- Ethereum is buying and selling close to $4,456, with over $4,800 to $5,000 to $5,200 concentrating on.

- Jack Mah’s report on the Ethereum reserve has raised optimism and attracted market consideration.

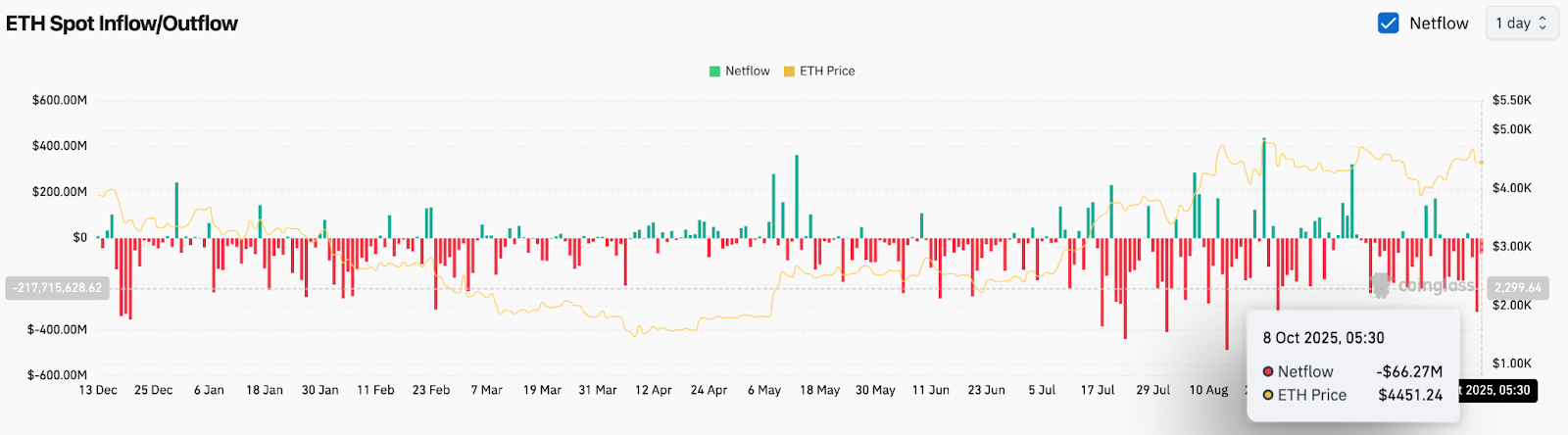

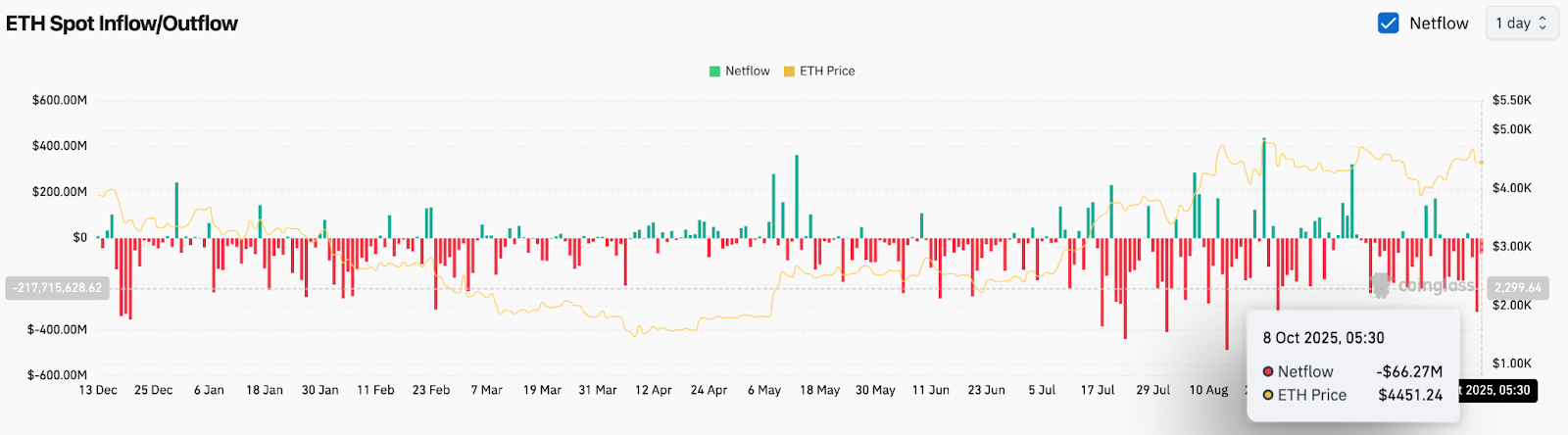

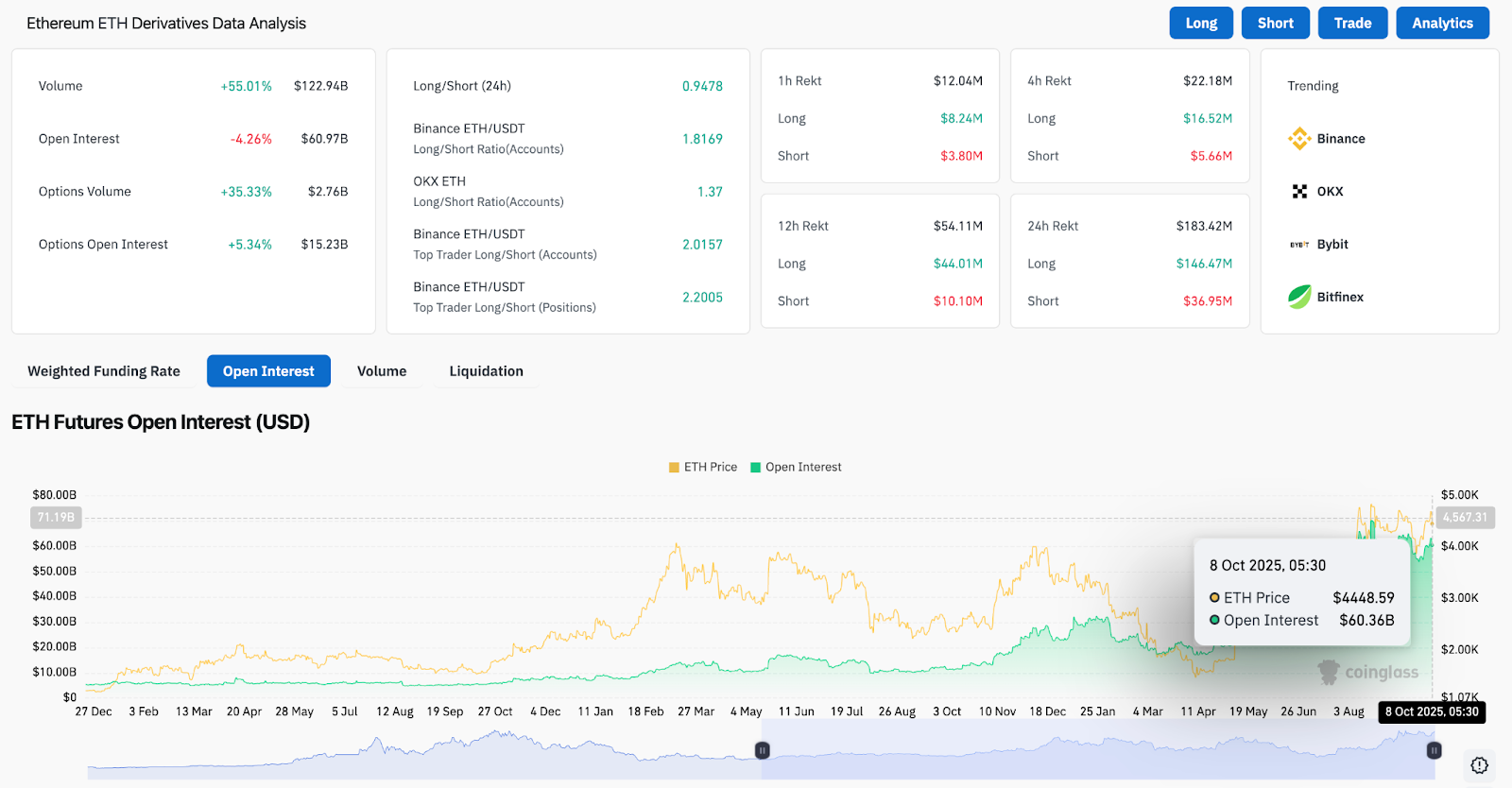

- The $66 million web outflow signifies a profit-taking motion, whereas by-product knowledge helps bullish bias.

