- DASH’s break from long-term consolidation indicators robust market participation

- Elevated open curiosity emphasizes dealer confidence, but additionally will increase potential volatility threat

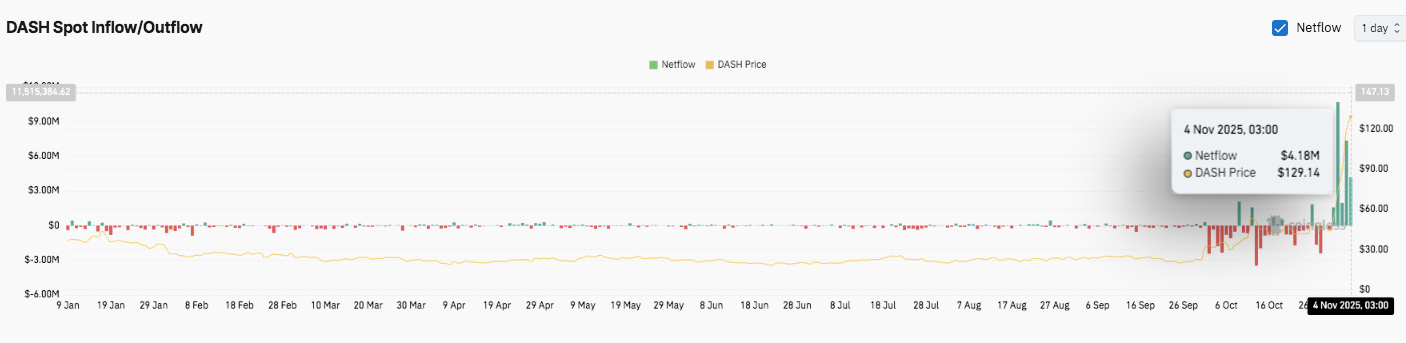

- Surging inflows and sustained EMA energy affirm rising investor confidence in DASH

DASH has made a formidable restoration, surging almost 200% in latest weeks amid bullish momentum throughout spot and derivatives markets. The cryptocurrency made a decisive break from its long-term integration channel and signaled new market participation after itemizing on Binance-backed decentralized alternate Astor. This transfer not solely revived curiosity from merchants, but additionally turned DASH’s technical construction into a transparent upward trajectory, attracting the eye of traders who had been on the sidelines throughout months of low exercise.

Bullish construction builds above key ranges

The latest rally took DASH from the $50 space to above $150, establishing an impulsive uptrend supported by all main exponential shifting averages. The asset continues to commerce comfortably above the 20, 50, 100, and 200-EMA traces, confirming sustained bullish management.

Speedy assist has fashioned round $123, which corresponds to the 0.786 Fibonacci retracement stage. Holding this zone might present the idea for continued enlargement in the direction of the $150 resistance, adopted by a better goal close to $170-$180.

Nevertheless, the $101 assist space might turn out to be necessary if the short-term correction deepens. This stage coincides with the earlier breakout resistance and the 0.618 Fibonacci retracement, marking a possible accumulation level. An additional decline to the 0.5 Fibonacci stage of $86 might check long-term consumers, but when held, the broad bullish construction will nonetheless maintain.

Derivatives Rise and Spot Market Exercise

Open curiosity in DASH futures has risen sharply, leaping from lower than $40 million to greater than $100 million as of early November. This surge suggests {that a} new wave of lengthy positions is getting into the market.

Consequently, merchants are expressing robust confidence in DASH’s near-term prospects. Nevertheless, a fast enhance in open curiosity additionally will increase the chance of volatility, particularly if leveraged positions are unwound throughout a pullback.

On-chain knowledge, however, reveals vital adjustments in influx exercise. On Nov. 4, inflows reached almost $4.2 million, the best in latest months.

This surge coincided with DASH breaking above $100, reflecting aggressive accumulation and elevated liquidity. This reversal from a protracted interval of stagnation indicators renewed confidence amongst traders, who view the coin’s reinvigoration as an indication of market energy.

Technical outlook for DASH costs

Key ranges stay clearly outlined for November.

- High stage: Speedy targets are $150 (latest swing excessive), $170, and $180. A confirmed breakout above $150 might pave the way in which for a Fibonacci extension close to $200.

- Lower cost stage: $123 (0.786 Fibonacci stage) acts as short-term assist, adopted by $101 (0.618 retracement) and $86 (0.5 stage). A sustained decline beneath $100 would sign a doable return to consolidation.

- Higher restrict of resistance: $150 stays a key zone for medium-term bullish continuation, coinciding with the psychological barrier and the final impulsive excessive.

Will DASH proceed its upward development?

DASH’s technical setup factors to a robust bullish construction above $120, supported by all main EMAs on an uptrend. The latest breakout from the long-running consolidation channel signifies new momentum. As inflows and open curiosity proceed to extend, merchants wish to see if consumers can maintain the $120-$123 vary to substantiate the energy of the development.

If momentum holds, DASH might prolong its rally in the direction of $170-$180, pushed by continued accumulation and favorable market sentiment. Nevertheless, failure to maintain above $120 might set off a pullback to $100 earlier than a brand new rebound. For now, DASH stays in an enlargement section, with merchants ready for affirmation from continued buying and selling volumes and sustained spot demand.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

!perform(e,n,c,t,o,r,d){!perform e(n,c,t,o,r,m,d,s,a){s=c.getElementsByTagName

!perform(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=perform(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.model=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window, doc,’script’,

‘https://join.fb.internet/en_US/fbevents.js’);

fbq(‘init’, ‘1279980307265195’);

fbq(‘observe’, ‘PageView’);