On the planet of digital finance, central financial institution selections, particularly US Federal Reserve System (FRB)has an excellent affect not solely on the normal market but in addition on market developments. cryptocurrency.

Regardless of being decentralized, Bitcoin (BTC) and different digital belongings are affected by: Adjustments in rates of interest and financial coverage Regulate world liquidity. Due to this fact, understanding how and why Fed rates of interest have an effect on cryptocurrencies is crucial for anybody investing in or managing cryptocurrencies. crypto sector.

Rates of interest as a lever in monetary markets

curiosity Payment Represents the price of cash. time FRB Financing selections are likely to make borrowing costlier, cut back liquidity, and cut back funding in dangerous belongings. Conversely, decrease rates of interest facilitate entry to credit score and direct funds towards extra speculative merchandise. cryptocurrency.

BitcoinThere isn’t any mounted return and it behaves just like a “risk-on” asset. Their worth tends to rise when buyers search different returns, and fall when buyers favor a return to authorities bonds or safer bonds.

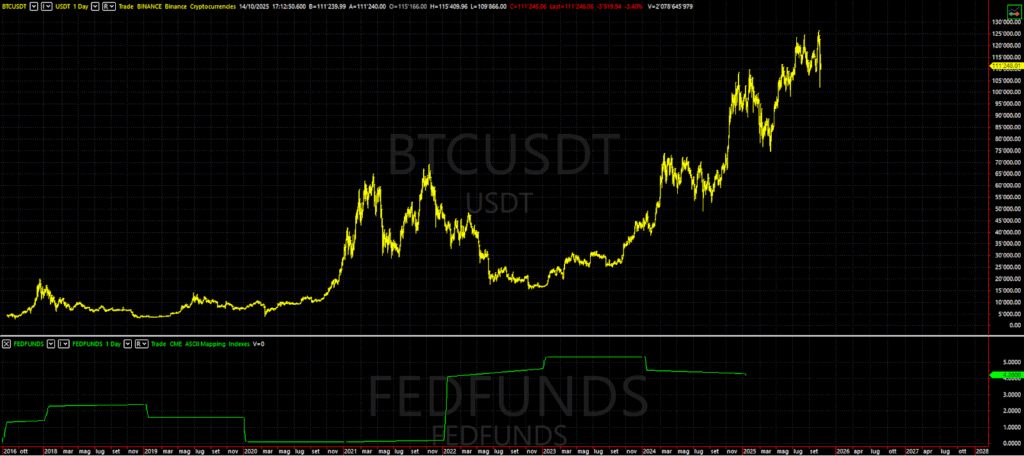

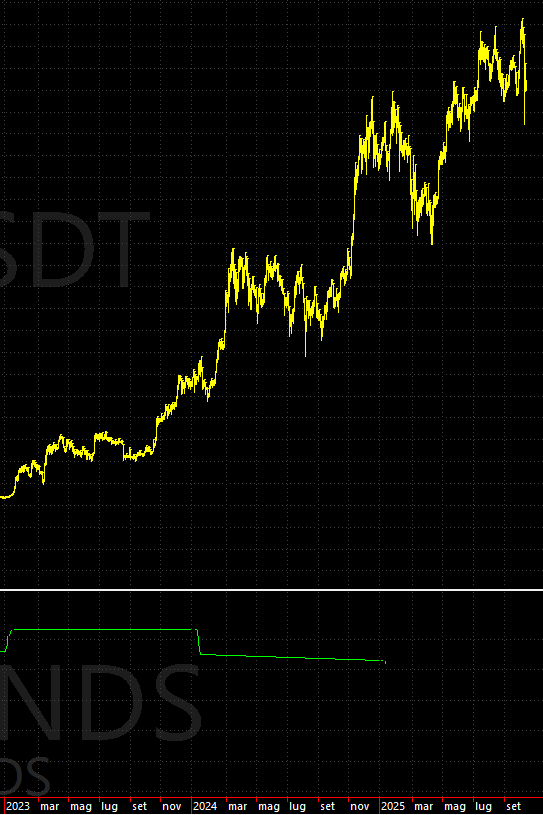

During times of expansionary financial coverage reminiscent of 2020-2021, near-zero rates of interest and ample liquidity supported an unprecedented growth within the crypto market. Nevertheless, as a result of financial tightening in 2022, worth of BTC collapsed, displaying a powerful correlation between Fed coverage and sector efficiency.

That is clearly seen in Determine 2, which reveals Bitcoin’s pattern in comparison with the FED charge on the identical chart.

