- Bitcoin costs traded as we speak at almost $109,700 and have assist of over $109,000, however are under the 111K-113.5K EMA cluster.

- BlackRock’s $66 million Bitcoin buy is being bought for World Allocation Fund Sign, which is increasing institutional adoption.

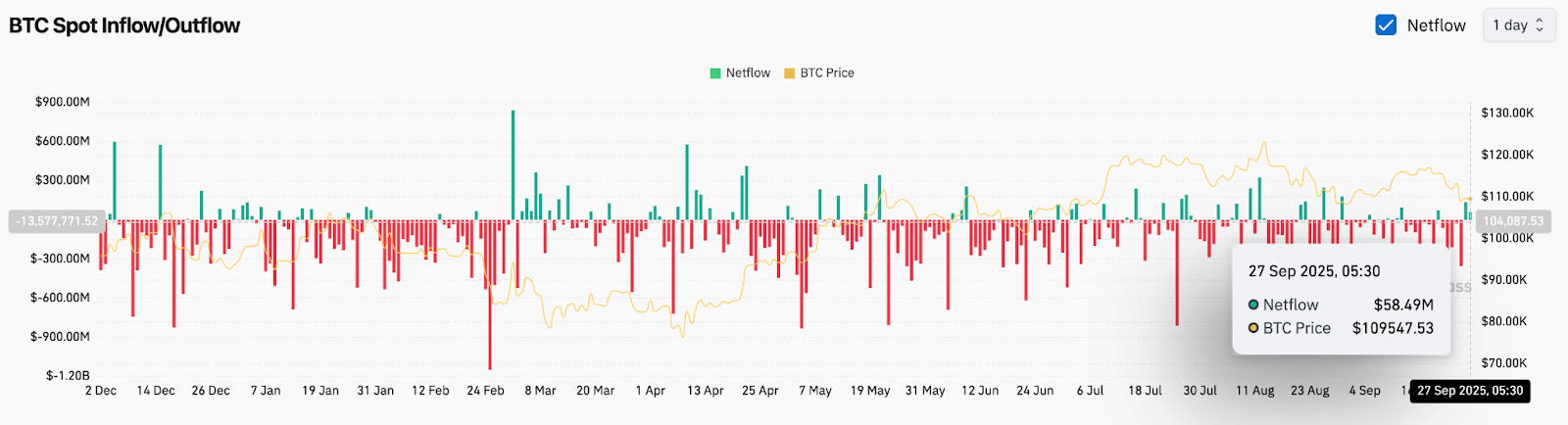

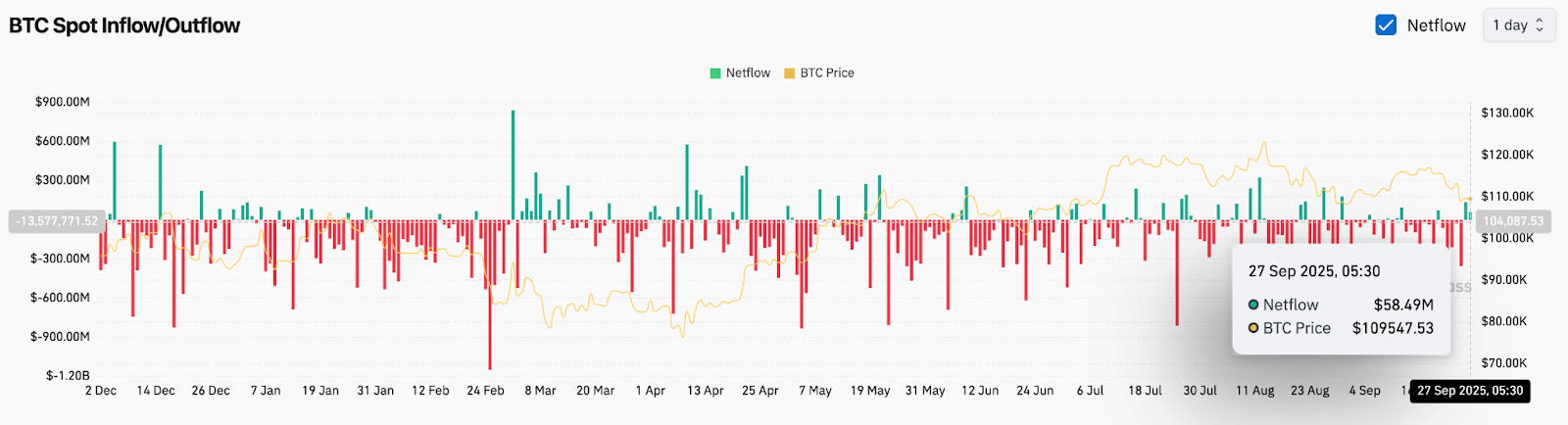

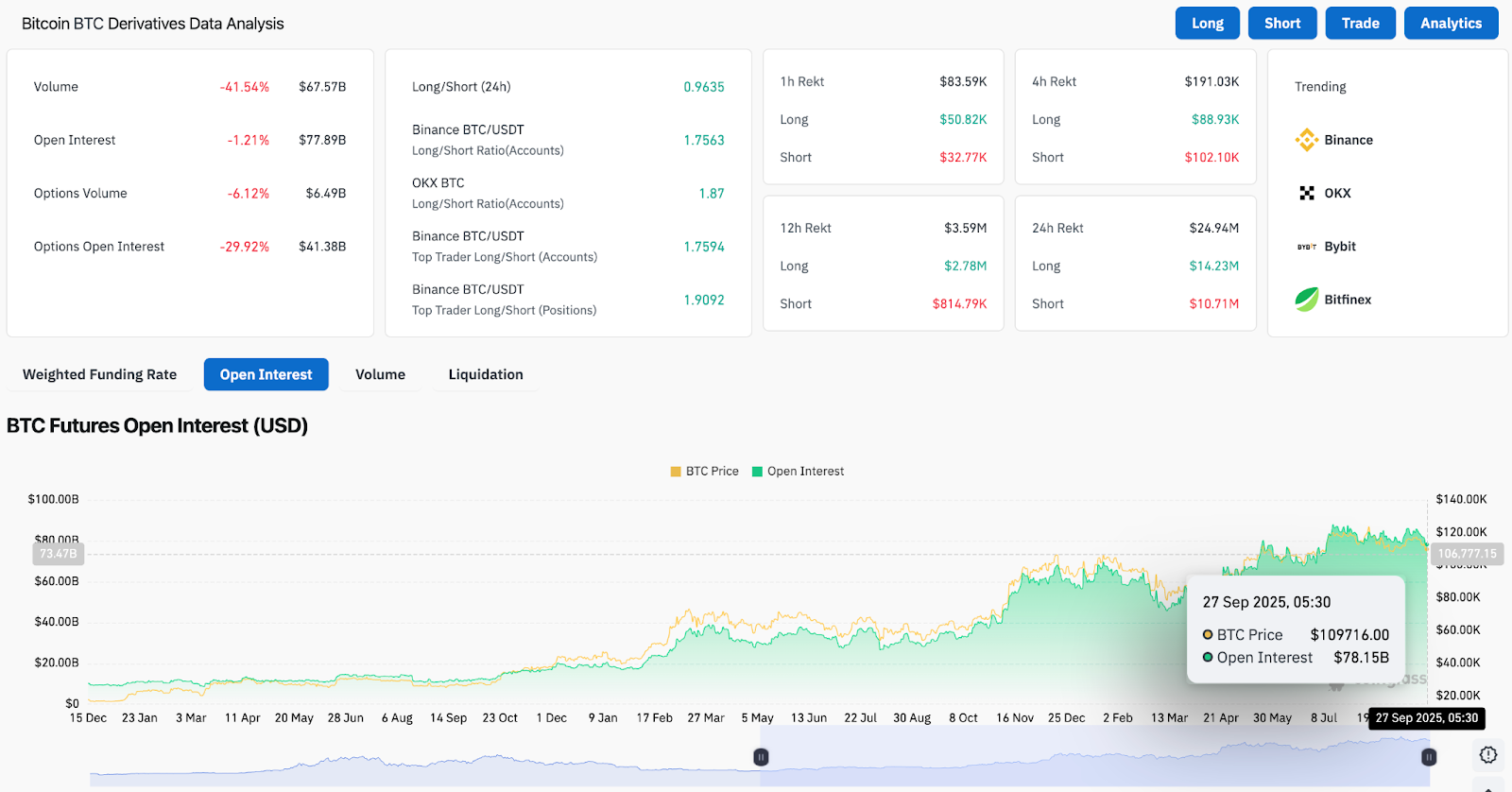

