- Bitcoin’s historic October earnings recommend the potential for a robust “up-to-bar” rally.

- Whale gross sales and reducing amenities exercise recommend short-term market vulnerability.

- Technical energy signifies situations within the center that help pushing to new highs.

As October begins, Bitcoin spans two tales. The so-called Uptober, a seasonal optimism, leaps in direction of historic efficiency and technical energy.

In the meantime, issues about hidden vulnerabilities and whale conduct are warned {that a} reset is imminent. The subsequent few weeks could resolve whether or not October will flip into one other “Uptober” or a scary “Rektober.”

1. Bull Case: Seasonality and Technical Momentum

Cryptocapo famous that September served as a transitional section for Bitcoin and the broader market. He warned that below the light floor, the vulnerability was widespread.

He says the market is designed to do additional washes earlier than constructing excessive, and within the quick time period it may lead to a reset. He careworn the necessity for buyers to hunt the reality, to not stick with bullish tales, even when the outlook is offensive.

Associated: Bitcoin Hash Price Hit Data 1.2 ZH/s, BTC Eyes $114K Breakout

Historic tendencies want the most recent ones

In distinction, Cryptosrus highlights Bitcoin’s highly effective seasonal historical past, highlighting that October has benefited in 10 of the final 12 years. Notable rally features a surge of almost 60% in 2013 and almost 48% in 2017.

With September ending in modest inexperienced territory, he sees present situations as a wholesome launchpad. He admitted that the macro influence may confuse the patterns, however he leaned in opposition to a bullish October, the place Bitcoin’s resilience was fueled throughout doubt.

2. Bear Case: Whale, Feeling Weak point, Hidden Dangers

Salsatekila gives much more nuance, stating that whales bought over 130,000 BTC in August and September. On the similar time, patrons from main establishments equivalent to Michael Saylor’s firm delayed their actions.

The institutional capital that animated many earlier conferences appears much less energetic now. The slowdown amongst main patrons provides to the story of dangers that October might even see Reset Not a surge.

He believes the anomaly may set the stage for a rally pushing it to $180,000 within the coming months, with short-term help being held near $112,000.

