- XRP worth is holding at $2.36 as we speak, with assist consolidating close to $2.24 as consumers defend the decrease certain of the multi-month triangle.

- The US shutdown has stalled the SEC ETF assessment, extending the delay and placing strain on XRP worth momentum.

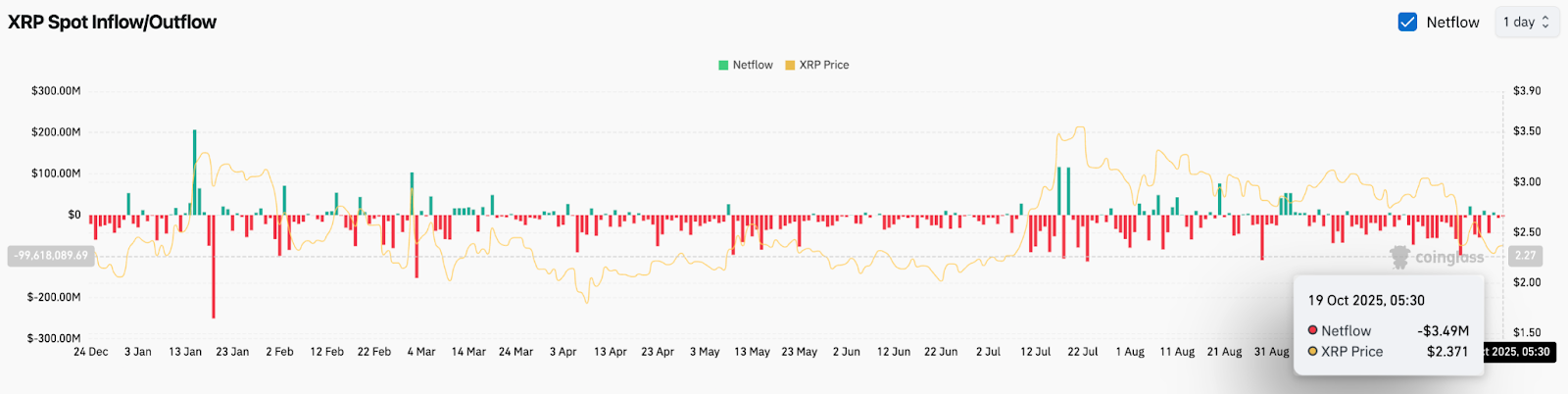

- On-chain flows stay weak, with outflows of simply $3.49 million, indicating restricted accumulation amid cautious sentiment.

XRP worth is buying and selling round $2.36 as we speak, holding simply above the important thing assist of $2.24 after a big drop of practically 27% in three weeks. The token continues to consolidate inside a symmetrical vast triangle as merchants monitor whether or not continued delays within the U.S. Securities and Trade Fee’s (SEC) assessment of ETFs might set off a deeper correction earlier than one other try at a rebound.

XRP worth maintains structural assist however momentum weakens

XRP worth dynamics (Supply: TradingView)

The day by day chart exhibits that XRP is buying and selling on the decrease certain of a multi-month triangular construction, with speedy resistance ranges at $2.59, $2.77, and $2.91, coinciding with the 20-day, 50-day, and 100-day EMAs. The broader setup means that the bullish construction will maintain so long as worth stays above the uptrend line assist close to $2.24.

Nevertheless, momentum indicators reveal declining power. The supertrend stays bearish at $2.91, however the RSI studying is hovering across the impartial zone after weeks of downward strain. A definitive shut beneath $2.24 might expose deeper liquidity close to $2.00 and set off a retest of $1.85. For now, consumers are cautiously guarding their assist base, however buying and selling exercise has slowed sharply as ETF uncertainty dominates sentiment.

ETF delays add to bearish strain

The most important headwind for XRP worth this week is the stalled SEC decision-making course of brought on by the partial U.S. authorities shutdown. Analysts have warned {that a} extended shutdown might push again key ETF assessment dates and delay the breakthrough catalyst for institutional inflows that many buyers had hoped for.

Crypto market commentator Blissful Soul highlighted that XRP might face one other decline if the ETF schedule is additional prolonged as a result of lack of short-term catalysts and weakening momentum. The SEC’s submitting course of has been paused since early October, and the XRP ETF stays amongst a number of pending approvals.

The U.S. Senate didn’t advance a funding decision final week, confirming the federal government shutdown will probably be prolonged for an additional week and regulatory actions will probably be placed on maintain. Merchants at present consider that the earliest progress on the ETF will happen as soon as the federal government resumes full operations, a delay that’s already weighing on market sentiment throughout altcoins.

October 19b-4 submitting deadline just isn’t true

Authorized specialists have moved on to sober hypothesis that the unique October 19b-4 submitting might have indicated a deadline for the launch of the XRP ETF. Greg Zetaris, a fellow at Duke Regulation College, clarified that the appliance is only one step within the course of, not the set off for approval or activation. When the SEC reopens, the method will begin once more on the assessment stage, moderately than from the start.

This clarification offers context for merchants who misinterpreted the October submitting as a assured opening sign. Whereas the moratorium slows potential institutional inflows, it doesn’t derail the ETF’s long-term prospects. Zetaris added that merchandise akin to CoinShares’ proposed XRP ETF (with BitGo as custodian and Valkyrie as seed investor) are anticipated to maneuver ahead rapidly as soon as the federal government returns to regular.

On-chain flows mirror weak demand

XRP Netflows (Supply: Coinglass)

Web outflows had been $3.49 million on October 19, in response to Coinglass trade information, highlighting the dearth of robust accumulation on this decline. The shortage of significant inflows suggests merchants stay cautious regardless of the institutional filings.

Total, XRP worth developments proceed to lag behind the general market restoration pattern, with spot flows being combined since mid-September. Continued constructive web inflows of over $20 million could be wanted to substantiate renewed shopping for strain, however stream exercise stays subdued for now.

Technical outlook for XRP worth

- High stage: Close to-term resistance ranges are $2.59, $2.77, and $2.91.

- Cheaper price stage: Main assist at $2.24, adopted by $2.00 and $1.85 in case of a breakdown.

- Development construction: A symmetrical triangle that tightens in direction of the height of November.

Outlook: Will XRP rise?

The outlook for XRP worth predictions will depend upon whether or not ETF-related optimism returns earlier than the subsequent macro transfer. Momentum might return to $2.77 and $2.91 as soon as the U.S. authorities reopens and the SEC resumes its assessment of ETFs within the coming weeks.

Till then, technical evaluation factors to a doable continuation of the consolidation or a retest of $2.24 if sellers stay lively. Institutional curiosity stays a medium-term security web, however short-term bias stays cautious. Analysts recommend that solely a break above $2.77 would reaffirm bullish dominance, whereas an in depth beneath $2.24 would sign short-term bearish continuation in direction of $2.00.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.