- XRP buying and selling quantity fell 25% to $1.8 billion amid weakening of market participation.

- Open curiosity on choices plummeted 53.69%, whereas optionally available quantity was spiked by 73.58%.

- Merchants are cautious previous to SEC’s determination concerning Grayscale’s Spot XRP ETF.

XRP registered $1.8 billion, falling 25%, 25%, with market earnings weakening. Regardless of a slight improve in previous days, XRP is shifting sideways, sandwiched between $2 help and $2.1 resistance as merchants await a crucial breakout.

Because the market cools, buying and selling volumes drop

The decline in XRP buying and selling quantity displays a lower in short-term momentum and a lower in dealer participation. A 25% drop in quantity means that fewer buyers will enter new positions as tokens commerce inside a decent vary.

Associated: Analyst Eye XRP Resistance and Influx Descending

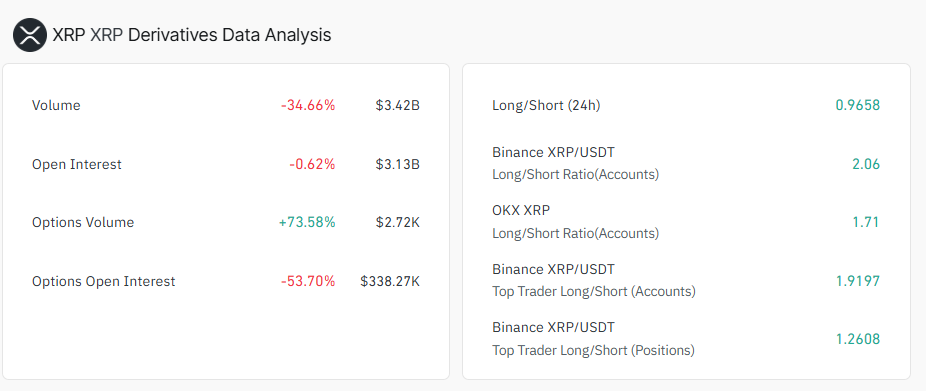

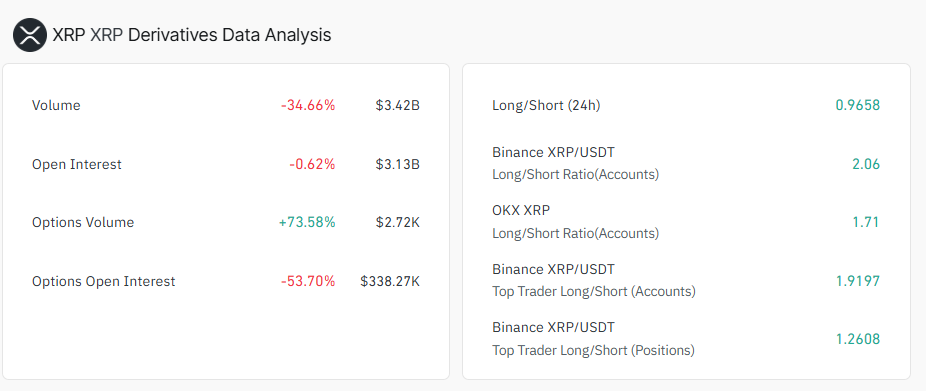

Equally, XRP by-product buying and selling quantity has declined by 34.53% to $3.43 billion, inflicting market exercise to say no. Open curiosity fell 0.47% to $3.14 billion, whereas optionally available choices plummeted from 53.69% to $339,100, indicating a big discount in present positions.

Nevertheless, the quantity of choices has elevated from 73.58% to $2,720, suggesting that some merchants are actively repositioning for hedging or guessing amid growing uncertainty.

Why are XRP merchants cautious?

Merchants are taking a cautious step in direction of assembly the SEC’s Could twenty second deadline to accommodate the grayscale utility of the Spot XRP ETF strategy. This uncertainty drives defensive positioning, with market members difficult potential delays or rejections from brokers.

Particularly, asset supervisor Teucrium not too long ago established a double leveraged XRP ETF. This raised questions concerning the SEC’s willingness to approve extra dangerous merchandise whereas delaying or rejecting normal spot ETFs.

