- Bitcoin stays above $108,000, defending key help as the worth stays sideways.

- The rise in derivatives open curiosity highlights the positioning of monetary establishments and the potential improve in volatility.

- Sustained foreign money outflows point out accumulation as buyers transfer BTC into self-custody.

Bitcoin continues to commerce in a slender vary round $108,000 as market individuals think about the subsequent decisive transfer. The cryptocurrency was going through resistance close to $111,934, which coincides with the 38.2% Fibonacci retracement, indicating purchaser hesitation following current features. Regardless of the sideways motion, derivatives buying and selling exercise stays excessive, indicating that institutional buyers are bracing for potential volatility within the coming classes.

Worth is above main help

Bitcoin stays steady above $108,000, which is in step with the 23.6% Fibonacci retracement. This degree acts as a short-term pivot for patrons to proceed defending in opposition to additional declines. A sustained shut beneath this threshold may pave the best way to $106,000, adopted by the current low of $103,046.

Conversely, a rebound from this space may retest the resistance ranges close to $111,934 and $114,686. The 20-day and 50-day exponential transferring averages (EMAs) are centered between $109,000 and $113,000 and function dynamic resistance ranges that have to be cleared for momentum to definitively choose up.

Enhance in open curiosity suggests institutional investor exercise

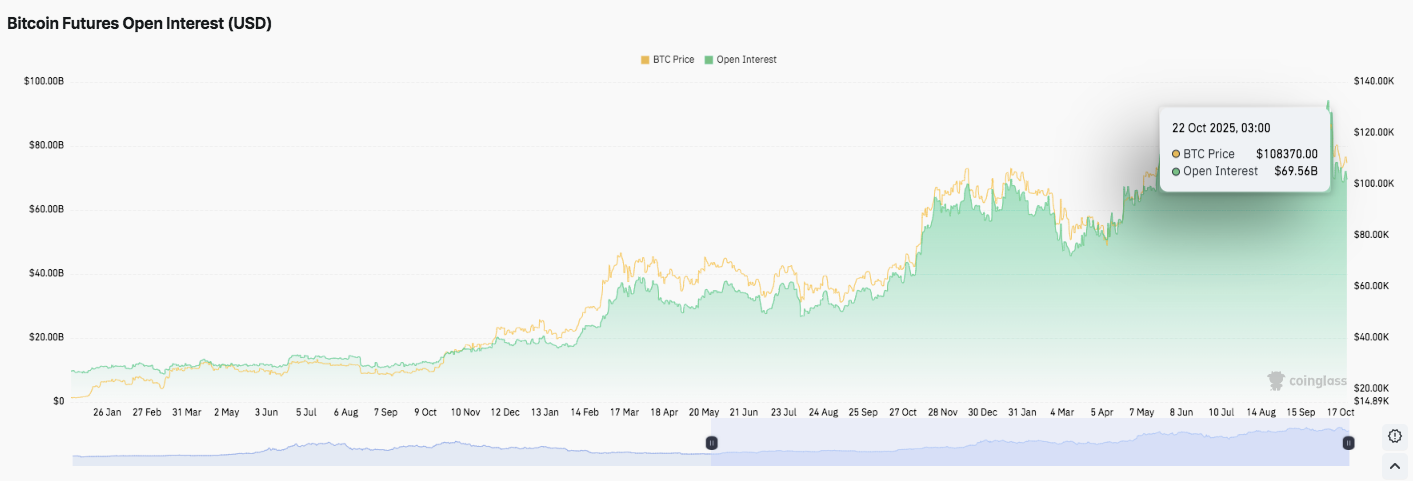

Bitcoin open curiosity has steadily elevated since mid-year, reaching $69.56 billion by October 22, in response to derivatives information. This is without doubt one of the highest values in 2025 and displays renewed involvement from institutional buyers. Analysts say such rallies typically precede large worth strikes, as leveraged positions improve volatility as soon as the market route turns into clear.

