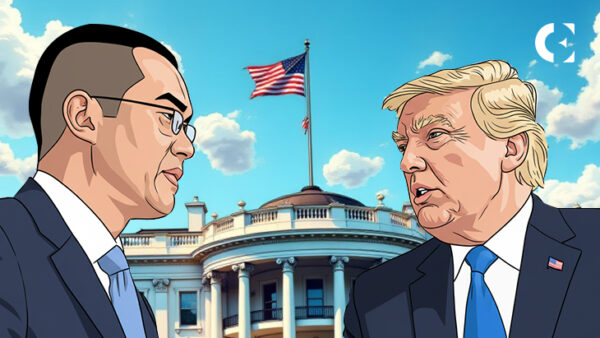

- Regardless of pardoning him, President Trump stated he “would not know” Binance founder Changpeng “CZ” Chao.

- The Trump household’s cryptocurrency firm, World Liberty Monetary, reportedly profited from $2 billion in trades linked to Binance.

- Lawmakers from each events have raised moral issues about potential conflicts of curiosity.

President Donald Trump defended his choice to pardon Binance founder Changpeng “CZ” Chao, claiming he doesn’t know him. This got here regardless of widespread criticism and questions concerning the Trump household’s conflicts of curiosity surrounding their very own cryptocurrency ventures.

Zhao, who led Binance till 2023, pleaded responsible to cash laundering violations in the identical yr. He was sentenced to 4 months in jail in April 2024 and launched in September 2024. Federal prosecutors beforehand accused Zhao of permitting terrorist organizations to switch funds by Binance, calling the act a “grave risk to the nationwide safety of the USA.” President Trump granted him a full pardon final month.

President Trump calls the incident a ‘Biden witch hunt’

In a 60 Minutes interview with CBS’ Norah O’Donnell that aired Sunday, Trump distanced himself from Zhao, saying he “would not know who he’s” and dismissing the incident as a “Biden witch hunt.”

Requested concerning the professionals and cons of pardoning a cryptocurrency billionaire who had monetary dealings along with his household’s enterprise, President Trump stated his sons had been concerned within the enterprise, not himself.

“I am glad they’re, as a result of it is in all probability an excellent trade,” he stated, including that he was “too busy with different issues” to study Binance’s actions.

Trump appeared irritated in the course of the change, finally threatening to stroll out of the interview earlier than persevering with.

Binance’s function within the Trump household’s crypto buying and selling

A Bloomberg report revealed that Binance performed a task in facilitating a $2 billion funding in World Liberty Monetary, a cryptocurrency firm majority-owned by the Trump household.

This funding by the Emirati government-backed fund MGX has elevated the worth of 1 US greenback of World Liberty’s stablecoin to greater than $2 billion from round $127 million earlier this yr. Binance has developed the know-how to help the stablecoin, however each corporations deny any connection between Zhao’s pardon and the funding.

A lawyer for World Liberty stated the corporate had “by no means sponsored, facilitated or influenced” the pardon. On the similar time, Binance’s authorized staff stated that Chao “didn’t function a facilitator of the connection” within the MGX deal.

Lawmakers denounce amnesty

The choice drew bipartisan criticism in Washington. Democratic Sen. Elizabeth Warren stated President Trump’s actions “make a mockery of justice” and warned that Congress must act to forestall corruption in pending cryptocurrency laws. Rep. Jerry Nadler known as the transfer a “disgraceful abuse of energy.”

Some conservative voices additionally expressed concern. Joe Lonsdale, a Trump supporter and tech investor, beforehand advised X that the president is “on a foul observe” and that the pardons “make it seem like there is a large fraud occurring across the president.”

The controversy comes as Trump faces new scrutiny over his use of presidential pardons. Critics have famous contradictions between President Trump’s declare that he didn’t know concerning the Zhao case and earlier statements criticizing President Biden for allegedly utilizing an autopen to signal the pardon “with out understanding something.”

Associated: Crypto market polarization: Was CZ’s pardon “apparent” or a case of insider benefit?

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.