- Solana is buying and selling close to $185 after rebounding from $180, defending its ascending channel base.

- It exhibits that consumers have returned to the low cost degree and accrued overseas alternate inflows of $25 million.

- Community stability of 6,000 to 10,000 TPS strengthens long-term reliability regardless of market fluctuations.

Solana value is hovering round $185 as we speak, stabilizing after a risky session that retested rising channel assist. The sharp intraday restoration from $180 highlights that consumers are defending key structural zones regardless of current stress throughout crypto markets.

Buying and selling volumes have normalized after a 12% drop on Friday, however updates on Solana Basis’s community throughput helped restore confidence after the flash crash.

Solana Value protects channel assist

The every day chart exhibits Solana sustaining its long-term ascending channel sample, with the decrease certain at present performing as a key assist close to $180. The 200-day EMA is approaching $186, reinforcing this demand zone. Overhead resistance has constructed up between the 20-day and 50-day EMAs at $212 and $216, respectively.

Though momentum indicators have cooled, situations stay constructive. An RSI of 35 signifies close to oversold situations, suggesting that sellers could also be dropping momentum after a pointy correction. If SOL sustains above $180, there may be nonetheless a robust probability of an easing rebound in the direction of the $200-$210 space.

A decisive shut above $216 might set off a bullish reversal in near-term sentiment, concentrating on intermediate channel resistance close to $235. Conversely, dropping $180 exposes the $165 space as the following main degree of safety.