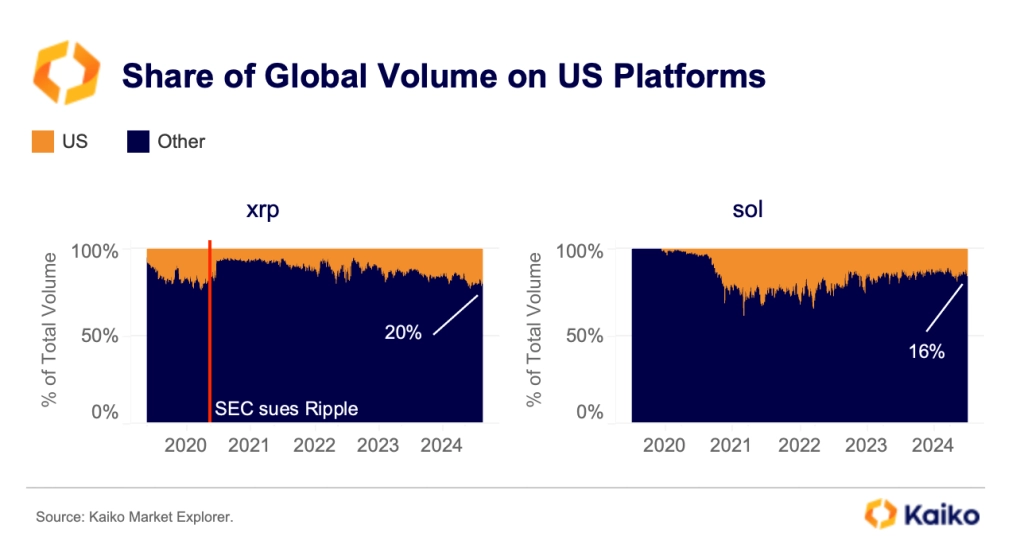

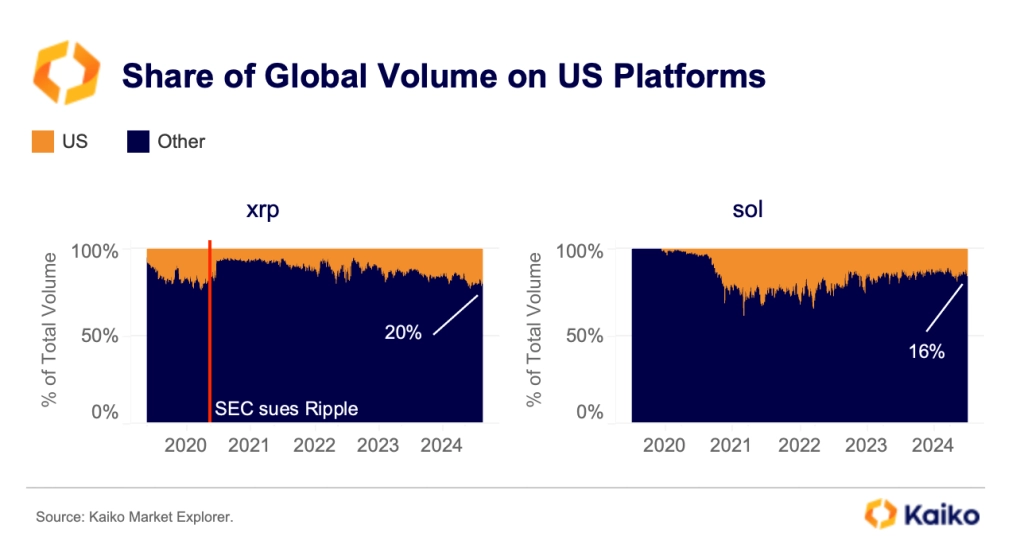

In the meantime, the shortage of XRP’s sturdy US futures market complicates the issue. A lot of XRP’s buying and selling actions are nonetheless being carried out by abroad exchanges. Nevertheless, the XRP quantity on US exchanges has been bettering not too long ago, Kaiko’s information reveals.

Essential ranges of defining XRP’s short-term outlook

Based on TradingView, the relative energy index (RSI) of XRP is now 48 within the impartial zone. This implies that property usually are not over-bought or over-sold. RSI has hovered this midway level for over per week, referring to missing momentum in both path.

Presently of reporting, it traded at $2.08, a rise of 0.8% up to now days. Costs are anticipated to vary till a breakout happens.

Associated: Girlinghouse shoots rumors concerning the 2025 IPO. Analysts are nonetheless bullish on XRP

If XRP falls beneath $2.03 help, your subsequent damaging goal is $1.96. A extra aggressive sale may push the value right down to a help degree that bouncing off April seventh of $1.61. On the highest, confirmed breakouts above $2.09 can open a move heading in direction of $2.5.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.