- Bitcoin is digital gold. Ethereum executes good contracts. XRP settles cross-border funds.

- These don’t battle. BTC shops worth, ETH builds apps, and XRP strikes worth between networks.

- 3-layer crypto stack: BTC Reserve, ETH Programmable Market, and XRP Quick Fee.

The “which coin wins” debate treats all blockchains as in the event that they remedy the identical job. it isn’t. Analysts, lovers, and traders are pouring out contemporary ideas on social feeds, however a rising variety of voices, together with skilled Vincent Van Wire, argue that the query itself is deceptive.

“Bitcoin, Ethereum and XRP had been by no means meant to compete. Every was constructed to resolve a special downside. The market is simply lumping them collectively as a result of they share the identical kind of ‘database’, the blockchain,” he stated.

Bitcoin (BTC): immutable digital gold

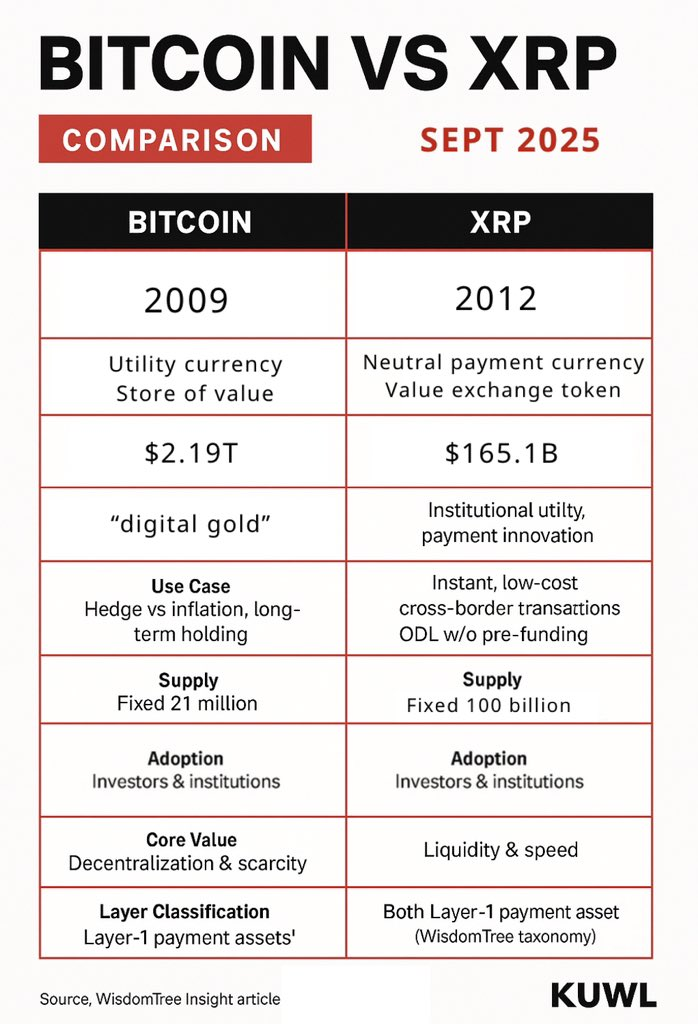

The story of Bitcoin begins in 2009 with the mysterious Satoshi Nakamoto. Its mission is easy. It’s a decentralized retailer of worth. Bitcoin eliminates intermediaries, ignores governments, and doesn’t run on good contracts. Though its blockchain is gradual by design, it’s predictable and safe.

- Objective: Protect worth, hedge towards inflation.

- Market capitalization: ~$2.19 trillion (~50% of the full cryptocurrency market).

- Use case: Digital gold for traders and establishments.

- Core options: decentralization and immutability.

Bitcoin isn’t meant to run decentralized apps or settle funds immediately. It exists as incorruptible cash, the baseline layer of the digital economic system.

Associated: Raul Pal predicts Bitcoin peak in 2026 regardless of debt transfers

Ethereum (ETH): decentralized laptop

If Bitcoin is gold, Ethereum is the programmable world. Launched in 2015, Ethereum remodeled blockchain right into a platform that enabled good contracts, NFTs, and DeFi. That blockchain is the muse of a brand new digital infrastructure, not a substitute for cash, however the basis of a system via which cash passes.

- Objective: Digital Infrastructure and Programmable Economic system.

- Market cap: ~$470 billion.

- Use instances: good contracts, NFTs, DeFi protocols.

- Key options: Decentralized, programmable, and versatile.

Ethereum is a spectacularly profitable experimental layer that turns code into an ecosystem that strikes cash. If Bitcoin holds worth, Ethereum creates worth.

XRP Ledger (XRP): An institutional bridge

Typically misunderstood within the retail trade, XRP was launched in 2012 with a deal with quick, compliant, institutional-level funds. Built-in into Ripple’s on-demand liquidity service, XRP strikes funds between currencies with out up-front funding and targets the spine of worldwide finance.

- Objective: Switch of worth between networks and currencies.

- Market cap: ~$165 billion.

- Use instances: cross-border funds, liquidity, and ISO-compliant funds.

- Key options: pace, effectivity, and interoperability.

Analyst Rob explains it succinctly: “Bitcoin shops worth, Ethereum builds an ecosystem, and XRP strikes worth between them. Consider it as a SWIFT different, not a DeFi playground.” In line with these specialists, the error is viewing these tokens as rivals. they do not compete. These complement one another and kind a three-layer basis for the way forward for digital finance.

The following decade might even see these three pillars working collectively: Bitcoin as the muse, Ethereum because the platform, and XRP because the bridge. In a world the place pace, effectivity, and programmability are key, this layered strategy may very well be the blueprint for the way forward for cash.

Associated: XRP Crowd Sentiment Extraordinarily Collapses: Historic Shopping for Alternative Arrives?

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.