- Bitcoin was held above the price base of short-term holders amid cautious market sentiment.

- It rebounded from $107,000 to $113,000, incomes 2.4% per week.

- Key indicators present weaker restoration with weak volumes, secure futures and elevated profitability.

Bitcoin traded simply on the short-term holder price base final week, and GlassNode’s market pulse highlights susceptible stabilization past spots, futures, ETFs and chain indicators as cautious sentiment continues to dominate.

It additionally featured a brief dip in opposition to $107,000 this week, which recovered to $113,000 as merchants examined their help ranges. Notably, Bitcoin is at present buying and selling at $112,947 after a rise of 0.8% over the previous day, rising its weekly achieve to 2.4%.

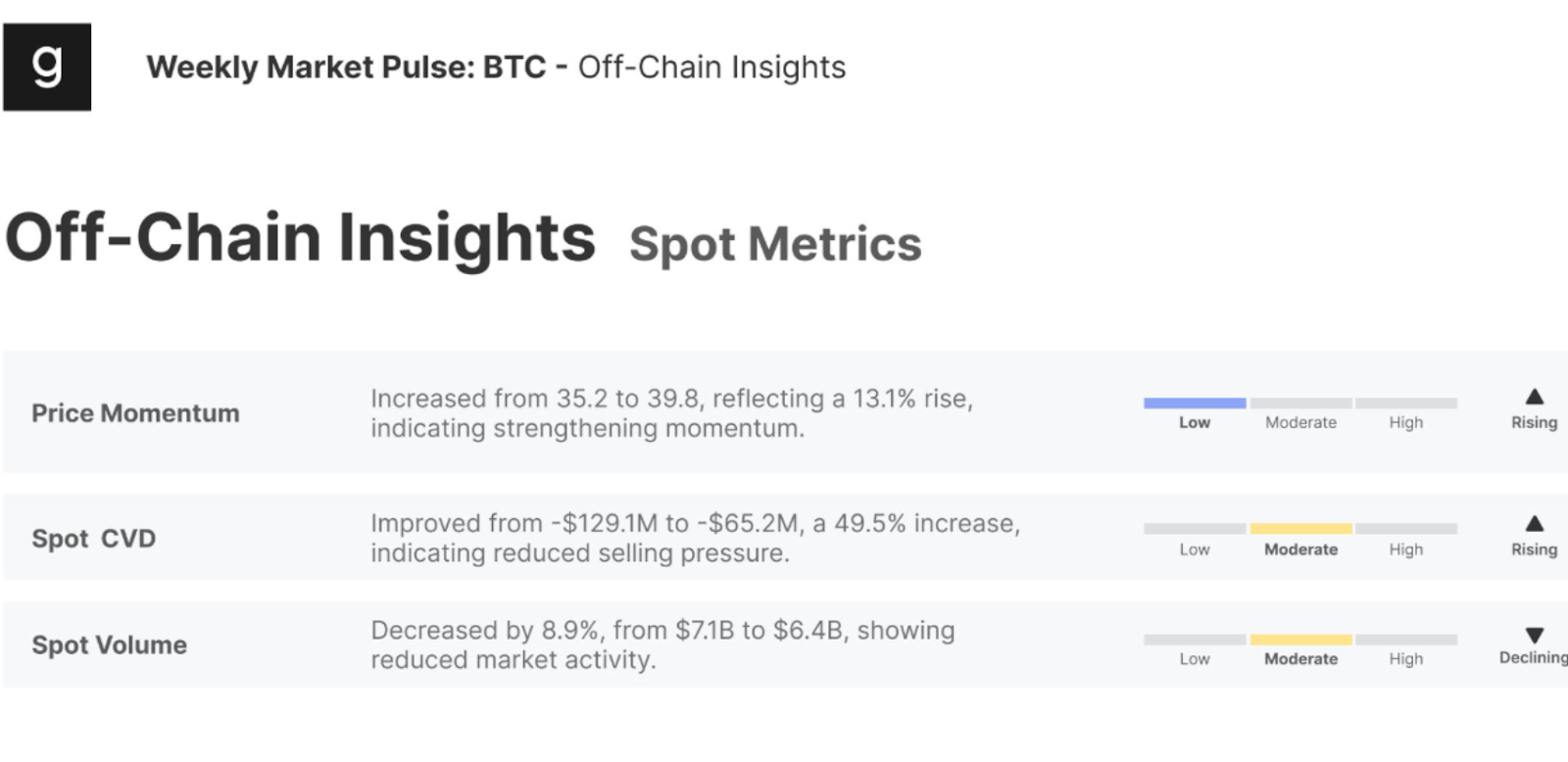

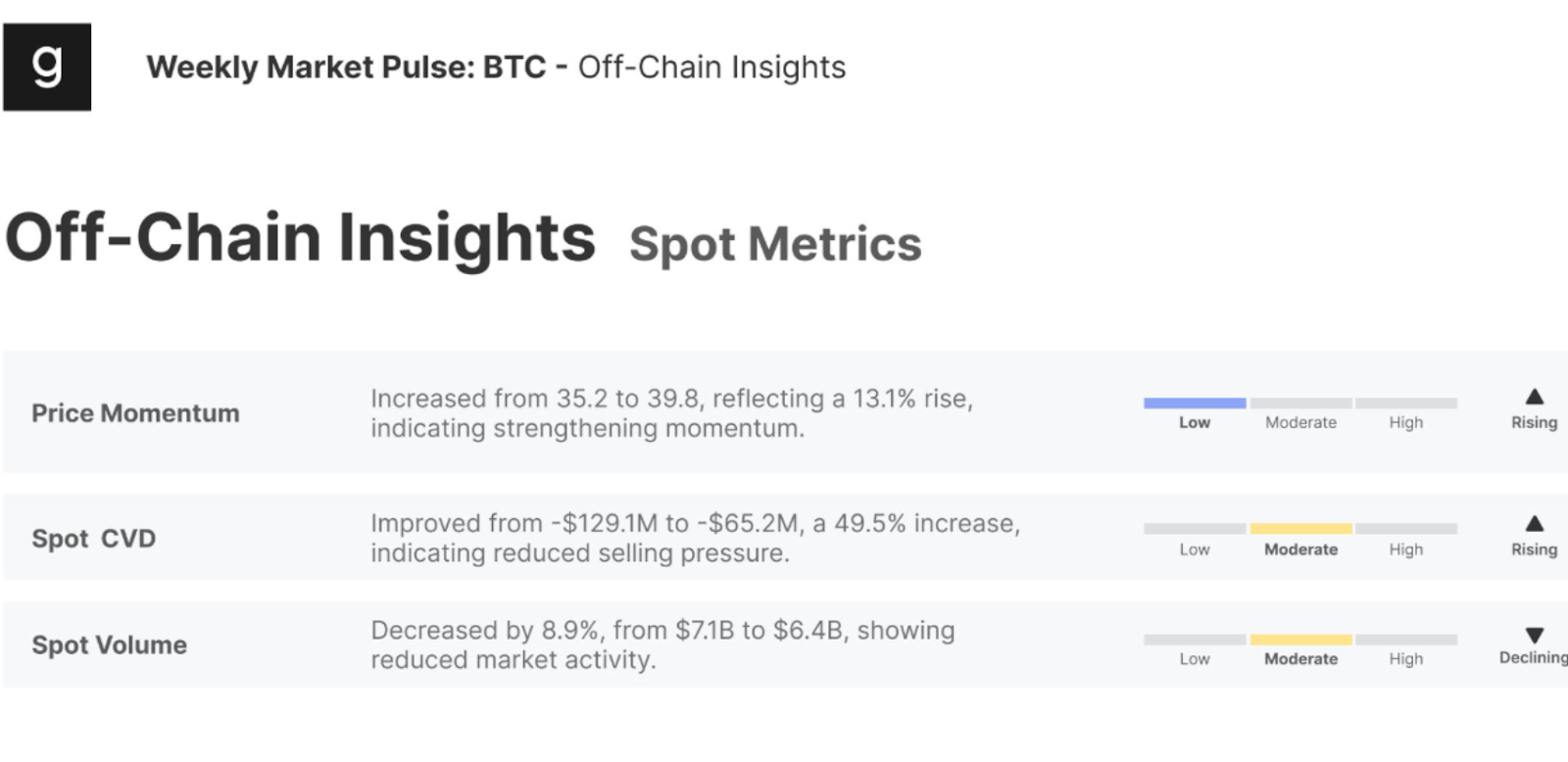

Spot Market: Gross sales have been suspended, however consumers will not be satisfied

