- Bitcoin costs maintain $116,500 in assist, however $118,000 stays a breakout ceiling for pushing to $120,000.

- Forbes warns of a 9.5T Fed shock, including warning as merchants are positioned conservatively within the derivatives market.

- On-chain information reveals a $131.1 million outflow, accumulation remains to be piled up even when sentiment stays impartial at 52.

At this time’s Bitcoin worth trades round $116,880, and after a short lived check of $117,100, it is consolidated. The quick assist cluster is near $116,500 and comes with 20-EMA, however the broader protection will likely be held at $115,600 and $114,500. The short-term combat is whether or not BTC will be prolonged to $118,500 or will be prolonged again to a deeper degree of assist.

Bitcoin worth integrates with channel resistance

On the four-hour chart, Bitcoin is locked inside rising channels, with capping moments between $117,500 and $118,000. Consumers defend 20 and 50 Emmas, however the $114,500 100 Emmas remains to be a key structural flooring.

The RSI is hovering at 55, exhibiting impartial momentum, however the uptrend stays so long as BTC is above $115,600. A decisive finish over $118,000 confirms bullish continuity and paves the best way to $119,200 and $120,000. Failure to carry $115,600 may expose BTC to $114,500 and $113,900.

Fed shock headlines add to market uncertainty

The background of the macro provides volatility. Forbes stories that Bitcoin and the broader crypto market are supporting a possible $9.5 trillion “Fed earthquake,” warning that the subsequent US coverage shift may function a shock wave. Merchants concern that sudden tightening of liquidity may put strain on dangerous property, however the Dovish sign may amplify Bitcoin worth motion right into a $120,000 zone.

The report enjoys consideration within the derivatives market, the place funding charges remained sluggish regardless of spot resilience. This means that buyers are positioning conservatively whereas awaiting readability from US financial coverage.

On-chain information reveals heavy leaks

The movement of change reinforces the bullish narrative. Coinglass information confirmed a web outflow of $131.1 million on September 19, indicating a drop in gross sales strain as Bitcoin costs right now are near $116,800. This continues to have a broader pattern that’s persistently outflow till September, highlighting that holders are shifting unbiased cash moderately than exchanges.

Such outflows often recommend accumulation, however the absence of sturdy influx additionally signifies that momentum stays cautious. A sustained web spill of over $200 million will strengthen convictions in breakout situations.

