As we speak’s XRP value is buying and selling at practically $3.08, and after testing the $3.12 resistance zone, it is pulled again barely. The tokens are built-in inside the wider Fibonacci vary, with assist near $2.94 and holding up momentum coated in areas between $3.18 and $3.20. Merchants are at the moment weighing the technical compression towards new adoption information from Chase Financial institution.

XRP Value opposes key resistance

Every day charts present that XRP is approaching the 0.382 Fibonacci retracement degree. The fast resistance is round $3.18, and the tremendous pattern indicators additionally converge. A clear breakout above this threshold may open a move to $3.19 and $3.30, tailoring Fibonacci ranges of 0.5 and 0.618.

Assist will stay clustered across the 20-day EMA, near $2.97, adopted by a $2.81 zone, matching the 50-day EMA. The breakdown underneath this base reveals deeper dangers in direction of a $2.56 degree through which 200-day EMA offers stronger structural assist.

Chase Financial institution’s hiring will enhance feelings

Market sentiment has improved after Chase Financial institution confirmed it might settle for funds with XRP. This information is interpreted as a milestone in institutional adoption, notably as Chase strikes to combine real-world cost channels with XRP ledgers.

Along with this, pleasure is constructed round Actual Tokens aimed toward unlocking actual property transactions in XRP ledgers, highlighting the broader function of XRP in asset tokenization. These developments don’t instantly change the know-how construction, however they improve long-term instances of demand-driven development.

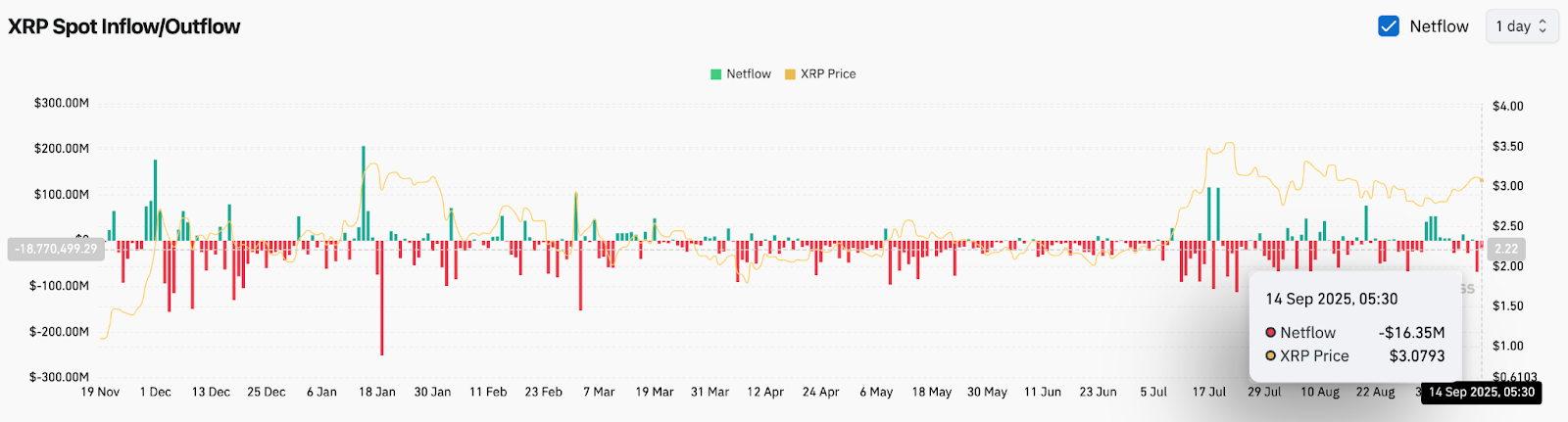

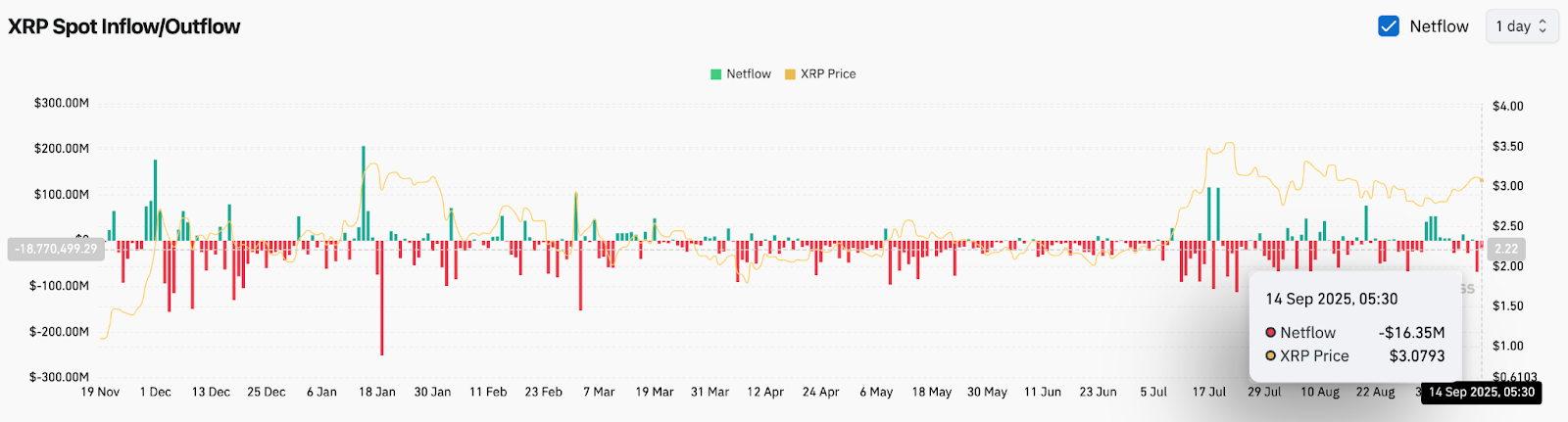

On-chain movement exhibits leaks regardless of information

On-chain knowledge highlights a wide range of positionings. Spot Netflows recorded a $16.35 million spill on September 14, indicating that merchants used current power to trim the publicity. The unfavourable movement contrasts with the broader bullish narrative, suggesting short-term consideration regardless of the headlines of monitoring recruitment.

The movement of the previous month has remained risky, oscillated between the inflow of gatherings and fast outflows in the course of the integration section. Analysts argue {that a} sustained shift to optimistic internet inflows of over $50 million is required to look at adoption-driven optimism.

Technical outlook for XRP value

The important thing resistance is $3.18, a degree enhanced by a downtrend line and an excellent pattern indicator. A important break above this zone may affirm bullish continuity, focusing on the following upward goal of $3.30. The $3.46 clearance, a 0.786 Fibonacci retracement, reintroduces the potential of a retest of the $3.66 peak.

On the draw back, failing to carry $2.97 will enhance gross sales stress and expose $2.81 as fast assist. As momentum grows, XRP returns to $2.56, unlocking a lot of its September restoration.

Outlook: Will XRP go up?

The direct trajectory of XRP depends upon whether or not the recruitment heading can offset the burden of everlasting outflows. If consumers defend $2.97 and set off a breakout above $3.18, the short-term bias is bullish in direction of $3.30-3.46.

Nevertheless, with no stronger on-chain affirmation, there stays a danger of one other rejection. Merchants are paying consideration as XRP navigates this pivotal zone. Right here, the story of structural compression and recent adoption collide to outline the following leg.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.