- XRP Costs held help of $2.67 as we speak whereas Bitcoin exceeded $109,000

- Analysts warned that XRP costs might immerse in $2.60 earlier than rebound in October

- ETF and Fed insurance policies are key October drivers for XRP worth momentum

Right this moment’s XRP costs present the tokens that will probably be consolidated after a number of weeks of market pullback. XRP costs fell from $3.65 in mid-July to round $2.69 for the weekend, whereas Bitcoin simply surpassed $109,000 from practically $125,000 in late August.

The retreat places main cryptocurrencies beneath strain, however analysts stated it became a brief shakeout earlier than the bullish run restoration in October.

Associated: Eric Trump encourages “purchase DIP” with BTC, ETH and XRP Recheck help. Is that this an opportunity now?

The $2.67 XRP worth help stays the identical

The $2.67 degree has served as a key help for XRP costs for a number of months. Analysts stated this vary will retain signaling integration forward of the subsequent XRP rally.

Information on the chain displays about 16% of XRP’s round provide, highlighting belief amongst long-term holders, with over 10 billion tokens not shifting for greater than a 12 months

XRP Information Catalyst is concentrated on October

Analysts highlighted a number of occasions that would form the momentum of XRP costs in October. These embody::

- Potential approval of the US Spot Crypto ETF as functions are tracked within the SEC’s official submission database.

- The EU market within the regulation of EU crypto property (MICA) has already been authorised and phased implementation is underway (European Fee), so progress in regulation readability is ongoing.

- The expectation that the Federal Reserve discount price will probably be lowered to the three.75-4.00% vary on the October 29 assembly is that CME’s FedWatch instrument reveals market pricing for mitigation odds.

These occasions might probably carry institutional inflow and liquidity again to XRP and different main cryptocurrencies.

Associated: XRP liquid stake expands whereas critics warn of yield dangers

The draw back of XRP costs is the chance earlier than restoration

Ought to traders anticipate a short-term decline?

Market watchers stated the XRP worth might slip additional earlier than staging the subsequent rebound. If a wider weak spot continues, XRP can check both $2.60 or $2.37, representing a correction of about 10% from the present degree.

Traditionally, dips of this dimension typically got here earlier than a sudden rebound when ETF approvals or insurance policies change purchases.

Can XRP attain new highs?

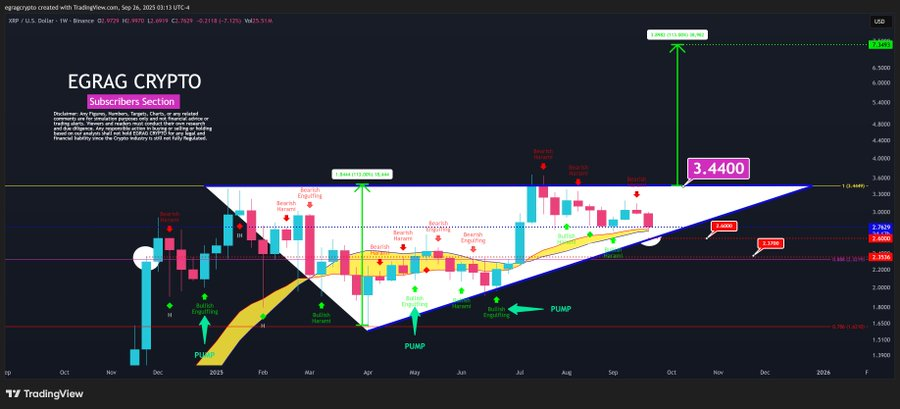

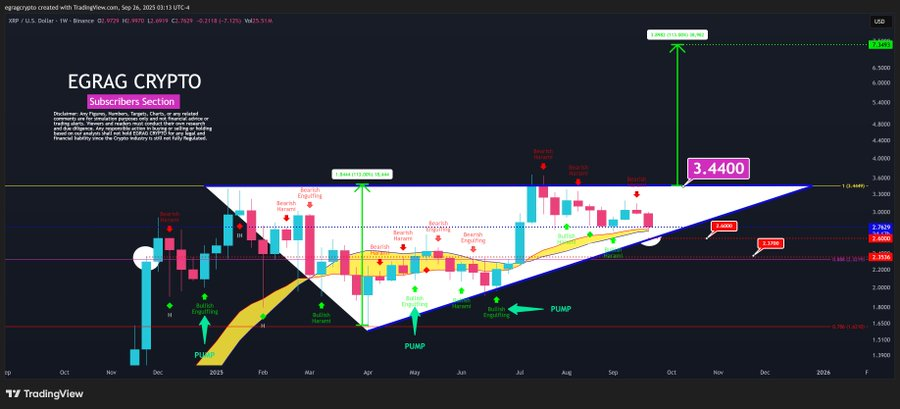

Analyst Egrag Crypto stated XRP has vital buy alternatives for beneath $3. If the market is shaping sturdy bullish weekly candles, XRP is aiming for a brand new all-time excessive of round $7.30.

Cryptocurrency holds on prime of the bull market help band, preserving the general bullish pattern intact.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.