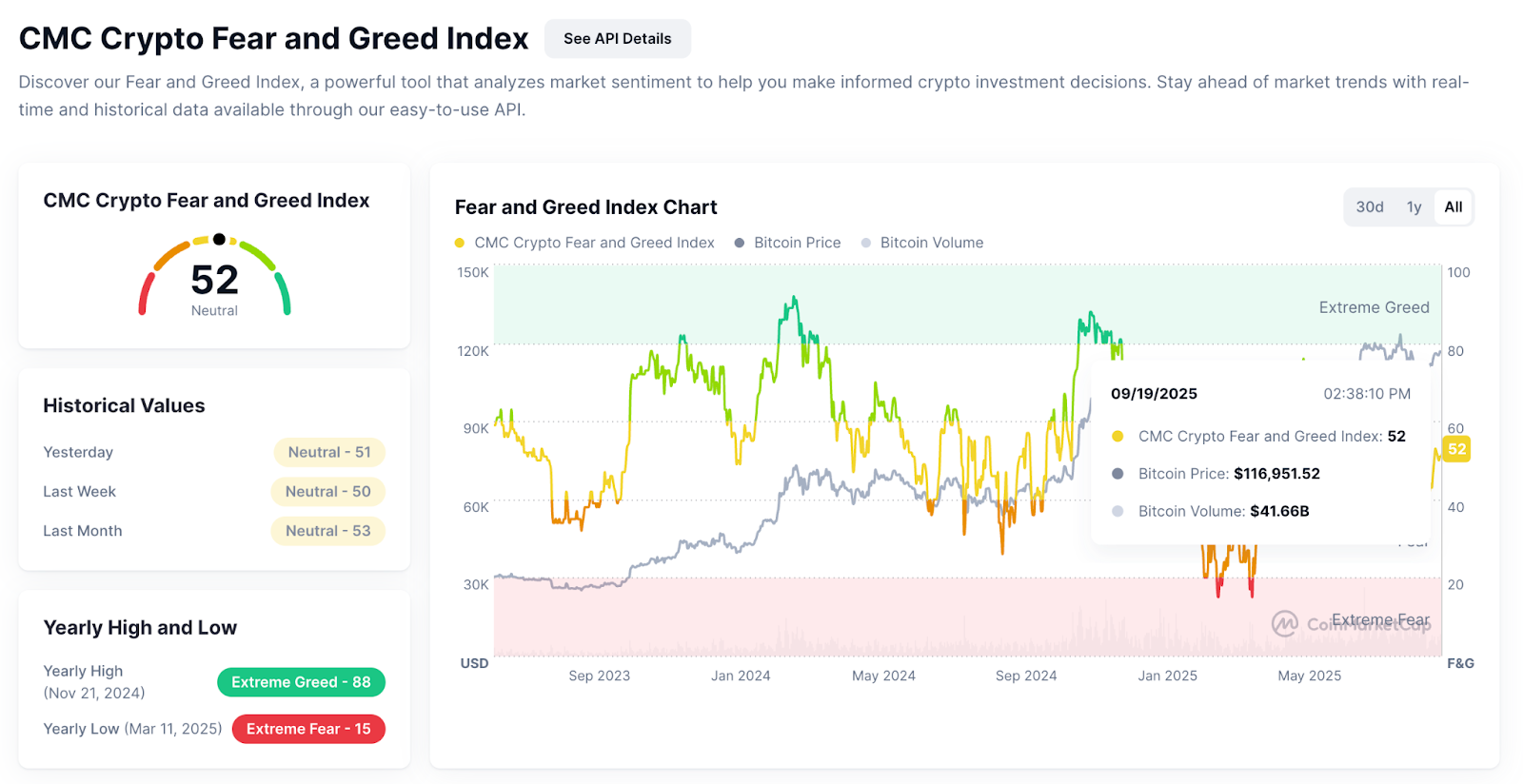

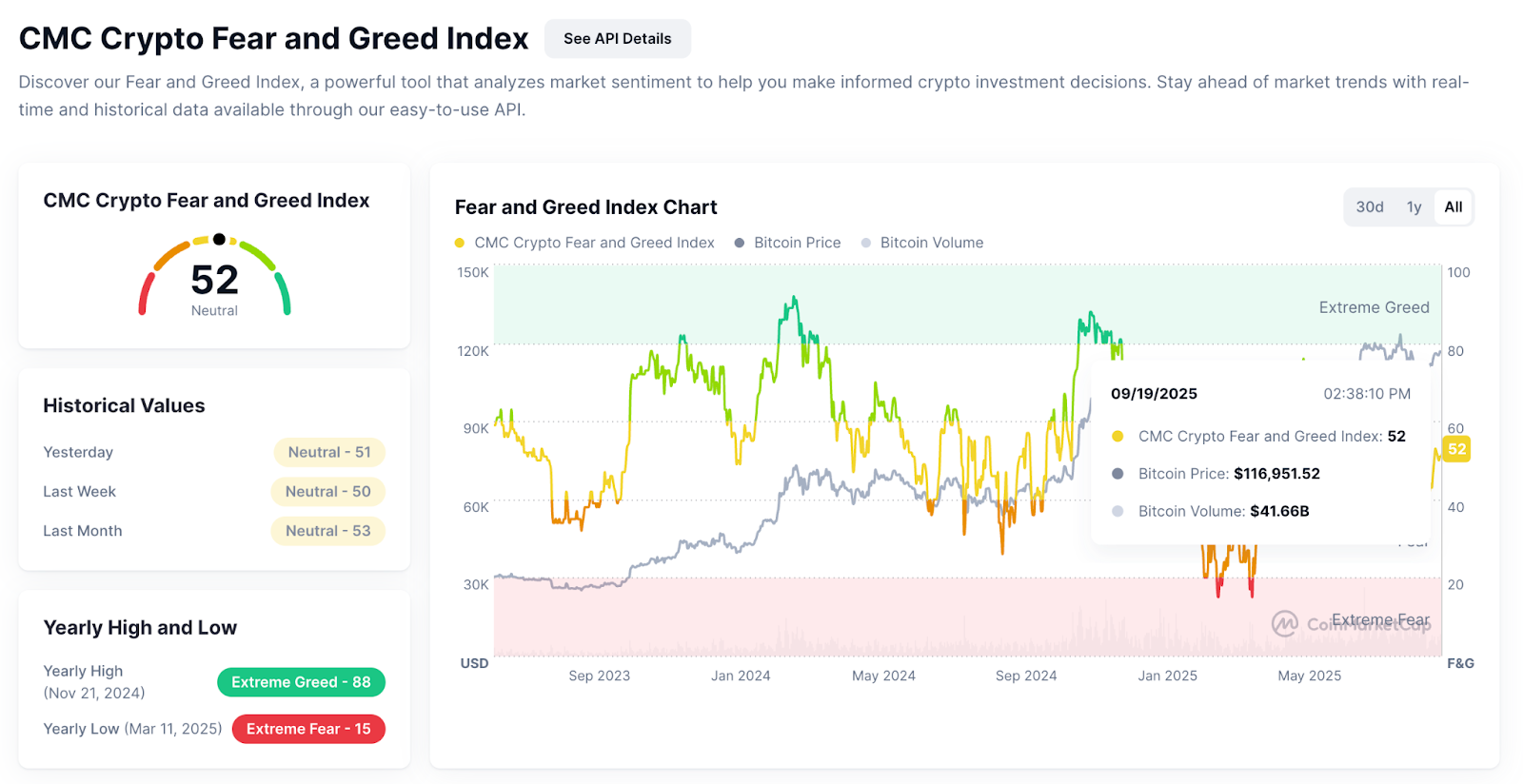

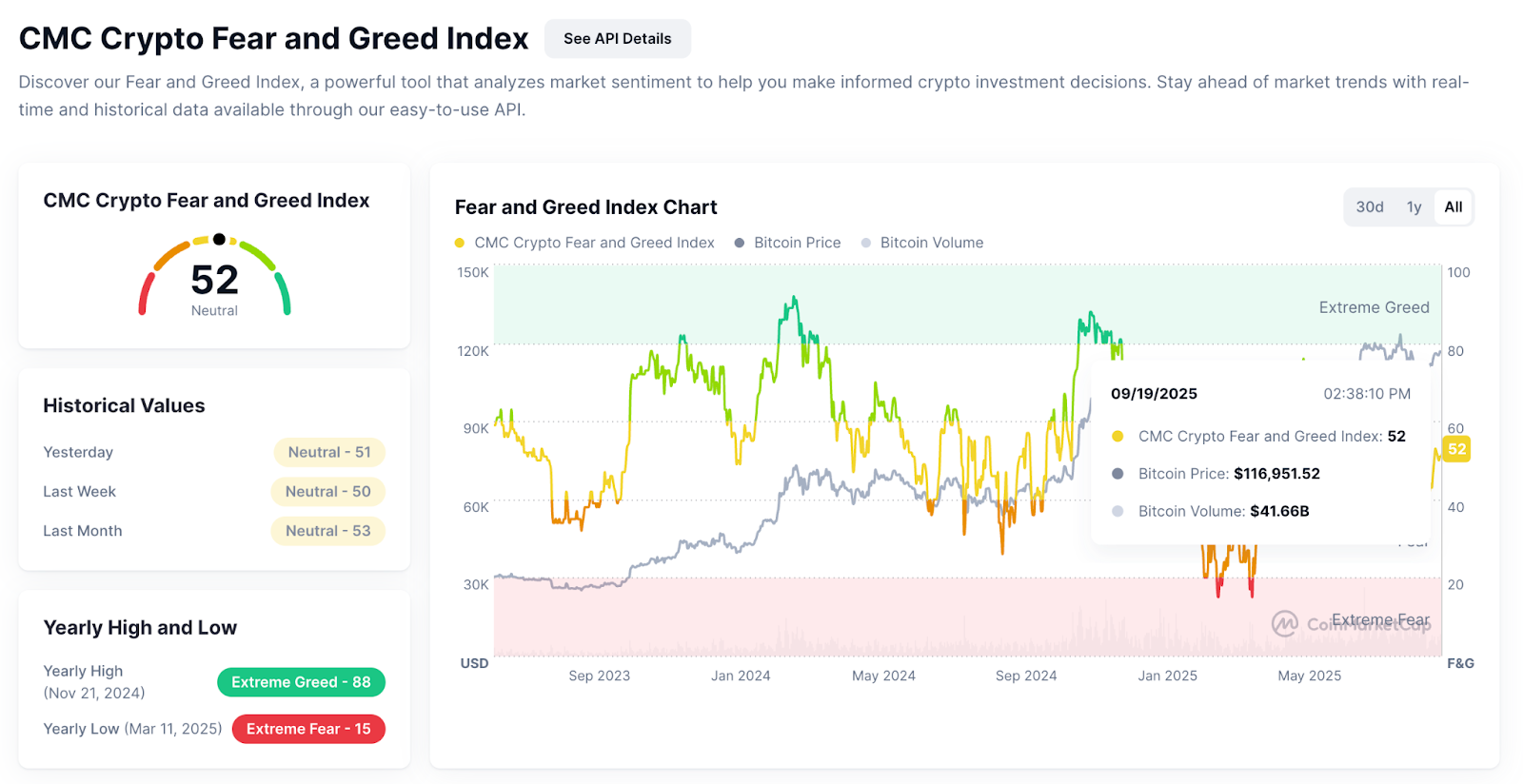

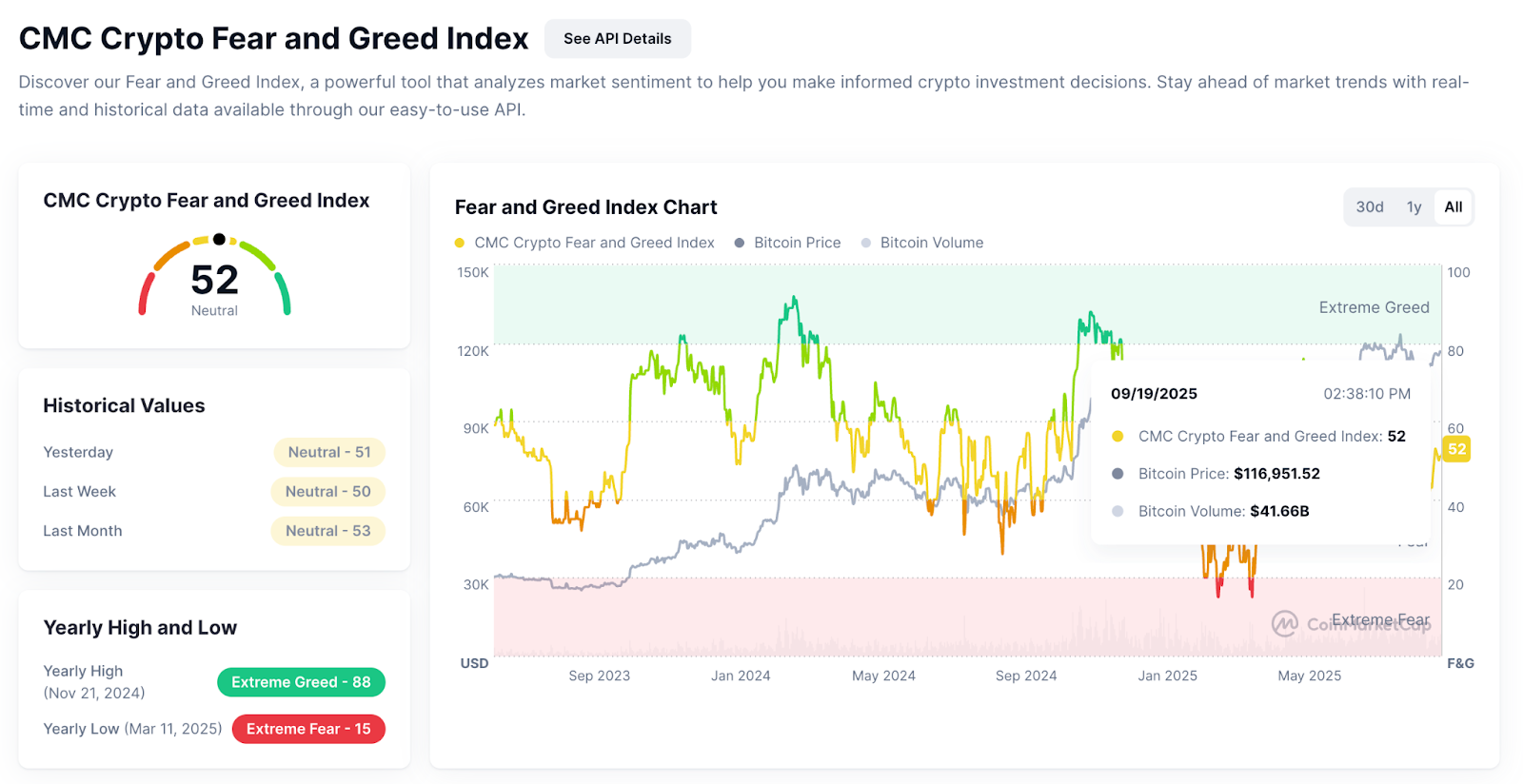

Market sentiment holds a impartial place

CMC Crypto’s concern and grasping indicators are at present at 52, reflecting impartial feelings. This follows final week’s 50 readings, exhibiting a slight improve in optimism, but it surely’s removed from the vibrancy seen at Bitcoin rallies earlier this 12 months.

The index means that the market remains to be undecided and balances the cautious optimism