- BNB maintains bullish developments above $1,200 with sturdy help from Main Emma

- Steady investor accumulation developments in open curiosity and spot inflow indicators

- Key breakouts above $1,242 might set off a sudden rally in the direction of the $1,300-$1,340 zone

BNB (Binance Coin) continues to indicate sturdy bullish momentum and maintains a place above $1,200. After regaining this essential psychological belt, the coin’s technical construction demonstrates sustained buying strain and steady investor belief. The broader development is firmly supported by the Bulls, with BNB buying and selling extra comfortably than the primary exponential transferring common (EMA) than anything.

Unhurt developments above key transferring common

The uptrend in BNB stays steady and is supported by all 4 main EMAs (20, 50, 100, and 200). It’s presently round $1,152 and a $1,098 50 EMA bent upwards, confirming the short-term bullish momentum. These zones function dynamic help for merchants trying to accumulate throughout minor pullbacks.

Moreover, the $1,048 100 EMA and the almost $991 200 EMA proceed to supply sturdy structural help for the broader bullish development. So long as BNB costs exceeded $1,150, market sentiment favors continued to maneuver upward. Under $1,080, short-term momentum might weaken, however the long-term development stays per bullish continuity.

Associated: Dogecoin Worth Prediction: 401(ok) Complete Rumors Trigger Bullish Tales

The Fibonacci zone exhibits main resistance ranges

Fibonacci’s retracement, which lately pulled a low swing from $926 to $1,340, reveals a number of factors of resistance. The 0.382 degree is near $1,302, whereas the 0.5 and 0.618 ranges are at $1,291 and $1,279, respectively. These are essential short-term boundaries merchants are intently monitored.

At the moment, BNB is near $1,206, with quick help of $1,182 and resistance of about $1,242. A important transfer above $1,242 might pave the best way for a rally to the $1,279-$1,302 zone. Past that, the $1,316 to $1,340 vary is the Bulls’ subsequent goal. Subsequently, the $1,182–$1,152 vary will proceed to function a powerful space of demand if minor modifications are made.

Futures open factors of curiosity in growing leverage

Information from BNB’s futures markets present a constant surge in rights all through 2025. Curiosity opened as of October sixth, from below $500 million in early March, exceeded $2.35 billion.

The growth of leveraged place usually precedes greater volatility, however on this case it displays the dealer’s confidence in sustained worth will increase. So long as BNB maintains stability of over $1,000, open rates of interest of over $2 billion help bullish prospects, highlighting that lengthy positions proceed to dominate the futures market.

