- SHIB has consolidated round $0.00001080 to $0.00001100, indicating a possible rebound zone.

- The main resistance at $0.00001178 is aligned with the 50-EMA and is testing bullish breakout momentum.

- Rising burn charges and lowering leverage spotlight long-term traits of shortage and accumulation.

Shiba Inu (SHIB) is displaying indicators of stabilization after latest volatility, with the token stabilizing across the $0.00001080 to $0.00001100 vary. This zone has turn out to be a key choice space as merchants think about the potential for a short-term pullback.

Regardless of the earlier correction, SHIB continues to commerce close to the main shifting averages, indicating that market individuals are nonetheless assessing whether or not the correction section may develop right into a restoration. Subsequently, the following directional transfer will doubtless rely upon the energy and fluidity of momentum round vital Fibonacci ranges.

Consolidation close to main Fibonacci ranges

The 4-hour chart exhibits that SHIB has retraced within the 0.5 and 0.618 Fibonacci areas, indicating that consumers try to defend their positions. At 0.00001178, there’s a retracement at 0.618 that matches the 50-EMA and gives an essential resistance level. Above this, we’ll enter the $0.00001214 area and probably $0.00001300 area, which might imply a return of bullish momentum.

On the draw back, short-term assist is close to the 0.382 stage at $0.00001010. If this stage just isn’t sustained, additional decline in direction of $0.00000982 and $0.00000900 is feasible. Moreover, the RSI stays within the impartial zone, suggesting that market sentiment is balanced whereas merchants anticipate extra definitive indicators.

Associated: Dogecoin Worth Prediction: DOGE eyes V-shaped restoration as US-China rhetoric calms market