Ethereum (Crypto: ETH) Costs are buying and selling round $4,456 right this moment, solidifying slightly below the important thing downtrend line that has been limiting upward makes an attempt since August. The market is outperforming short-term assist, with consumers defending the $4,390-$4,290 zone the place the 20-day EMA and 50-day EMA converge.

Ethereum costs preserve rising assist

On the each day chart, Ethereum continues buying and selling throughout the rising triangle sample outlined by its upward assist from June and horizontal ceilings round $4,750-4,800. This construction means that breakouts are imminent as costs method the triangle’s vertices.

Momentum indicators stay impartial, however are steady. The RSI is about 53, and we will see that there’s room for motion in both path. In the meantime, the 20-day EMA is $4,390 and the 100-day EMA is $3,964, bolstering the broader upward development. A closing value exceeds $4,800 signifies a seamless bullish part, paving the way in which for $5,000-$5,200, whereas failure to take care of $4,290 may very well be uncovered to an additional decline of $3,960.

Associated: Monero Value Forecast: Bullseye will attain $343 as market curiosity recovers

Regardless of the energy of derivatives, spills resume

In response to Coinglas, Ethereum recorded a web outflow of $66 million on October 8, indicating a light profit-taking following the rise final week. Brief-term capital outflows typically cool overheating value traits, however traditionally, sustained weak point within the alternate charge steadiness has preceded mid-cycle changes.

Nonetheless, the outflow comes amid a 24-hour, 55% enhance in quantity, indicating an elevated exercise moderately than a panic exit. This distinction means that merchants are rotating capital moderately than utterly departing from the market, a transfer that’s widespread earlier than structural breakouts.