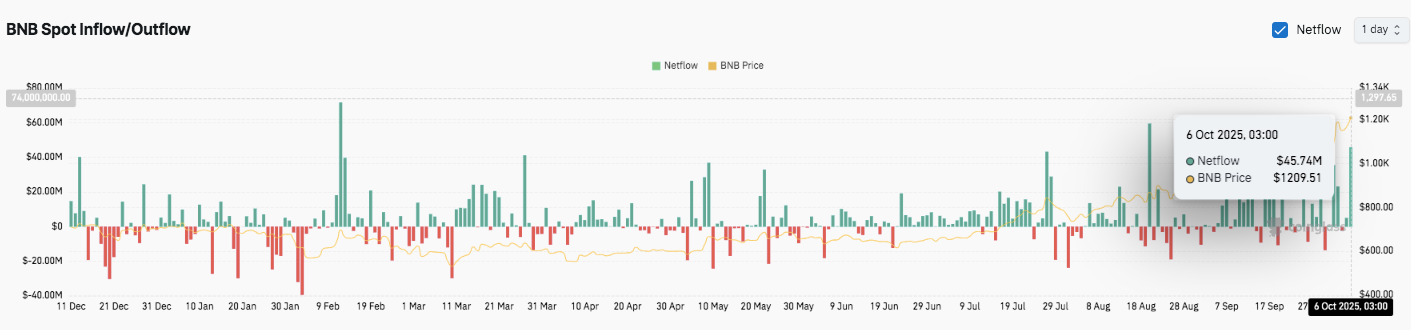

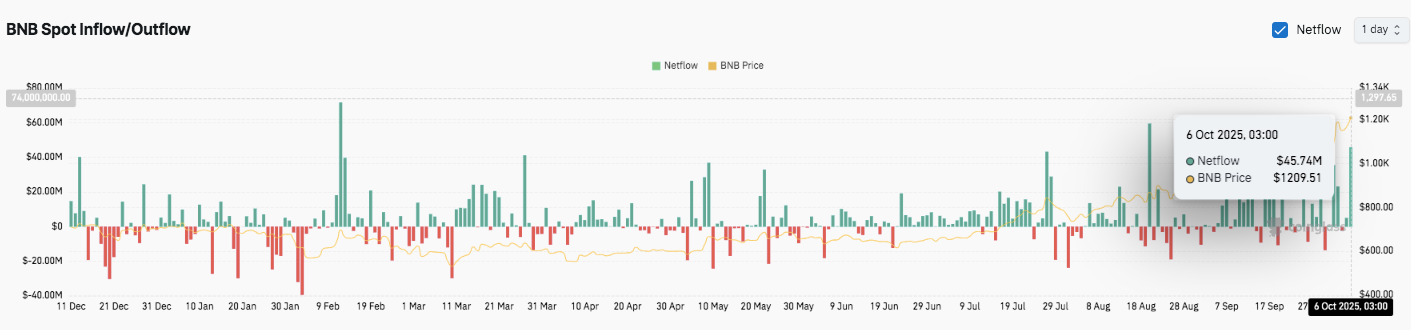

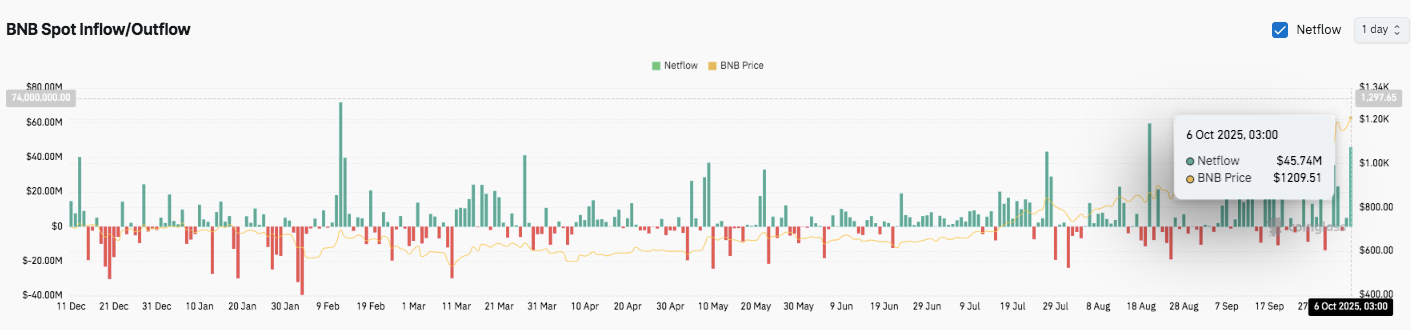

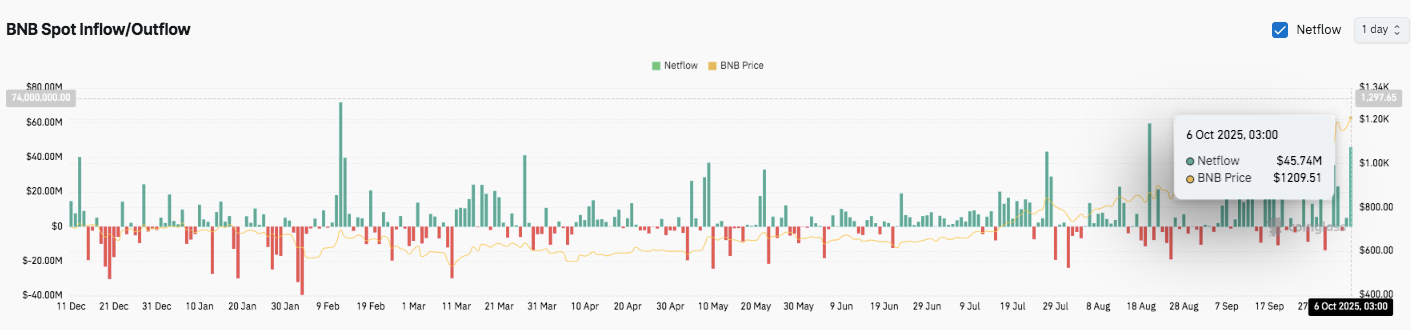

Spot inflow highlights investor accumulation

On-chain knowledge reveals that the inflow of BNB spots has been steadily rising since mid-September. On October sixth, internet influx reached $45.74 million, with BNB rising coinciding with $1,209.51. This constant sample of constructive internet movement means that buyers are accumulating and predicting a continuation of uptrends.

Moreover, historic patterns present that such influential spikes precede sturdy gatherings and strengthen market optimism. If the shopping for development continues, BNB might quickly see a sustained breakout to $1,300 and retest the $1,340 zone.

Associated: Cardano Worth Forecast: ADA integrates as Coinbase’s Reserved Surge 462%

BNB Technical Outlook (Binance Coin)

BNB will preserve a strong technical construction because the market enters October, with well-defined help and resistance zones forming short-term expectations.

Upside Degree: $1,242, $1,279, and $1,302 stand as quick factors of resistance. Breakouts past these might drive BNB to $1,316 and $1,340.

Drawback degree: Preliminary help is $1,182, adopted by $1,152 (20 EMA) and $1,098 (50 EMA). A deeper pullback might probably retest $1,048 or $991 (200 EMA).

Ceiling of resistance: The vary of $1,316 to $1,340 varieties an essential barrier. Closures over $1,340 every day verify the continued wider uptrend.

The chart means that BNB is consolidating past short-term EMA, forming a bullish continuity sample. This compression stage usually precedes a speedy worth improve, particularly when supported by rising quantity and open curiosity.

Does BNB maintain earnings of over $1,200?

BNB’s bullish setup in October will depend upon its skill to revive the $1,242 resistance space, above $1,180. The sustained accumulation and robust inflow recommend continued optimism. If momentum is strengthened, BNB can goal between $1,300 and $1,340 within the quick time period.

Nevertheless, placing a day of lower than $1,150 will weaken the short-term bias and open the door to a correction to $1,098. For now, consumers are nonetheless in management, and the confluence of on-chain demand and the beneficial technological construction means that BNB is positioned on one other higher leg this month.

Associated: BNB worth flag below scrutiny as a GROK report results in centralized provide danger

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version will not be answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.