- Ethereum is consolidating inside main Fibonacci zones as merchants assess its subsequent path.

- Though momentum has slowed, the construction stays stable with a robust assist zone primarily based on the EMA.

- Growing institutional investor curiosity and Fusaka improve strengthens Ethereum’s medium-term prospects.

After a latest rally to $4,768, Ethereum has been positioned in an necessary technical zone resulting from a short-term decline. The present worth round $4,339 displays a managed correction reasonably than an entire reversal, with merchants carefully monitoring the Fibonacci retracement degree and the subsequent main community improve. Market response close to $4,294 and $4,406 will decide the subsequent stage of momentum as buyers stability technical indicators with community fundamentals.

Consolidation round important Fibonacci zones

The present Ethereum retracement coincides with Fibonacci ranges between $3,820 and $4,768. The value settled on the 0.5 retracement at $4,294 and the 0.618 retracement at $4,406. Such ranges are usually accumulation ranges, at which short-term sellers are inclined to exit and long-term patrons to renew.

Intermediate assist will probably be round $4,294, with extra notable corrections seemingly round $4,182 or $4,043. Resistance has fashioned at $4,406 and $4,611, and a confirmed breakout above $4,611 may sign a return to the swing excessive of $4,768. Because of this, merchants see this zone as a swing space that would decide the path of Ethereum in late October.

Associated: Bitcoin worth prediction: Polymarket and former PayPal chief predict 1.3 million BTC

Momentum weakens however construction stays

Moreover, the transferring averages are displaying a bullish stagnation. The 20-EMA at $4,494 and 50-EMA at $4,458 are flat, minimizing upward stress. That is supported by the 100-EMA and 200-EMA, each of that are simply above $4,400, making a confluence of assist that strengthens the $4,294 axis as a defensive wall.

Nonetheless, a worth transfer beneath the 200-EMA may welcome short-term swings to $4,182. Nonetheless, merchants are hopeful {that a} restoration above $4,406 may set off buying energy once more, supported by institutional patrons and future developments.

