- Solana’s rebound above $189 suggests fragile bullish momentum amid market warning

- Improve in open curiosity highlights rising speculative confidence in Solana futures

- Spot outflows recommend merchants stay cautious regardless of Solana’s short-term restoration

Solana (SOL) has been within the highlight once more in current classes because the token rebounded from current lows close to $170 and confirmed resilience regardless of market uncertainty. The sharp restoration pushed the value above the $189 help stage, suggesting renewed shopping for strain from merchants.

Nonetheless, short-term information now means that Solana’s spot market exercise is beginning to sluggish, regardless of enhanced futures participation, revealing a divide between speculative and long-term investor sentiment.

Technical setup signifies a fragile bullish restoration

The 4-hour SOL/USDT chart exhibits a rebound from the $169.74 low, with worth consolidating above the 23.6% Fibonacci retracement stage close to $189.50. Consumers seem like re-entering the market on this zone, exhibiting confidence after a interval of sell-off.

Instant resistance lies on the 38.2% stage at $201.72, however additional upside may push the token in direction of key medium-term targets of $211.59 and $221.47, that are in keeping with the earlier consolidation section.

On the draw back, help at $189 stays necessary. A break beneath that might coincide with the 0% retracement zone and expose us to $170 once more. Market construction signifies a short-term bullish correction inside a broader downtrend.

Associated: Shiba Inu Value Prediction: Can SHIB’s 25% Burn Spike Spark the Subsequent Bullish Wave?

If the shopping for continues above $201.72, a reversal sample could also be confirmed, however whether it is rejected, draw back strain might improve once more. Due to this fact, merchants are carefully monitoring whether or not Solana can preserve its momentum above $190 to keep up its continued restoration.

Futures market confidence will increase as open curiosity rises

Along with worth developments, Solana’s open curiosity spiked considerably in October, reflecting elevated participation in derivatives buying and selling. As of October 13, open curiosity reached $10.29 billion and SOL traded round $197.23, its highest since April. The regular improve in open curiosity as costs recuperate signifies new lengthy positions and rising optimism amongst merchants.

Traditionally, such simultaneous will increase in worth and open curiosity precede sturdy bullish continuations, suggesting that speculative urge for food stays excessive. Nonetheless, elevated exercise additionally indicators extra volatility forward, as leveraged merchants can amplify worth actions if sentiment adjustments quickly.

