- Bitcoin will defend $123K after the breakout and can shield $128.5,000 from $125.5 million as its subsequent upside goal.

- The technique stories fourth quarter truthful worth income of $3.9 billion and strengthens the corporate’s adoption of Bitcoin.

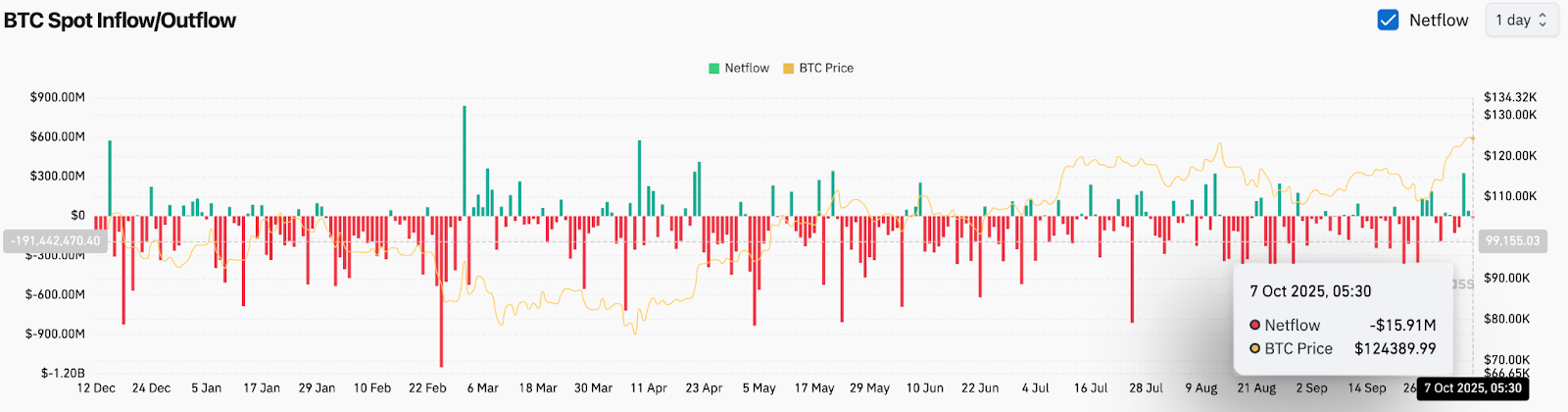

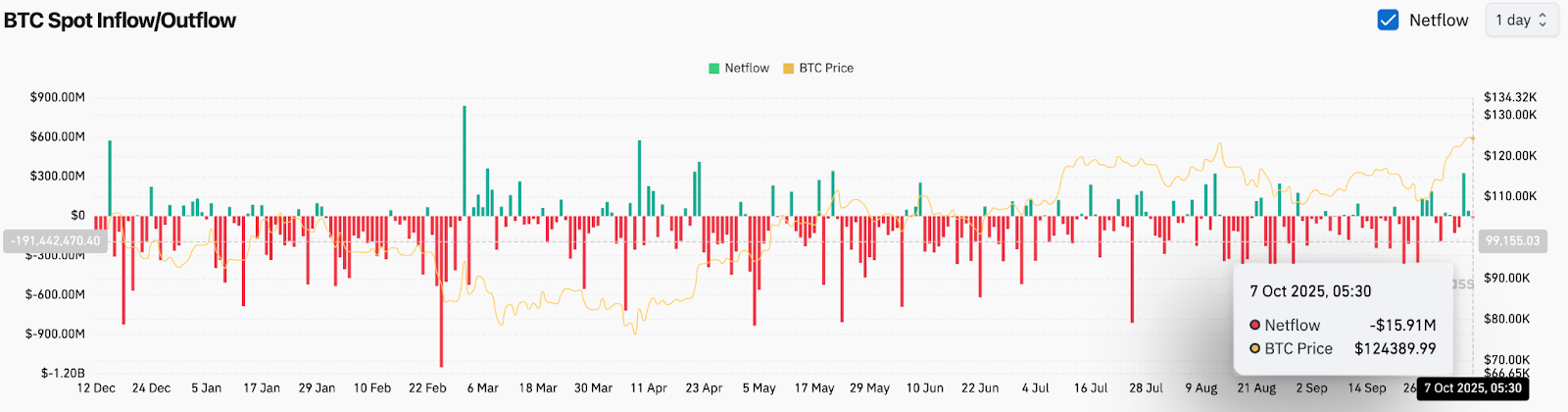

- On-chain move reveals a $15.9 million outflow, signaling cautious accumulation throughout integration.

Bitcoin costs at this time are buying and selling at practically $124,180, and are secure after these months of robust breakouts from the triangular construction. Consumers are defending the newly revived $123,600 zone as information has been digested that the company big technique reported $3.9 billion in its truthful worth valuation for the third quarter of 2025.

Bitcoin value extends rally throughout the upward channel

Day by day charts present that Bitcoin is constant to keep up robust progress throughout the Rising Channel. Costs are presently testing the midline at practically $124,800. The $117,800 20-day EMA and $115,500 50-day EMA fashioned a strong assist cluster and confirmed the bullish integrity of the pattern.

The RSI, close to 71.6, suggests delicate extra situations after a pointy restoration from $111,000 final week, however momentum stays rising. So long as BTC exceeds $123,000, the short-term construction stays constructive. A break from $125,500 to $126,000 might pave the best way to $128,500 and mark the higher restrict of upward channels.

Technique’s $3.9 billion report strengthens the institutional narrative

Investor sentiment has been closely supported after Michael Saylor confirmed that his technique recorded $3.9 billion within the third quarter of 2025 in a complete valuation of Bitcoin’s truthful worth. The announcement highlighted the increasing position of the Ministry of Company Finance in reinforcing BTC’s macro papers as a digital reserve asset.

