XRP enters remaining part in October 2025, with merchants questioning if the token can regain the $3 mark earlier than Halloween. After displaying robust momentum within the third quarter of 2025, the cryptocurrency is going through a major decline, with buyers intently monitoring for indicators of a breakout on the finish of the month.

On the time of writing, XRP is buying and selling round $2.40, reflecting a decline of 1.0% up to now day and 17% up to now 30 days. Regardless of this decline, XRP enjoys a 343% enhance in annual efficiency.

Quantity is at the moment round 12% above the weekly common, suggesting continued participation from each retail and institutional buyers.

Exceptional technical degree

- Help: Round $2.35, strong since mid-October.

- Resistance: Between $2.80 and $3.00. A powerful transfer above $2.60 may sign an upside.

- If XRP falls under $2.40, a retest of $2.25 could happen.

Concerning whale exercise and breakout patterns, some analysts are evaluating this to XRP’s 2017 bull run. Nonetheless, many agree that it’s unlikely to rise above $3 anytime quickly except there’s a main catalyst.

Authorized and institutional elements

The value of XRP can be influenced by information concerning legal guidelines and laws. Ripple’s authorized victory towards the SEC has contributed to market confidence, however focus has now shifted to the potential of an XRP ETF.

The SEC’s determination on the proposed Spot XRP ETF might not be finalized this month, however moderately in late November or December.

Particularly, Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and CoinShares are awaiting SEC approval for his or her XRP ETF purposes, which have been delayed from October 18 to 25 as a result of authorities shutdown. The same holdup additionally impacts Litecoin, Solana, and Cardano ETFs.

However, Polymarket information reveals that the XRP ETF has a 99% probability of being accepted by 2025. ETF analyst Nate Geraci mentioned a delay was inevitable, whereas Bloomberg’s Eric Balchunas described it as a short lived “rain delay.”

In the meantime, Ripple-backed Evernorth introduced plans to go public and lift greater than $1 billion as a part of increasing its XRP holdings. The transfer is interpreted as an indication that main buyers nonetheless see long-term worth within the Ripple ecosystem.