The momentum within the spot market exhibits that offensive gross sales have been eased, however consumers haven’t but stepped in with confidence. The relative power index (RSI) rose 13.1% from 35.2 to 39.8. This means a lower in vendor management, however beneath the impartial threshold of 40.7.

Extra importantly, the Spot Cumulative Quantity Delta (CVD) has improved by almost 50%, indicating decrease gross sales stress, however general Spot buying and selling quantity really fell by 8.9%.

Associated: Bitcoin (BTC) will hit $200,000 within the fourth quarter? Tomley explains how to try this

This mix of gross sales stress and weak purchase quantity is a traditional indication of the delicate and low conviction market.

GlassNode’s report famous that Spot CVD has improved from $129.1 million to $65.2 million, a rise of 49.5%, indicating a decline in gross sales stress.

Futures Market: Merchants haven’t added threat, maintain

Futures exercise is firmly held. Open Interes rose barely to $45.2 billion, near the $47.2 billion higher statistical band. This means that merchants saved their positions open with out including any essential new leverages.

Nevertheless, the lengthy place funding price fell 8.4% to $2.5 million, decreasing the will to pay premiums for bullish publicity. In the meantime, the Cumulative Quantity Delta of Everlasting Futures improved 74.9% to $186.7 million, highlighting the purchasing conduct when it moved to $107,000 every week.

Choices Market: “Good Cash” is hedging for drops

Participation within the choices market declined, with open curiosity immersed in 1.2% to $43.1 billion, all the way down to $43.7 billion. Volatility spreads have been diminished from 18.4% to 17.4%, indicating milder expectations and diminished threat premiums.

Nonetheless, merchants remained defensive. 25-delta’s skew rose to 10.1% with high-end thresholds above 7.4%, indicating sustained demand for draw back safety and elevated bearish sentiment.

