- Bitcoin slides from 126K to 121K, decreasing the crypto concern and greed index to 55 (impartial).

- The $650 million liquidation and excessive open curiosity counsel short-term warning.

- Analysts see a ‘wholesome reset’ earlier than a possible ETF-driven rebound.

The Crypto Market cooled sharply as merchants booked income from Bitcoin’s current all-time excessive run. In line with Coinmarketcap, the full crypto market capitalization decreased by about 2.5% in 24 hours to $4.15 trillion.

As such, the Crypto Worry and Greed Index offered by Binance-backed Coinmarketcap has dropped from 62% representing greed to 55%, representing impartial sentiment from merchants.

Associated: Wall Road veteran Paul Tudor Jones updates Bitcoin calls as institutional income climb

What’s subsequent for Crypto Market Sentiment?

Is elevated open curiosity a nasty omen?

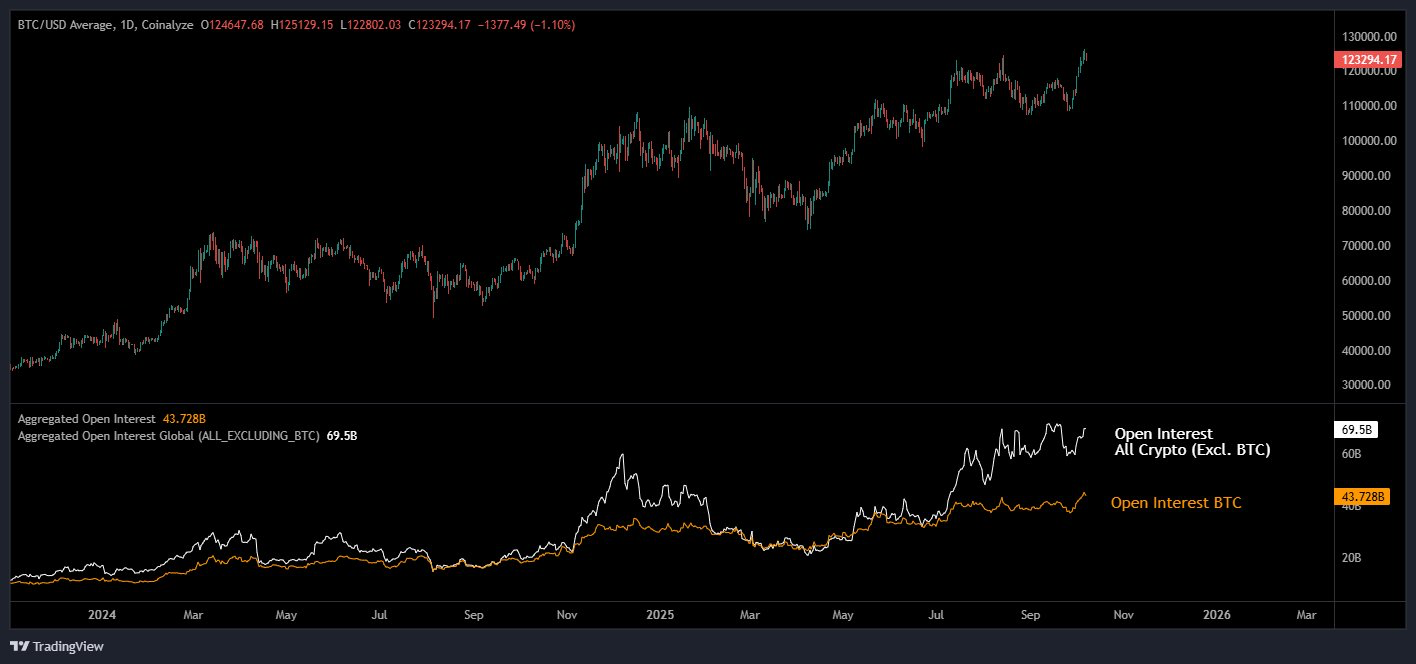

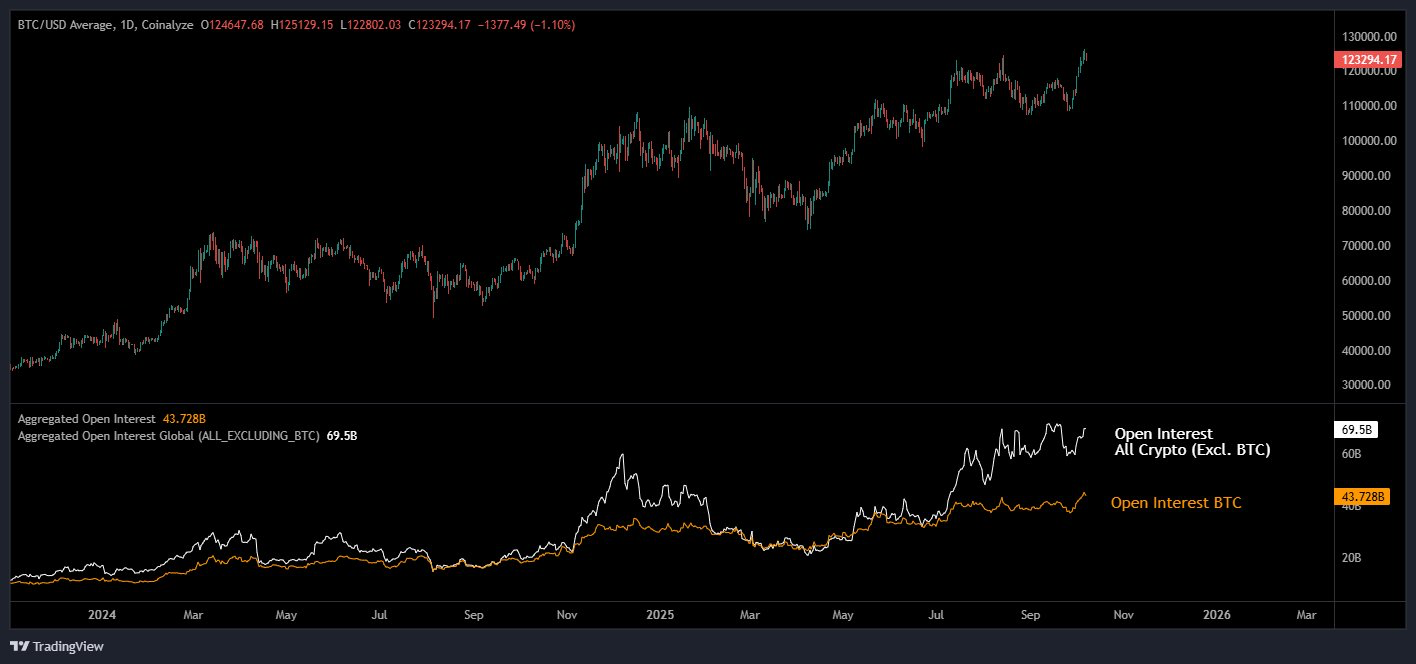

Crypto Markets open curiosity scaled to the identical stage recorded within the fourth quarter of 2024, with a 30% draw back.

Already, crypto markets with excessive leverage have resulted in vital liquidations of lengthy merchants, thus selling the likelihood of lengthy squeezes. Over the previous 24 hours, over $650 million was liquidated from the Crypto market, and over $497 million concerned lengthy merchants.

Nonetheless, Bitcoin’s funding charge has shifted from unfavorable to optimistic, indicating a potential rebound within the coming days. Notably, a optimistic funding charge is related to a bullish outlook, and vice versa.

Analyst insights and expectations

In line with Crypto analyst Benjamin Cowen, Bitcoin’s dominance is about to get well within the coming weeks as liquidity from Altcoins shifts. Crypto analysts have beforehand famous that the Parabolic Altseason will solely start after Ethereum worth units some new all-time highs.

