- Bitcoin reveals energy, however conviction-based investments are quickly declining

- Speculative capital controls the crypto as long-term traders come out or search fast income

- BTC value motion and sign suggests a possible rise to $100,000 amid robust demand

Bitcoin continues to climb, incomes over 10% final week. However beneath the floor, deeper modifications are underway within the crypto market. As noticed by Ki-Younger Ju, CEO of Cryptoquant, the period of value-driven funding seems to have light.

He says since 2018, many former long-term cryptographers have both left the market or are shifting for short-term income.

https://twitter.com/ki_young_ju/standing/1912491882028102127

The present focus argues that there’s doubtlessly little dedication to the long-term imaginative and prescient of many tasks past Bitcoin itself, and includes fast, speculative capital that chases a doubtlessly unstable panorama.

Associated: This Bitcoin 2016 Fractal can ship XRP value to $6: Evaluation

Ki-Younger JU: Did crypto funding transfer from conviction to hypothesis?

Ju factors out that over time Web3 tasks have struggled to attain significant adoption. In consequence, builders and traders are equally going through elevated stress. Most tasks now not entice devoted supporters, and even the strongest followers present indicators of fatigue.

Associated: Q2 Bitcoin outlook brightens with a positive macro shift, technical energy

The character of crypto funding has change into a transaction as capital flows transfer quickly between belongings and sometimes with little fundamental assist. Ki-Younger Ju says that at present’s atmosphere is dashing up greater than sure and creates an environment that leaves little room for affected person innovation.