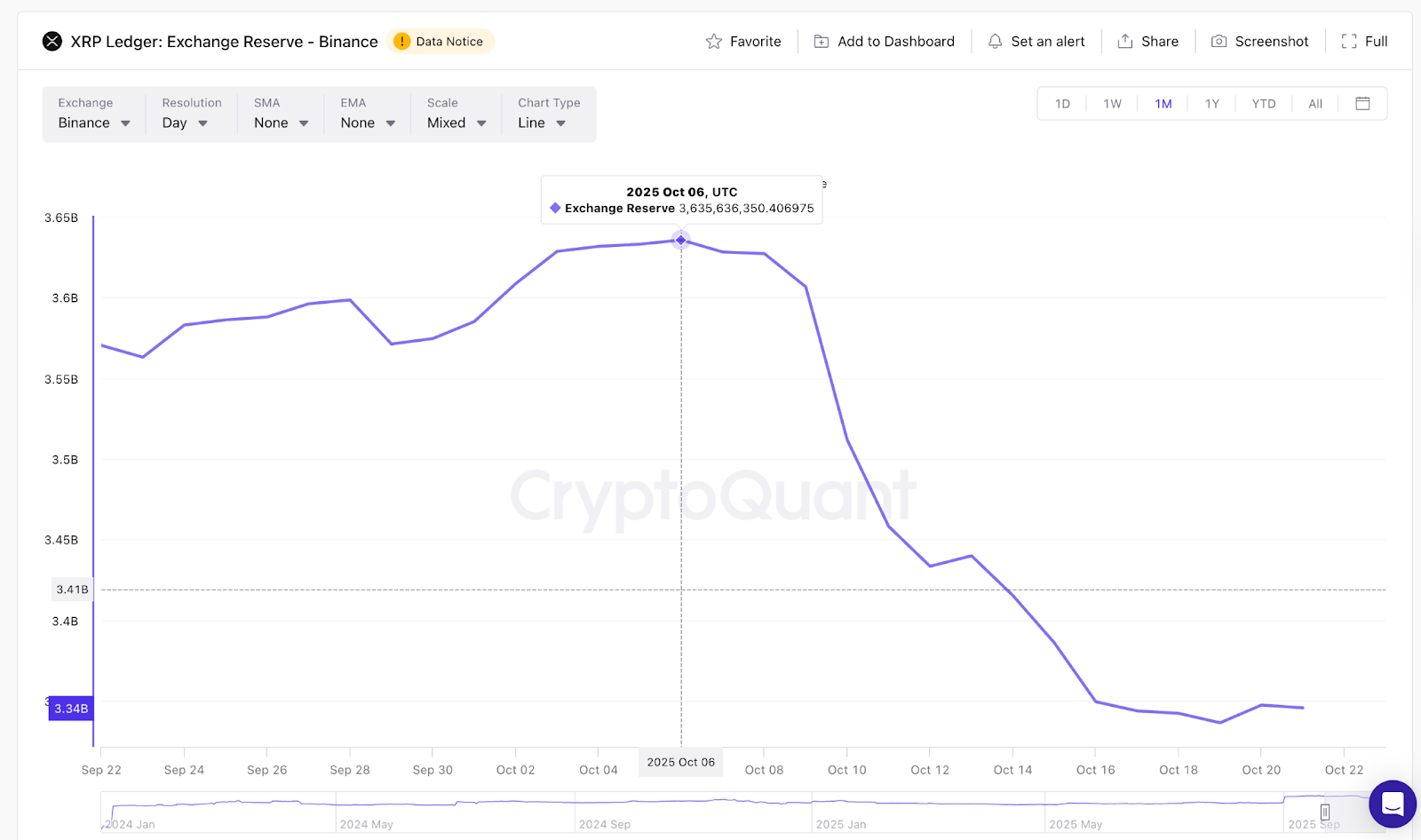

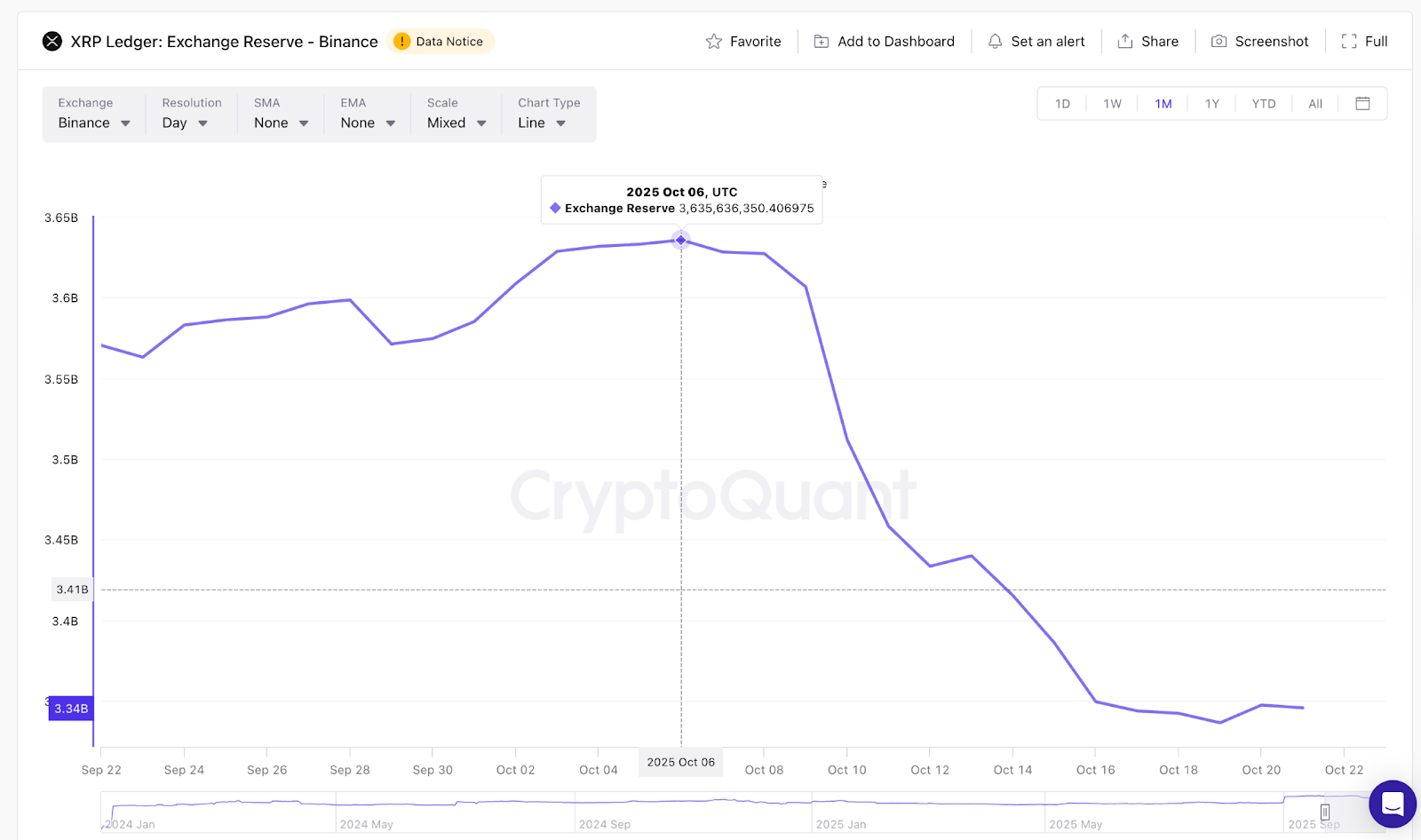

Equally, on-chain information from CryptoQuant suggests belief amongst long-term holders. The on-chain report revealed that overseas trade reserves are reducing.

In October, XRP on the Binance trade declined from 3.6 billion to the present 3.3 billion degree, reinforcing the “provide shock” narrative. This means that offer might be tight as a result of shrinking trade balances and the worth of XRP could rise within the close to future.

Market sentiment and technical outlook

Market sentiment stays cautiously optimistic. Derivatives information reveals choices merchants are beginning to place for the rally.

CoinGlass information reveals elevated exercise in derivatives buying and selling, with open curiosity down simply 0.06% and futures buying and selling quantity leaping 38.4% to just about $8.57 billion. This means that merchants are rebuilding their positions moderately than exiting them, indicating an expectation that XRP worth motion is imminent.

From a technical perspective, XRP is breaking above a multi-year downtrend line as 30 million XRP whales accumulate in 24 hours.

Analyst Cryptokareo in contrast this transfer to the 2017 breakout that led to a surge to $3.50, noting that there’s resistance between $3.30 and $3.50, which may push the worth as much as $5 to $7 if momentum holds.

Ali Martinez additionally highlighted the resumption of whale exercise supporting the rebound from $2.25. Within the shorter timeframe, XRP holds assist at $2.42 and faces resistance at $2.60. A break above the closing worth may push the worth as much as $2.85-$3.00, whereas a drop under $2.40 may set off a retest of $2.25.

Nonetheless, most consultants agree that the shortage of a short-term set off makes it unlikely to rise above $3 earlier than Halloween.

Broader market dynamics

Macroeconomic elements will proceed to affect XRP’s trajectory. Cryptocurrency markets have been delicate to modifications in US rate of interest expectations, international liquidity, and ETF-related sentiment.

