- Dogecoin has dropped by 13.8% over the previous two weeks.

- The $0.14 most important help ought to be held to take care of a bullish setup.

- Resistance of $0.15 and $0.16 stays an essential hurdle.

Dogecoin (Doge) might be present in a big breakout cusp, with new chart patterns shaped on three-day candles that resemble earlier conferences.

If the setup is stored, it might trigger a 364% spike, growing the value of Dogecoin from its present vary from almost $0.14-0.15 to about $0.67.

Supply: CoinMarketCap

Nonetheless, latest worth actions have proven important volatility, and a collapse under the primary help might reverse short-term bullishness, notably in mild of the weaker broader market.

DogeCoin Worth: RSI breakout suggests sharp rise

Between April fifth and seventh, Dogecoin fell to $0.13 earlier than briefly rebounding.

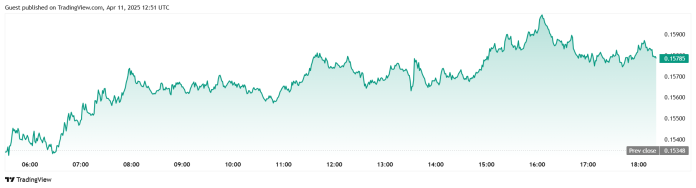

The token traded at $0.14 on April tenth, then hovered round $0.15.

Regardless of the slender vary, Dogecoin has declined by 5.8% over the previous week, 13.8% over the 2 weeks and 6.9% over the 30 days.

Current expertise formations level to breakouts in RSI (relative power index) resistance and worth motion patterns that replicate earlier pre-rally.

Historic help reversed to resistance, and bullish divergence patterns emerged. In each instances, they beforehand preceded main upward actions in previous bull cycles.

In February, Dogecoin went above 70% from a excessive of almost $0.67, to round $0.2.

The present chart indicators present related structural components to the early phases resulting in the rally, suggesting attainable restoration if momentum continues.

Help at $0.14 helps bullish instances

Dogecoin exhibits relative power throughout the broader crypto market losses.

On the day the worldwide crypto market fell 4.4%, Dogecoin registered a modest acquire of 0.11%.

This slight decoupling demonstrates elementary resilience and purchaser exercise at present worth ranges.

Steady whale accumulation and a minor restoration in each day buying and selling volumes help the steadiness of the coin.

Nonetheless, macroeconomic issues, together with a shift in Donald Trump’s commerce coverage orientation, proceed to weigh on the broader market, and will have an effect on traders’ confidence and threat selections.

A sustained drop under $0.14 might disable latest restoration alerts and trigger deeper corrections.

Resistance between $0.15-0.16 stays a hurdle

Fast resistance stays at $0.15 and $0.16. With out a rise in buying and selling quantity, Dogecoin might have a tough time breaking by means of.

A confirmed transfer above $0.16 might pave the way in which for additional earnings at $0.20 as the subsequent key resistance.

A breakout situation is confirmed because the consolidation of costs near present ranges continues.

Failure to violate these resistance ranges might prolong the combination part and delay the subsequent leg.

The $0.67 long-term purpose is conditioned

The technical construction suggests a transfer to $0.67, however some situations must be met.

These embody sturdy purchaser curiosity, macroeconomic stability, and checking throughout a number of time frames utilizing quantity and momentum indicators.

Earlier worth surges from related setups point out that conferences of this measurement are attainable however not assured.

For now, Dogecoin stays certain by vary, together with metrics suggesting that the approaching weeks might decide the subsequent huge transfer.

Because the RSI breakout sample first appeared in Coinjournal, post-dog coin costs had been set for 364% of the rally.