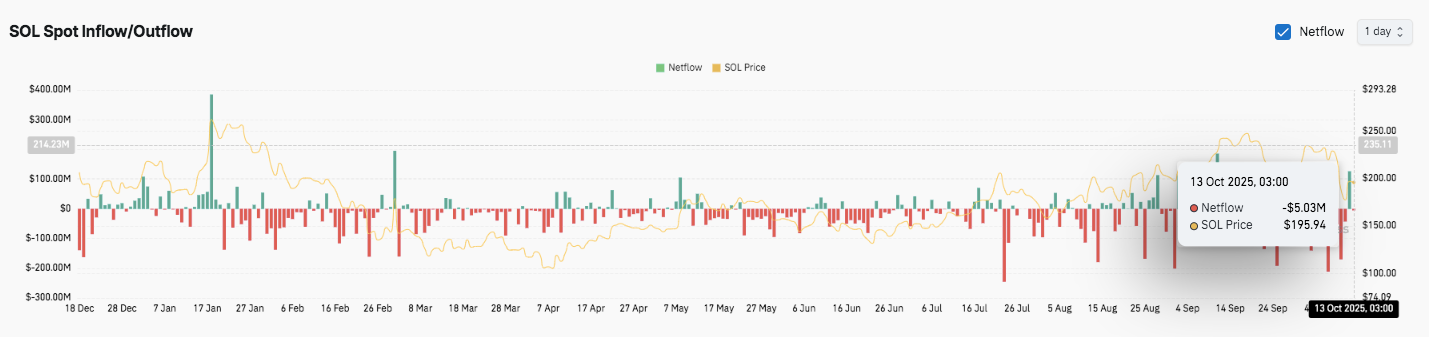

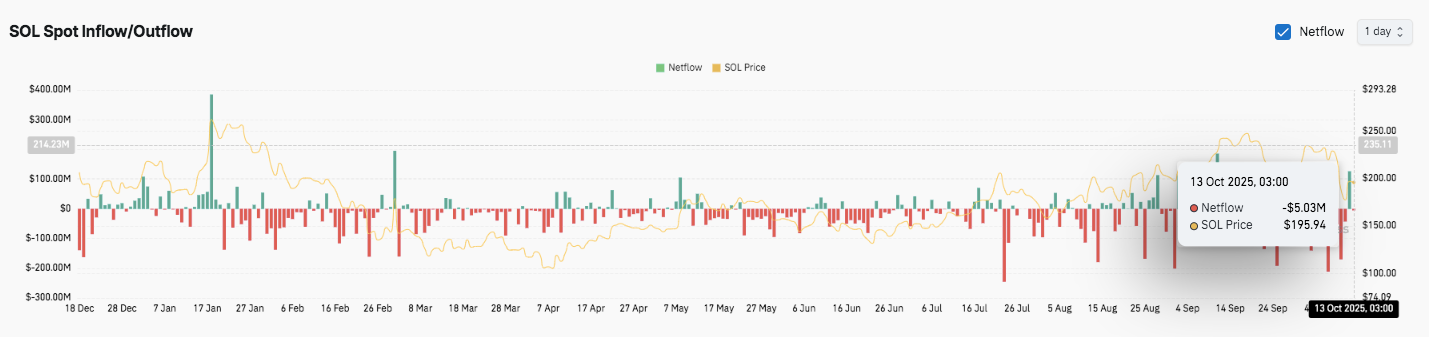

Capital outflows from spot markets sign short-term warning

Whereas the derivatives market exhibits energy, Solana’s spot influx and outflow developments reveal a extra cautious investor perspective. The community recorded internet outflows of $5.03 million on October 13 as the value hovered round $195. This sample has been alternating with inflows and outflows since late September, suggesting that merchants are taking earnings moderately than including new funds.

Furthermore, peak inflows in January and Might coincided with native worth will increase. The present decline in accumulation suggests consolidation moderately than new bullish growth. Solana’s subsequent large transfer might due to this fact rely upon whether or not spot demand returns to enhance continued futures enthusiasm.

Technical outlook on Solana (SOL) worth

Key ranges stay effectively outlined heading into mid-October. Upside targets embody the $201.72, $211.59, and $221.47 ranges alongside the 38.2%, 50%, and 61.8% Fibonacci retracement zones. Affirmation of above $201.72 may open the door for a broader restoration in direction of the $230-$235 vary, and if momentum holds, it may strengthen the bullish continuation.

Associated: Dogecoin Value Prediction: DOGE eyes V-shaped restoration as US-China rhetoric calms market

On the draw back, instant help is at $189.50, adopted by $179.00, and the current swing low at $169.74. A break beneath this construction may reintroduce bearish strain and widen losses in direction of $160, invalidating short-term restoration hopes.

The present setup means that Solana is staying inside a correctional pullback inside a broader downtrend. Momentum indicators are exhibiting early bullish traction, however confidence stays fragile.

A sustained rally in direction of $220 appears achievable if patrons preserve management above $190 and quantity strengthens. Nonetheless, failure to defend $189.50 may end in recent promoting strain.

Will Solana be capable of proceed her restoration?

Solana’s mid-October outlook hinges on whether or not the bulls can break above $201.72 and obtain sustained inflows from each spot and derivatives merchants. Whereas the continued improve in open curiosity displays rising speculative optimism, internet outflows from spot exchanges suggest cautious investor sentiment. Due to this fact, SOL stays at a vital juncture the place new shopping for momentum may decide the following large development.

Associated: Chainlink Value Prediction: LINK Restoration Faces Main Resistance

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.