pushed by the outflow with considerations a few potential Fed shock. The quantity stays secure at $41.6 billion, emphasizing that liquidity stays intact, however convictions are restricted.

Technical outlook for Bitcoin costs

The short-term Bitcoin worth forecast is mounted between the $116,500 assist flooring and the $118,000 resistance cap. This vary has develop into an necessary zone for merchants. Consumers attempt to consolidate earnings, whereas sellers check momentum on the cap.

If Bitcoin costs right now exceed the $118,000 degree, the momentum will quickly develop to $118,500 and doubtlessly $119,200, with $120,000 coming as the subsequent main goal. Such a transfer will affirm that the Bulls are regaining management and that it may strengthen their belief within the wider uptrends.

On the draw back, shedding the $116,500 threshold may induce extra strain to $115,600 and $114,500. A deeper slide may doubtlessly revert the value to $113,900, testing the resilience of medium-term holders.

Outlook: Will Bitcoin go up?

Bitcoin’s path to development relies on whether or not it breaks previous the $118,000 ceiling earlier than the macro dangers develop into emotionally heavy. Whereas on-chain outflow and impartial sentiment present a supportive background, the looming Fed shock may inject volatility.

Analysts are cautiously optimistic so long as right now’s Bitcoin worth is above $115,600. A decisive push above $118,000 may set off an acceleration to $120,000, however shedding $115,600 may delay bullish instances and retest the $114,500 zone. For now, Bitcoin is consolidating with an upward bias, ready for the subsequent catalyst.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.