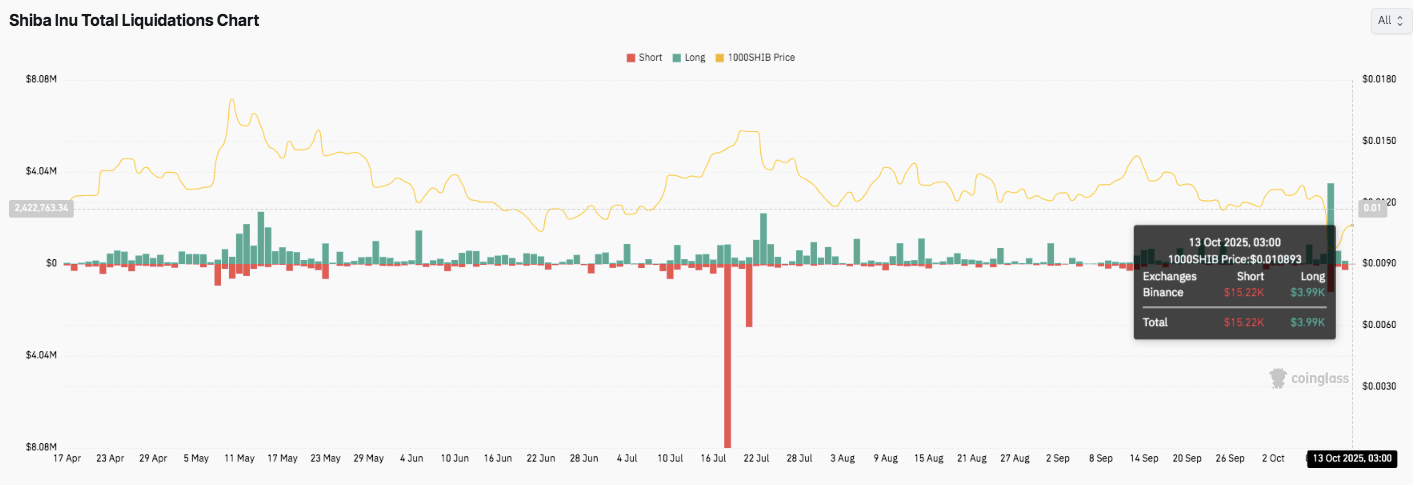

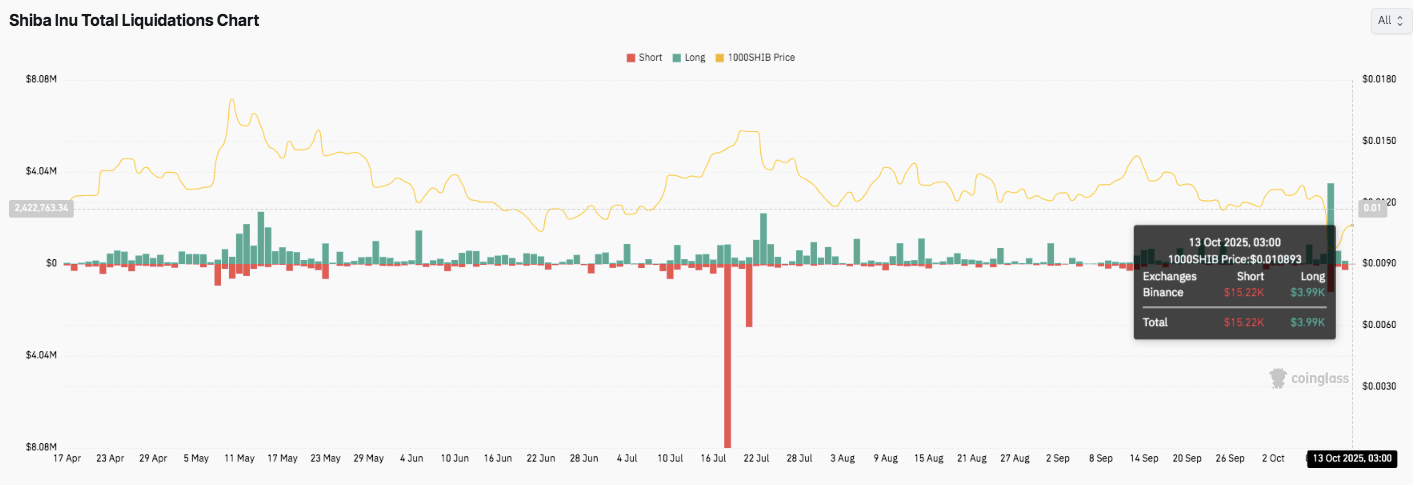

Futures and clearing knowledge present accumulation

SHIB’s derivatives market knowledge exhibits a surge in clearing exercise, highlighting elevated volatility in capital inflows and outflows. On October 13, quick liquidations totaled $15,220 in comparison with lengthy positions of $3,990. This sample means that the bears had the higher hand early within the session, however a rebound in an prolonged liquidation signifies renewed shopping for effort because the token assessments the $0.01089 zone.

