Launch date:

Final up to date:

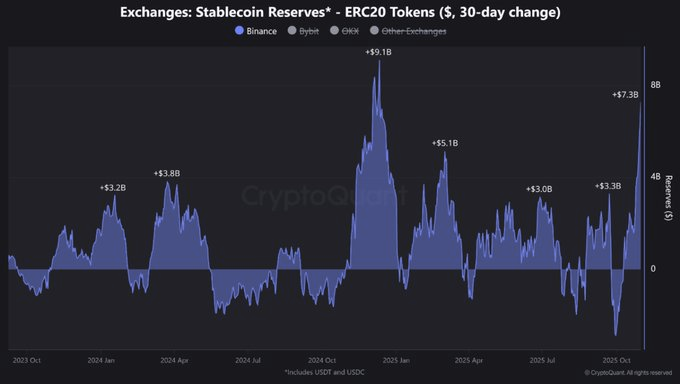

- Binance stablecoin inflows reached $7.3 billion, indicating renewed liquidity within the crypto market.

- Trade knowledge exhibits Binance’s 67% dominance and robust USDT, USDC accumulation.

- Inflows of greater than $5 billion are sometimes preceded by giant rallies and sign future market volatility.

In keeping with the most recent knowledge from CryptoQuant, the Binance-led centralized alternate noticed its ERC-20 stablecoin steadiness improve by $7.3 billion in 30 days, a stage seen simply earlier than Bitcoin broke by to its 2024 excessive. Inflows of this dimension recommend that merchants are placing their new cash on Binance quite than holding it of their vaults or smaller venues. The market sees this as “deployable liquidity” and tends to maneuver to BTC, ETH, or liquid L1 when a catalyst emerges.

Associated: Cryptocurrency liquidity soars as stablecoin provide reaches document excessive of $217.8 billion

$7.3 billion influx: The place does the “dry powder” come from?

CryptoQuant knowledge exhibits that this influx is targeting Binance. The alternate holds about 67% of the overall market share and is strengthening its dominance. Whereas OKX and Bybit recorded slight positive factors, capital inflows to Binance had been supported by cross-chain liquidity infrastructure. Analysts observe that almost all of inflows are made up of USDT and USDC. This displays new deposits from each private and institutional wallets.

Motion on this chain signifies that “dry powder” is accumulating. Massive holders are actively transferring their stablecoins to their Binance wallets. CryptoQuant’s Julio Moreno stated spikes of this dimension typically happen prematurely of total market exercise. “Stablecoin inflows mirror capital reserves,” he stated, noting that overseas alternate reserves typically improve earlier than a brand new speculative cycle.

How inflows evaluate to previous bullish cycles

The present influx of $7.3 billion displays a sample seen throughout earlier bull phases. Reserves elevated by $3.8 billion in April 2024, which was consistent with pre-ETF expectations. One other massive improve occurred in early 2025. Throughout this era, inflows reached $5.1 billion, simply forward of Bitcoin’s subsequent rally.

Supply: X

The all-time excessive for inflows was $9.1 billion in early 2025. This marked the best liquidity accumulation prior to now two years. After a mid-year contraction, inflows started to select up in October, indicating that sideline funds are returning to exchanges.

Why this $7.3 billion surge alerts impending market motion

CryptoQuant analysts observe a transparent historic sample. The numerous improve in buying and selling exercise was preceded by month-to-month capital inflows of over $5 billion. The present determine of $7.3 billion displays vital liquidity. This “dry powder” can shortly change into unstable as it’s deployed in property similar to BTC and ETH.

Broader macro components are additionally contributing to this new exercise. This consists of issues like reducing Federal Reserve rates of interest and reducing borrowing prices. As market liquidity expands, stablecoin developments stay an vital indicator of short-term market course.

Associated: Solana receives $255 million in stablecoin inflows main the chain. Sol Eyes $300

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

!operate(e,n,c,t,o,r,d){!operate e(n,c,t,o,r,m,d,s,a){s=c.getElementsByTagName

!operate(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=operate(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.model=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window, doc,’script’,

‘https://join.fb.web/en_US/fbevents.js’);

fbq(‘init’, ‘1279980307265195’);

fbq(‘observe’, ‘PageView’);