decrease transaction charges, and elevated provide after merging have all been proven to be weaker in chain exercise.

This mix displays a waning short-term curiosity between customers and merchants.

Nonetheless, historic evaluation reveals that phases of exercise decline usually precede sharp worth restoration.

In earlier cycles, the same magnitude decline triggered a mean worth rise to over 200% over the following few months.

For that reason, some buyers are wanting intently, pondering that the present worth area is a possible accumulation zone.

Indicators recommend backside

The present convergence of technical and over-chain knowledge refers to Ethereum approaching the top of the present downtrend.

Coming to the 2018 excessive, costs with RSI under 30 and realised worth of $2,000 are all uncommon occasions that are inclined to happen close to main market turning factors.

Whereas Ethereum continues to face short-term stress resulting from muted community exercise, long-term indicators recommend that belongings could also be close to backside.

If previous patterns repeat, Ethereum can see a major restoration from right here, doubtlessly rising from $6,500 to $7,000 within the subsequent cycle.

For now, Ethereum stays a key focus for each retail and institutional market members who’re monitoring the affirmation of development reversal metrics earlier than making a significant transfer.

Submit Ethereum drops by 5%, however a sign rebounding to $7,000 was first made in Coinjournal.