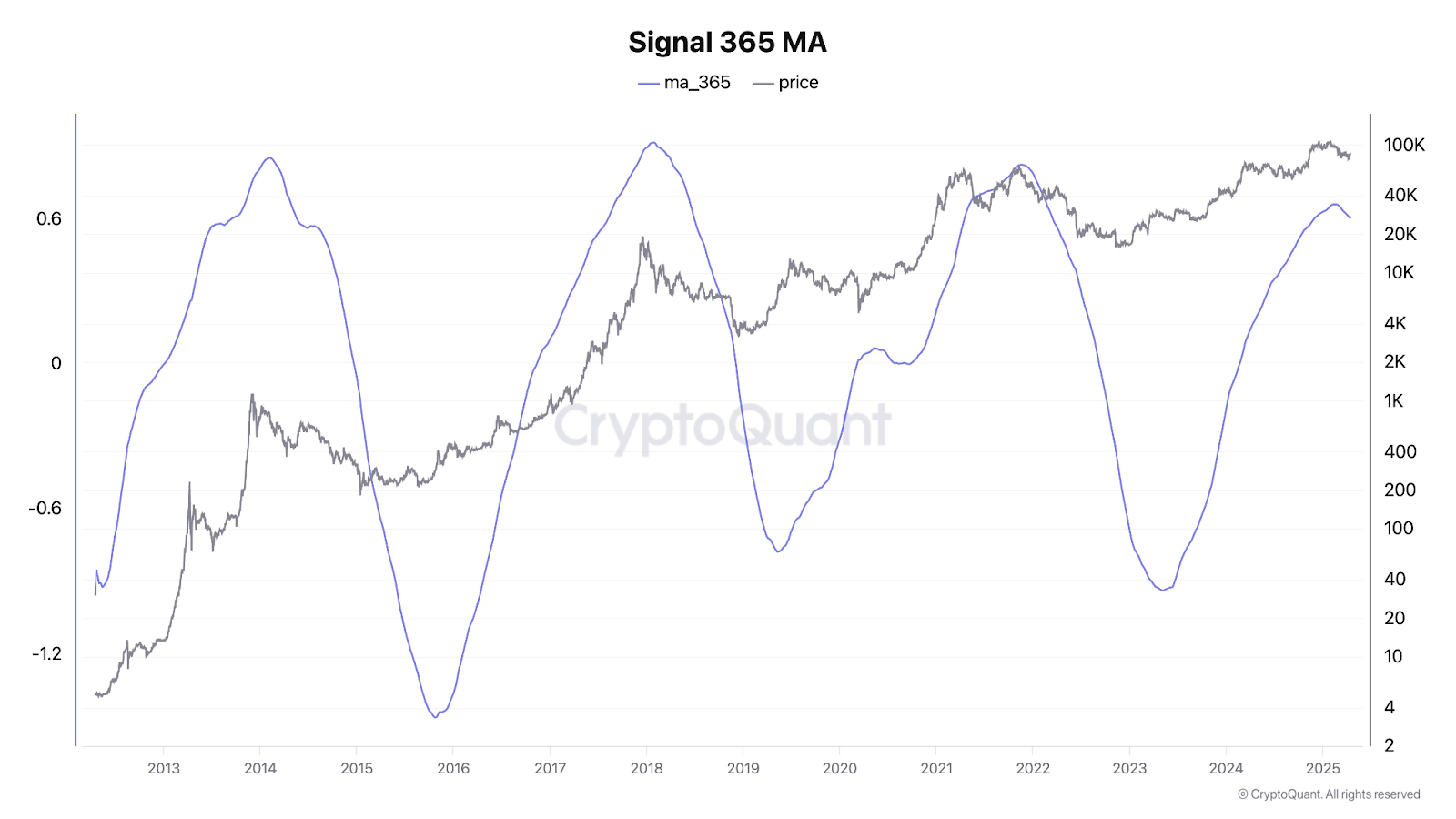

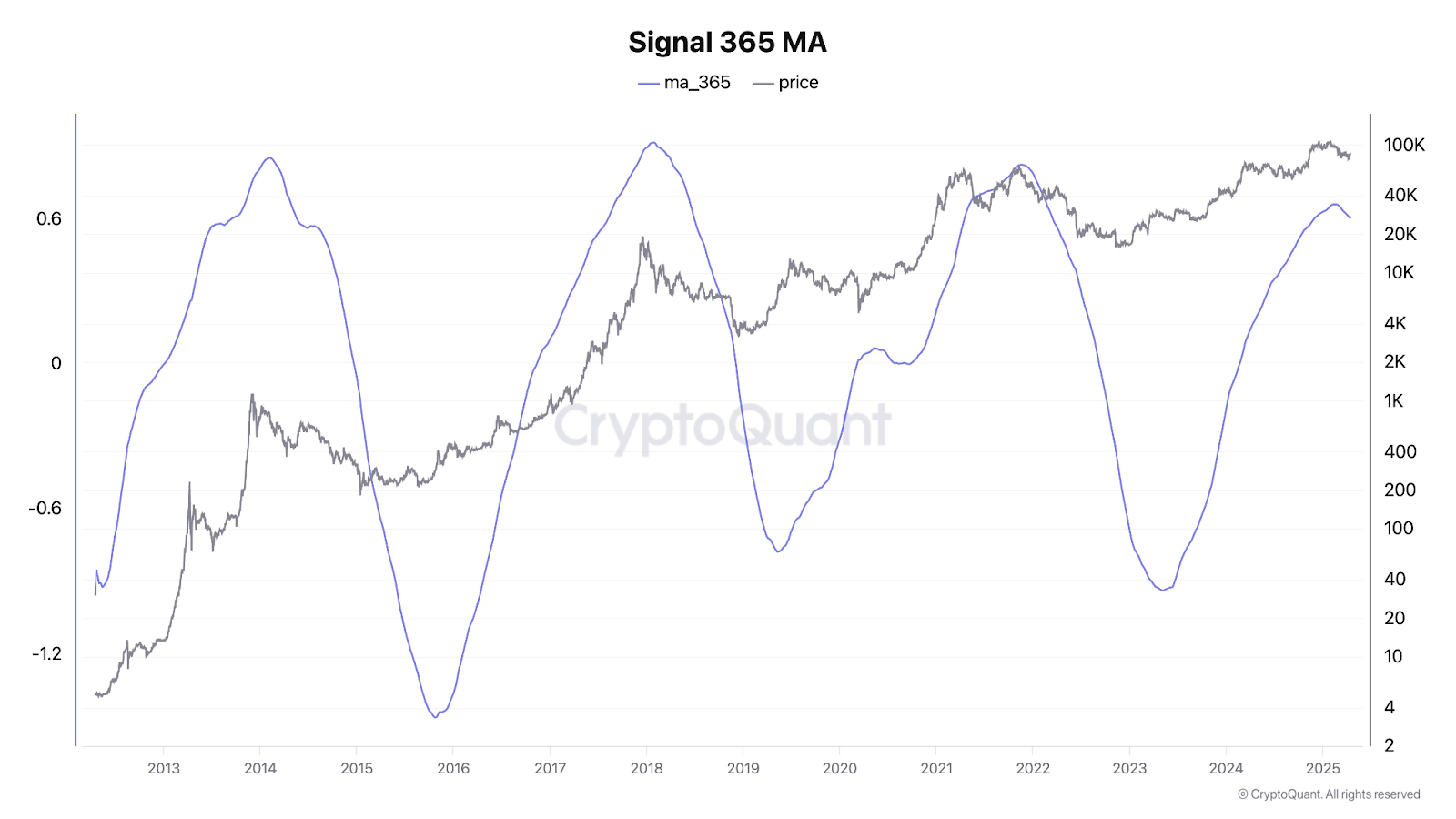

Moreover, the cyclical nature of Bitcoin’s provide and demand makes issues much more difficult. Historic evaluation of Bitcoin costs and 365-day transferring common alerts reveals predictable rhythms. Peaks close to the sign vary of 0.6-0.8 are constantly marked as extreme levels.

In distinction, troughs round -1.2 are inclined to precede main gatherings and mark accumulation zone. The present upward trajectory of this sign suggests a rise in demand. Nonetheless, it means that Bitcoin should still have room for development because it has not but reached a traditionally important peak.

Bitcoin integration suggests an upward breakout

Bitcoin is at present buying and selling inside the horizontal channel, based on analyst Ali Martinez. Lately, the worth has bounced again from its major assist degree of $83,200. The response suggests a robust proper to purchase, which may result in a retest of resistance of practically $84,500.

If momentum continues, bitcoin may invade Cap near $85,800. A confirmed motion past that degree signifies a unbroken bullish development.

As of press time, Bitcoin was buying and selling at $84,830.17, with each day quantity exceeding $23 billion. Present traits present resilience whilst broader traders change habits.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version isn’t accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.