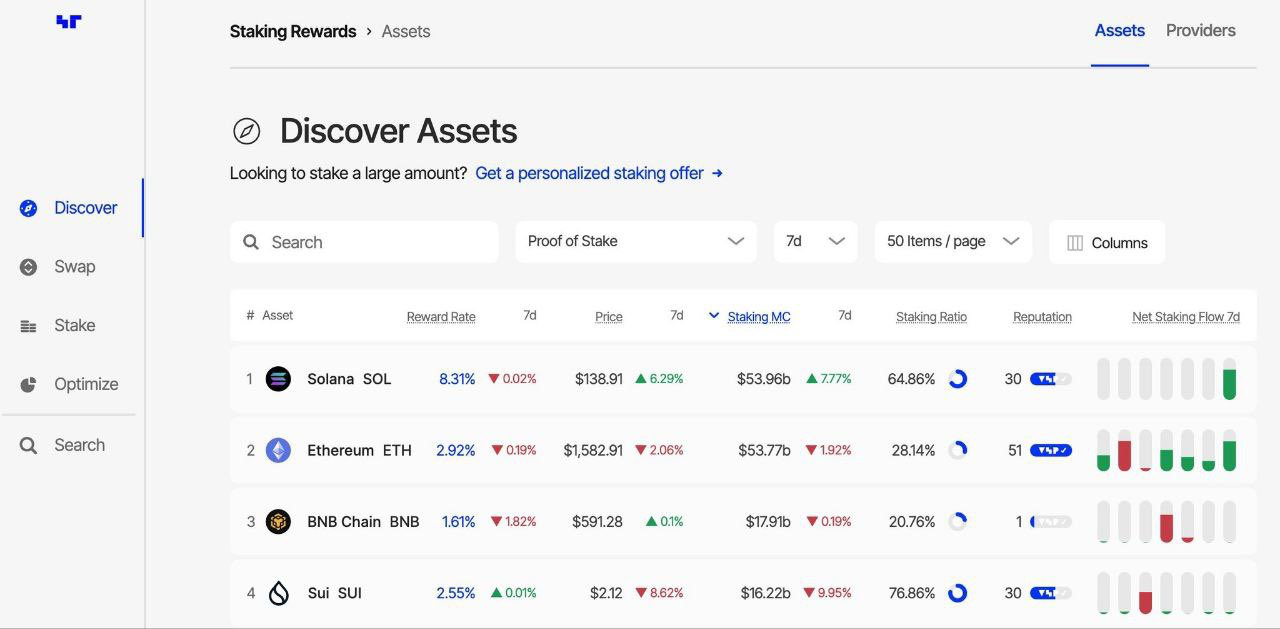

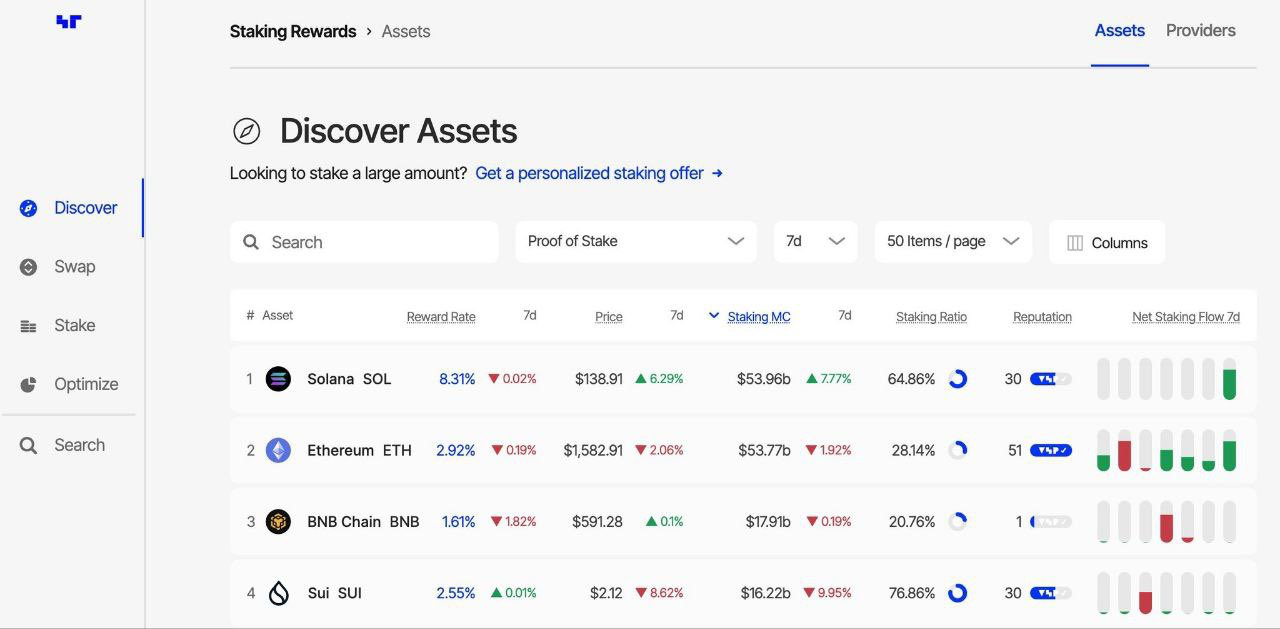

- On-chain information reveals that the provision price of 67% of the stakes in Solana is greater than twice that of 30% of the Ethereum

- Solana’s baseline staking reward of 6.6% is considerably greater than Ethereum’s 2.8% APY by way of Lido

- Sol doesn’t supply staking minims, unlocks for 2-3 days, giving it a larger benefit over ETH’s strict terminology

On-chain information reveals tendencies that companies are trying carefully. Buyers have chosen to wager Solana (SOL) on greater than twice the Ethereum (ETH).

Ethereum is a legacy chain, with Solana’s glorious rewards and versatile circumstances making it a transparent winner within the conflict for the silly capital. This pattern is supported by the system’s surge in adoption, with public corporations already holding giant SOL positions.

Associated: Solana (sol) is a surge in institutional adoptions as public corporations accumulate $591 million

On-chain information reveals that Solana’s staking price is from double Ethereum

Solanabeach’s information speaks all. Roughly 67% of Solana’s complete provide is at present being piled down, accounting for greater than $82 billion in lock worth.

In distinction, in keeping with Beaconcha, solely about 30% of Ethereum’s complete provide bets. This isn’t a brand new growth. Solana’s Starked Worth quickly overtaked the Ethereum again in April 2025, however has since been dominated by that share metric. This means a transparent and protracted desire amongst holders to lock SOLs on ETH.

Solana’s 6.6% staking reward crushes Ethereum’s 2.8% APY

The principle cause traders favor to staking Sol is straightforward. That is higher for you.

Solana’s native block rewards present Validators with a baseline APY of roughly 6.6% pushed by the community’s deliberate inflation schedule. Liquid staking platforms like JITO can enhance this yield even greater, usually exceeding 8% via MEV rewards.

Ethereum, alternatively, presents a lot decrease baseline yields. Lido, the most important liquid staking supplier, at present presents 2.8% APY. For capital allocators, the selection is obvious.

Minimal and quick unlock provides Solana an enormous edge

Past yields, Solana makes staking rather more accessible. Anybody can guess the quantity of sols straight from their pockets in a easy 2-3 day unlock interval.

For Ethereum, that is the other. A minimal of 32 ETH (over $120,000) is required to run the validator node. It is a barrier that pushes most customers right into a liquid staking pool with longer, extra variable unlock intervals.

This mixture of excessive capital necessities and strict phrases is a significant deterrent. It is a key consider a broader market shift, from Ethereum staking to the upcoming wave of altcoin ETFs, and we plan to redefine this market cycle.

Associated: From Ethereum stakes to Altcoin ETFs, October can redefine crypto investments

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version isn’t accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.