- Technique’s BTC leverage ratio has dropped to simply 0.22. That is the bottom level in a number of years.

- Technique’s BTC BET was rewarded with a strong 11.4% YTD return in Bitcoin.

- Japan’s Metaplanet and Hong Kong’s HK Asia holdings are following within the footsteps of its technique.

Technique (previously micro-Technique) which is a toddler of the company BTC accumulation poster has added one other 3,459 BTC ($285.8 million), bringing that whole to an astounding 531,644 BTC, exceeding $35.9 billion.

How a lot has Technique Inc been used for the reason that newest buy of Bitcoin?

On-line rumors resolve the danger of methods, however the information means that they don’t seem to be.

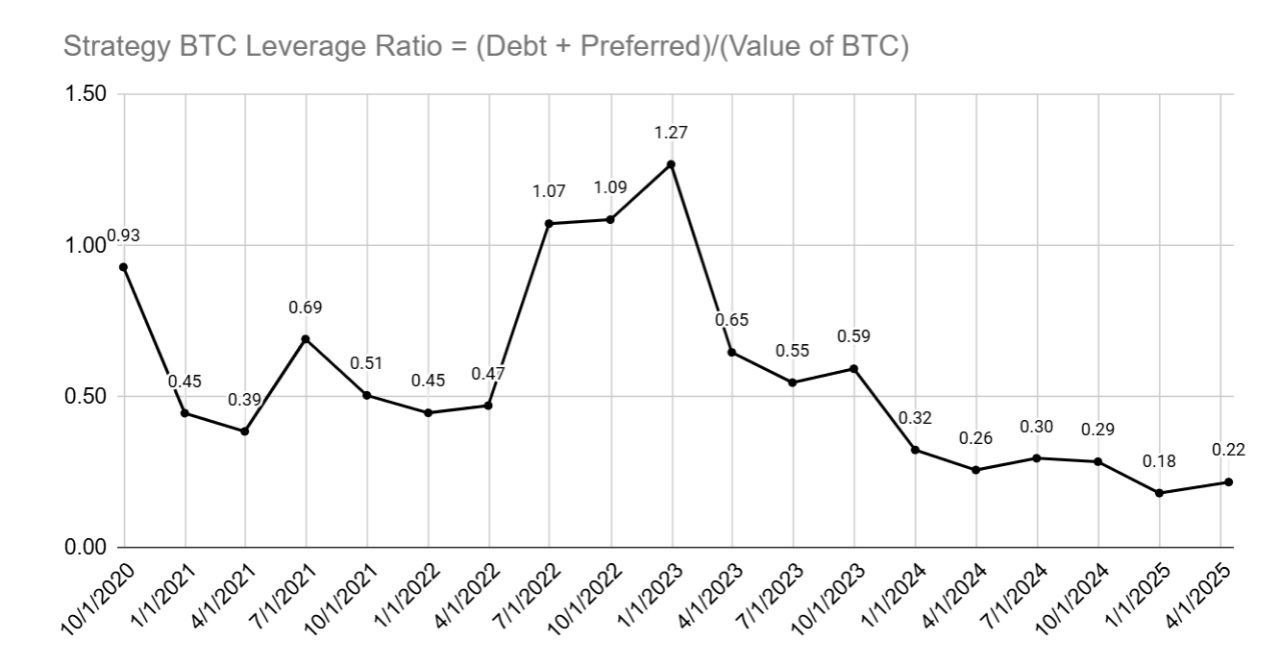

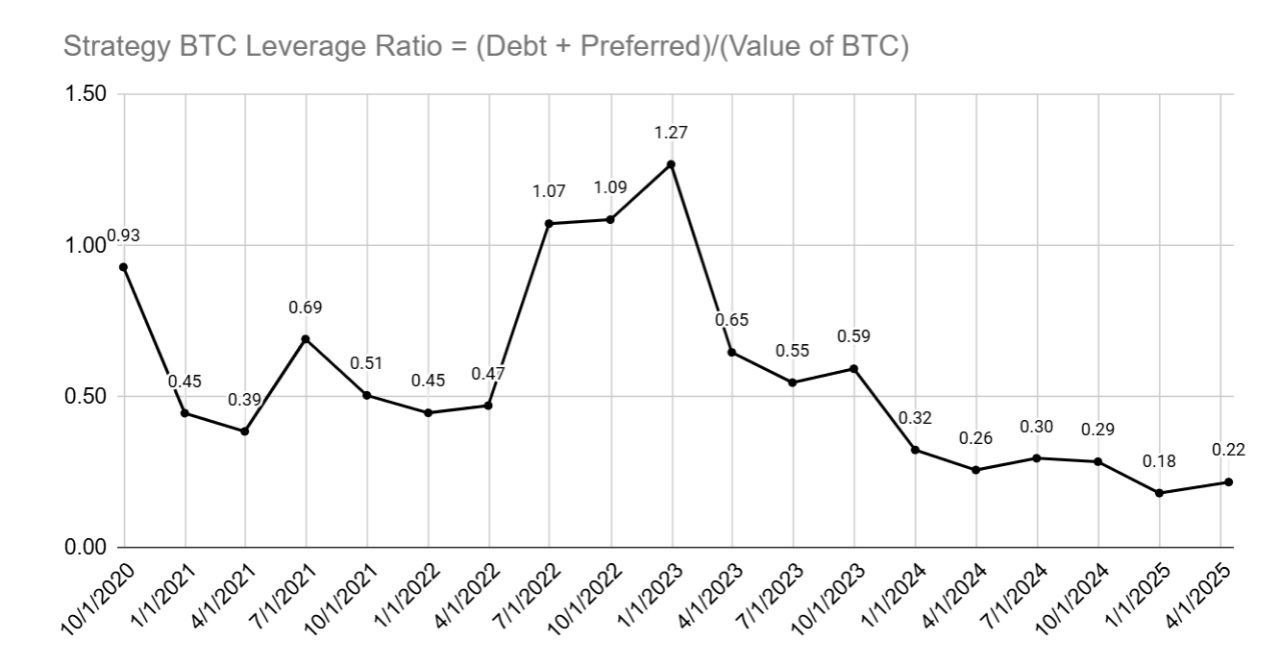

Breakdown of technique BTC leverage ratios – Calculated AS (debt + most well-liked inventory) ÷ Worth of BTC held – Present danger publicity is effectively beneath the historic common.

Trying on the charts that vary from late 2020 to early 2025, there are some things which can be clear.

- At its peak within the first quarter of 2023, the technique leverage ratio reached 1.27. In different phrases, the worth of the obligations briefly exceeded the market worth of BTC holdings.

- Quick ahead to April 2025, the ratio fell sharply to 0.22, one of many lowest ranges ever.

- This downtrend has been constant since mid-2023, reflecting each an increase in Bitcoin value and a extra measured borrowing technique.

Even Bull Run, like in late 2021 and 2022, the technique was operated with considerably increased leverage (for instance, 1.07 in mid-2022 and 1.09 in fourth quarter 2022). Due to this fact, by comparability, the present angle seems cautious, if not fully conservative.