3. A balanced view: This October might be decisive

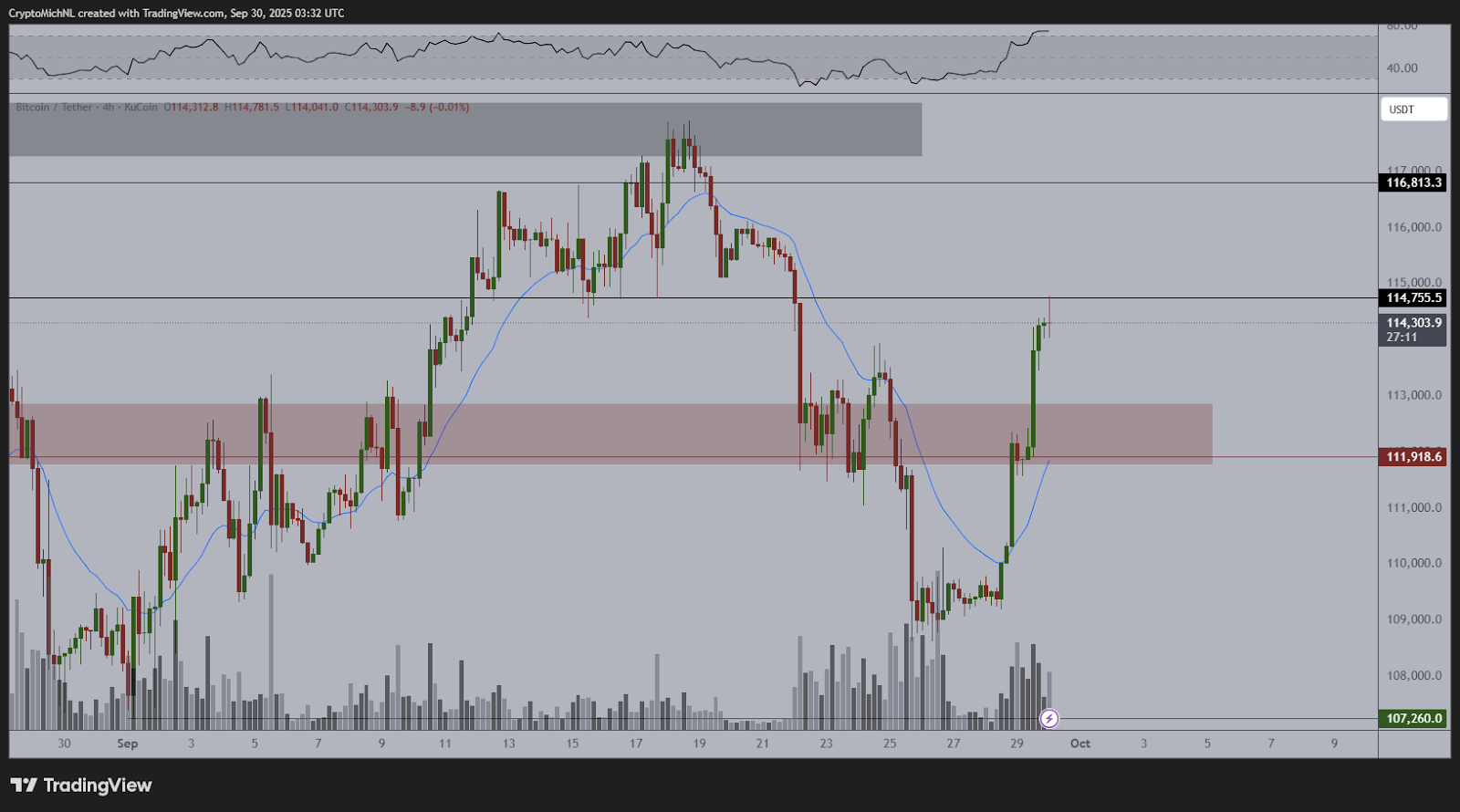

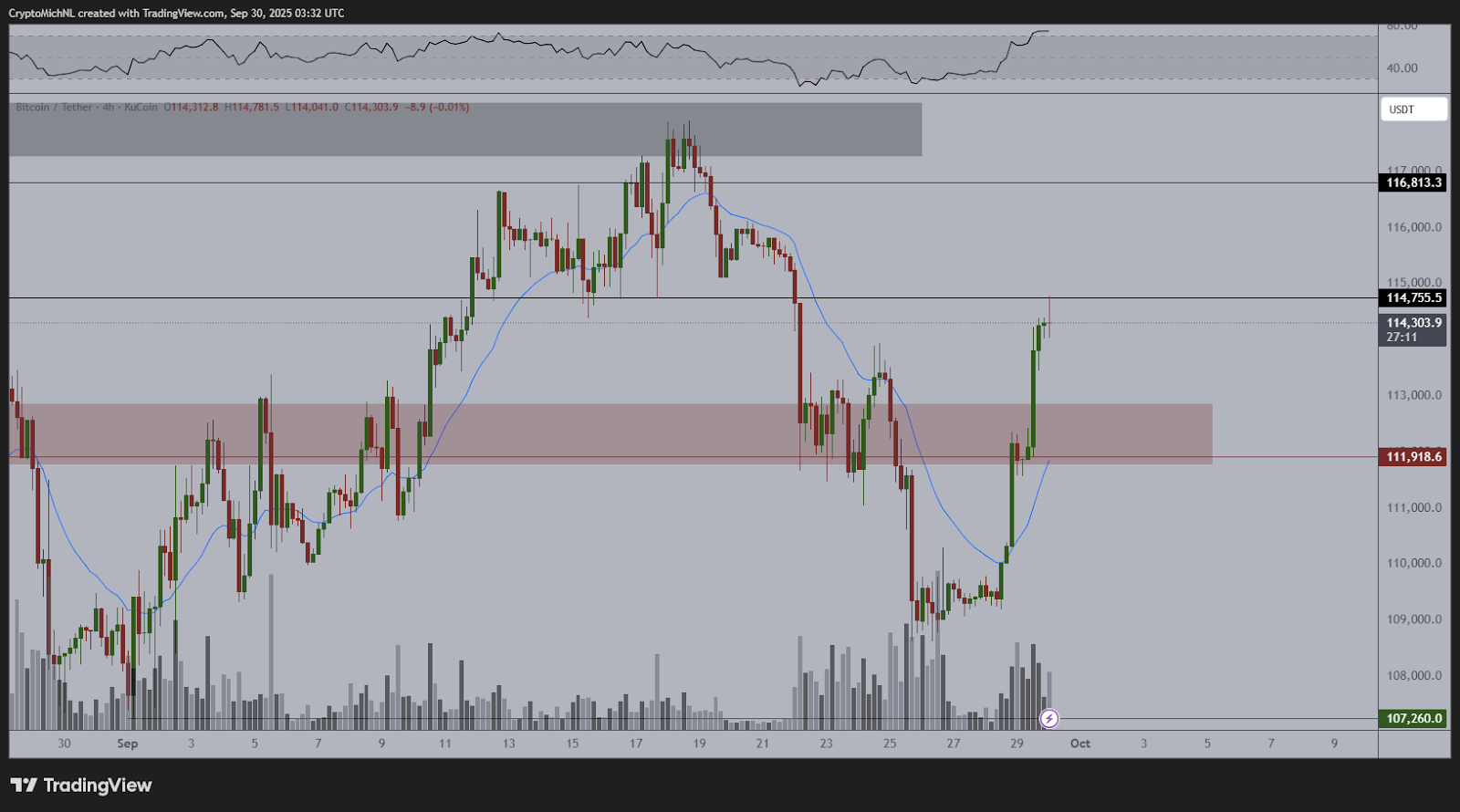

Michael Van de Poppe noticed that Bitcoin had breached a key resistance at $111,900, and flipped to help when the value reached $114,755. He famous that short-term pullbacks to $113,000 are attainable, however a wider set-up seems to be most well-liked. He stated if the help zone stays the identical, it may run in direction of the brand new all-time excessive in October.

Associated: Bitcoin Value Prediction: BTC holds $111K with merchants eye contact $115K liquidation set off

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.