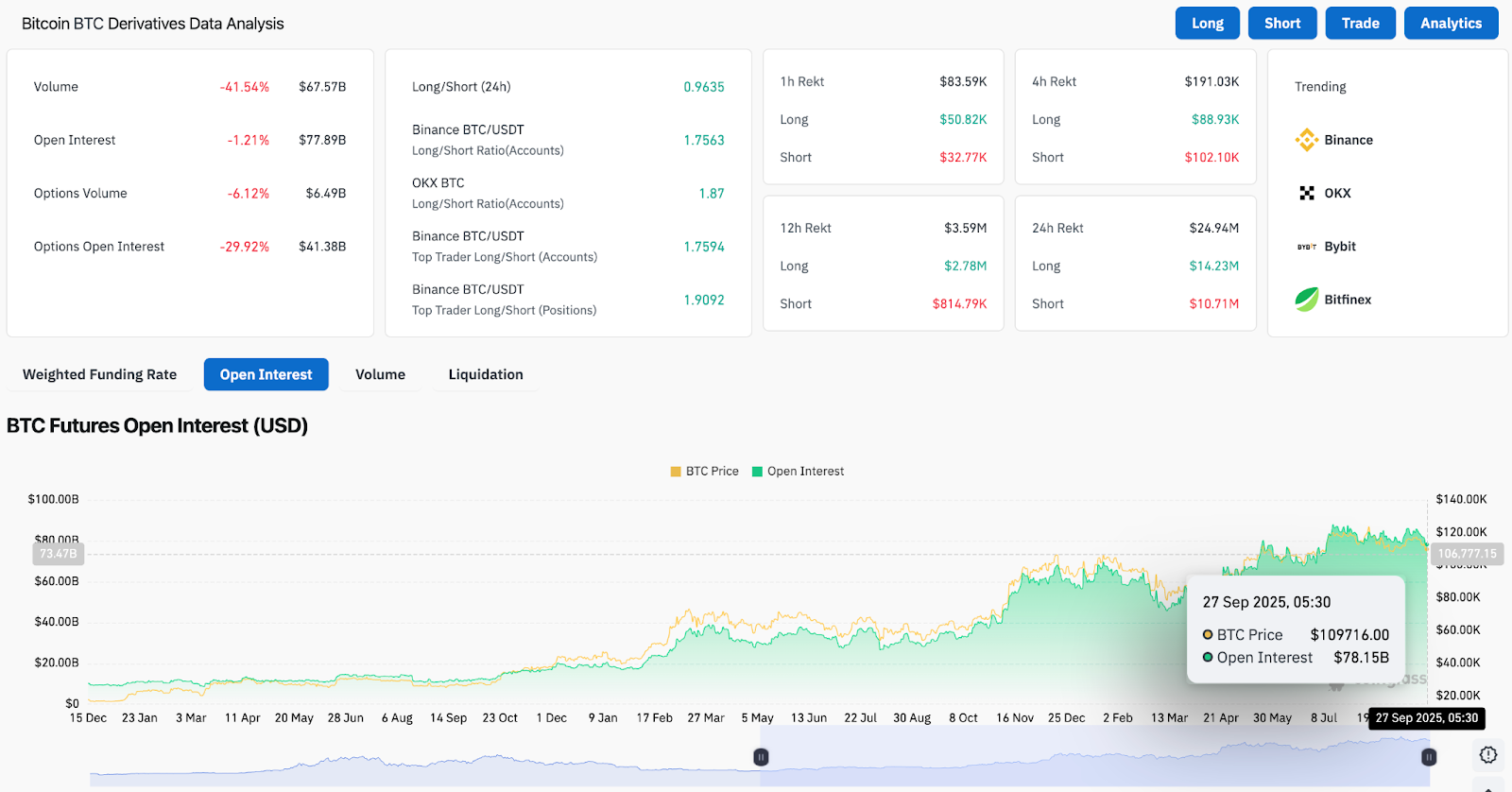

- The web influx of $58.49 million signifies a brand new build-up, however open curiosity on futures slips to $78.1 billion with cautious leverage.

