- Ethereum is buying and selling close to $4,102, holding trendline and EMA help after being rejected by the $4,260 resistance.

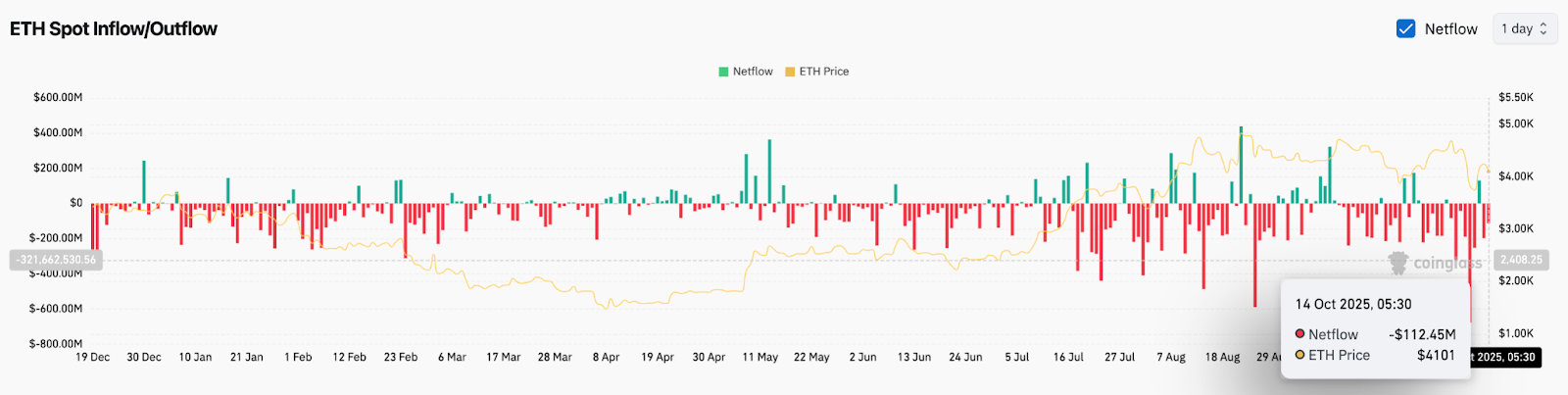

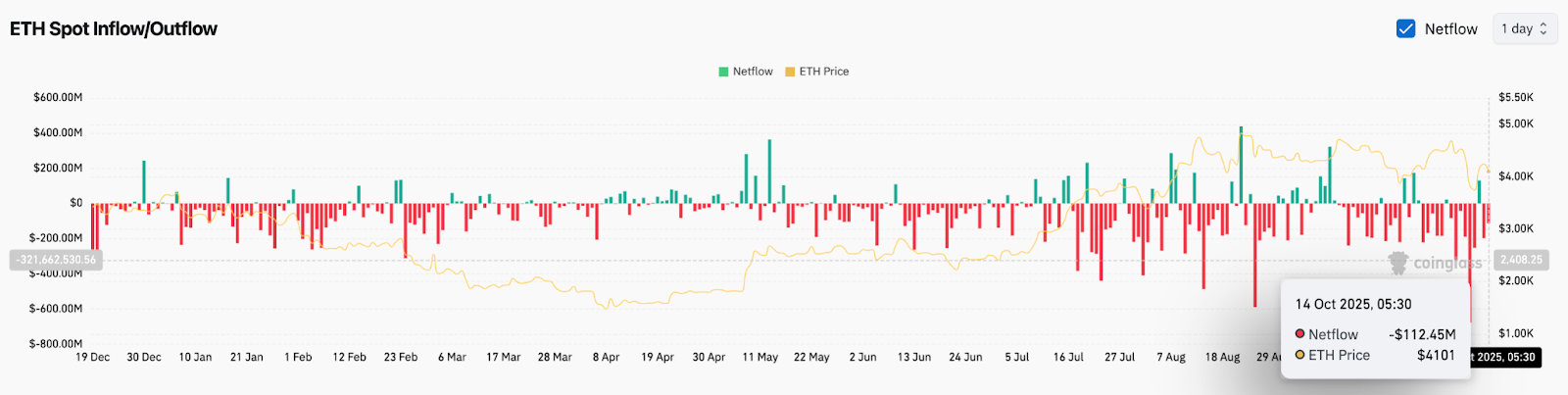

- Coinglass knowledge exhibits outflows of $112 million, suggesting long-term accumulation regardless of cooling speculative demand.