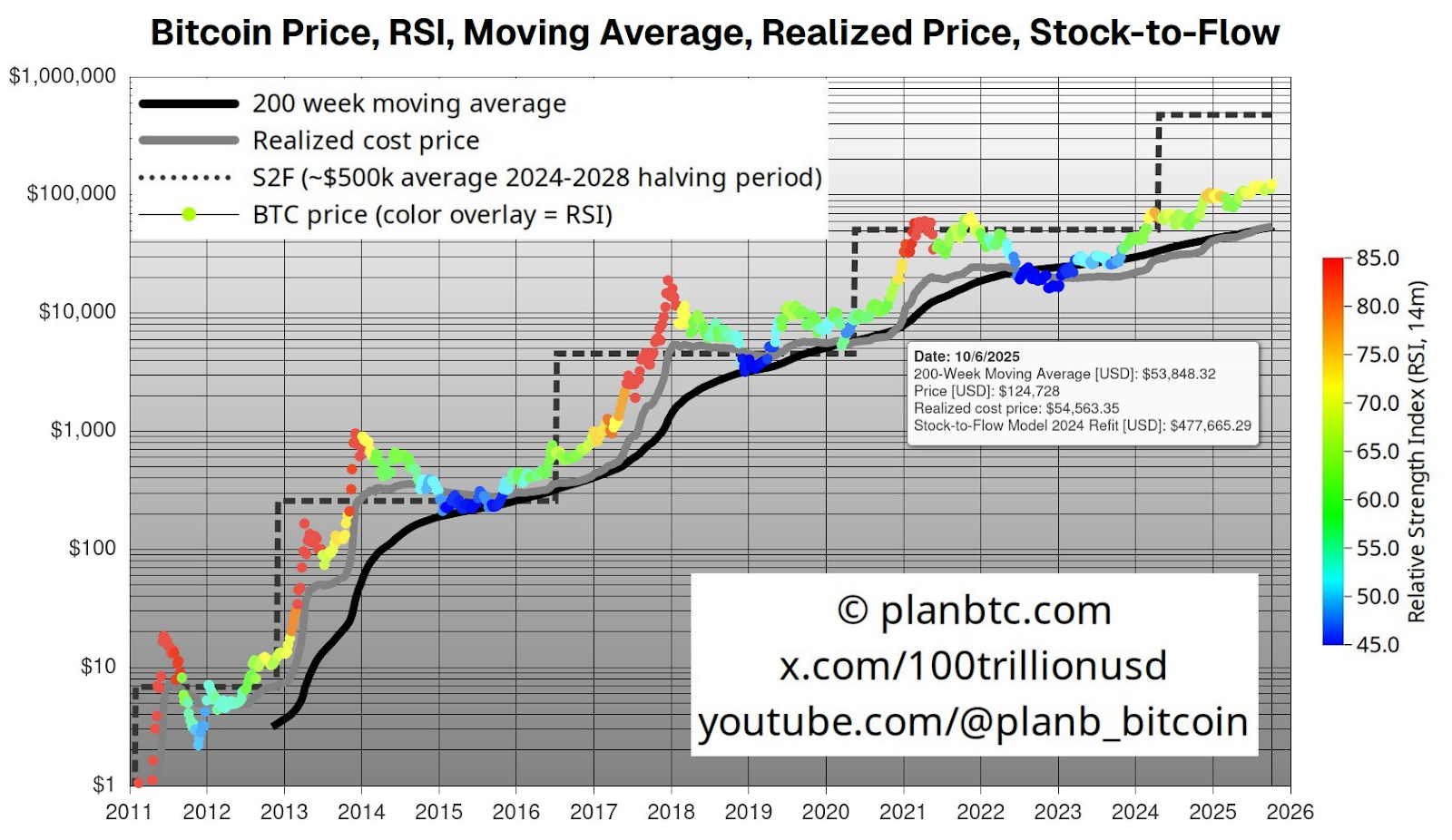

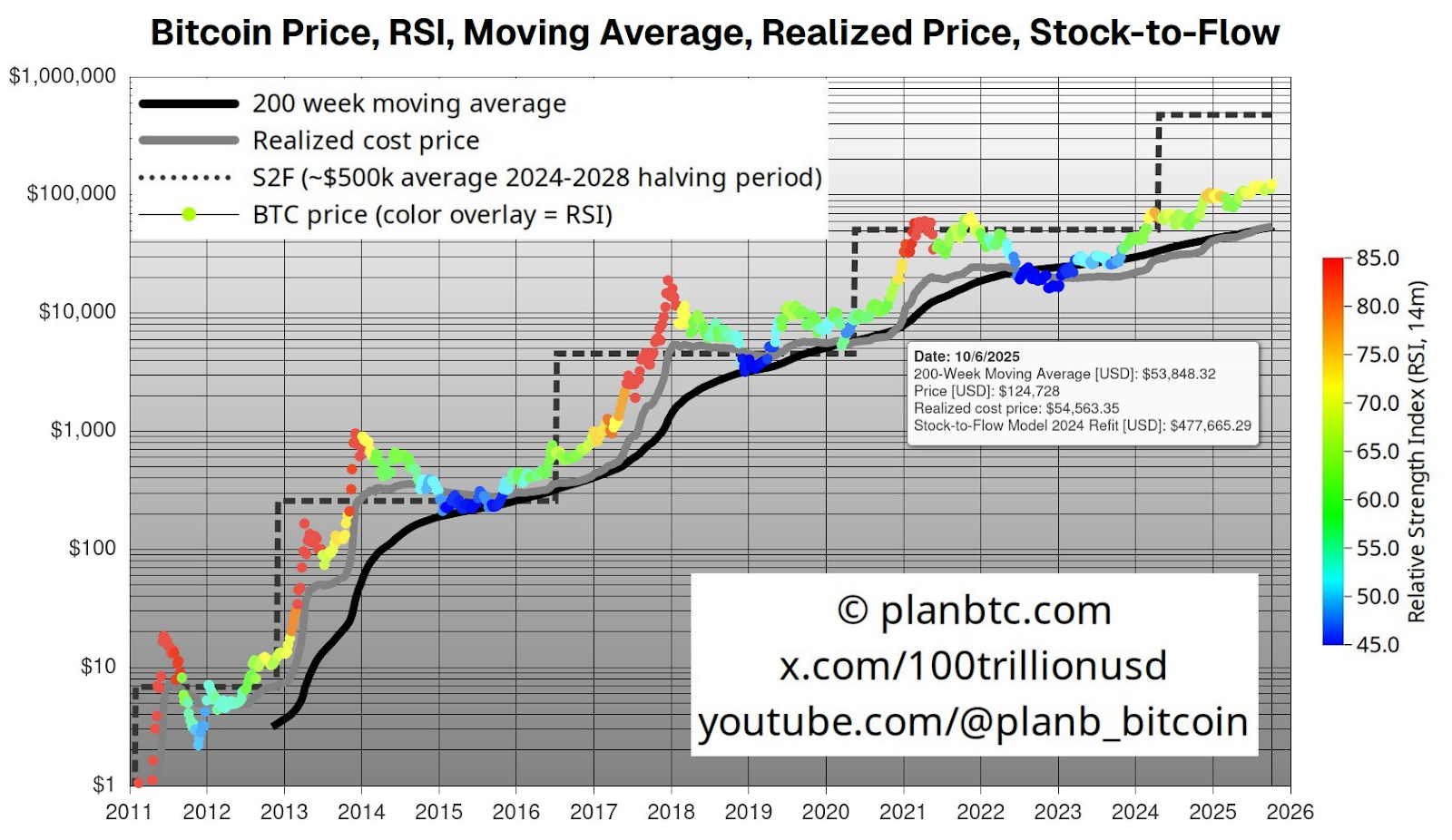

In the meantime, Crypto analyst Planb reiterated that extra reverse momentum will happen within the close to future. Moreover, Planb famous that Bitcoin’s month-to-month relative power index (RSI) is hovering round 72.