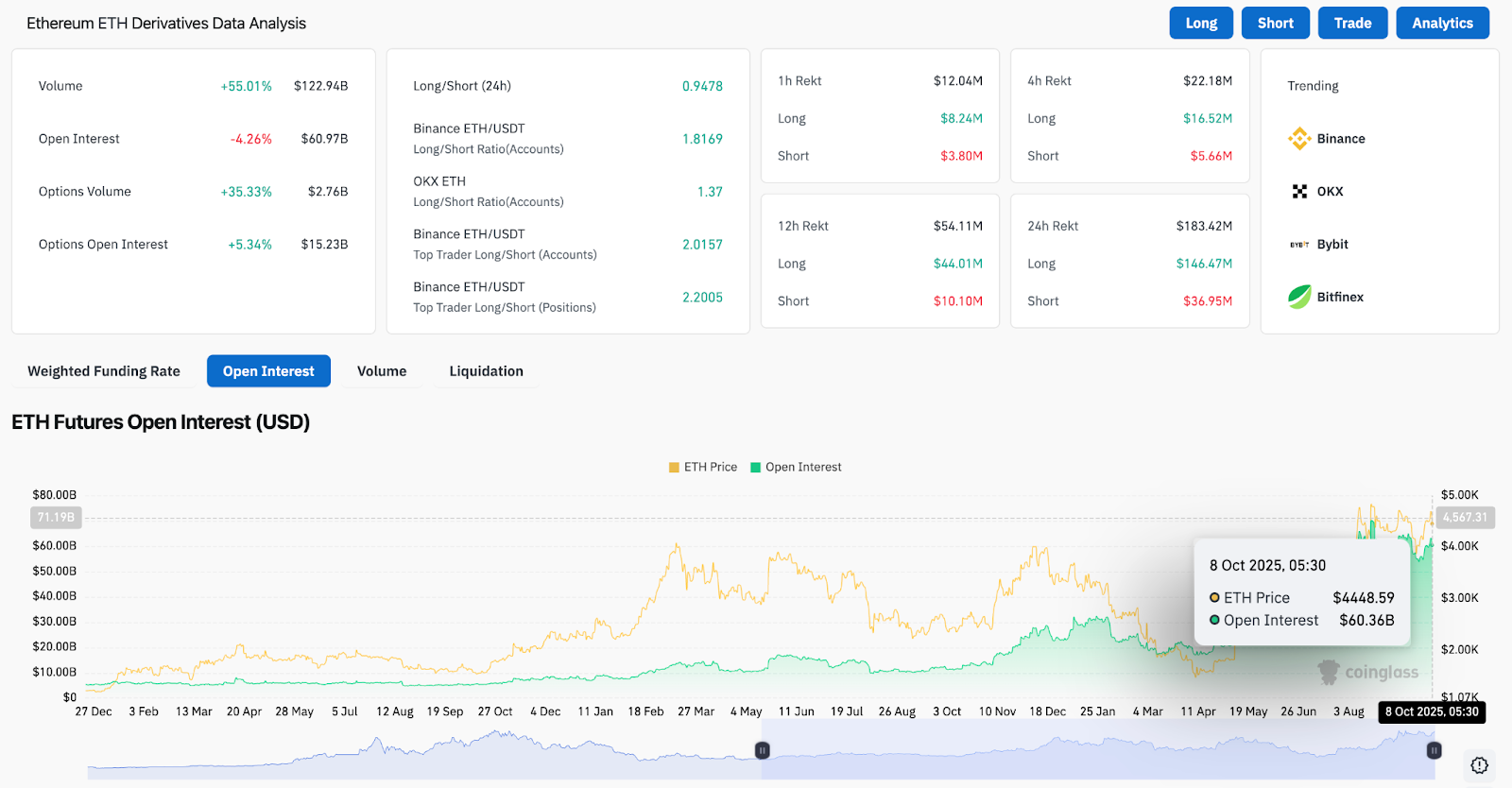

Derivatives present advanced feelings

Open curiosity fell 4% on the day to $60.9 billion, whereas open curiosity for choices rose to $15.2 billion, in keeping with by-product knowledge. This modification reveals merchants will scale back leveraged positions whereas rising publicity by way of hedging methods.

Specifically, Binance’s lengthy/quick ratio is 2.02, indicating that high merchants preserve a powerful lengthy bias. In mild of Ethereum’s latest rise, positions of over $180 million have been settled in 24 hours, of which a protracted place of $146 million have been settled.

Associated: Stella value forecast: XLM is strong close to $0.40 as merchants monitor breakouts

If choice buying and selling quantity continues to normalize whereas open pursuits proceed to extend, this implies consolidation will happen earlier than potential volatility will increase.

Jack Marr’s Ethereum reserves spark Investor optimism

Market sentiment obtained a brand new increase, and the headline shortly attracted consideration amongst merchants after Crypto Rover reported that Jack Ma was constructing a strategic Ethereum reserve. Particulars stay unconfirmed, however the submit illustrates similarities with the buildup traits seen early within the Bitcoin cycle.

Such narratives have a tendency to draw speculative inflow from Asian markets, the place Ethereum developer recruitment and staking participation is quickly increasing. The mix of iconic investor belief and technical positioning may increase new curiosity past the $4,800 resistance.

Technical outlook for Ethereum costs

Brief-term Ethereum value forecasts revolve across the following key ranges:

- Higher goal: If bullish momentum returns, it is going to be $4,800, $5,000, and $5,200.

- Decrease worth assist materials: The short-term protection zones are $4,390, $4,290 and $3,960.

- Pattern assist: $3,500 (200-day EMA), indicating a long-term management line.

A unbroken closing value above $4,800 may confirm the upward triangle breakout and mark the start of Ethereum’s subsequent impulse wave.

Outlook: Will Ethereum rise?

Ethereum will stay constructive technical place so long as costs are above the $4,290-$4,390 vary. Regardless of the short-term capital outflows, by-product knowledge and cumulative headlines recommend that the market stays bullish.

Associated: Cronos (CRO) Value Prediction: Merchants Eye’s breakout as a consequence of a surge in open curiosity

If consumers can regain $4,800, the breakout may speed up in direction of $5,200, reaffirming Ethereum’s management within the ongoing market cycle. Conversely, if you happen to fail to observe assist, the worth consolidation could take longer earlier than the subsequent main transfer.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses that come up because of your use of the content material, services or products described. We encourage our readers to take nice care earlier than taking any motion associated to us.