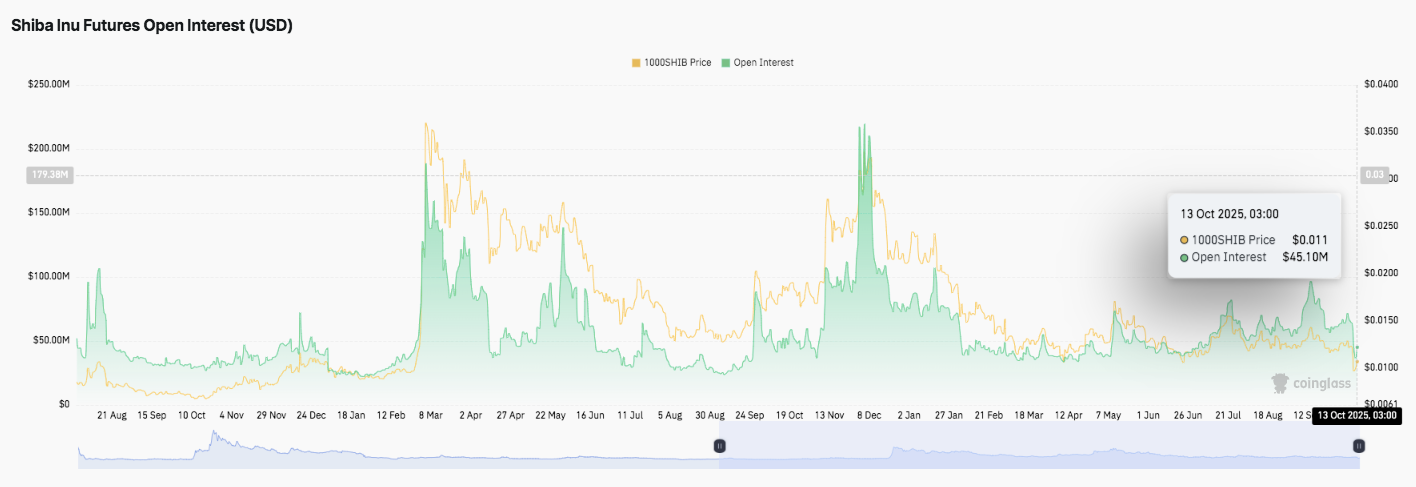

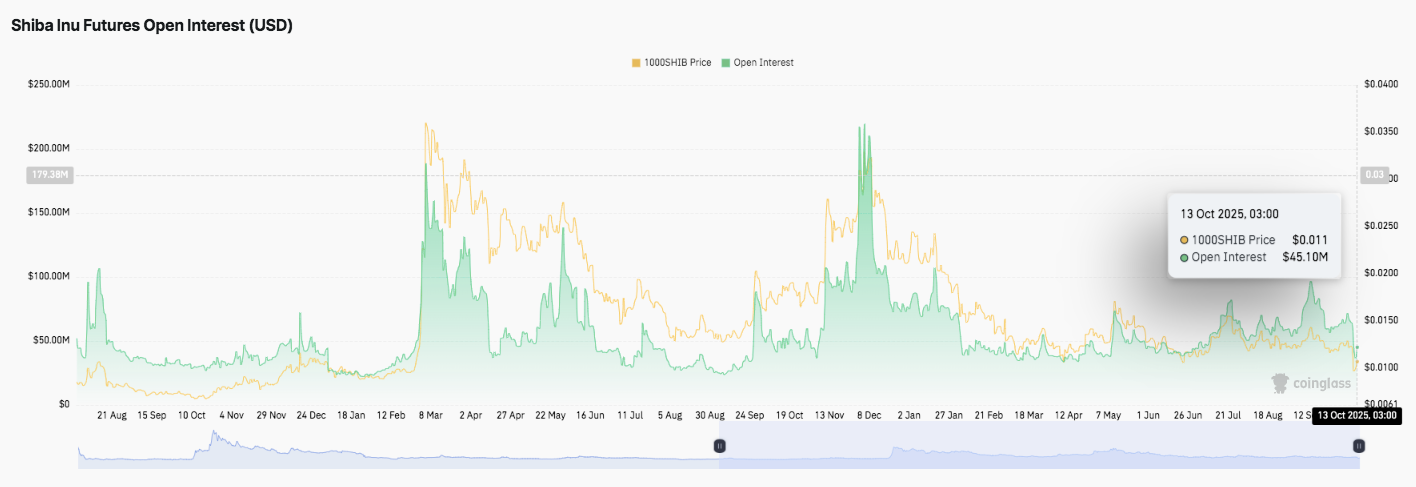

In the meantime, open curiosity declined from a peak of simply over $200 million in March to $45.1 million by mid-October, reflecting lowered leverage publicity. Nonetheless, continued exercise means that merchants stay engaged. If open curiosity will increase as costs get better, speculative curiosity returns and SHIB may expertise a short-term spike in volatility.

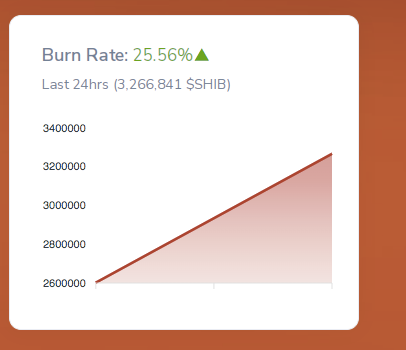

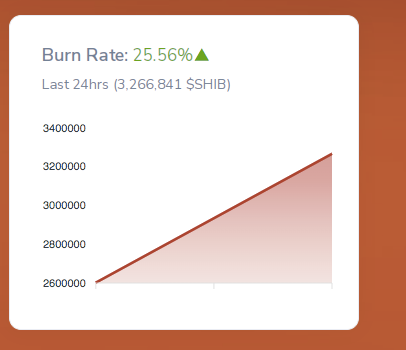

Decreasing burn price and provide enhances long-term perspective

The Shiba Inu’s deflationary design continues to play an essential position in Tokenomics. Of the full provide of 999.98 trillion, roughly 410.75 trillion SHIB has been completely incinerated and 589.24 trillion stays. Of this quantity, 4.49 trillion are locked in staking contracts as xSHIB.

The community’s burn price spiked by greater than 25% prior to now 24 hours, with 3.26 million tokens destroyed. Subsequently, whereas short-term sentiment fluctuates, constant token reductions assist the undertaking’s long-term shortage story. This continued provide contraction and market stabilization may doubtlessly strengthen SHIB if total crypto momentum improves.

Associated: Chainlink Worth Prediction: LINK Restoration Faces Main Resistance

Technical outlook for Shiba Inu (SHIB) worth

Shiba Inu (SHIB) continues to commerce inside a slim worth vary, with worth actions starting from $0.00001080 to $0.00001100. This construction means that SHIB is accumulating vitality in direction of a possible breakout after an prolonged retracement section. Importantly, the value is testing the midrange Fibonacci retracement zone, with each the 100-EMA and 200-EMA appearing as resistance limitations.

higher worth stage is effectively outlined, with the 0.618 Fibonacci stage at $0.00001178 serving as the primary hurdle for the bulls. As soon as this threshold is crossed, the token may rise in direction of $0.00001214 after which attain $0.00001300. If momentum strengthens above $0.00001364, consumers on the 200-day EMA might try a transfer in direction of $0.00001472 and $0.00001600. These ranges would verify a short-term reversal and reestablish medium-term bullish momentum.

lower cost stage Confidentiality is maintained as $0.00001010 acts as a direct line of protection. Failure to keep up this zone may end in a fall in direction of $0.00000982 or $0.00000900. The 0.382 Fibonacci stage helps this base and suggests merchants are accumulating throughout the decrease band.

Technically, SHIB seems to be compressing inside a descending wedge, however this sample usually precedes an enlargement in volatility. The RSI studying stays impartial, suggesting market indecision, whereas the burn-driven deflationary mechanism continues to enhance long-term fundamentals.

Outlook for the approaching weeks

October’s development shall be decided by whether or not Shiba Inu can regain the vary of $0.00001178 to $0.00001214. Continued shopping for strain close to these bases may set off a restoration to the $0.00001300-$0.00001472 space. However, a decline under $0.00001000 may strengthen the bear market to $0.00000900.

Associated: XRP Worth Prediction: ETF Countdown Sparks New Optimism

With the buildup of inflows, lowering leverage, and rising burn price, the SHIB configuration reveals a consolidation-to-breakout construction. Subsequently, merchants shall be watching to see if the bulls take over and spark one other optimistic wave as volatility subsides by mid-October.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.