bigger market picture

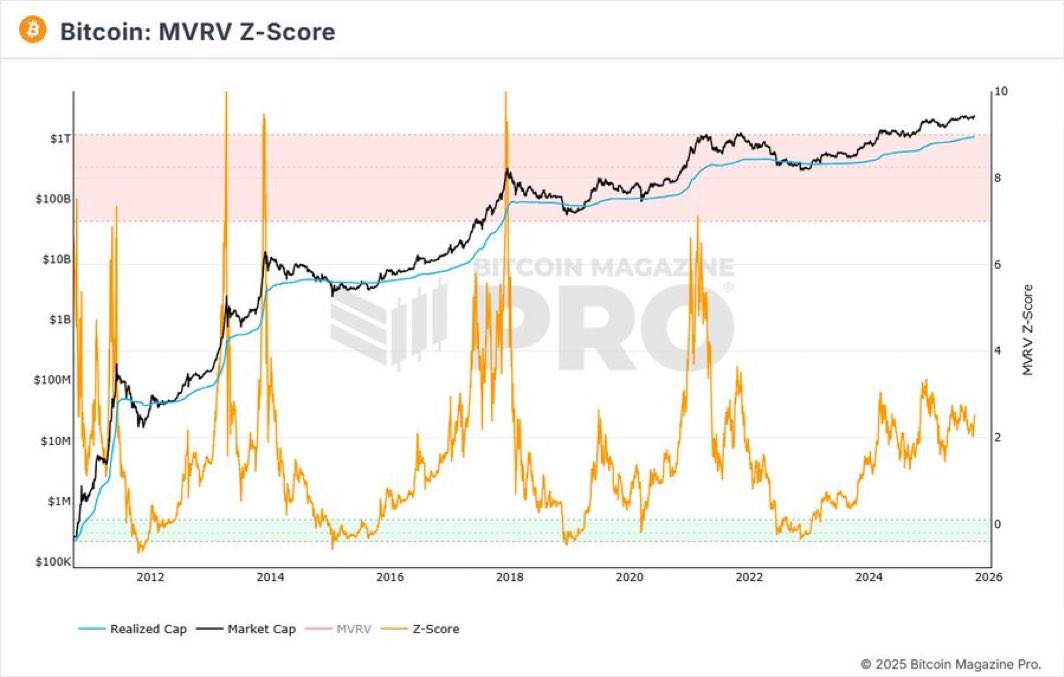

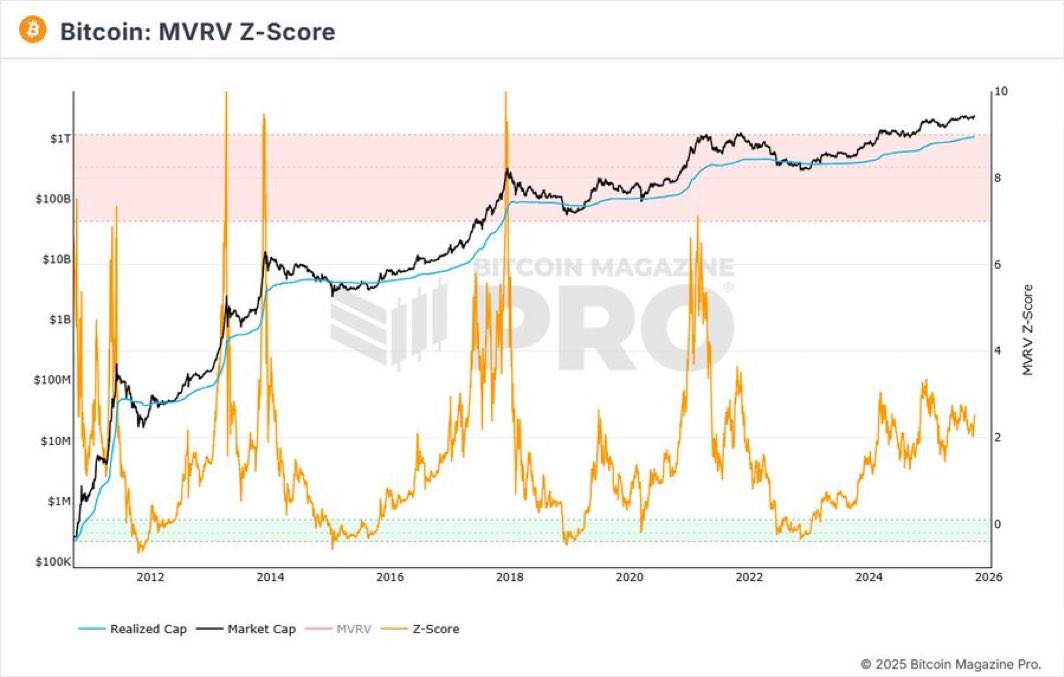

The crypto market has but to expertise parabolic development just like the bull rally summers of 2017 and 2021. Moreover, the MVRV Z-score exhibits that Bitcoin worth has but to document a peak just like earlier bull market cycles.

The bullish macro outlook is bolstered by renewed demand for US spot BTC ETFs. Over the previous two weeks, U.S. Spot BTC ETFs have recorded over $4.4 billion in web money inflows, led by BlackRock’s IBIT.

Finally, Bitcoin will lead the broader crypto market in the same parabolic rally just like gold as capital turnover escalates. For the primary time in human historical past, gold costs exceeded $4,000 per ounce, buying and selling at round $4,038 at press time.

Associated: Bitcoin Eyes $250K As Arthur Hayes Hyperlinks

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t chargeable for any losses incurred because of the usage of the talked about content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.