- Pi value is holding close to $0.202 at present, going through resistance from the EMA cluster and testing a serious decrease sure at $0.192.

- Merchants need to push Pi’s ISO 20022 compliance forward of the November 2025 deadline as a bridge to regulated finance.

- The technical outlook is that $0.25 is the principle resistance stage, and a breakout of $0.192 poses a draw back danger in the direction of $0.180.

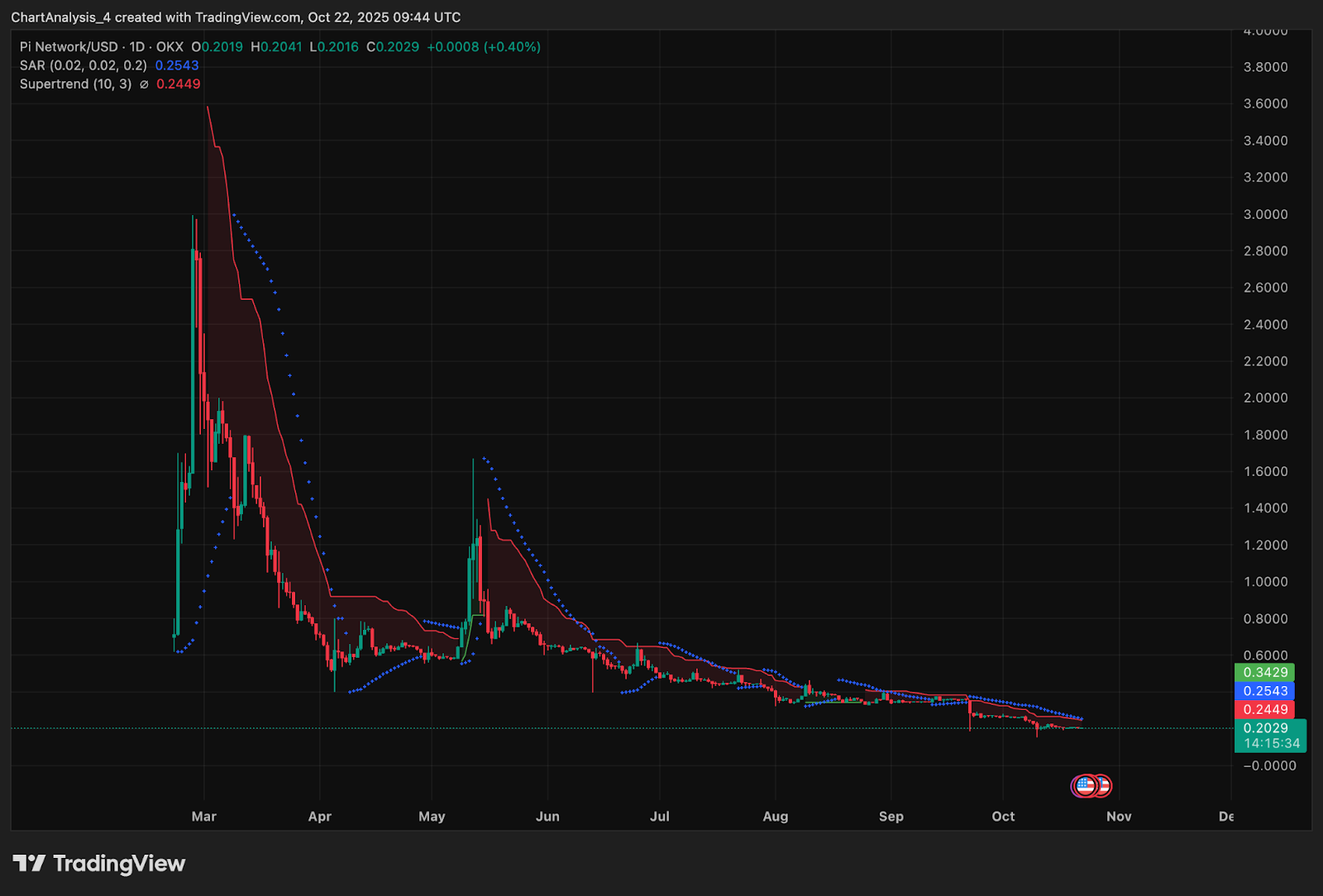

Pi value is buying and selling round $0.202 at present, struggling to regain momentum after weeks of promoting stress. The token continues to face resistance from the descending EMA cluster, however patrons are holding on to a key ground close to $0.192. Merchants at the moment are contemplating whether or not Pi’s efforts to develop into ISO 20022 compliant will probably be sufficient proof to alter the tone of the market.

ISO20022 alignment fosters long-term optimism

The Pi Community neighborhood highlighted this week that the undertaking is already ISO20022 compliant, establishing itself as a part of the monetary messaging requirements that underpin the worldwide banking system. With a November 22, 2025 compliance goal date, Pi positions itself because the bridge between Web3 property and controlled finance.

This growth may help institutional discussions in regards to the utility of Pi, as ISO20022 is seen as a requirement for integration into conventional cross-border fee flows. Nonetheless, the Pi value replace noticed little rapid response, suggesting the market is concentrated on short-term liquidity moderately than long-term implementation milestones.

Sellers hold stress on EMA cluster

On the 4-hour chart, Pi value motion continues to be restricted to the 20-50 EMA vary from $0.2047 to $0.2211. Makes an attempt to regain this zone have repeatedly failed, leaving short-term bias tilted low. If a bigger downtrend line extending from early September strengthens the resistance and patrons try a breakout, the 200 EMA at $0.249 turns into the following prime.

Associated: Solana Value Prediction: SOL faces stress with Hong Kong spot ETF approval

Help continues to carry at $0.192 and has been examined a number of occasions throughout October. As soon as this criterion is breached, Pi’s value prediction mannequin will develop into cautious and the following goal is more likely to be round $0.180. The RSI is hovering at 47, reflecting indecision, with no change in momentum on both facet.

Every day chart confirms sustained downtrend

The each day chart highlights that the general pattern stays bearish. The Parabolic SAR continues to point out resistance above the worth, and the Supertrend indicator additionally exhibits a promoting bias. Till Pi regains $0.24 to $0.26 at present, the rally is more likely to be seen as a correction moderately than a pattern change.

Buying and selling volumes have been additionally considerably decrease in comparison with August and September, reflecting a lower in members. And not using a restoration in demand or clear macro triggers, Pi dangers extending its restructuring part moderately than attaining a sustained restoration.

quick time period outlook

On the draw back, if the worth shouldn’t be maintained at $0.192, the Pi coin value could possibly be dragged all the way down to $0.180 and even $0.165, deepening the bearish construction. Till these thresholds are examined, merchants will deal with Pi as a consolidation moderately than a pattern.

Pi value replace on October twenty third stays balanced. The bulls might want to retake the EMA cluster and shut above $0.25 to substantiate a doable restoration, whereas the bears will intention to make the most of the decline beneath $0.19.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.