- BNB worth is buying and selling round $1,294 as we speak, consolidating beneath the $1,320 resistance after rebounding from the $1,050 low.

- On-chain information reveals an influx of $96 million, indicating new accumulation regardless of the protracted Binance controversy.

- Key Ranges: Upside worth targets are $1,350 and $1,380, and key help pivots are $1,231 and $1,207.

BNB worth is buying and selling round $1,294 as we speak, persevering with to rise after a pointy rebound from final week’s low of $1,050. The restoration from the 200-day EMA has pushed the worth again into the important thing resistance zone between $1,300 and $1,320, and this degree will decide whether or not the rally extends greater in the direction of greater ranges or stalls attributable to provide stress.

BNB worth retests symmetrical triangle resistance

On the 4-hour chart, we will see that BNB has damaged out of its symmetrical triangle formation and is exhibiting robust shopping for momentum close to $1,150. The 20-day EMA at $1,231 and 50-day EMA at $1,207 are serving as rapid help, whereas the 100-day EMA close to $1,154 reinforces the broader bullish construction.

Value is testing resistance at $1,320, marked by the higher boundary of the triangle and the excessive of the earlier worth motion. A transparent break above this zone might open the door to $1,350 and $1,380, whereas rejection might lead to a pullback to $1,231 or $1,207.

The parabolic SAR is beneath the worth, suggesting a near-term bullish section, whereas the RSI stays impartial, leaving room for continued upside if momentum strengthens.

