- Ethereum struggles beneath $4,000 as 200-day EMA limits bullish restoration momentum

- $47 billion in futures open curiosity signifies sturdy demand, rising institutional investor exercise

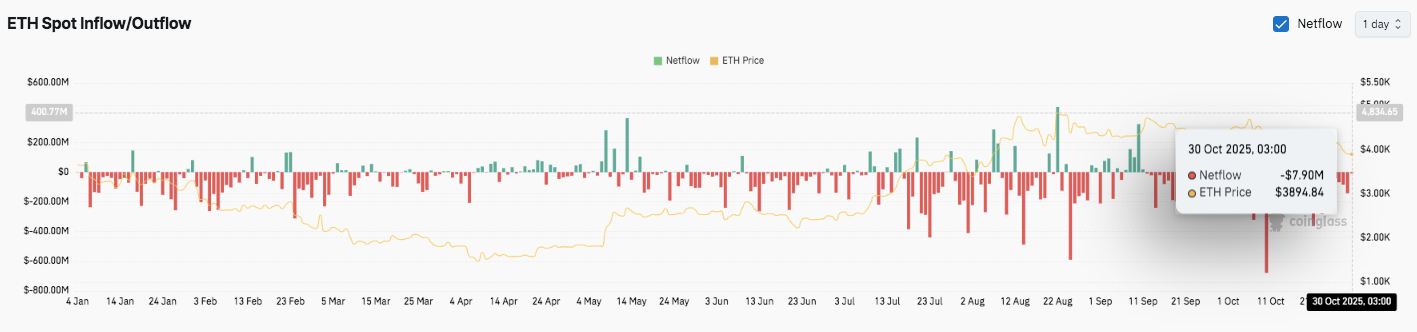

- On-chain outflow and community progress point out a sustained investor accumulation pattern

Ethereum (ETH) is displaying indicators of elevated volatility as soon as once more after its value did not maintain above the $4,000 mark. The cryptocurrency is at the moment buying and selling round $3,892, reflecting gentle bearish overtones as its worth stabilizes beneath a key resistance space. This transfer follows a number of failed makes an attempt to reclaim the 200-day exponential shifting common (EMA), which continues to behave as a ceiling for upward momentum.

Value fluctuations and main expertise ranges

Ethereum’s chart exhibits the 50% Fibonacci retracement stage at $4,101 performing as short-term resistance. The 38.2% enhance at $3,949 can also be an vital zone to look at, as a break above this might pave the way in which to $4,257. On the draw back, instant help lies across the 23.6% Fibonacci stage at $3,753, which coincides with the superior demand zone from mid-October.

If Ethereum sustains above $3,753, it might stabilize earlier than retesting greater resistance ranges. Nevertheless, continued buying and selling beneath $3,900 might add additional draw back stress in direction of $3,441, a whole retrace of the earlier swing. Subsequently, merchants wish to see if ETH can decisively shut above $4,100 to verify a bullish reversal.

Associated: XRP Value Prediction: Huge Whale Accumulation Collides With Weak Flows

Derivatives and institutional traits

Open curiosity in Ethereum futures reached $47.03 billion, indicating sturdy institutional investor exercise. This regular rise since mid-2025 highlights rising confidence amongst skilled merchants. The information additionally suggests that giant buyers are constructing long-term positions somewhat than participating in short-term hypothesis.

Moreover, the divergence between secure open curiosity and low volatility signifies an aggressive hedging technique. If open curiosity stays above $45 billion, analysts anticipate the bullish part to proceed, supported by inflows from institutional buyers.

On-chain momentum is rising

Ethereum’s on-chain knowledge helps the optimistic outlook. Change internet flows present continued outflows all through 2025, with buyers withdrawing belongings from buying and selling platforms. On October thirtieth, ETH traded round $3,894, with complete outflows of $7.9 million. This sample usually displays accumulation and lowering promoting stress.

https://twitter.com/tokenterminal/standing/1983658978673676758

Moreover, Token Terminal knowledge reveals that Ethereum’s Layer 1 community has achieved file transaction and consumer exercise. The elevated use of DeFi platforms and NFTs has led to a speedy enhance within the variety of each day transactions and lively addresses. The community’s capability to effectively deal with this exercise signifies a robust demand for elevated scalability and on-chain providers.

Associated: Dogecoin value prediction: Doge consolidates as open curiosity rises

Technical outlook for Ethereum value

Ethereum (ETH) value stays agency after dealing with rejection on the $4,100 resistance stage. The asset is buying and selling close to $3,892 with main help and resistance ranges defining the subsequent course.

- Prime stage: $3,949 and $4,101 function instant resistance zones alongside the 38.2% and 50% Fibonacci retracements. A sustained breakout above $4,101 might set off momentum in direction of $4,257 and even $4,478.

- Cheaper price stage: The 23.6% Fibonacci stage at $3,753 stays the important thing short-term help. A decisive break beneath this flooring might expose ETH to a deeper correction goal round $3,441, a whole retracement of the earlier rally.

- Higher restrict of resistance: The 200-day EMA close to $4,089 is the primary barrier to regaining medium-term bullish management. An in depth above this stage will guarantee a reversal into the $4,250-$4,480 vary.

The technical construction means that ETH is buying and selling in a compression part between $3,750 and $4,100, and a breakout in both course might result in vital volatility.

Can Ethereum regain $4,000?

Ethereum’s short-term pattern hinges on consumers defending the $3,753 zone whereas conserving futures open curiosity above $45 billion. Persistent change outflows and increasing institutional positioning point out potential accumulation.

If the bullish inflows strengthen and the value closes above $4,100, ETH might regain upward momentum in direction of $4,257 and $4,478. Nevertheless, if the value fails to maintain above $3,753, there might be renewed promoting stress in direction of $3,441.

Associated: Bitcoin value prediction: Analysts warn of additional decline as BlackRock sells $2 billion in BTC

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.