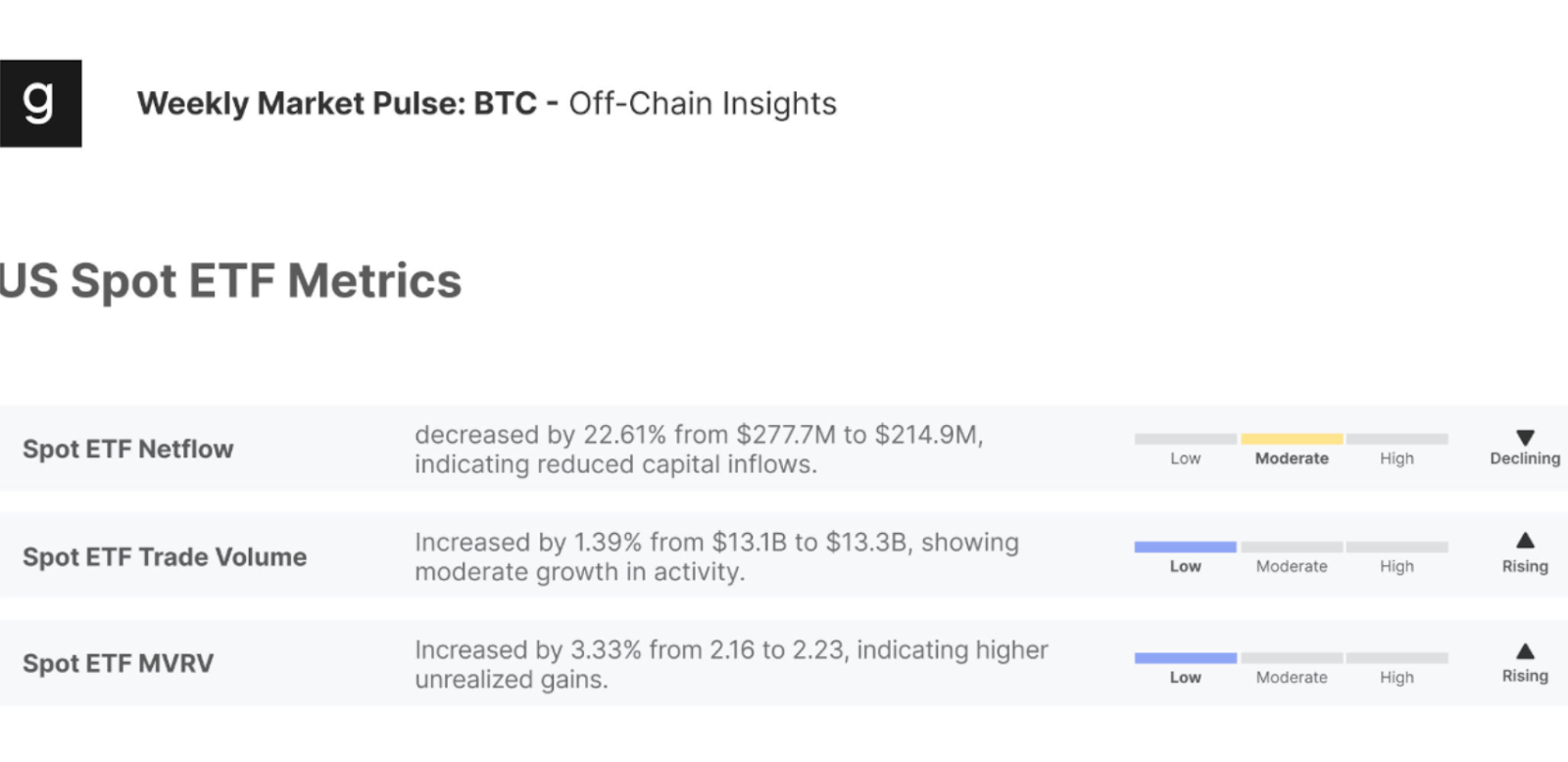

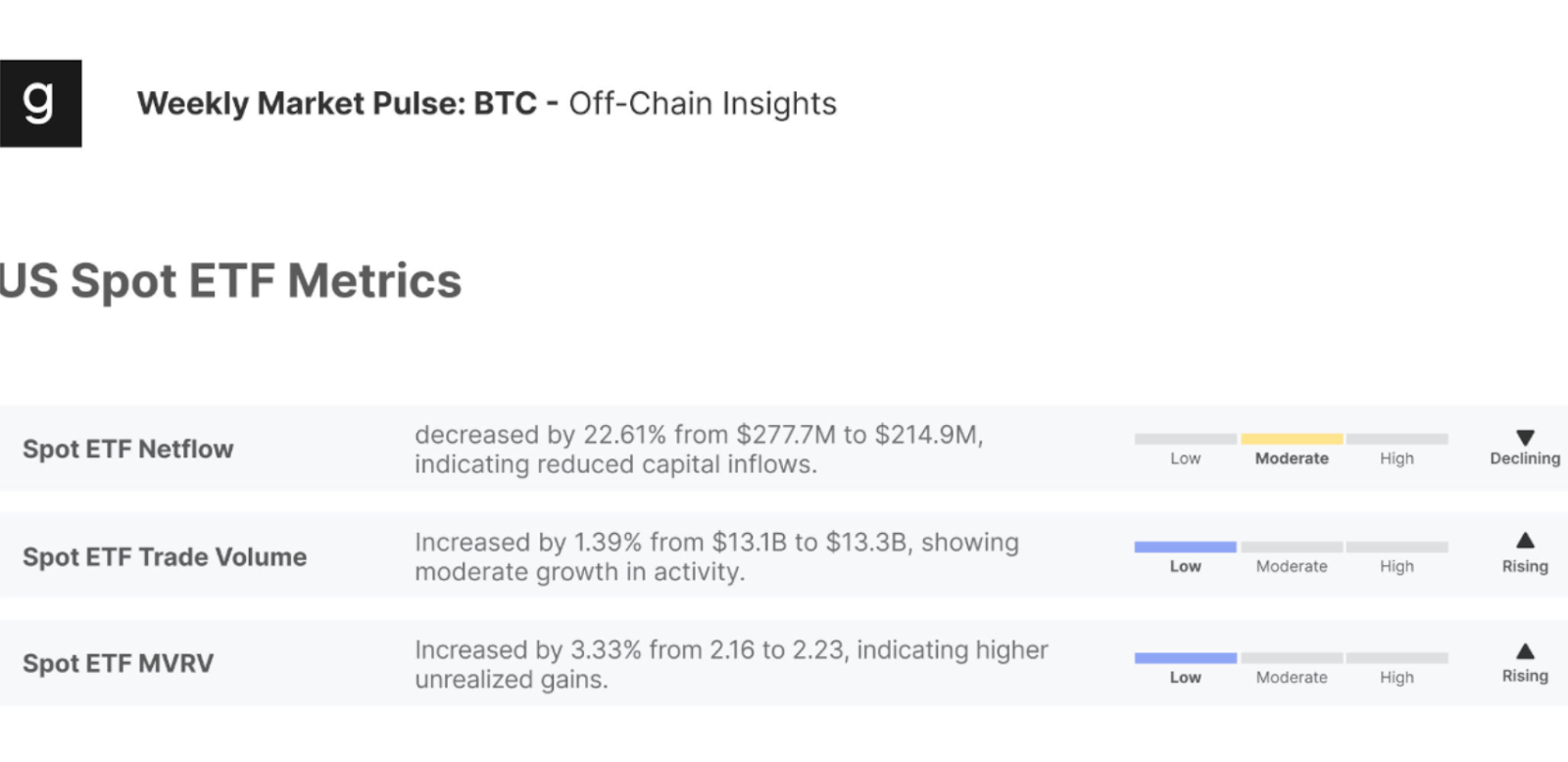

ETF move: Institutional consumers are bystanders

Spot Bitcoin ETFs registered within the US had a slower influx final week. Web move fell 22.6% from $277.7 million to $224.9 million. ETF buying and selling quantity rose to only $13.3 billion, however beneath historic norms.

The ETF Market Worth and Realized Worth (MVRV) ratio rose conservatively from 2.16 to 2.23, suggesting delicate unrealized income and restricted short-term revenue acquisitions.

On-chain actions present a modest improve

Community exercise has been barely enhanced. Lively addresses elevated by 3.8% to 719,300, returning to historical past vary. Switch quantity fell 3.6% to $8.3 billion, however transaction charges fell 6% to $490,700, decreasing demand for block area.

In the meantime, capital flows confirmed delicate enhancements. The capitalization that was realized elevated by 2.7% to 2.8%, however the provide ratio of short-term to long-term holders elevated. Sizzling Capital’s share fell barely, with much less speculative churn.

Associated: Bitcoin ETFs are seeing $246 million inflows, however the general market is cautious

Particularly, extra traders are making income. The proportion of revenue provide rose from 88% to 89%. Web unrealized revenue/loss elevated from 18.6% to 1.14, whereas the realised profit-fail ratio rose to 1.4 to 42%, indicating that traders are incomes at a measured tempo.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version will not be answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.