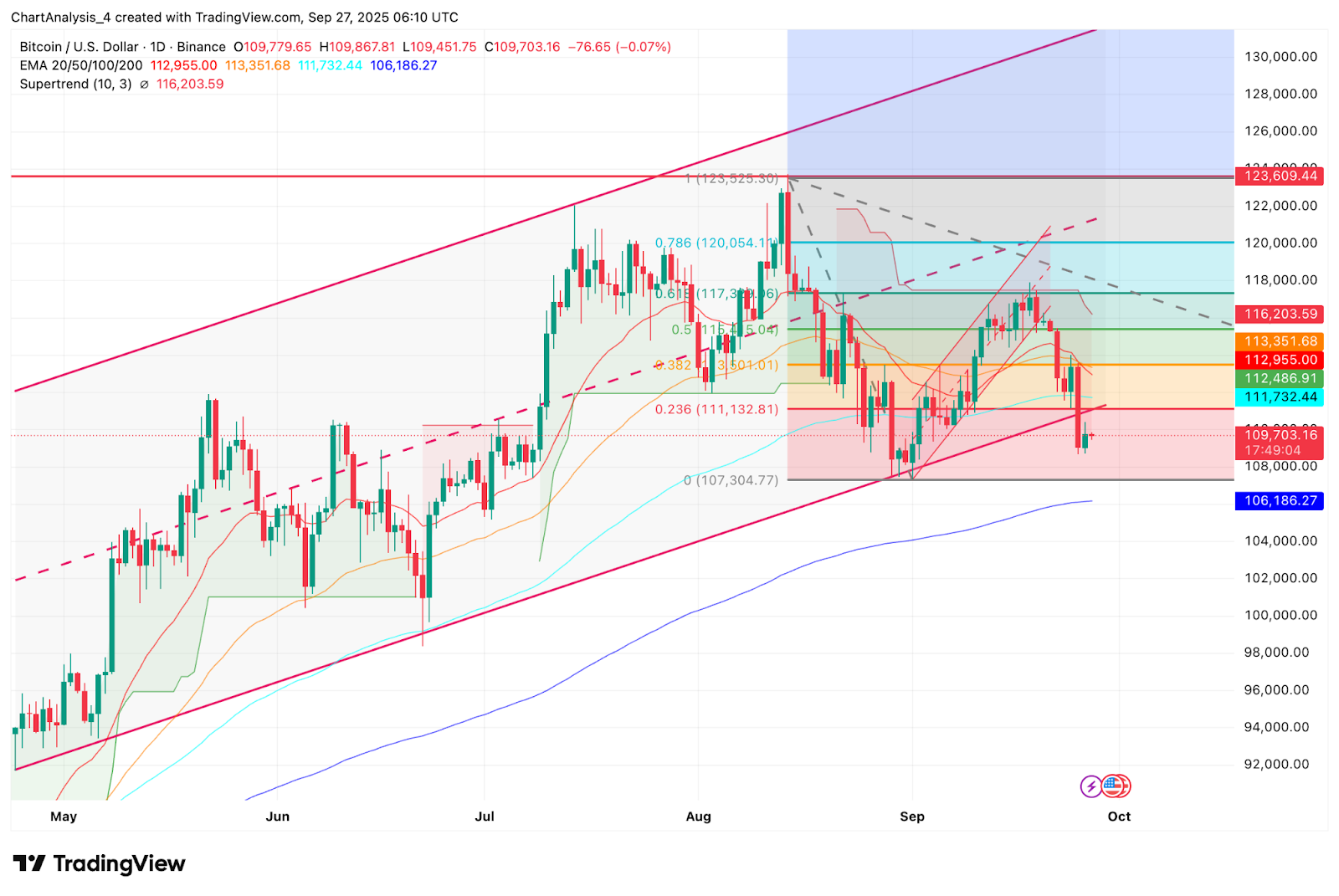

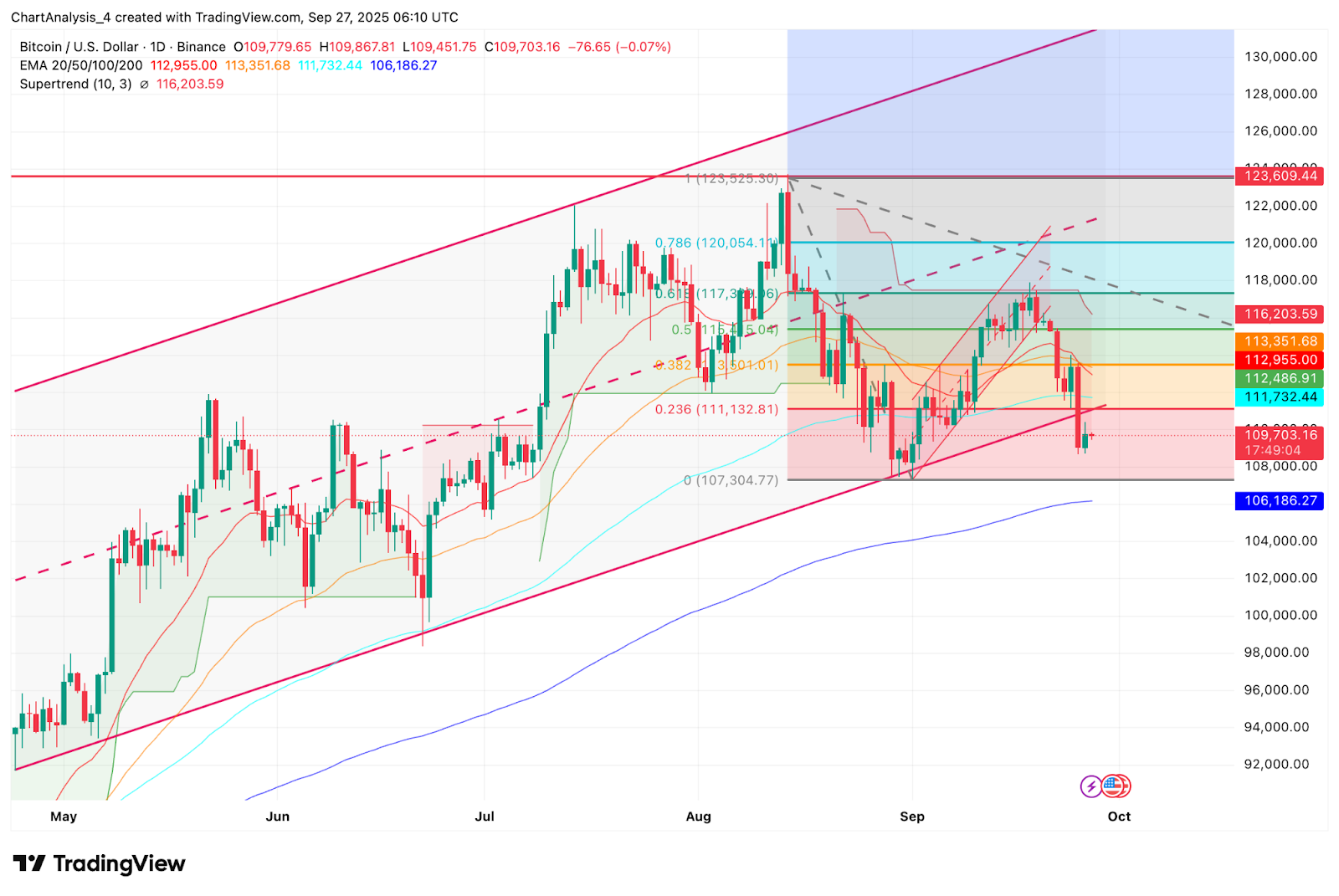

Bitcoin costs as we speak are buying and selling at almost $109,700, down from the $111,000 to $113,500 resistance cluster. Consumers defend the $109,000 zone, however their momentum has pale after repeated failures to regain the EMA cluster. Now, the market measures institutional inflow of susceptible applied sciences.

Bitcoin Worth holds necessary assist, however is preventing Emma

On the every day charts, Bitcoin reveals hovering round $109,700. The 20-day EMA varieties the ceiling at $112,955 and the 50-day EMA varieties the ceiling at $113,351. Instant assist is $109,000, however deeper demand is near $107,300, marked by a 0.236 Fibonacci retracement.

The RSI sign stays impartial, highlighting the dearth of convictions from each side. The SuperTrend indicator continues to flush the resistance at $116,200, and matches it to $115,000, near the 0.5 Fibonacci degree. Until the client recovers $113,500, a wider setup dangers sliding right into a decrease built-in channel.

Buy of BlackRock provides an institutional tail

Market Sentiment acquired a significant increase after BlackRock bought $66 million value of Bitcoin for the World Allocation Fund. This growth highlights rising institutional adoption and provides credibility to long-term bullish papers.

