- ChainLink is held above the principle EMA and promotes ongoing hopes of short-term bullishness.

- The rising open income point out robust dealer engagement within the linked derivatives market.

- Persistent trade outflows present cautious sentiment regardless of worth will increase.

ChainLink (Hyperlink) has lately gained consideration because it has lately proven a short-term uptrend following its low of practically $20.37. The cryptocurrency bounced above the principle transferring common, together with a 50 EMA of round $22.12 and a 100 EMA of practically $22.36.

Moreover, the $21.90 200 EMA at the moment serves as a powerful help zone and supplies a basis for potential worth will increase. Merchants are intently Fibonacci’s retracement ranges from the current Swing Excessive to the $25.63 low, as these factors might decide short-term resistance and help.

Fibonacci ranges and key worth targets

Quick resistance appeared round $23.28, a 1.618 Fibonacci extension, and Hyperlink is already dealing with a slight rejection. If the Bulls preserve power, the subsequent resistance vary is between $24.49 and $25.29, akin to retracement ranges of 0.786 and 0.236. These zones can problem upward momentum, but in addition supply potential breakout alternatives.

Conversely, on the draw back, the hyperlink will retest help for practically $22.12, bolstered by a 50 EMA or decreased to a further $21.83, consistent with the two.618 Fibonacci enlargement. A sustained break under these ranges might result in deeper integration close to the current swing low of $20.37.

Associated: ChainLink whale scoop 800K hyperlink that has develop into Stablecoin Provide HITS RECORDS $283B

Spinoff actions mirror the pursuits of highly effective merchants

Along with worth motion, chainlink futures have seen a pointy rise in open curiosity all through 2025. Since July, curiosity opened from earlier ranges of $300 million to $600 million has risen to surpass $1.3 billion by early October.

This surge signifies the next degree of dealer participation, suggesting that each speculative betting and hedging methods drive market engagement. The parallel rise in hyperlink costs and open curiosity displays elevated confidence amongst by-product merchants, strengthening the prospects of short-term bullish momentum.

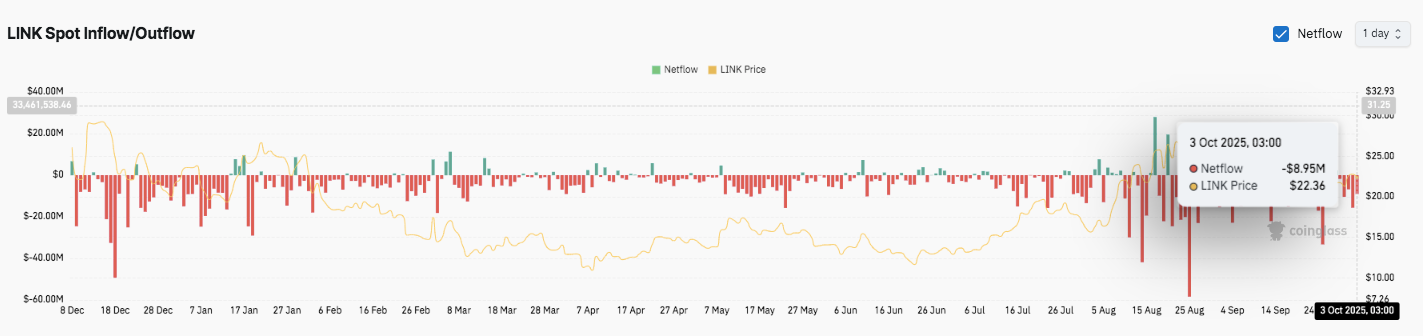

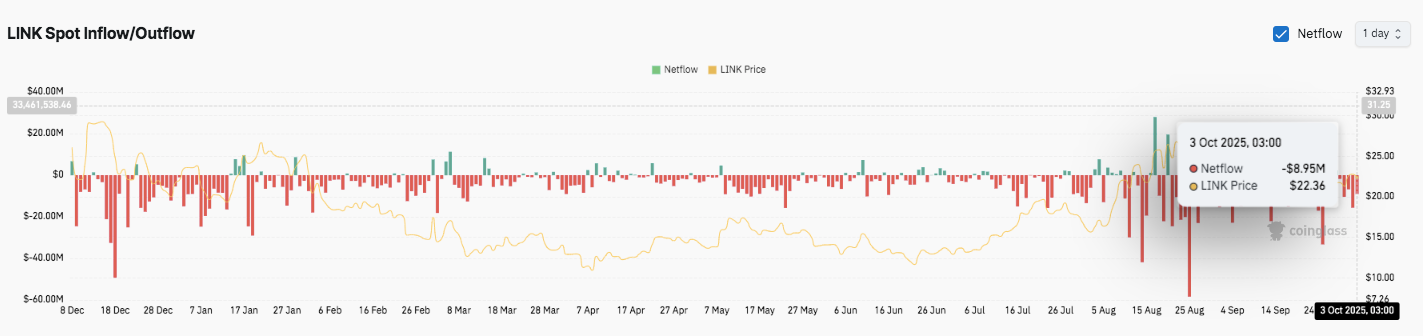

Persistent Change Outflow Sign Warning

Nonetheless, regardless of rising worth actions, Hyperlink skilled a sustained web spill from the trade all through 2025. Specifically, from mid-August to late September, some spikes exceeded $40 million, however inflows remained restricted.

The $8.95 million web outflow on October 3 exhibits continued gross sales stress, highlighting cautious sentiment regardless of makes an attempt to get better the worth. These outflows point out long-term holding habits, however recommend that buyers proceed to weigh market circumstances in opposition to potential dangers.

Technological outlook for ChainLink Costs

Key ranges stay clearly outlined in October:

- Upside Stage: Quick hurdles are $23.28, $24.49 and $25.29. Breakouts may be prolonged to $26.00 and $27.35.

- Drawback degree: $22.12 (50 EMA help), a current low swing of $21.83 and $20.37.

- Ceiling of resistance: $25.29, which coincides with the 0.236 Fibonacci retracement, is a crucial degree for flipping for mid-term bullish continuation.

The technical pictures recommend that the hyperlinks are compressed round main Emma and Fibonacci clusters. Right here, a crucial breakout may cause a rise in volatility in both course.

Associated: ChainLink is at the moment the official pipeline of US authorities financial knowledge.

Will ChainLink be on sale in October?

Chainlink’s October worth forecast will depend upon whether or not the Bulls are capable of defend the $22.12-$21.83 zone. Each technical compression and rising open curiosity are transferring in direction of rising volatility sooner or later.

If bullish momentum is strengthened, the hyperlink might retest $26.00, and even $27.35. Nonetheless, for those who do not personal $21.83, you danger breaking right into a deeper integration close to $20.37. For now, the hyperlink stays in a pivotal zone. The October story helps optimism, however the circulate of conviction and the EMA flip decides on the subsequent leg.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version will not be answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.