Institutional Curiosity and Future Fusaka Upgrades

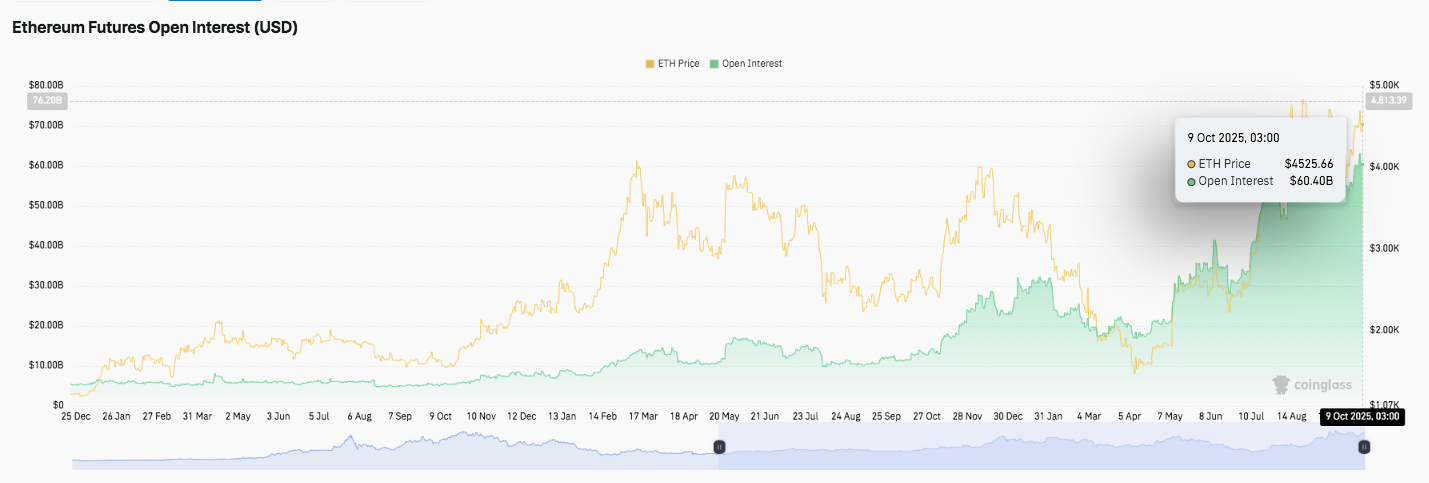

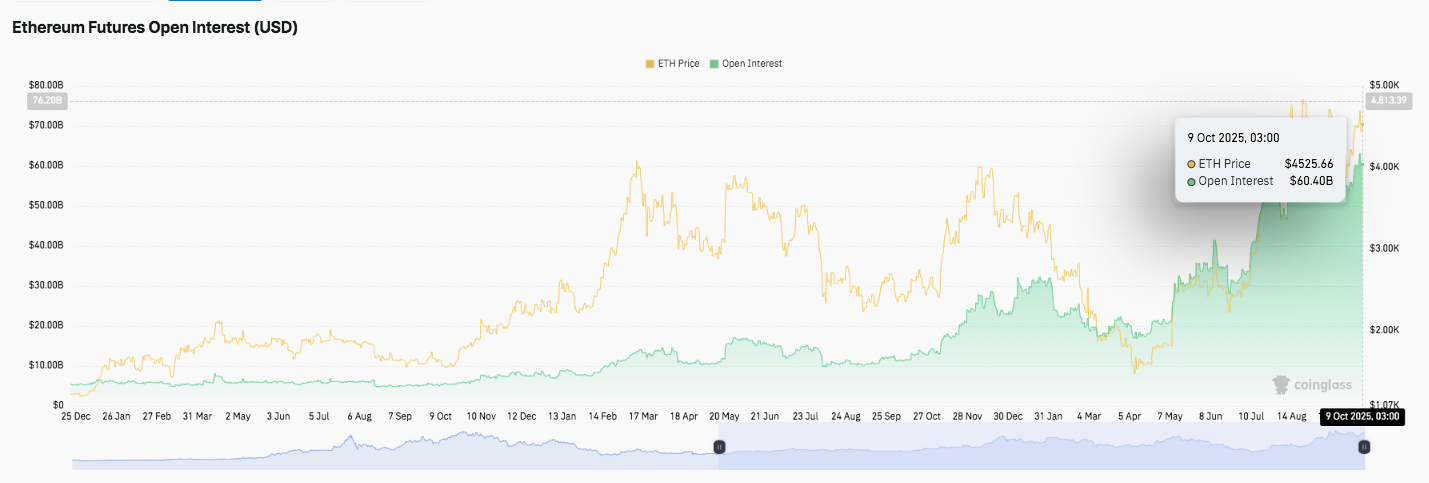

Moreover, open curiosity in Ethereum futures reached 60.4 billion, the best degree since mid-year. This improve signifies rising confidence amongst merchants and excessive involvement from institutional buyers. This coincides with ETF-led inflows as curiosity in Ethereum resumes after a summer time lull.

Associated: Dogecoin Worth Prediction: DOGE stays at $0.25 as CleanCore buys 710 million cash

What’s noteworthy is that spotlight has additionally shifted to future Fusaka upgrades. Presently lively on the Holesky testnet, it has launched PeerDAS, a system that splits Ethereum’s 128kB blobs into smaller fragments for environment friendly knowledge processing. In response to the core builders, this mechanism will increase scalability by almost 8x, reduces bandwidth, and allows easy participation of smaller stakers.

Technical outlook for Ethereum worth

After final week’s retracement, Ethereum is buying and selling close to $4,340, with key ranges remaining carefully aligned.

- Prime degree: $4,406 and $4,611 are the subsequent resistance zones, adopted by the earlier swing excessive of $4,768. If the bullish quantity returns, a break above $4,611 may open the best way to $4,950 and $5,120.

- Lower cost degree: $4,294 and $4,182 kind fast assist, whereas $4,043 and $3,820 present deeper cushions. The 200-day EMA close to $4,358 stays an necessary line of protection for intermediate-term holders.

Ethereum worth motion is at present swirling inside a midrange Fibonacci channel, suggesting compression earlier than a bigger directional transfer. A flat 20-day and 50-day EMA signifies lack of momentum, however the long-term construction stays intact.

Will Ethereum resume its uptrend?

Ethereum’s future path in October will rely on whether or not the bulls can defend the $4,294 to $4,182 zone and proceed to extend curiosity in futures. Lengthy-term stability above $4,406 may restart the transfer in the direction of $4,768 and above, particularly if a Fusaka improve is on the playing cards. Nonetheless, a robust breakdown beneath $4,182 may ship ETH right down to $4,043 and even $3,820, which might point out an prolonged consolidation.

Associated: PancakeSwap (CAKE) Worth Prediction 2025-2030: Can Deflationary Tokenomics Drive Development?

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.