As merchants await readability on ETF approval, XRP has been discovered fluctuating inside a slim vary, reflecting the consolidation seen throughout main digital belongings.

Nonetheless, a number of current XRP information updates, together with Ripple’s enlargement within the Asia-Pacific area and new partnerships targeted on cross-border funds, present basic context that would assist the following huge transfer if general market momentum improves.

Can XRP attain $3 earlier than Halloween?

Realistically, XRP faces an uphill battle to achieve $3 by October thirty first. Whereas this setup is technically sound and sentiment stays impartial to optimistic, there may be not sufficient time for main catalysts to materialize.

Barring any sudden bulletins, akin to an early ETF determination or a major partnership announcement, the worth is prone to fluctuate between $2.30 and $2.90 for the remainder of the month.

conclusion

XRP’s October outcomes had been stuffed with hope and hesitation. Though the token is holding above main assist, it’s going to want a powerful catalyst to achieve $3 earlier than Halloween.

With regulatory updates and institutional developments on the horizon, XRP stays the highest asset to observe as 2025 attracts to a detailed.

Discussions on social media have fueled optimism, however information suggests $3 continues to be out of attain within the brief time period. That is potential if a strong catalyst emerges, however underneath the present circumstances it’s unlikely.

Analysts estimate that in a bullish situation, XRP may rise as excessive as $3.05, however a extra sensible expectation is throughout the vary of $2.50 to $2.90.

The SEC’s overview of the XRP ETF proposal has been delayed, with most reviews pointing to late November or December 2025 as a brand new determination date.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.