- Ethereum outflows enhance as institutional investor shopping for indicators a potential pattern reversal.

- ETH holds vital assist at $3.7,000 regardless of a bearish EMA, indicating cautious market setup.

- The surge in open curiosity signifies that merchants are getting ready for Ethereum’s subsequent huge worth transfer.

Ethereum stays close to vital assist ranges as on-chain information reveals large foreign money outflows, suggesting a cautious however doubtlessly bullish setup. The token is buying and selling round $3,715, with merchants monitoring whether or not new institutional shopping for, led by BlackRock’s $46.9 million accumulation, marks a turning level within the ongoing correction.

Market construction displays continued downward strain

Ethereum continues to commerce with bearish momentum after failing to regain power above the $3,943 mark, which coincides with the 0.382 Fibonacci retracement degree. The worth stays beneath the 20-50 EMA cluster round $3,950-4,100, confirming the presence of robust promoting strain.

Importantly, the 20 EMA remains to be beneath the 50, 100, and 200 EMAs, sustaining a bearish pattern within the brief time period. The subsequent main assist is positioned close to $3,750, which coincides with the 0.236 Fibonacci degree. A break beneath this degree may head in the direction of the $3,620-$3,440 liquidity zone.

Moreover, the $3,439 degree stays an vital horizontal demand zone and represents the structural low fashioned in June. On the upside, Ethereum faces resistance at $3,943, adopted by a dense provide space between $4,066 and $4,162 the place the 50 EMA and 100 EMA intersect. A clear break above $4,254 would offer the primary robust signal of a pattern reversal.

Associated: Shiba Inu Worth Prediction: SHIB falls as key assist faces new promoting strain

Derivatives and arranged exercise present rising belief

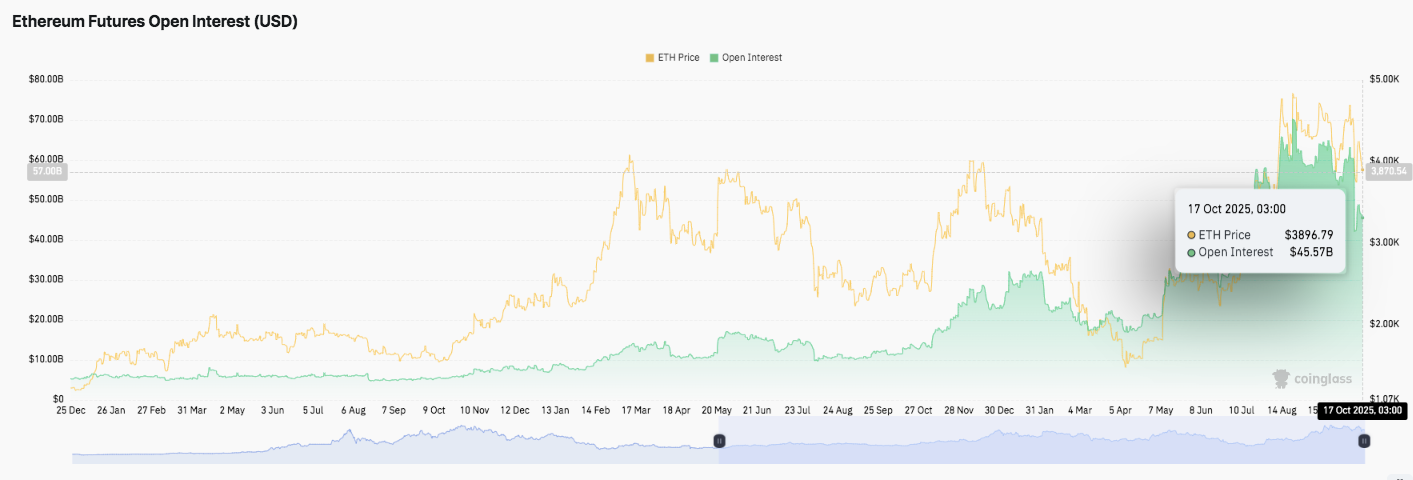

Ethereum’s open curiosity soared to $45.57 billion as of October 17, reflecting elevated participation from institutional traders. This enhance in leveraged positions signifies that merchants are getting ready for the following huge worth transfer.

