- Ethereum worth is buying and selling round $4,048 immediately after reclaiming the $4,000 degree, with patrons defending the $3,900 help.

- Approval of retail ETPs for Bitcoin and Ethereum within the UK could spark optimism and encourage long-term capital inflows.

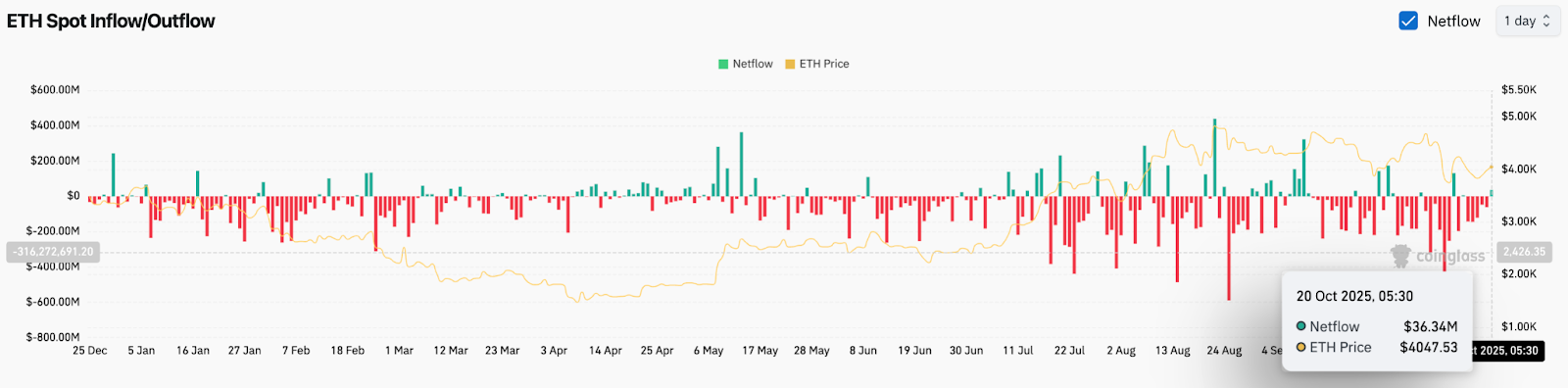

- Internet inflows on the alternate confirmed $36.3 million in ETH inflows, suggesting that sellers are dropping momentum after weeks of heavy outflows.

Ethereum (CRYPTO: ETH) worth is buying and selling round $4,048 immediately, testing resistance after regaining the psychological $4,000 mark. Consumers want to prolong earnings from final week’s lows of $3,700, however the token stays capped beneath the downtrend line that has formed the market since early September. With UK regulators approving retail entry to merchandise traded on crypto exchanges, traders are actually contemplating whether or not this catalyst will likely be sufficient to drive ETH out of the consolidation zone.

Consumers defend main help round $3,900

ETH worth motion was risky till October, with a pointy drop beneath the main shifting averages earlier than patrons stabilized the market. The $3,900-$4,000 area is supported by the 100-EMA cluster and has repeatedly acted as a requirement zone.

On the 4-hour chart, Ethereum is approaching supertrend resistance close to $4,100, which coincides with the 50-EMA. A break above this degree may pave the way in which to $4,180 and even $4,300. Nevertheless, if it fails to maintain above $4,000, we threat retesting $3,850, the place uptrend line help is constructing.

Merchants observe the next: Ethereum worth volatility is shrinking, and compression suggests impending motion. The short-term query is whether or not inflows from new ETP listings can offset broader promoting strain.

UK retail ETP approval sparks optimism

The underlying issue this week was the UK Monetary Conduct Authority’s resolution to elevate a four-year retail ban on the cryptocurrency ETN and open entry to Bitcoin and Ethereum ETPs on the London Inventory Trade.

Asset administration firms 21Shares, Bitwise, and WisdomTree have all launched ETH merchandise, and BlackRock has listed the iShares Bitcoin ETP. Analysts say it is a landmark transfer for European markets, increasing entry to tens of millions of retail traders by way of commonplace brokerage accounts.

Associated: Solana Value Prediction: Merchants concentrate on key breakout as market stabilizes

Within the case of Ethereum, the addition of staking-backed merchandise with decreased charges may appeal to long-term flows. Market individuals argue that simpler entry by way of regulated channels will enhance sentiment and strengthen the bullish case for ETH. Nonetheless, merchants cautioned that near-term demand may reasonable as traders assess the dangers.

Blended deployment seems in Trade circulation

Coinglass’ on-chain knowledge highlights that ETH web flows turned optimistic on October twentieth, with an influx of $36.3 million as the worth recovered to $4,047. Though small, this marks a change from the large outflows seen earlier within the month when every day losses exceeded $300 million.

Continued outflows over the previous few weeks have amplified draw back dangers, however the latest stabilization suggests sellers could also be dropping momentum. Analysts say bigger inflows are wanted to maintain the broader rally and additional affirmation is required.

Ethereum worth updates point out that retail demand from the UK launch may reinforce this pattern if alternate balances proceed to shrink and short-term promoting provide decreases.

Technical outlook: upside rests on $4,100 break

Within the brief time period, Ethereum worth predictions rely upon whether or not the bulls can recuperate $4,100. Clearing this barrier would solidify momentum and set targets at $4,300 and $4,500. Above this, the downtrend line close to $4,650 will likely be a key impediment earlier than pushing in direction of $4,800.

On the draw back, fast help lies at $4,000, adopted by $3,850. A break beneath the uptrend line would expose ETH to $3,700 and $3,500, zones the place patrons have beforehand seen robust rebounds.

Outlook: Will Ethereum Rise?

Ethereum’s October 21 outlook stays balanced. The launch of a regulated ETH ETP within the UK is a giant sentiment booster, however technical affirmation remains to be wanted. A break above $4,100 is prone to carry additional momentum, however failure to maintain $4,000 dangers additional decline.

For now, Ethereum worth motion is caught between robust elementary help from ETP implementation and technical resistance overhead. Merchants will likely be intently monitoring forex flows and quantity to find out whether or not they have sufficient confidence on this rally to show right into a full restoration.

Associated: Pump.enjoyable Value Prediction: PUMP Value Defends Structural Help

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.