- Ethereum Worth holds $4,509, and consumers have been testing the $4,560 resistance that concluded the rally since August.

- The US Treasury exempts ETH from the 15% company tax, growing confidence in institutional adoption.

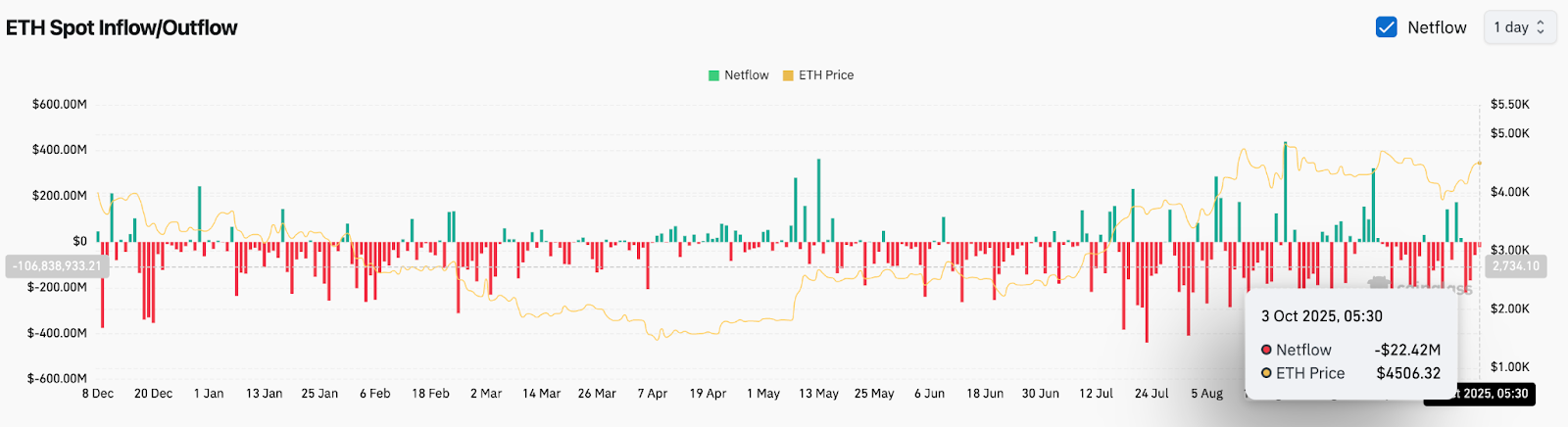

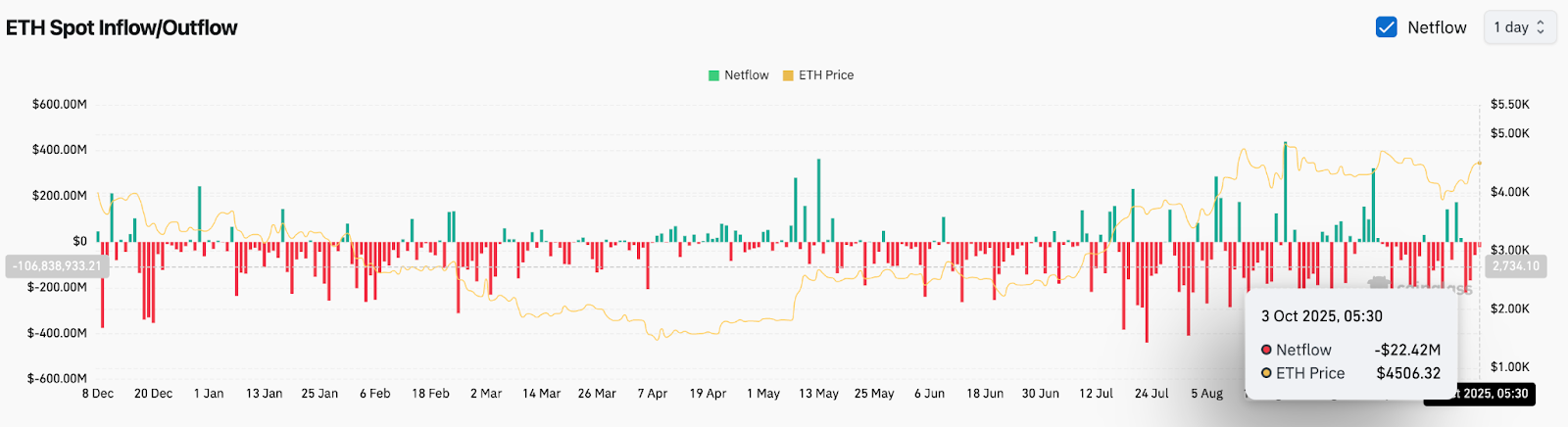

- On-chain move reveals a web spill of $22.4 million, signaling delicate build-up, however uneven convictions.

At present’s Ethereum costs are buying and selling at $4,509, regaining momentum after bounces again from the $4,307 help zone. Consumers are pushing downward resistance strains close to $4,560. Presently, the market focus will shift as to whether ETH can break this ceiling or return to a deeper degree of help.

Ethereum Costs retain a triangular construction

Each day charts present requires Ethereum inside a symmetrical triangle sample. Assist has been pinned on Rising Trendline beginning in April, converging at 20-day EMA and $4,307. The resistance stays stable, near $4,560. This can be a downward line the place we repeatedly refused to fulfill.

Momentum has improved, with an RSI of 57, referring to impartial to susceptible state after rebounding from bought territory. A profitable break of over $4,560 clears the trail to $4,700 and probably $4,850, however failure at this degree dangers a pullback to $4,238 and $3,906, the place 100 days of EMA and trendline help converges.

US Treasury Tax Exemptions Promote Optimism

Ethereum acquired a powerful fundamental catalyst this week after the US Treasury exempts ETH from the 15% company tax. This choice supplies a regulatory tailwind and locations Ethereum extra favorably for moral adoption.

Analysts argue that exemptions scale back long-term value limitations for corporations which have ETH on their steadiness sheets. Market responses are cautiously bullish, sentiment has improved throughout the futures market, and inflows have been ingrained. Merchants see this as a validation step that strengthens Ethereum’s place in opposition to competing Layer 1 networks.