Moreover, open curiosity has almost doubled since mid-year, suggesting confidence amongst each lengthy and brief contributors. This enhance displays the stabilization in worth seen round $3,896, reinforcing a possible setup for elevated volatility if the worth route is confirmed.

Alternate circulate reveals accumulation conduct

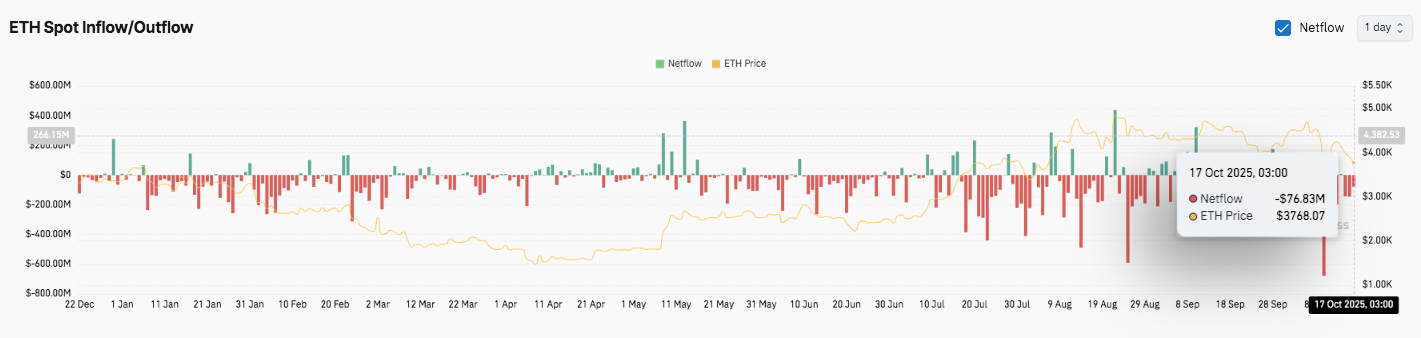

In keeping with latest information, the trade has seen a internet outflow of $76.83 million, and the trade’s provide continues to pattern downward. Whereas promoting strain stays, sustained outflows usually mirror accumulation by long-term holders.

In consequence, this sample may tighten the accessible provide of Ethereum, paving the best way for a pointy restoration when demand will increase. Whereas earlier influx surges marked non permanent highs, present information reveals consolidation slightly than capitulation.

Associated: Bitcoin Worth Prediction: BlackRock triggers $1 billion sell-off, BTC falls

Technical outlook for Ethereum (ETH/USD)

As Ethereum navigates the correction construction heading into late October, key ranges stay clearly outlined.

- Prime degree: The fast hurdles are $3,943 (0.382 Fib retracement) and $4,066-4,162 (50-100 EMA cluster). A break above these may prolong to $4,254 (0.618 fib), leaving $4,476 of room in a broader restoration.

- Lower cost degree: $3,750 (Fib 0.236) acts as short-term assist, after which $3,620 to $3,440 is the following liquidity and demand zone. A transparent breakdown beneath $3,700 may reveal these deeper ranges.

- Higher restrict of resistance: The $4,100 zone stays a key degree for reversing the medium-term bullish construction because it coincides with the EMA confluence and former rejection space.

The technical construction means that ETH is solidly inside a bearish continuation sample with decrease highs forming beneath dynamic resistance. Volatility stays compressed, indicating {that a} definitive breakout may prolong momentum in both route.

Will Ethereum maintain the $3,750 zone?

Ethereum’s near-term trajectory will depend upon whether or not consumers can maintain assist above $3,750 and soak up continued promoting strain. If the worth maintains this base and recovers between $3,950 and $4,100, it may set off a restoration in the direction of $4,254 and above. Conversely, if it fails to maintain above $3,700, the correction may widen in the direction of $3,440.

Associated: Dogecoin worth prediction: Musk’s tweet reignites hype, however resistance continues

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.