- Ethereum worth is presently hovering round $3,836 as ETF inflows from BlackRock and Constancy present short-term assist.

- Resistance between $3,968 and $4,154 stays important, with draw back threat in the direction of $3,570 if the assist fails.

- The US CPI announcement reveals $2.59 billion lengthy and $3.65 billion brief, probably triggering large-scale liquidations.

Ethereum worth is buying and selling round $3,836 right now, struggling to carry above short-term assist after a unstable week. Bulls level to new ETF inflows and institutional shopping for, however merchants stay cautious of macro headwinds and potential liquidation threat if momentum weakens.

ETF demand drives Ethereum worth fluctuations

Ethereum’s worth efficiency is displaying some stability following the addition of latest ETF curiosity following Monday’s $420 million redemption. In keeping with knowledge shared by market analyst Ted Pillows, the ETH ETF recorded $141.7 million in inflows on October 21, of which BlackRock and Constancy accounted for greater than $101 million. This marks the strongest each day ETF inflows since early October and offers a decrease finish for sentiment after weeks of uneven demand.

Associated: Bitcoin Value Prediction: BTC Consolidates as Merchants Anticipate Breakout Sign

Regardless of the supportive flows, Ethereum worth stays beneath the 50-day EMA of $3,968 right now and is struggling to get well close to the 100-day EMA of $4,063. A sustained restoration above these ranges is required to make sure that institutional demand can overcome latest promoting stress.

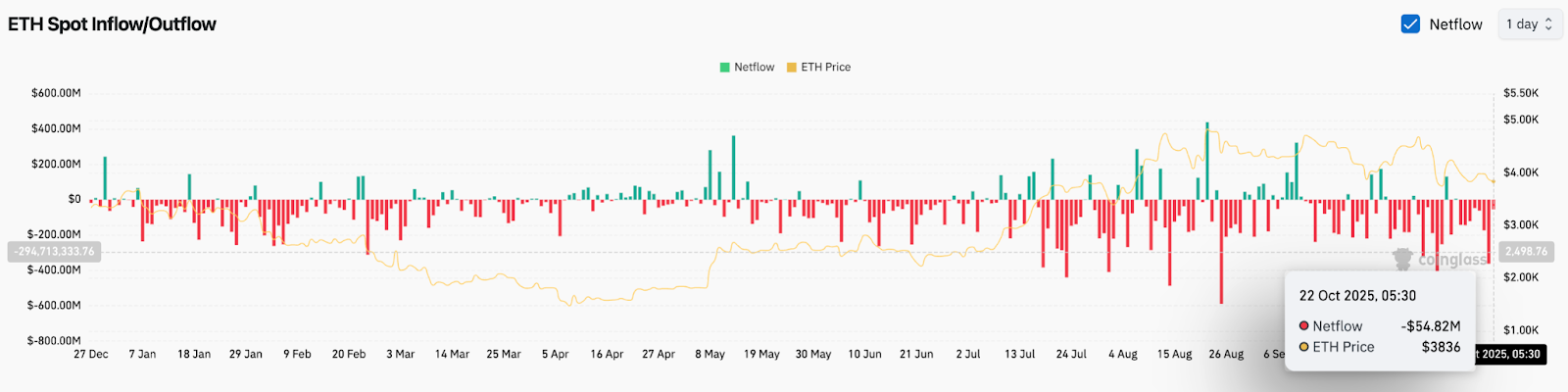

Netflows present blended emotions

On-chain knowledge highlights the tug of struggle between consumers and sellers. Coinglass spot circulate knowledge reveals there was roughly $54.8 million in web outflows from the trade on October twenty second, following giant outflows at first of the month. Internet outflows are typically supportive of costs as they point out holders are transferring ETH off exchanges, however the magnitude of the fluctuations has been modest in comparison with July and August, when outflows had been extra energetic.

This leisure explains why Ethereum worth prediction fashions stay splintered. Whereas short-term merchants see outflows as a bullish signal, the shortage of robust accumulation suggests the market is ready for affirmation from broader catalysts earlier than constructing upward momentum.

Technical resistance limits upside momentum

Ethereum worth motion on the each day chart reveals resistance between $3,968 and $4,154, marked by the 50-day EMA and 100-day EMA. Value’s rejection on this zone in early October highlights the challenges bulls face in regaining bullish momentum.

Associated: Pi worth prediction: ISO20022 compliance story meets key resistance

The relative energy index (RSI) is round 40, indicating that ETH is just not but in oversold territory however lacks robust momentum. A breakdown beneath $3,772 exposes the 200-day EMA and downtrend line intersection at $3,570. Conversely, if we break above $4,154, our focus will shift to $4,400 and finally $4,800, the place ETH hit its all-time excessive in August.

Macro knowledge that approaches ETH worth prediction

At the moment, the macroeconomic scenario performs a decisive position. Pillows factors out that if Ethereum declines by 10%, $2.59 billion of ETH longs may very well be liquidated, whereas if ETH rises by 10%, $3.65 billion of shorts may very well be worn out. This units the stage for a pointy transfer following this week’s launch of the US Client Value Index (CPI).

If the CPI falls beneath 3%, a brief squeeze will happen, and compelled liquidations may trigger the worth of Ethereum to rise. A greater-than-expected sell-off would speed up the general altcoin sell-off and threat an extra drop beneath key assist. This makes the CPI launch one of the vital necessary near-term drivers for ETH and the broader altcoin market.

Outlook: Will Ethereum Rise?

For now, Ethereum worth forecasts stay balanced between ETF-driven demand and macro uncertainty. The bulls have to defend the $3,772-$3,800 zone and reclaim the $3,968-$4,154 resistance band to pave the best way to $4,400. Failure to carry assist may rapidly put $3,570 in danger, with the chance of additional decline if CPI knowledge disappoints.

Associated: Solana Value Prediction: SOL faces stress with Hong Kong spot ETF approval

ETF inflows from BlackRock and Constancy counsel that confidence amongst monetary establishments stays intact, however the market’s potential to soak up macro shocks will decide the following leg. Merchants maintaining a tally of Ethereum worth right now are on the lookout for a breakout or breakdown that would decide sentiment by way of November.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.