- Solana Value trades practically $207 at the moment and can merge throughout the upward channel after a denial from $246.

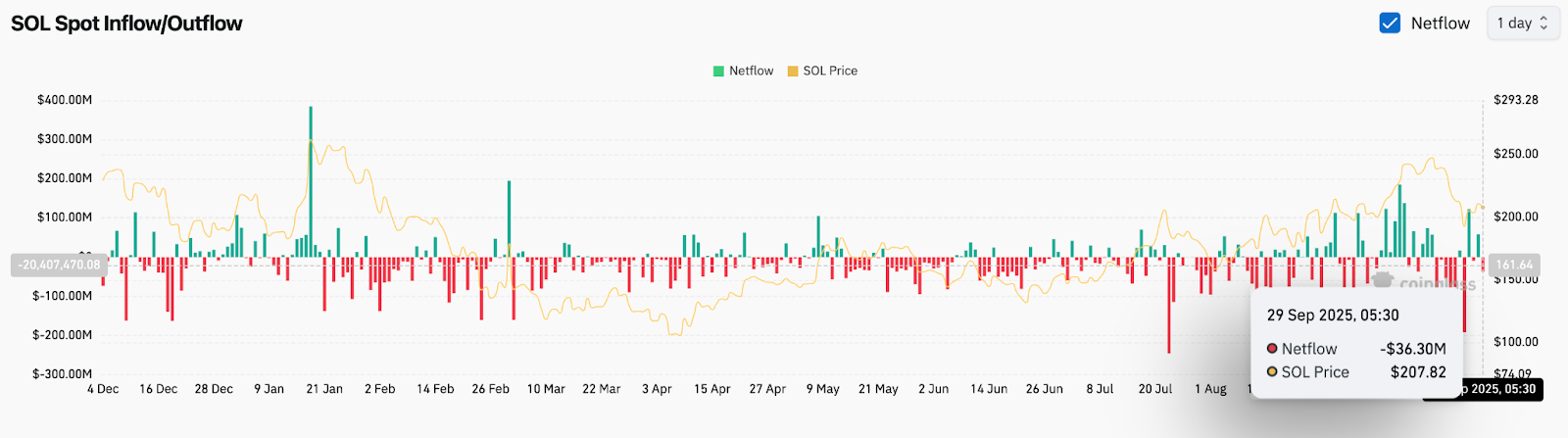

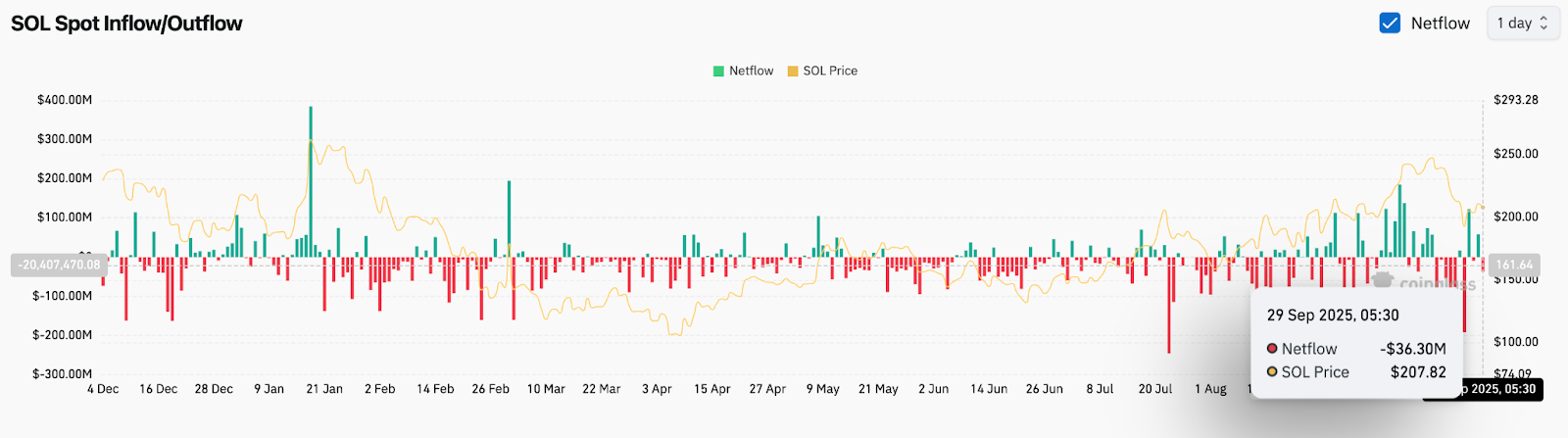

- The online spill $36.3 million highlights susceptible sentiment, with patrons absorbing pressures of over $200.

- Developer progress is strengthening its fundamentals, with Solana main the trade with 10,700 energetic builders.

Solana Value Right now is buying and selling practically $207 and has been steady after sharp gross sales strain pushed the token down from its $246 peak earlier this month. The $207-$210 zone serves as rapid assist, however the resistance is close to the $216-$220 cluster. The important thing query now could be whether or not patrons can defend this flooring or whether or not costs will slide in direction of deeper assist.

Solana Value integrates throughout the Rising Channel

Each day charts present Solana holding throughout the rising channel, however their momentum light after being rejected close to the $246 resistance band. The 20-day EMA for 20 days is $208, the 50-day EMA for 208 is priced at $208, and the 100-day EMA for 194 provides a wider assist base.

The RSI sits at 45, reflecting the momentum of cooling since final week’s failure, and the MACD sign stays flat. A sustained transfer beneath $207 dangers exposing ranges between $195 and $194, adopted by a long-term EMA of $182. The benefit is {that a} clear restoration above $216 may resume its path to $225 and $252.

Associated: Bitcoin Value Prediction: BTC holds 111K {dollars} as dealer’s eye $115K liquidation set off

On-chain knowledge refers to heavy leaks

Alternate move knowledge highlights up to date gross sales strain. Solana recorded $36.3 million in web spills on September 29, indicating that merchants have shifted liquidity from the change. This happens after weeks of inconsistent flows the place the buildup stage is repeatedly offset by a sudden sale.