The replace additionally rekindled discussions in regards to the institutional momentum of Bitcoin heading for This autumn as listed entities and ETFs proceed to build up positions inside stronger truthful worth accounting requirements. Analysts level out that constant firm profitability related to BTC holdings strengthens belief in long-term demand and value stability.

Trade move signifies managed outflow inside integration

In response to Coinglass, spot trade knowledge confirmed a web outflow of $15.9 million on October seventh, reflecting a cautious accumulation fairly than an aggressive distribution. Over the previous two weeks, Netflows has alternated between small influxes and outflows, suggesting that merchants are taking income however haven’t left their positions.

Traditionally, everlasting web spills have coincided with medium-term conferences as provide exchanged for self-supported ones. Analysts see the present sample as a wholesome integration, following a 12% runup in BTC since late September. A sustained outflow of over $100 million confirms deeper accumulation forward of a possible This autumn breakout.

Technical outlook for Bitcoin costs

Brief-term Bitcoin value forecasts stay fastened in sustaining breakout channels.

- Upside Degree: If momentum continues, $125,500, $128,500, $132,000

- Drawback stage: Primary assist is $123,000, $117,800, $115,500

- Pattern Assist: $107,500 (200-day EMA) for long-term protection line

Outlook: Will Bitcoin go up?

Bitcoin stays properly positioned inside its bullish channels, supported by its constructive company catalysts and secure on-chain move conduct. Strategic revenues strengthen the broader institutional narrative, and secure outflows counsel restricted gross sales stress.

Analysts imagine that if BTC can safe a day closure of greater than $125,500, the following goal zone might be close to $128,500-$132,000. Nevertheless, if you cannot exceed $123,000, you may set off minor fixes in direction of the EMA cluster earlier than the following leg will get excessive.

For now, Bitcoin’s broader construction stays upwards, with patrons underneath management because the market is excessive ranges of resistance till mid-October.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.