On-chain move displays blended feelings

Alternate knowledge reveals a web spill of $22.4 million on October 3, highlighting a modest accumulation as ETH recovered $4,500. This implies that consumers are inserting them within the dip, however the move stays uneven in comparison with the heavy buildup stripes in July.

Spot exercise nonetheless doesn’t present robust perception, as alternating inflows and outflows point out merchants are cautious about committing at present ranges. Open curiosity in futures is steady, indicating defensive positioning quite than aggressive lengthy exposures. Analysts warn that within the absence of a constant web spill, Ethereum value motion may very well be sure to vary throughout the triangle.

Technical outlook for Ethereum costs

Quick-term Ethereum value forecasts fluctuate relying on whether or not the customer is ready to safe a breakout.

- Upside Goal: $4,560, $4,700, $4,850

- Disadvantages help: $4,307, $4,238, $3,906

- Pattern Line Protection: $3,456 for the ultimate main help

So long as ETH is above $3,900, the broader uptrend stays. The decisive break of $4,560 opens the door in direction of $4,850 and probably $5,000 over the subsequent few weeks.

Outlook: Will Ethereum rise?

Ethereum will enter at a pivotal technical fork in October. Whereas the US company tax exemption supplies a powerful narrative enhance, chart compression reveals {that a} greater transfer is approaching.

If ETH has had momentum cleared $4,560 and Outflow helps breakout, analysts anticipate the value to rise from $4,850 to $5,000. Nonetheless, in case you fail to exceed $4,307, you could possibly delay bullish papers and publish a $3,900 zone. For now, Ethereum balances a powerful basis with necessary technical limitations, and consumers are searching for a affirmation of the subsequent leg.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version is just not accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.