Associated: North Carolina’s “Digital Asset Freedom Act” appears like a Bitcoin invoice

What’s the low leverage sign in your technique?

This traditionally low leverage ratio reveals monetary administration relatively than despair. It reveals that the technique will not be actively borrowing to chase the worth pump. As an alternative, the corporate makes use of profit-held mixtures to take care of its inventory, debt and income, and to construct itself up with out extreme publicity.

As a result of BTC trades are priced at $85,000, the common buy value for the technique is $67,556, which is a return of 11.4% per 12 months regardless of market volatility.

Are different corporations shopping for bitcoin for Treasury reserves?

The technique strategy appears to have influenced different company gamers as effectively. Japanese firm Metaplanet added 319 BTC ($26.3 million) with a mean value of $82,549, bringing its whole holdings to 4,525 BTC ($386.3 million).

Associated: “Preserve a Watch”: Hayes hyperlinks to Bitcoin income which can be coming stress within the bond market

Due to Bitcoin’s highly effective driving, it’s locked to a 108.3% return in 2025 alone. HK Asia Holdings additionally elevated its video games, shopping for one other 10 btc, pushing the overall to close 29 btc. Although small in measurement, this transfer is symbolically vital, particularly given China’s unstable regulatory stance on crypto.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version will not be accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.