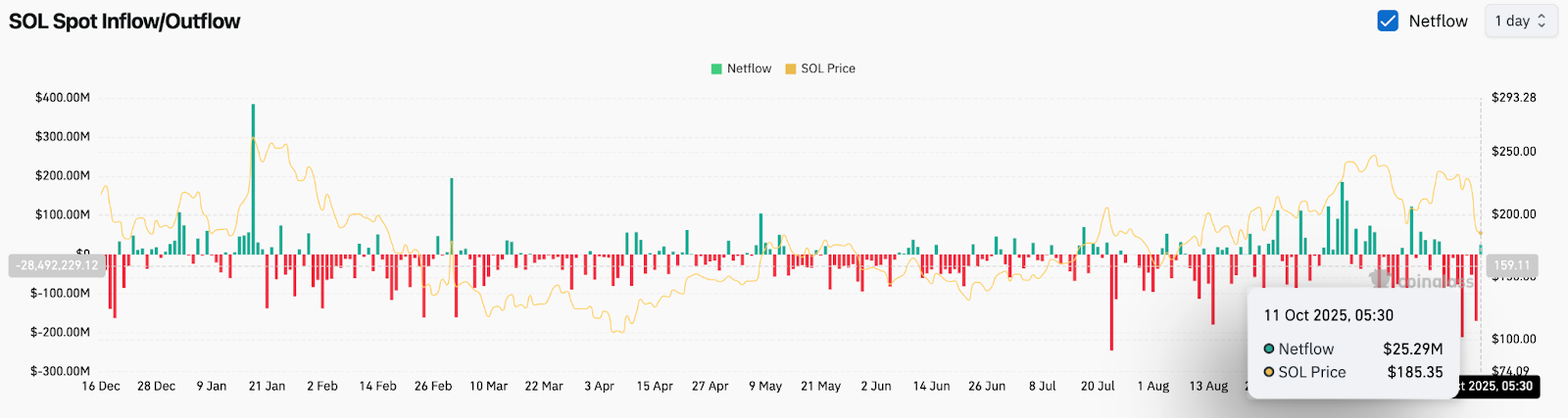

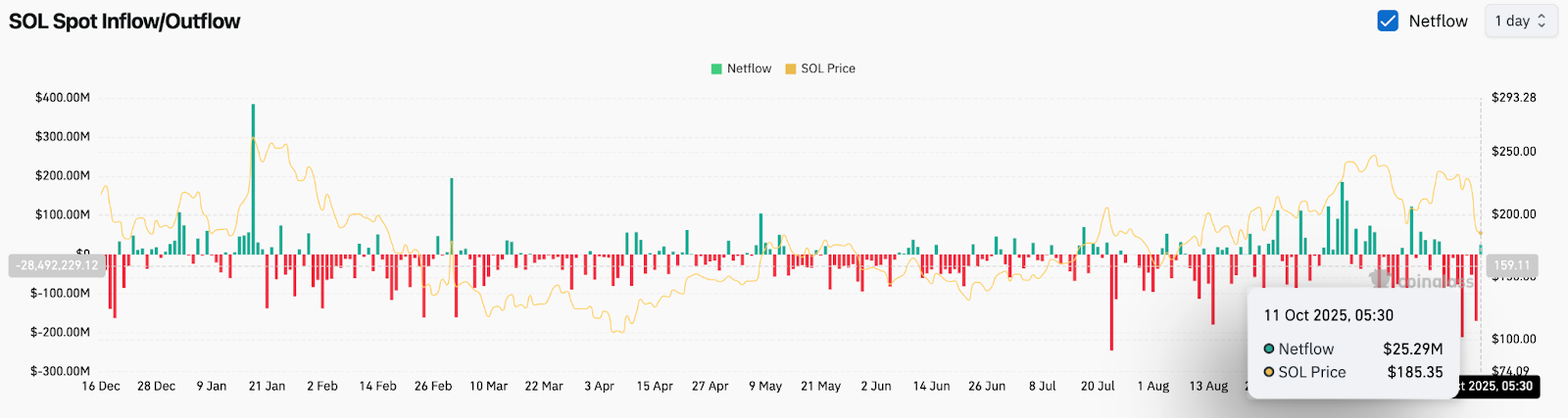

On-chain flows present new accumulation

In accordance with Coinglass information, Solana recorded web inflows of $25.29 million on October 11, marking a notable change from the earlier week’s sustained outflows. This means that spot consumers are re-entering the market at discounted costs.

The information additionally means that long-term holders are accumulating, with inflows of cash coming in as value assessments the decrease finish of that channel. Whereas general sentiment stays cautious following the broader market decline, this optimistic influx pattern is a touch at rebuilding confidence.

Analysts notice that if every day inflows proceed to exceed $20 million, Solana might maintain costs above $185 all through the week on liquidity-driven assist.

Community energy strengthens market confidence

In a current publish about X, the Solana group highlighted that the community maintained efficiency even below excessive demand, processing 6,000 to 10,000 transactions per second whereas conserving median charges low. Utilization additionally reached almost 60 compute models per block, demonstrating scalability below stress.

This operational stability reassured buyers after a risky week and contrasted with earlier outages that sometimes shook sentiment. The flexibility to effectively cope with such spikes highlights Solana’s rising technological maturity and will function a long-term bullish sign.

Technical Outlook for Solana Costs

Solana’s construction stays constructive so long as the $180 channel base holds. The speedy resistance zone lies between $199 and $212, with a number of EMAs clustered collectively. A break above $216 is prone to set off momentum shopping for concentrating on $235 and $245.

If the value falls beneath $180, the draw back extensions can attain $165 and $150. This can be a degree that corresponds to the earlier liquidity zone and Fibonacci retracement. If the RSI recovers above 45, a near-term reversal will turn into extra probably.

outlook. Solana Go Up

Solana’s near-term restoration will depend upon whether or not the bulls can maintain assist above $180 and reclaim the $200-$210 vary. The mix of optimistic on-chain inflows, coordinated technical assist, and powerful community efficiency signifies that situations are enhancing from final week’s drop attributable to liquidations.

Analysts stay cautiously optimistic, predicting a rebound towards $230 if shopping for momentum returns. Nevertheless, a lack of $180 will invalidate the bullish setup and shift the main target to deeper assist close to $165.

For now, Solana’s on-chain and resiliency throughout its community offers consumers motive to stay engaged till the broader market stabilizes.

Quick-term technical outlook for SOL costs

- resistance: $199–$212, $216, $235

- assist: $180, $165, $150

- bias: Cautiously bullish above $180

- Breakout set off: Closing value above $216

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.