Alternative value and threat attraction

of Relationship between rates of interest and digital foreign money is principally defined by the idea of alternative value. When authorities bonds supply low returns, buyers search riskier however extra worthwhile alternate options. Bitcoin. Conversely, when rates of interest rise and bonds begin providing engaging returns once more, capital tends to stream again into safer investments.

2022 was a transparent instance of this. and us charge Fast worth will increase and excessive inflation setting; Bitcoin This confirms that the Fed’s financial coverage can immediately affect market sentiment and the alternatives of market operators (see Determine 2).

Liquidity and Leverage: The Engines and Traps of the Cryptocurrency Market

Cryptocurrency markets thrive on liquidity. When credit score is ample and rates of interest are low, buyers have easy accessibility to funds for speculative or leveraged operations.

This dynamic drives worth will increase and drives innovation. Decentralized finance (DeFi)loans and excessive yields have doubled due to world extra liquidity.

Nevertheless, when rates of interest rise, the state of affairs adjustments radically. Funds turn into costlier, leverage decreases, and operators who’re extra in danger are compelled to liquidate their positions. That is what’s going to occur in 2022, when platforms like Celsius and BlockFi collapse below the burden of evaporated liquidity and more and more difficult-to-maintain debt. Due to this fact, financial tightening could not solely cool costs but in addition jeopardize the steadiness of your complete cryptocurrency ecosystem.

Surprises from the Fed and Bitcoin Volatility

Cryptocurrency markets not solely react to the Fed’s official selections, but in addition to expectations and alerts predicting the Fed’s actions. phrases of President Jerome Powell It may well have an effect on Bitcoin developments as a lot as charge adjustments.

If the Fed is stricter orhawkish” tone, buyers have a tendency to cut back their threat publicity, whereas their phrases turn into extra lenient or “dovish” sentiment improves and cryptocurrencies regain momentum.

For instance, in the summertime of 2023, even the slightest trace that charge hikes is perhaps paused was sufficient to set off robust recoveries in Bitcoin and Ethereum. Due to this fact, rate of interest expectations have turn into one of many foremost drivers of cryptocurrency market volatility.

Bitcoin and inflation: between fable and actuality

For a few years Bitcoin described as potential.secure haven belongingsNevertheless, in recent times, this idea has been questioned.

Throughout the excessive inflation part of 2021-2022, Bitcoin didn’t transfer like gold and misplaced worth following the developments of tech shares. That is as a result of the Fed’s resolution to lift rates of interest to fight inflation has lowered liquidity and pushed buyers into extra steady belongings.

In the long run, Bitcoin should still retain its retailer of worth perform, however within the brief time period it seems to be extra delicate to enterprise cycles and financial coverage than to shopper worth ranges.

Rate of interest repercussions in decentralized finance

Decentralized finance can also be affected by the Fed’s selections, though it isn’t immediately linked to the banking system.

in DeFi protocolsrates of interest are shaped algorithmically based mostly on liquidity demand and provide. Nevertheless, as world rates of interest rise and “secure” yields turn into extra engaging, liquidity tends to stream out of decentralized protocols and into conventional techniques. On this sense, DeFi is a digital reflection of world finance and can’t ignore the macroeconomic dynamics that decide the price of capital.

New connections between macroeconomics and crypto markets

With the maturation of the sector and the entry of institutional buyers, Bitcoin is changing into more and more influenced by macroeconomic variables. immediately Funding funds, ETFs, and listed corporations deal with BTC As a full-fledged monetary asset, it’s influenced by the identical components that drive shares and bonds: financial progress, inflation, and, after all, financial coverage.

This makes the cryptocurrency market an integral a part of the worldwide financial system. Decentralization of know-how doesn’t imply independence from financial mechanisms. Quite the opposite, Bitcoin has turn into a delicate thermometer measuring selections made at central financial institution headquarters.

Conclusion: The inevitable relationship between Bitcoin and the Fed

It’s presently unimaginable to research the cryptocurrency market with out contemplating the affect of the Federal Reserve’s selections. Rates of interest have an effect on capital flows, threat urge for food, and finally the worth of Bitcoin. When rates of interest are low, liquidity is plentiful and markets are likely to develop. Conversely, a rise tightens credit score, reduces hypothesis, and impacts costs.

Surprises from the Fed proceed to create volatility, whereas inflation and restrictive coverage are exerting bearish stress on digital belongings. So long as the greenback stays the world’s reserve foreign money, the Fed’s selections will proceed to form the crypto world. Anybody who actually needs to know the place Bitcoin is headed should be taught to learn not solely the charts however (and maybe most significantly) the FOMC assertion.

See you subsequent time. Have enjoyable buying and selling!