- Bhutan will transfer its nationwide digital ID to Ethereum by 2026, strengthening its case for institutionalization of ETH.

Ethereum value right this moment is buying and selling round $4,102, down 3.3% up to now 24 hours as sellers check the $4,080 to $4,100 help zone. This pullback comes after resistance at $4,260 was rejected earlier within the week, however consumers proceed to carry onto the long-term uptrend line that has been driving ETH greater since April. The main focus now shifts as to whether this structural help will be maintained amidst cooling on-chain flows and headlines of recent adoption.

Ethereum Value Retest Vital Help Zone

On the every day chart, Ethereum remains to be in a broad uptrend construction, however the current pullback has introduced it nearer to an vital resolution level. The value is hovering across the 50-day EMA of $4,246 and the 100-day EMA of $3,978, each of which have converged on multi-month trendline help. Rapid resistance lies at $4,254, with provide strengthening between $4,540 and $4,550 and a bearish reversal of the supertrend indicator.

Associated: Bitcoin Value Prediction: BlackRock’s Fink backs BTC as ‘digital gold’

A sustained shut beneath $4,080 may floor deeper draw back targets at $3,900 and $3,540, whereas a break above the present demand zone may stabilize momentum. Though RSI readings near impartial ranges mirror a cooling section, the broader construction stays trending constructive so long as $3,540 help holds.

On-chain flows spotlight continued outflows

In keeping with alternate knowledge from Coinglass, Ethereum recorded web outflows of $112.45 million on October 14, indicating gradual accumulation regardless of volatility. This follows weeks of combined forex exercise, with frequent inflows in periods of rising costs and sharp outflows in periods of falling costs.

Though web flows stay damaging, analysts say this pattern means that long-term holders are withdrawing their ETH into chilly storage, indicating continued confidence. Nevertheless, the shortage of a big surge in inflows additionally highlights the decline in speculative demand within the quick time period. Merchants stay centered on whether or not future institutional catalysts will reignite momentum, particularly as staking participation will increase.

Bhutan anchors nationwide digital id on Ethereum

In a serious foundational growth, Bhutan has confirmed that its nationwide digital id platform will absolutely migrate to the Ethereum blockchain by early 2026. The venture, initially constructed on Cardano’s IOG, will now anchor its credentials on Ethereum, permitting residents to confirm private attributes by decentralized identifiers tied to the community’s verification infrastructure.

Ethereum co-founder Vitalik Buterin hailed the transfer as a milestone in public blockchain adoption, emphasizing the empowerment of residents by self-sovereign digital identities. This growth follows current efforts round vitality markets, tokenized treasuries, and stablecoin funds, and reinforces Ethereum’s rising function in nationwide infrastructure.

Analysts peg truthful worth at $8,000 to $10,000.

Market strategist Ted Pillows reiterated his bullish stance, saying Ethereum may “catch as much as the cash provide M2” within the fourth quarter. He anticipated truthful worth to be between $8,000 and $10,000 by Q1 2026, supported by institutional bids, staking approvals, and liquidity rotation from different layer 1 property. His submit, which in contrast the worldwide M2 growth to ETH’s value efficiency, gained consideration amongst merchants who see Ethereum as a macro hedge in tight liquidity cycles.

This macro-driven story is in line with Ethereum’s long-term Wyckoff accumulation sample, the place every cycle correction has traditionally preceded a pointy restoration. If macro liquidity improves within the fourth quarter, speculative and institutional demand may reignite as Ethereum aligns with international monetary development.

Outlook: Will Ethereum Rise?

Ethereum’s outlook for mid-October stays cautiously optimistic. A pullback to a trendline is seen as a pure consolidation section inside an ongoing cycle. On-chain outflows point out long-term accumulation, and the Bhutan consolidation provides a powerful adoption layer to the Ethereum story.

Associated: Solana Value Prediction: SOL value rebounds as open curiosity soars above $10 billion

If ETH stabilizes above $4,000, analysts consider there’s room for a restoration in the direction of $4,550 and $4,800 within the coming classes. Nevertheless, a lack of that threshold will delay the rally and check consumers’ confidence close to $3,540. For now, Ethereum stays a pivotal asset that balances structural help and new international calls for.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.