On-chain flows present new buy intent

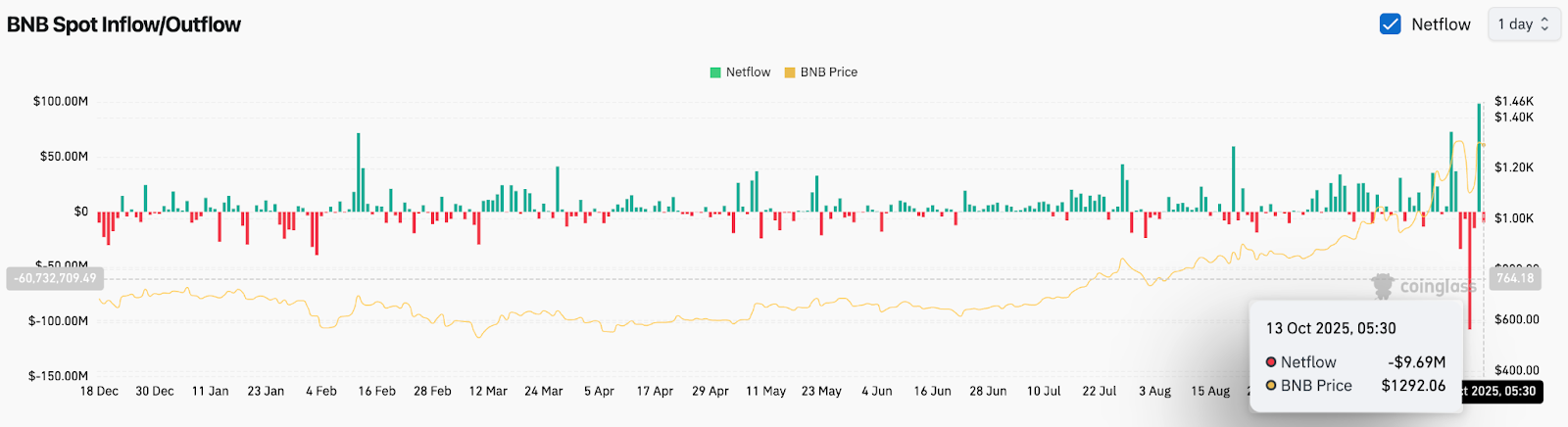

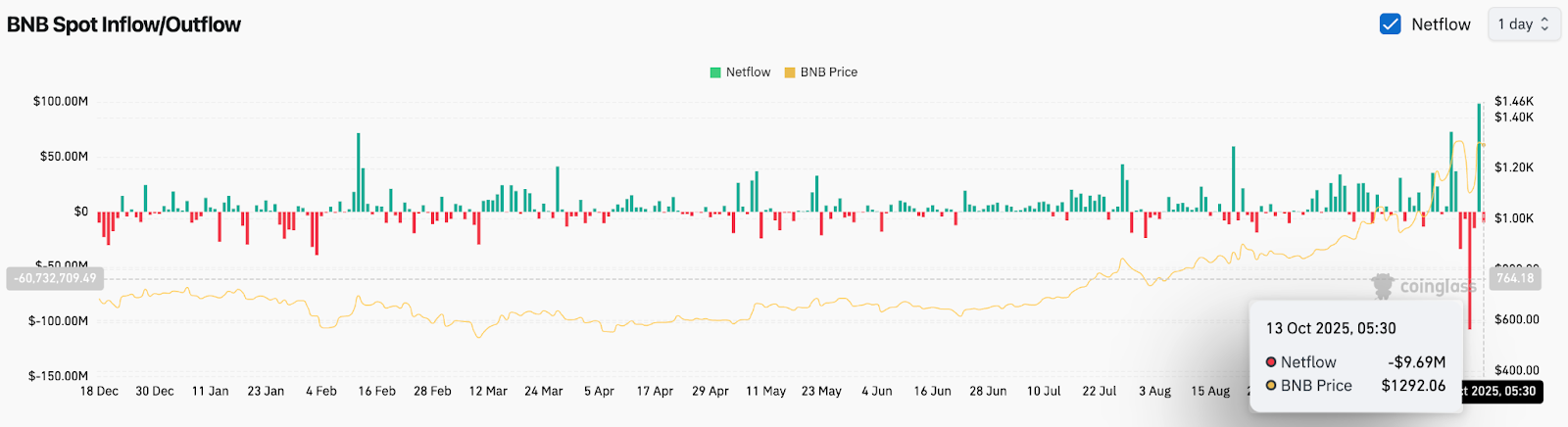

In response to Coinglass’ on-chain information, there was a internet influx of $96 million yesterday, adopted by a smaller outflow of $9.69 million as we speak, indicating a shift from panic promoting to accumulation. These numbers replicate renewed investor confidence after probably the most risky week for the Binance ecosystem.

The change in stream course is noticeable. Massive capital inflows typically point out a redeployment of sensible cash after a capitulation occasion. Analysts mentioned that constant each day inflows of greater than $25 million might maintain the rebound, however combined inflows might hold it range-bound between $1,200 and $1,320.

Binance controversy destabilizes sentiment

The market buzz intensified after HyperLiquid Each day questioned Binance’s position in final week’s large liquidation occasion and famous that token costs, together with BNB, had rebounded “as in the event that they have been untouched.” The put up hinted at manipulation, noting that costs have been recovering shortly regardless of widespread losses throughout merchants’ portfolios.

Though there was no official remark from Binance, the dialogue has created short-term uncertainty in market sentiment. Nonetheless, BNB stays the third-largest cryptocurrency, gaining greater than 16% previously 24 hours, highlighting its resilience regardless of the scrutiny.

Technical outlook for BNB worth

BNB’s technical scenario stays constructive so long as the worth stays above the $1,231 pivot zone.

- Prime degree: If bullish momentum continues, $1,350, $1,380, $1,420.

- Lower cost degree: If denied, $1,231, $1,207, $1,150.

- Pattern anchor: The 100-day EMA at $1,154 and 200-day EMA at $1,074 proceed to outline long-term help.

Outlook: Will BNB rise?

BNB’s near-term trajectory relies on whether or not patrons can preserve the influx momentum and defend $1,231. Current inflows of $96 million sign new accumulation from institutional traders, suggesting renewed confidence after the flash crash.

If the worth can maintain above $1,300 attributable to elevated spot quantity, analysts count on it to go in the direction of $1,350-$1,380 in future buying and selling. If $1,231 can’t be defended, the main target might return to $1,150.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.