Associated: Pi worth prediction: ISO20022 compliance story meets key resistance

The sturdy correlation between worth and open curiosity highlights elevated speculative publicity. Open curiosity stays above $65 billion, indicating that main merchants stay assured in Bitcoin’s long-term pattern regardless of short-term consolidation.

Foreign money outflows point out accumulation

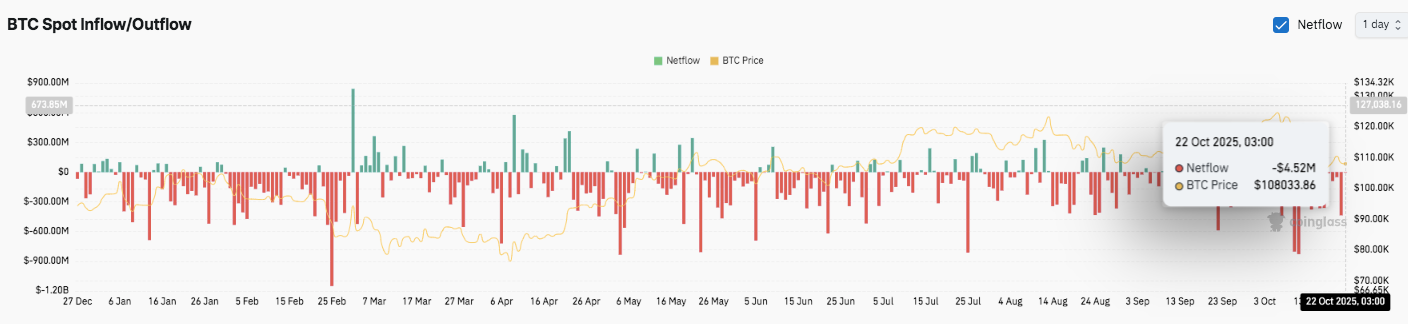

In the meantime, Bitcoin spot web flows have proven continued outflows all through October. On October 22, the alternate recorded a modest outflow of $4.52 million whereas the worth hovered round $108,033.

This pattern means that buyers are transferring belongings into self-custody and lowering circulating provide on buying and selling platforms. Foreign money inflows briefly disrupted this sample earlier this yr, however promoting stress shortly subsided. Constant withdrawals point out that the market is now leaning towards accumulation quite than distribution.

Technical outlook for Bitcoin worth

Key ranges stay clearly outlined for late October. Bitcoin (BTC) continues to consolidate inside a slender vary, buying and selling between $108,000 and $114,000.

- High degree: The rapid hurdles are $111,934, $114,686, and $117,433. A break above the $115,000 zone may prolong the rally in direction of $121,345 and retest $125,000, in step with the 61.8%-78.6% Fibonacci retracement vary.

- Lower cost degree: Instant help lies at $108,000, adopted by $106,000 and the current swing low of $103,046. A break beneath $106,000 would expose BTC to a deeper retracement close to $101,500.

- Higher restrict of resistance: The 200-day EMA close to $113,500 stays a key degree for a transition to medium-term bullish momentum. If the worth continues to shut above this mark, sentiment may swing again in favor of patrons.

The technical setup means that BTC is compressing between converging EMAs, forming a narrowing worth vary. This sample typically precedes a pointy directional motion.

Will Bitcoin breakout or appropriate its decline?

Bitcoin’s subsequent decisive transfer will depend upon whether or not patrons can stick with the $108,000 flooring lengthy sufficient to get better $112,000 to $114,000. Open curiosity has risen to just about $69 billion, indicating that merchants are bracing for volatility.

Associated: Solana Worth Prediction: SOL faces stress with Hong Kong spot ETF approval

If bullish momentum strengthens together with continued foreign money outflows, BTC may retest $117,433 and $121,345. Nonetheless, a lack of the $108,000 degree may create promoting stress in direction of $106,000 and $103,000.

For now, Bitcoin stays at a crucial juncture. The compression between the This fall transferring common and historic seasonality means that elevated volatility is imminent, making this consolidation section essential for the subsequent directional breakout.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.