Nonetheless, the market has not seen any deep panic. Spot costs are nonetheless above $200, suggesting that patrons try to soak up gross sales strain. Open curiosity in futures has flattened, displaying consideration quite than aggressive quick positions. Nevertheless, analysts warn that steady spills may delay makes an attempt to regain the $220 resistance zone.

Developer Development Enhances the Fundamental Story

Past short-term buying and selling, Solana’s developer ecosystem continues to increase quickly. Chainspect’s knowledge reveals Solana main the trade with over 10,700 energetic builders, virtually twice as many Ethereum figures. In whole, over 61,000 builders are concerned all through the ecosystem, with Solana main the most important share.

This surge in developer exercise is necessary for long-term evaluations. Extra builders means extra functions, higher adoption, and sustained demand for Sol Tokens. Momentum is clear in transaction progress and new tasks that choose Solana as their base community. Market members view this as a structural benefit that offsets short-term volatility.

Solana Value Technical Outlook

Solana’s direct roadmap focuses on a assist base of $207-210 and a resistance cluster of $216-220. As soon as above $207, the channel construction continues as is, with $225 and $252 holding $252 as the next goal if momentum returns. A breakdown beneath $207 can drag the value to $195 and deepen the danger zone close to $182.

Prediction degree

- Upside: $216, $225, $252

- Disadvantages: $207, $195, $182

Outlook: Will Solana go up?

Solana’s short-term outlook depends upon whether or not patrons can defend $207 and regain the resistance vary of $216-$220. Whereas on-chain move suggests cautious sentiment, the community’s burgeoning developer base provides a robust long-term anchor.

So long as Sol is above $195, analysts will stay constructive. A breakout above $220 will strengthen the bullish case to $225 and $252, however when you lose $207, the main focus will return to $195 and $182.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version will not be chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.