Merchants are taking a look at whether or not BlackRock’s strikes will set off a stream of imitation from different massive asset managers. If maintained, such allocations might take in provide quicker than minor points, enhancing the case of Bitcoin’s subsequent breakout.

On-chain information reveals constructive web circulate

Change information reveals a web influx of $5849,000 on September twenty seventh, updating the buildup on the spot degree. Though weekly flows stay risky, sediment pickups emphasize that they enhance demand after a number of weeks of blended exercise.

Traditionally, inflows over $50 million typically precede stronger upward pressures in the event that they final. Nonetheless, analysts warn that daytime spikes will not be sufficient to reverse the broader cooling development except they contain rising lively addresses and constant accumulation.

Open curiosity in futures displays cautious leverage

Spinoff information highlights a mushy background. Bitcoin Open Interes fell to $78.1 billion, down 1.2% that day. Open curiosity on choices additionally fell by almost 30%, reflecting a lower in speculative urge for food.

Nonetheless, the lengthy/brief ratio reveals a leaning in the direction of bullish positioning, by which Binance’s prime dealer accounts maintain extra lengths than shorts. This means that convictions between massive accounts stay intact whereas leverage is saved.

Technical outlook for Bitcoin costs

Quick-term Bitcoin worth forecasts fall on assist bands starting from $109,000 to $107,300. A clear protection right here permits patrons to reorganize EMA clusters between $111,700 and $113,500 for one more try.

- Rising Degree: If momentum is strengthened, $113,500, $116,200, $120,000.

- Drawback ranges: $109,000 and $107,300, if gross sales strain arises, there’s a deeper danger in the direction of $106,000.

Outlook: Will Bitcoin go up?

The outlook for Bitcoin is balanced intimately. The institutional buy from BlackRock provides a powerful, long-term narrative, however the technical momentum continues to be rounded out by the EMA cluster. On-chain circulate reveals early indicators of restoration, though the spinoff information displays cautious leverage.

So long as Bitcoin exceeds $109,000, analysts see room for one more try at a restoration to $116,000. A vital closure above $113,500 checks this situation, however dropping $107,300 might trigger the main focus to return to $106,000, delaying the following leg.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.